Q2 2025 Central Banks Outlook

Most major central banks continued to lower interest rates in 2025, with the European Central Bank (ECB) still implementing consecutive rate cuts, but the Federal Reserve may stick to the sidelines as the ongoing transition in US trade policy clouds the outlook for growth and inflation.

North America

Federal Reserve

The Federal Open Market Committee (FOMC) has kept US interest rates on hold following the 25bp rate-cut in December, and the central bank may retain the current policy throughout the first half of 2025 as Chairman Jerome Powell insists that ‘we do not need to be in a hurry to adjust our policy stance.’

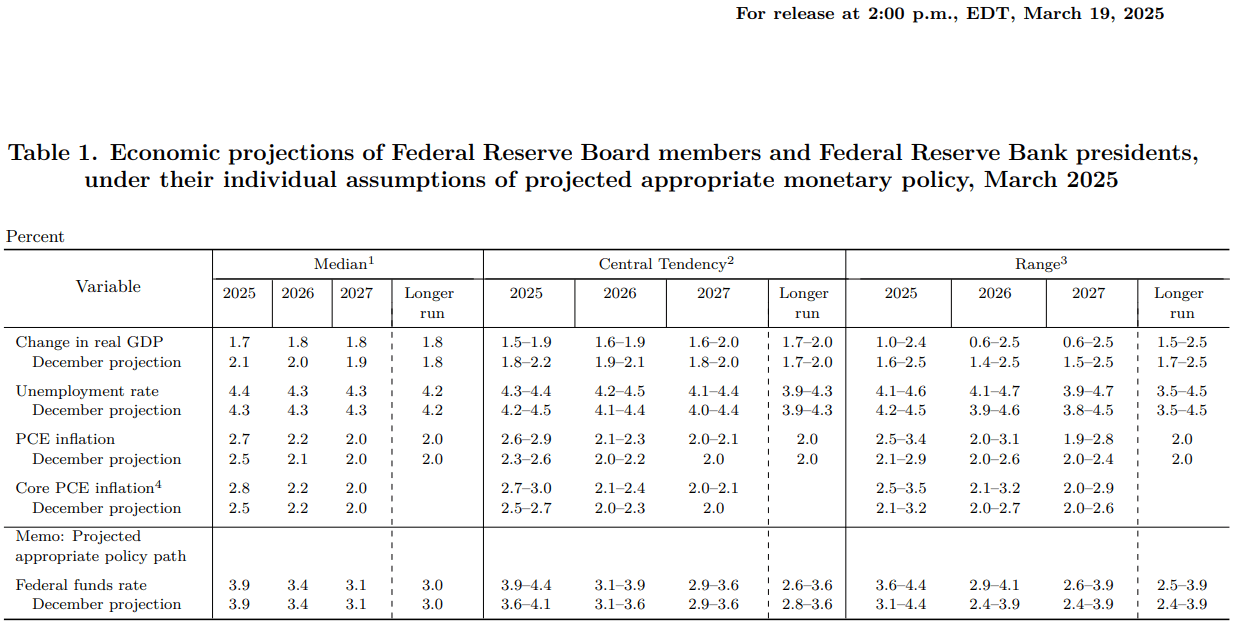

Source: FOMC

Nevertheless, the fresh forecasts from Fed officials suggest the central bank is still on track to further unwind its restrictive policy as the update to the Summary of Economic Projections (SEP) shows a downward revision in the growth forecast, and the FOMC may continue to strike a dovish forward guidance as the ‘median participant projects that the appropriate level of the federal funds rate will be 3.9 percent at the end of this year.’

In turn, the US Dollar may face headwinds as the Fed still pursues a neutral policy, but the central bank may keep US interest rates on hold over the coming months amid the threat of a trade war.

Europe

European Central Bank

The European Central Bank (ECB) continued to unwind its restrictive policy this year as the Governing Council lowered Euro Area interest rates in January and March.

The ECB may stick to its rate-cutting cycle as the central bank insists that ‘the disinflation process is well on track,’ and the Governing Council may retain the current course for monetary policy as ‘most indicators of underlying inflation are pointing to a sustained return of inflation to our two per cent medium-term target.’

However, the decision by European lawmakers to increase public spending may push the ECB to the sidelines as President Christine Lagarde and Co. acknowledge that ‘a boost in defence and infrastructure spending could also raise inflation through its effect on aggregate demand,’ and the central bank may reassess the path for Euro Area interest rates amid the shift in fiscal policy.

As a result, the ECB may adopt a wait-and-see approach over the coming months, and developments coming out of Europe may keep the Euro afloat with the government stimulus underway.

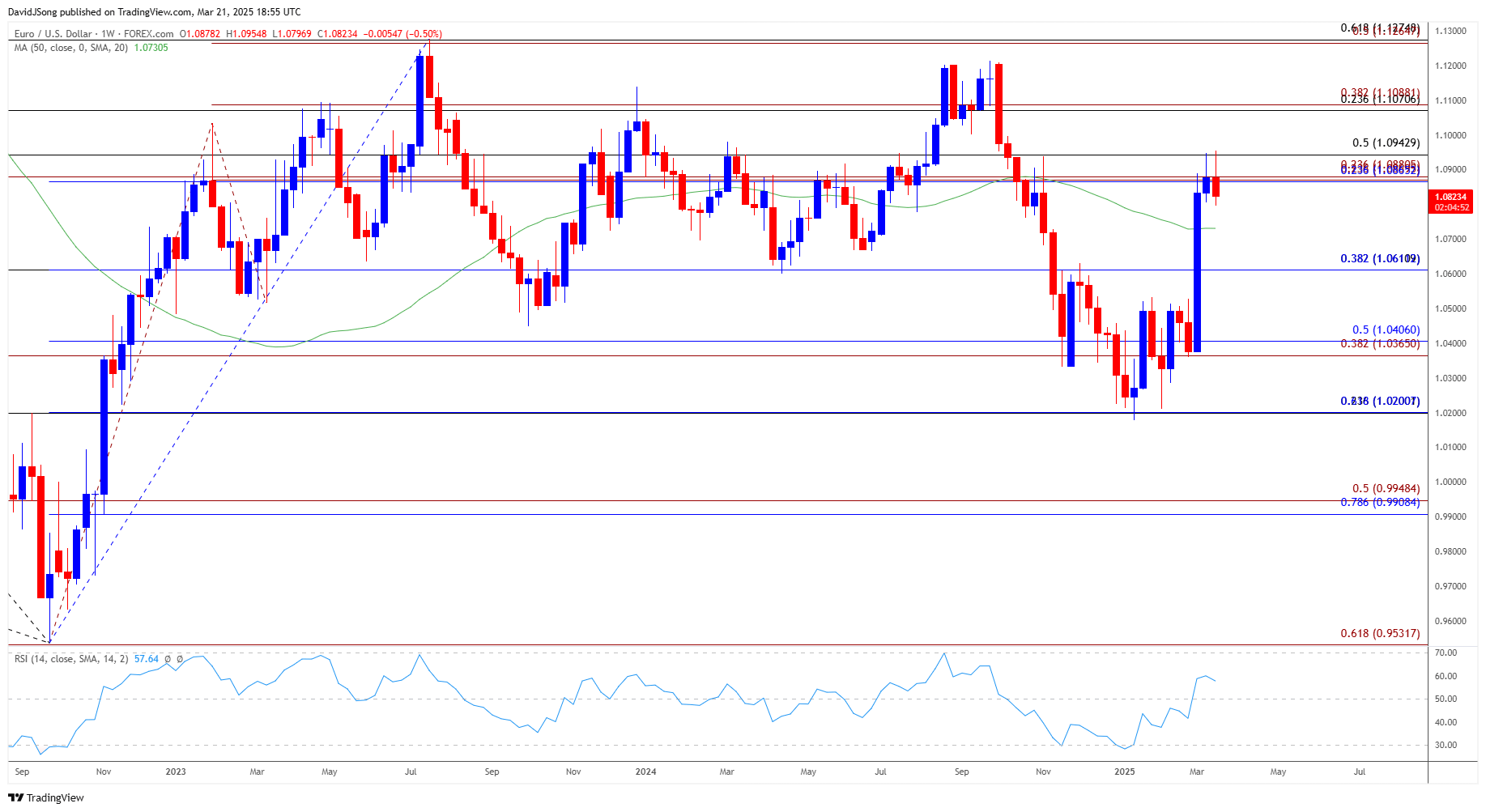

EUR/USD Weekly Chart

Source: TradingView

EUR/USD briefly pushed above pre-US elections rates after failing to close below 1.0200 (61.8% Fibonacci retracement) earlier this year, and a weekly close above the 1.0870 (23.6% Fibonacci retracement) to 1.0940 (50% Fibonacci retracement) zone may push the exchange rate towards the 1.1070 (23.6% Fibonacci retracement) to 1.1090 (38.2% Fibonacci extension) area.

A breach above the 2024 high (1.1214) opens up the 1.1270 (50% Fibonacci extension) to 1.1280 (61.8% Fibonacci retracement) region, but EUR/USD struggle to retain the advance from the yearly low (1.0178) if it fails to close above the 1.0870 (23.6% Fibonacci retracement) to 1.0940 (50% Fibonacci retracement) zone on a weekly timeframe.

Lack of momentum to hold above 1.0610 (38.2% Fibonacci retracement) may push EUR/USD back towards the 1.0370 (38.2% Fibonacci extension) to 1.0410 (50% Fibonacci retracement) zone, with the next area of interest coming in around 1.0200 (61.8% Fibonacci retracement).

Asia/Pacific

Bank of Japan

Meanwhile, the Bank of Japan (BoJ) kept interest rates on hold in March after raising the benchmark interest rate by 50bp to 0.50% in January.

It seems as though the BoJ is still reluctant to pursue a rate-hike cycle as ‘underlying CPI inflation is expected to increase gradually,’ and Governor Kazuo Ueda and Co. may retain a gradual approach in normalizing monetary policy as ‘there remain high uncertainties surrounding Japan's economic activity and prices.’

With that said, the persistent interest rate differential between Japan and its counterparts may lead to further swings in the carry-trade, and the Japanese Yen may face increased volatility over the coming months should BoJ stay on track to normalize monetary policy.

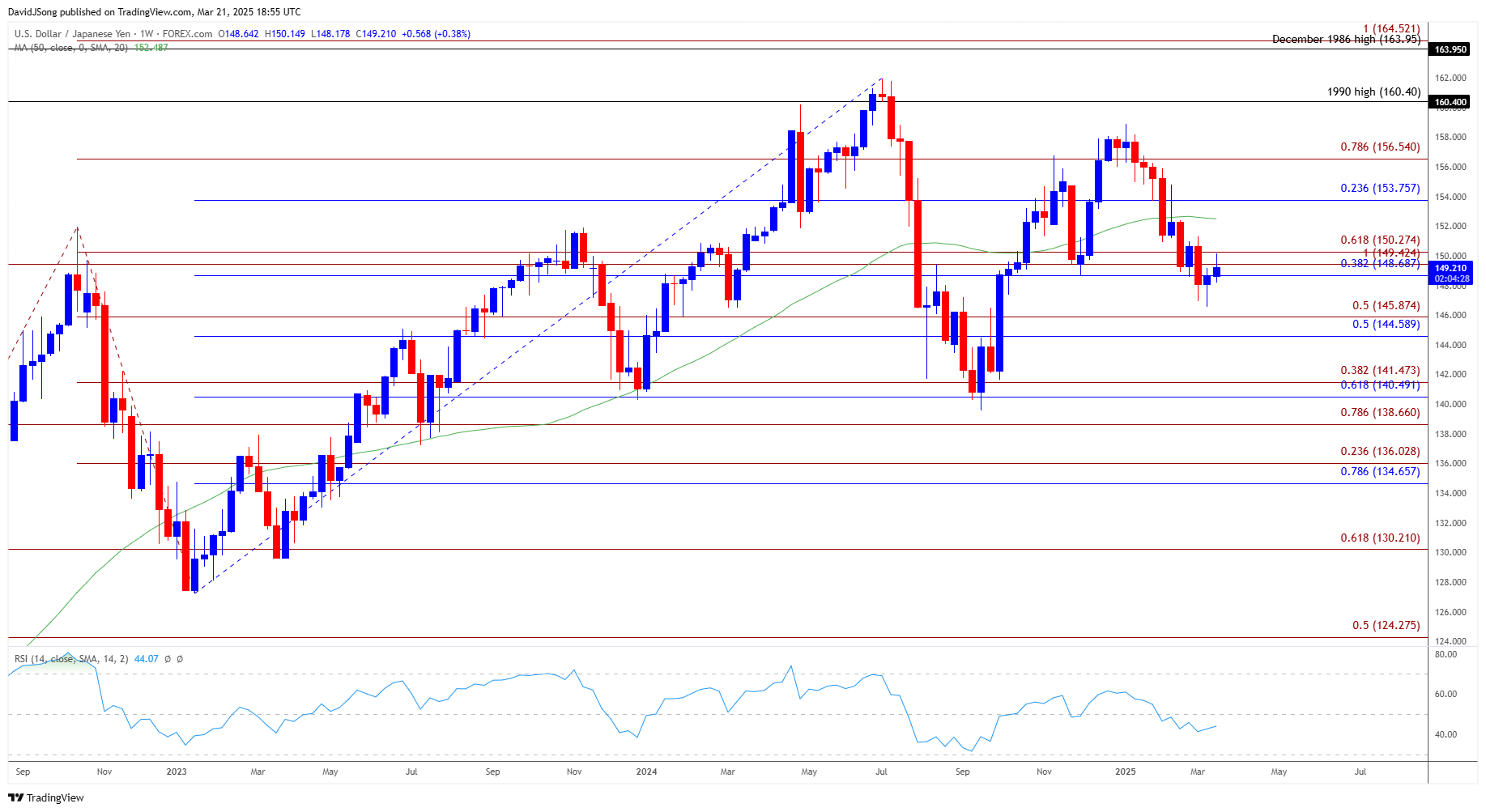

USD/JPY Weekly Chart

Source: TradingView

USD/JPY failed to defend the advance from the end of 2024 as it pushed below the December low (148.65), and the rebound from the March low (146.54) may turn out to be temporary as the exchange rate struggles to trade back above the 148.70 (38.2% Fibonacci retracement) to 150.30 (61.8% Fibonacci extension) zone.

A weekly close below the 144.60 (50% Fibonacci retracement) to 145.90 (50% Fibonacci extension) area brings the 140.50 (61.8% Fibonacci retracement) to 141.50 (38.2% Fibonacci extension) region on the radar, with the next area of interest coming in around the September low (139.58).

At the same time, a weekly close above the 148.70 (38.2% Fibonacci retracement) to 150.30 (61.8% Fibonacci extension) zone may push USD/JPY back towards 153.80 (23.6% Fibonacci retracement), with the next area of interest coming in around 156.50 (78.6% Fibonacci extension).

Written by David Song, Strategist

Follow David on X: @DavidJSong