Q2 2025 EUR/USD Outlook

EURUSD Q2 Forecast Depends As Much on Dollar’s Haven Status as Growth and Rate Differentials

Critical Factors:

- Tariffs and emergent trade wars threatens to undermine the Greenback’s status as a ‘safe haven’ – especially a rarified haven with a carry premium

- EURUSD enters the second quarter of 2025 with a significant yield advantage to the Dollar, but that outlook is highly fluid

- With the US cutting fiscal spending aggressively and Germany making a U-turn on stimulus, the growth paths are potentially highly divergent

The currency market’s benchmark cross experienced significant volatility through the first quarter of 2025, but the charge seemed to originate more and more from ‘non-traditional’ macro fundamental themes. Differentials of growth, interest rates and risk profile are consistent drivers in exchange rates and the liquidity of the EURUSD pulls more strongly towards these core drivers than perhaps most other crosses where atypical drivers have a greater capacity for traction. However, this pair isn’t immune to systemic shifts that effect the largest economies and financial systems in the world.

With US President Donald Trump’s aggressive implementation of new trade, foreign relation, economic, financial and other relevant polices in just his first few months of office, volatility is the natural by-product of uncertainty. And, that uncertainty is unlikely vanish through the second quarter. The real question is just how indulgent the market will be around the headline-driven uncertainty versus how much pressure the core macro themes are exacting on our focus.

Trade Policy - The Hardest Risk to Price for EURUSD

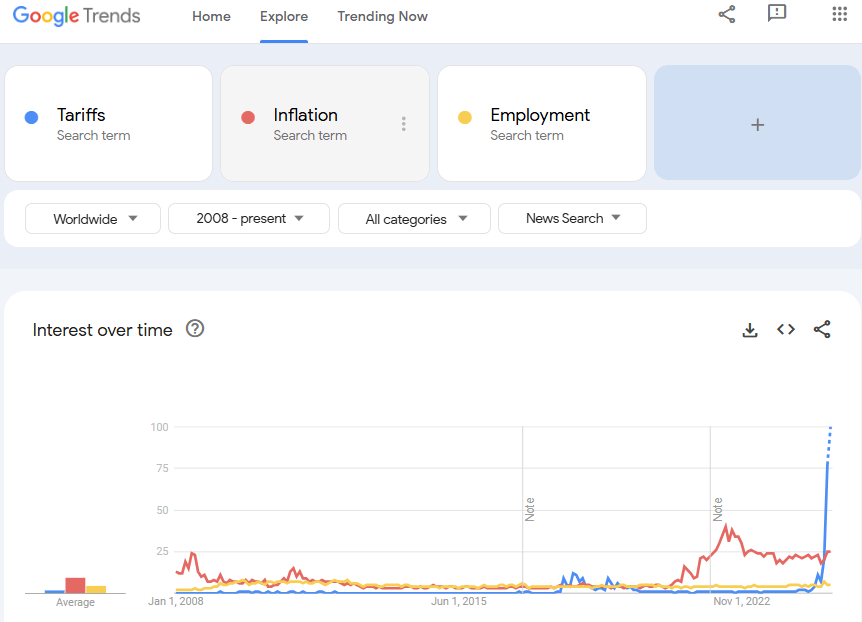

In the opening months of 2025, there was a clear shift in the macro focus of the investors and market participants across the global and asset types. Using Google Trends to compare the changing tides of attention, we can see below the dramatic increase in worldwide news searches related to ‘tariffs’ as compared to ‘inflation’ and ‘employment’. For benchmarking terms, inflation is closely associated to major central bank policy setting and employment is a principal reading for economic health – two of the standard measures of currency valuation over time.

What fundamental themes end up dictating the movement of the markets depends on a few factors: how broad is the scope of influence for the market at large; how great is the capacity for changing the discount afforded to the matter and how long is it likely to persist within a state of flux. When it comes to trade policy, the potential for escalating trade wars to significantly curb global growth, fan inflation and redirect the flows of global capital streams is massive. As far as ‘pricing in’ the various outcomes has been exceptionally difficult given how quickly new threats are issued as well as the quick reversals with delayed application with negotiations. If the White House leverages the market reactionary force as part of its strategy to force negotiation, the period of uncertainty before we can expect a clear schedule of actions – much less resolution – is likely to be further extended.

Google Trends Search Interest Comparison of ‘Tariffs’, ‘Inflation’ and ‘Employment’

Source: John Kicklighter, trends.googles.com

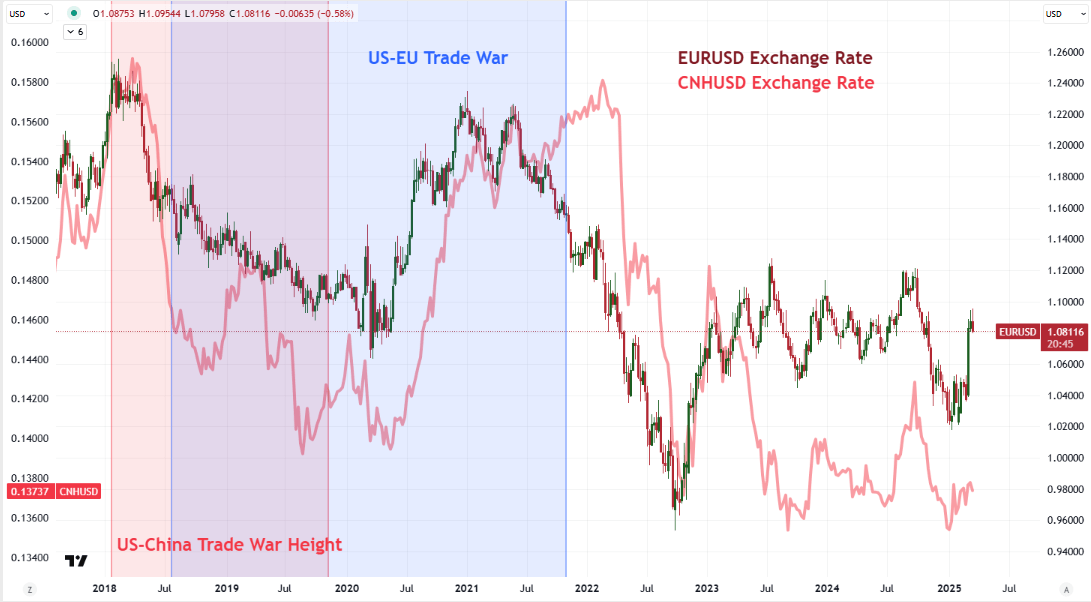

When it comes to ‘trade wars’, it is worth noting that that Google search is far less intensive than ‘tariffs’. That is due to a number of factors that range from technical distinctions to the preferred language in media and press releases. Nevertheless, they ultimately lead to the same financial impact – one just tends to refer to a protracted scenario. Yet, whether we reference the tariffs that kicked up in 2018 or those being raised in 2025, the European Union is not the first region that comes to mind. Where the US and China seem to have already revived their trade war and aggressive actions have focused on the United States’ North American neighbors (Canada and Mexico), the discord with the Euro area was nascent into the close of the first quarter.

The delayed start to the economic conflict between the US and European Union means there is even less clarity and thereby less discount to the risk it poses. Threats against specific goods is one thing, but the open-ended potential of reciprocal tariffs is more difficult to ‘game out’ in projecting paths forward. The Trump administration warned that VAT taxes (value added tax) could be construed as tariffs, which creates significant uncertainty given how extensively they are used in Europe as part of their tax structure.

What’s more, the US engaging in an earnest trade war against the EU would carry far greater ramifications for global trends. For economic scale, the Eurozone is comparable to the GDP of China, but the former is far more entangled in the global structure than the latter. While the gauge of Euro to Dollar strength from these actions may boil down to their respective growth or yield impact, there is a more systemic factor to consider through this storm: could the Greenback see its absolute safe haven status and the level of its global use diminished? If so, it can materially change its response to more basic environmental changes – like the emergence of a sheer ‘risk on / risk off’ trend.

Chart of EURUSD Overlaid with CNHUSD and Trade Wars in First Trump Administration (Weekly)

Source: John Kicklighter, TradingView

Traditional Macro Themes – Whether Key Drivers or Measures of Trade Wars

While the direction of trade relations between the US and the Eurozone carries the greatest degree of uncertainty in the EURUSD’s macro landscape, the threats can – and are likely to – ease moving forward. Should that happen, the markets are likely to revert to the more traditional drivers of price evolution: underlying risk trends, growth comparisons and yield differentials. Yet, even in an anxiety-racked and headline-focused environment around tariffs, the measure of relative strength in FX terms is likely to be measured by these same matters. For instance, if trade wars continue to grow, there is a greater probability of inflation in the US that keeps the Fed on a path of higher relative rates while the growth hit to more-export dependent trade partners is made more vulnerable. In that scenario, the discrepancies would seem to favor the Dollar so long as it is not victim to ostracism which pushes other countries to increase their trade with others.

In the event trade fears settle – whether because of productive negotiation or the markets growing numb to the headlines – we are likely to refocus back on the core academic themes to influence trends. Setting aside general risk appetite which was still buoyant globally but lacking for clear progress, the outlook for growth and interest rates seemed to exhibit divergent courses. Using the IMF’s forecasts as a common source, the outlook for the US was for 2.7 percent and 2.1 percent growth in 2025 and 2026, respectively. For the Euro Area it was 1.0 and 1.4 percent. That said, the aggressive fiscal cuts being pursued in the US via the DOGE initiative is a big contrast to the spend reversal witnessed in Germany. Theis could significantly alter the course of activity for each and result is serious changes in further growth forecasts.

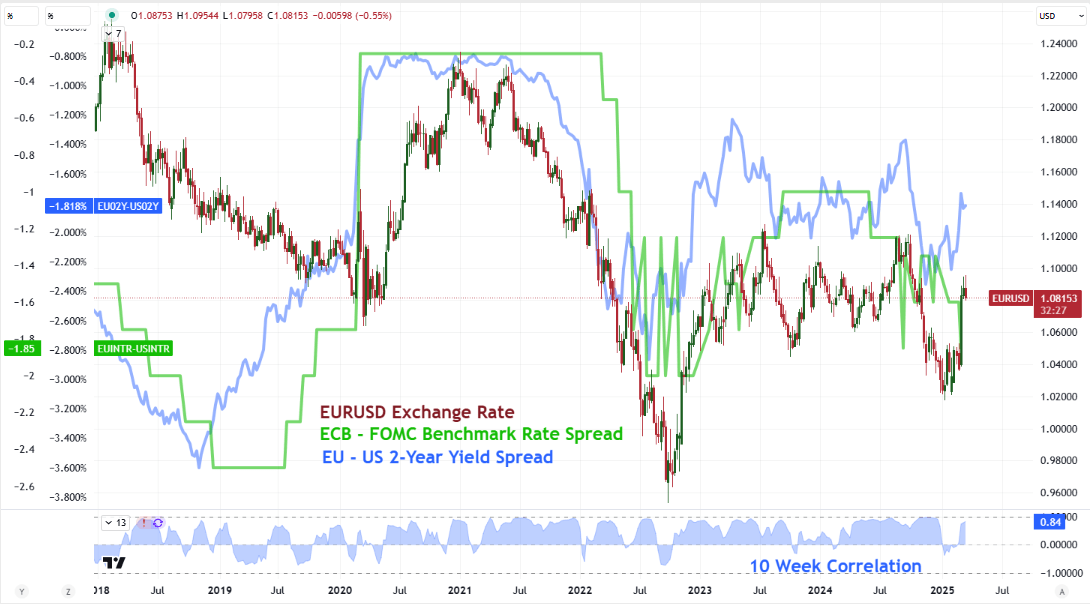

On the interest rate side of the equation, the Federal Reserve shifted to more of a ‘wait-and-see’ position amid the great uncertainty for the economic outlook, which levels the US benchmark interest rate at a range of 4.25 - 4.50 percent. The European Central Bank (ECB) earlier in March offered more balance in its remarks, but even a full stop on its dovish course would leave the US a 1.85 percentage point yield advantage (with the ECB benchmark at 2.65 precent) – that is still near the highest overall premium in the Dollar’s favor since the inception of the Euro. The FOMC has rate decisions on May 7th and June 18th (with updated forecasts) in the second quarter. The ECB’s meetings will fall on April 17th and June 5th.

Chart of EURUSD Overlaid with ECB-FOMC Benchmark and EU-US 2-Year Yield Spreads (Weekly)

Source: John Kicklighter, TradingView, Federal Reserve and European Central Bank

A Picture of the EURUSD’s Technical and Speculative Position

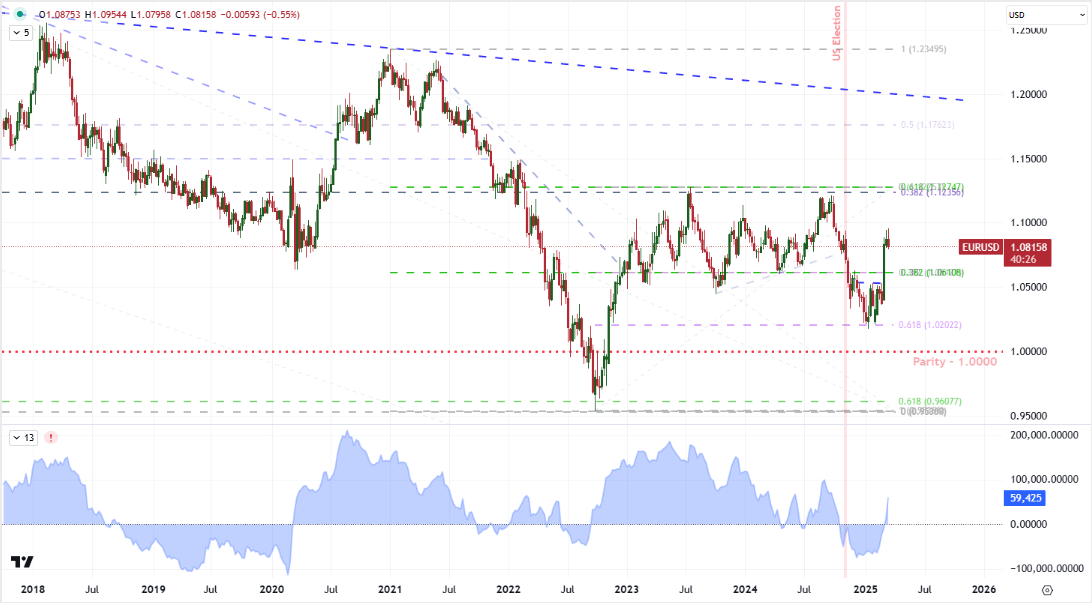

The larger technical picture of EURUSD reflects well the weight of uncertainty on the fundamental side. The sharp rally from the cross in March broke some interim, medium-term technical levels like the 38.2 percent Fib retracement of the January 2021 peak to September 2022 trough and 31.2 percent Fib from the September 2022 low to July 2023 high both around 1.0600. However, the swell in volatility didn’t clear out any major technical barriers that have shaped a broader congestion channel since roughly November 2022.

The broad range on the benchmark exchange rate spans from approximately 1.1200 down to 1.0200. It is a good probability that we experience significant volatility within this envelope over the coming quarter, but committing to a clear trend will likely depend on the emergence of a singularly important fundamental focus that is evolving. To the upside, 1.1200 is a key line in the side for its representing a host of Fibonacci levels as well as the upper threshold of the range for the past three years. Above that, the 1.2000 figure stands prominent as a trendline projection from the past 10 years’ peaks and the 38.2 percent Fib of the range from 2008 to 2022.

As we watch the evolution of fundamentals and the manifestation of price action via technical, don’t neglect the speculative representation. Open interest (essentially ‘participation) in EURUSD futures has held within close reach of the record high set in 2023. As for net speculative positioning in the derivative measured in the CFTC’s Commitment of Traders report, trade wars swung the market from its heaviest net short position in five years to a distinct net long. More volatility in positioning will likely translate into more volatility in the underlying exchange rate.

Chart of EURUSD and Net Speculative Euro Futures Positioning from the CME (Weekly)

Source: John Kicklighter, TradingView, CME

Written by John Kicklighter, Global Head of Content