Q2 2025 GBP/USD Outlook

- Introduction

- GBP/USD outlook

- UK economic factors

- BoE rate cuts

- GBP/USD outlook

- US economic factors

- Political factors

- Fed rate cuts

- GBP/USD technical analysis

Introduction

After a particularly weak Q1, which saw GBP/USD drop over 6%, the pair saw a solid performance across the first quarter of 2025, recouping some of Q4’s losses. GBP/USD has seen gains of 3.4% in Q1 2025 amid notable USD weakness. While the pound posted substantial gains against the US dollar, GBP’s performance against other major peers has been mixed. GBP fell against the JPY and the EUR but rose against the CHF, AUD, NZD, and CAD.

With GBP/USD experiencing substantial gains, the pair has recovered from the early 2025 low of 1.21 to trade at a five-month high close to 1.30 heading into Q2. However, with rising uncertainties surrounding the global outlook and as UK domestic challenges increase, GBP/USD may struggle to extend gains much further, and a correction lower across the quarter could be coming.

GBP/USD outlook UK economic factors

1. Inflation & wage growth

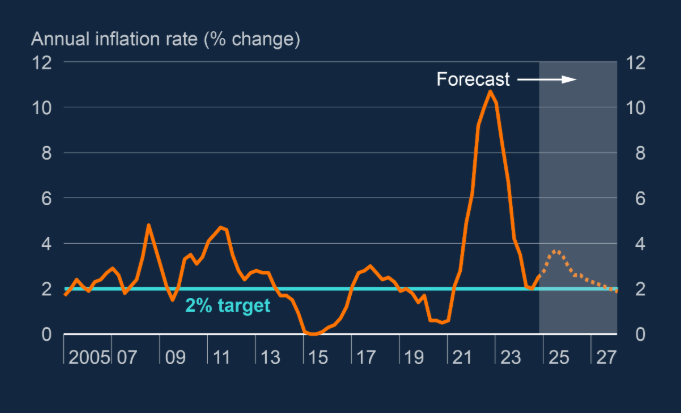

UK inflation rose to 3% YoY in January, which was still 1% above the BoE’s 2% target level. CPI is expected to increase across Q2 to peak at 3.7% in Q3. Service sector inflation rose to 5% in January. The BoE will want to see this cool before cutting rates further.

The labour market remains resilient, with unemployment at 4.4% and wage growth strong at 5.9%. Wage growth is intrinsically linked to service sector inflation. At these elevated levels, wage growth is inconsistent with inflation cooling back to 2% and is a clear obstacle for further BoE cutting rates.

However, the UK labour market will likely weaken over the coming months and quarters as the mood music darkens, owing to a sharp increase in employer taxation in April and an almost 7% increase in the National Living Wage. As a result, services inflation could cool more quickly, lifting rate cut expectations and pulling GBP lower. It is worth noting that given the lag in the data, this may not start showing up until the end of Q2.

The rise in employer tax burden will likely weaken the jobs market, but it could also increase inflation as firms pass on the increased staffing costs to customers.

Source: BoE February report

2. Growth

These challenges come as the UK economy is stagnant at best. Data showed that the UK GDP contracted by 0.1% at the start of the year. The BoE has slashed its growth forecast for 2025, and the OECD also cut its growth forecast for the UK.

This stagflationary outlook will likely persist in Q2, which puts the BoE in a challenging position given the different monetary policy responses required for sticky inflation and weak growth. This will likely keep the BoE cautious in its approach to monetary policy easing.

3. Trade tariffs and rising uncertainty

The UK has escaped most of Trump's trade tariff rhetoric. The next round of reciprocal tariffs will take place in early April, and the effect could spill over into the UK economy, although to what extent remains to be seen.

Uncertainty is likely to remain a key theme throughout the quarter as investors consider the impact of the trade tariffs on the global economy. This could cause investors to adopt a more risk-averse strategy, hurting demand for GBP.

GBP/USD outlook BoE rate cut expectations

The BoE has cut rates three times since starting its monetary easing cycle in August last year. The central bank reduced rates by 25 basis points in August and November last year and by a further 25 basis points in February, taking the benchmark rate from a peak of 5.25% to its current level of 4.5%.

Above, we have highlighted uncertainties and challenges to the outlook, which support a gradual approach to rate cuts. We expect the BoE to cut rates 3 times this year, once a quarter, in May, September, and November. This is more than what we expect from the Federal Reserve, which could pressurise GBP across this and coming quarters.

GBP/USD outlook US economic factors

At the time of writing, the USD has fallen over 4% since the start of the year. The U.S. dollar index dropped from a high of 110.18 in January to a 5-month low of 103.20 in March.

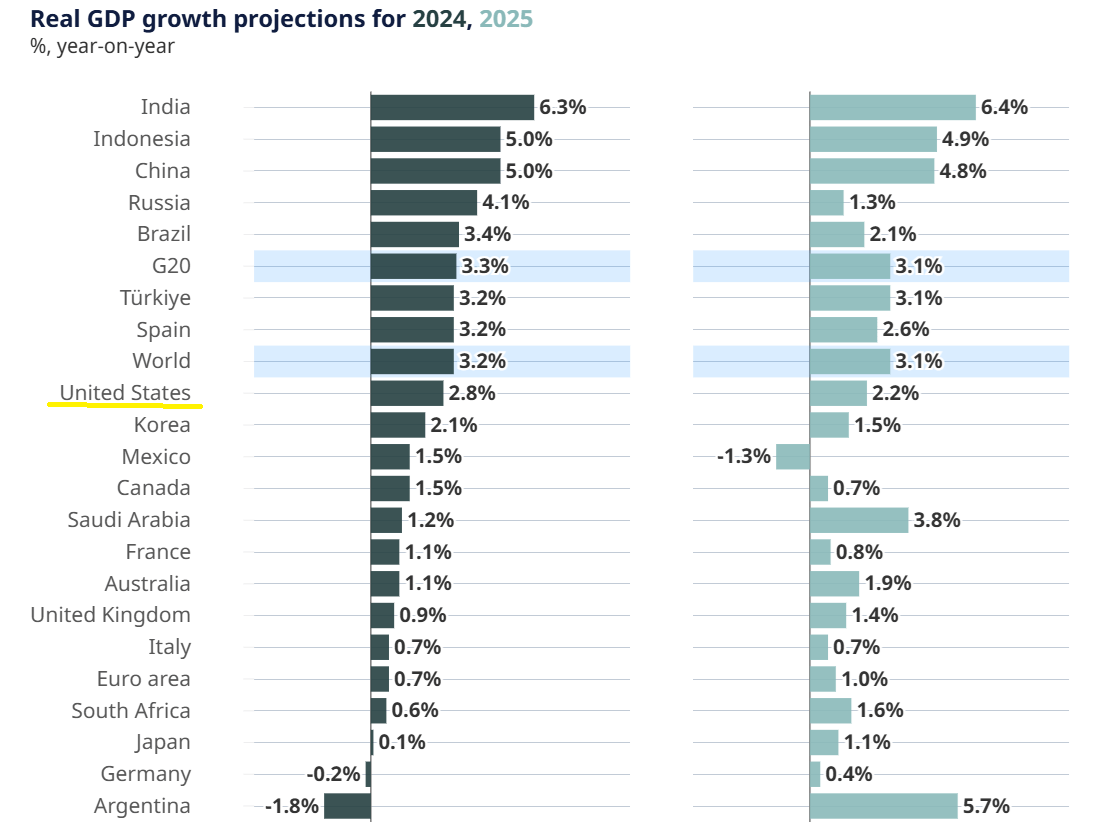

The U.S. dollar has fallen sharply since President Trump took office and applied trade tariffs on major trading partners. Trump is expected to add to these tariffs and apply global reciprocal tariffs as of April 2. As a result of uncertainty over the impact of Trump’s policies, business and consumer confidence has deteriorated, PMI data shows that business activity has stalled and the OECD lowered US growth forecasts.

OECD Economic Outlook March 2025

Attempting to figure out the impact of these trade tariffs on the US economy is challenging, even for the Fed. Fed Chair Powell said in the March meeting that they were “not sure how this would pan out.”

The central bank's March forecasts raised inflation expectations to 2.7% while lowering growth expectations to 1.7%. Yet the central bank maintained its outlook for two rate cuts this year, although 8 of the 19 policymakers saw just one cut this year.

Fed Chair Powell's downplaying of recession risks and a fading rotation from the US to Europe could provide a fresh upside for the US dollar across the coming quarter.

GBP/USD outlook Federal Reserve rate cut expectations

The Federal Reserve cut rates by 100 basis points across the latter part of 2024, reducing rates from the range of 5.25% - 5.5% to 4.25%-4.5%. The Fed paused rate cuts in Q1, and Powell made it clear that the Fed is not in a rush to cut rates further until the data shows it is necessary.

In the March meeting, the Fed’s dot plot pointed to two 25 basis point rate cuts this year, although there was less conviction than in the January meeting. The market is also pricing in two rate cuts. However, more policymakers saw just one or even no rate cuts in 2025. The window for two rate cuts is narrowing, and a move before June is unlikely.

Conclusion

As we head into Q2 2025, the outlook for GBP/USD remains clouded by a mix of domestic and global uncertainties. GBP/USD has risen in the first quarter, boosted by a weaker US dollar. However, headwinds are rising.

The UK economy is grappling with stagnant growth, sticky inflation, and elevated wage pressures, which are limiting the BoE’s ability to ease monetary policy more aggressively. However, April’s rise in employer taxation will likely weaken the jobs market and could cool service sector inflation more rapidly, raising rate cut hopes and pulling GBP lower.

Meanwhile, the US economy faces its own challenges, with trade tariff uncertainty and slower growth. However, the Fed's cautious stance on rate cuts and Pwel’s downplaying of recession risk could provide some support for the dollar.

Ultimately, further GBP/USD gains may be capped at 1.30, and selling pressure could increase.

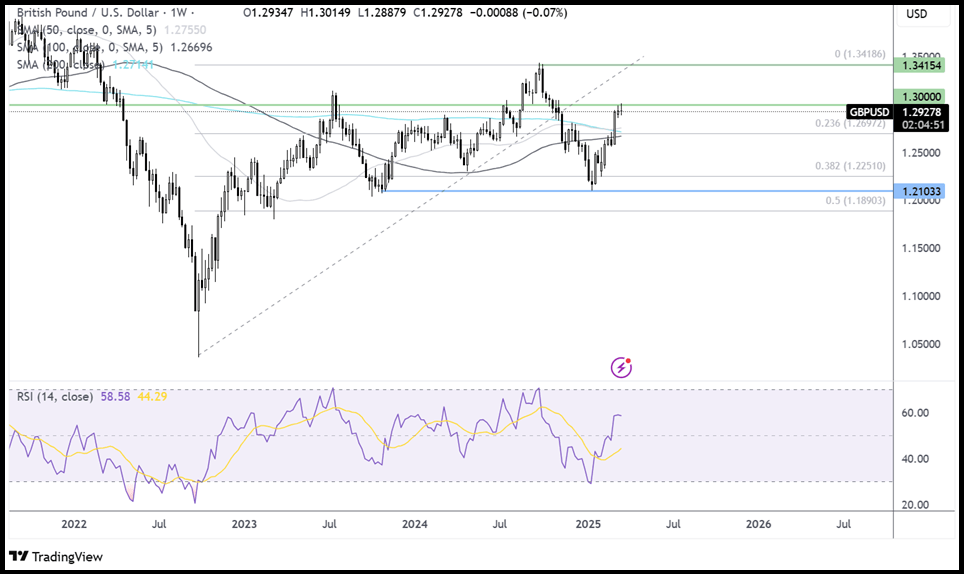

GBP/USD technical analysis

Source: Tradingview

GBP/USD continues to trade below its rising trendline dating back to 2022 and trades within a familiar range.

The price recovered from the 1.21 low, extending gains above the 200 SMA, but is running into resistance at the 1.30 psychological level. The appearance of a shooting star candle could point to a bearish reversal.

Immediate support is at 1.27, the 200 SMA, and the 23.6% Fib retracement of the 2022 low of 1.0360 and the 2024 high of 1.3425. A break below there opens the door to 1.2250, the 38.2% Fib retracement ahead of 1.21.

Should buyers close above 1.30, this could spark further gains towards 1.34. A rise above here is needed to create a higher high.

Written by Fiona Cincotta, Market Analyst

Follow Fiona on X: @City_Fiona