I’ve admittedly sounded like a broken record this past week, repeatedly calling for a top on the ASX 200 — only to watch it climb higher. The only saving grace has been my caution: I’ve consistently noted that a break below key support levels would be needed to confirm a pullback.

Now, once again, I’m leaning into a bearish short-term bias — but with updated resistance levels and price structure to guide the setup.

View related analysis:

- Japanese Yen (JPY) Sentiment Could Be at an Extreme: COT Report

- USD/JPY, USD/CHF, EUR/USD Analysis: USD Reversal Grinds Away

- USD/JPY, GBP/JPY Technical Outlook: BOJ Inaction Weighs on Japanese Yen

- ASX 200 Falters at Resistance, Pullback Pending?

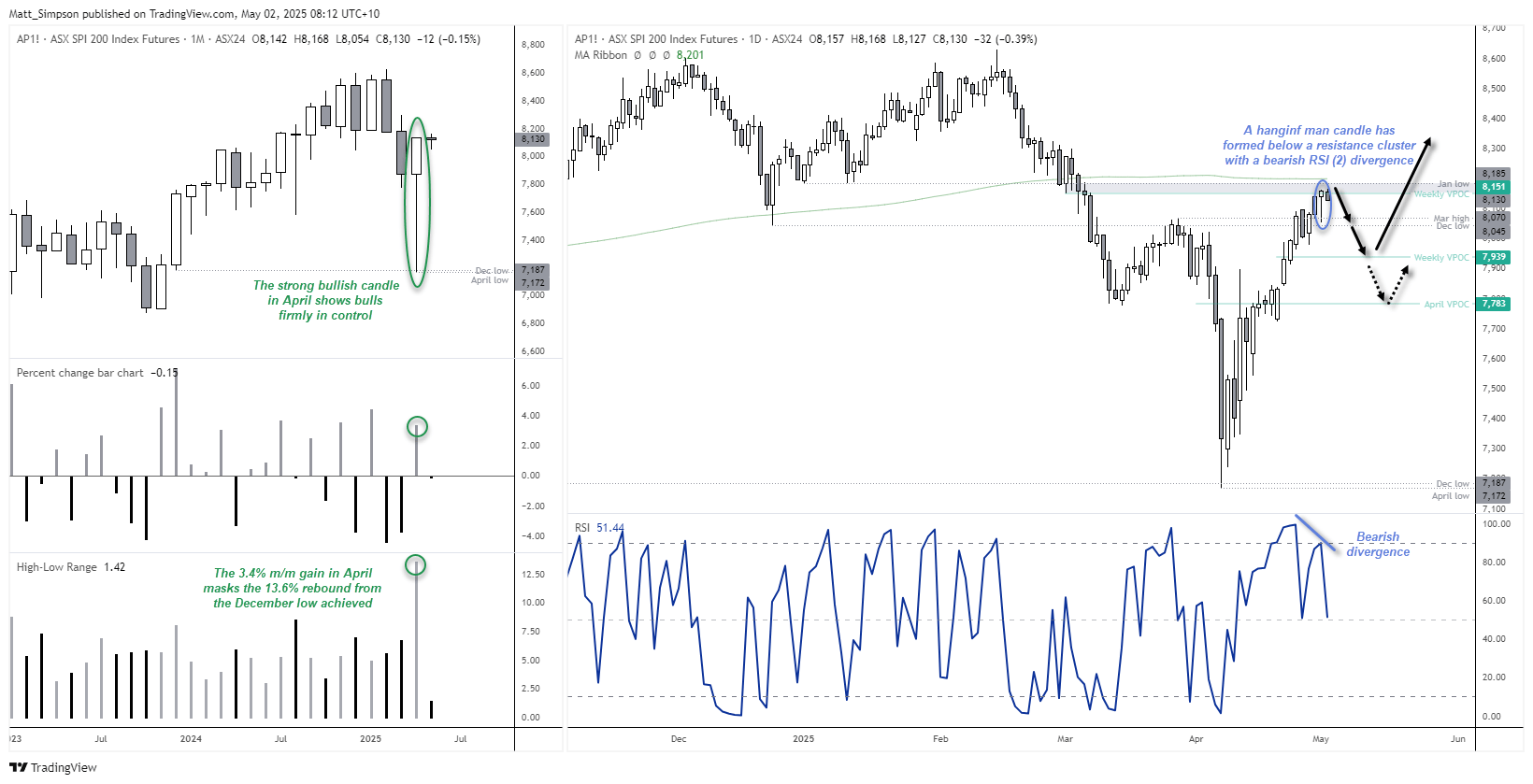

ASX 200 (Australian 200 Index): Monthly, Daily Charts

The ASX 200’s 3.4% month-over-month gain in April understates the index’s actual strength — it surged an impressive 13.6% from its April low to high. A large bullish hammer candle formed by month-end, suggesting buyers remain firmly in control. While this points to the potential for further upside, I remain cautious about how sustainable this level of bullish momentum is. A short-term pullback or two appears increasingly likely, even if the broader uptrend remains intact.

A hanging man candle formed on Thursday, signalling near-term exhaustion. It carries extra weight in my view, given that it formed beneath the January low and the 8200 handle. A bearish divergence has also emerged on the RSI (2), and with the 200-day SMA sitting at 8201, a notable cluster of resistance levels hovers nearby for bears to consider fading into.

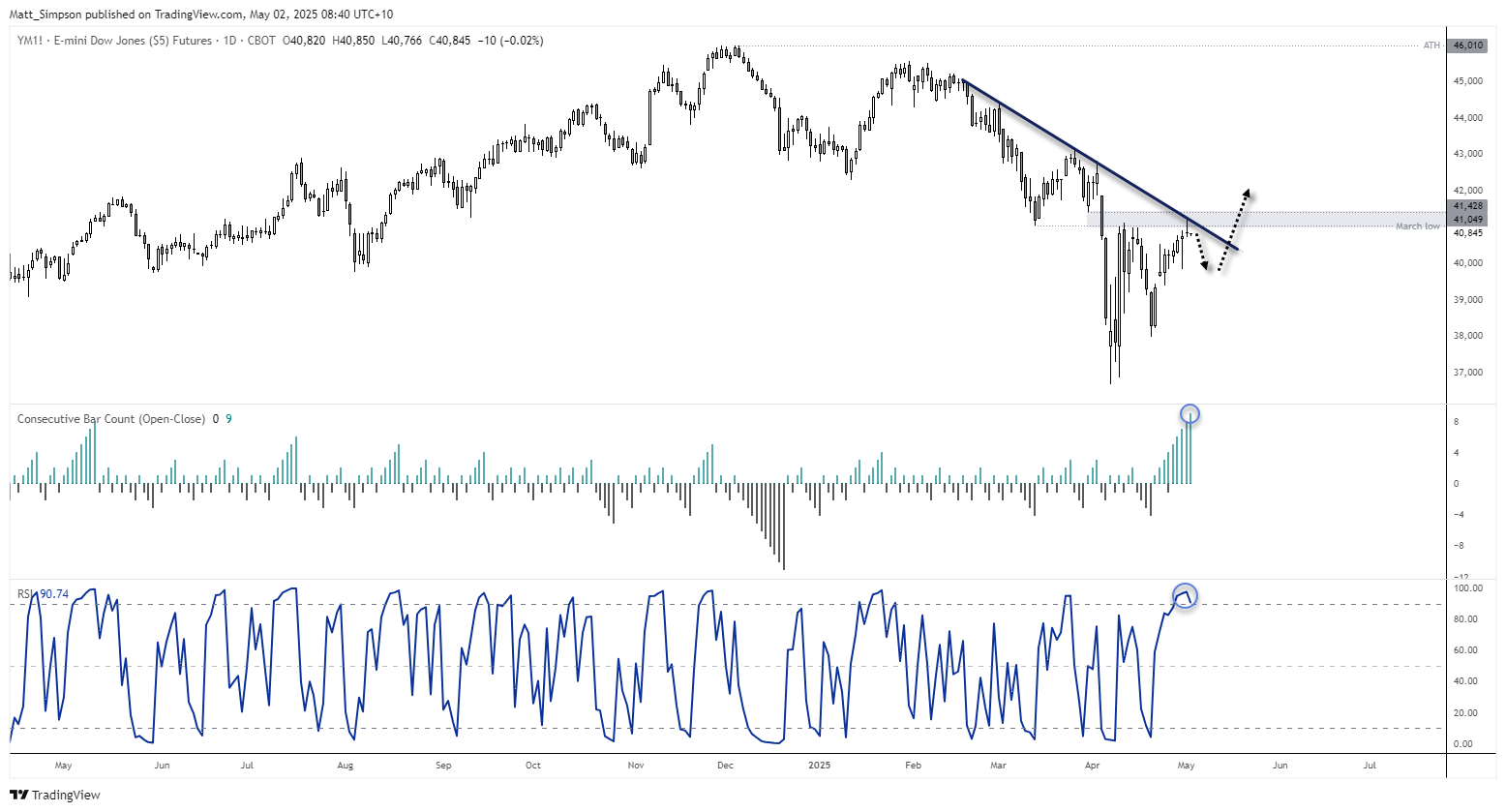

Dow Jones (DJI Futures) Technical Analysis: Key Levels and Market Outlook

Of the three major Wall Street indices, the ASX 200 tends to share the strongest positive correlation with the Dow Jones Industrial Average (DJI futures). That makes current Dow price action particularly relevant for Australian traders.

At present, the Dow Jones rally appears to be stalling at critical resistance levels — specifically near the March low, the March 31 swing low, and a longer-term descending trendline. This confluence of resistance suggests a potential exhaustion point for bullish momentum.

Adding weight to the bearish case:

- The Dow Jones has printed eight consecutive bullish daily candles, a streak not seen since May 2024

- The Daily RSI (2) reached overbought territory on Tuesday, flagging stretched short-term conditions

Given these technical signals, a pullback on the Dow Jones appears increasingly likely. Such a move could serve as a bearish catalyst for the ASX 200, further reinforcing the case for a short-term retracement across both indices.

Economic Events in Focus (AEST / GMT+10)

- 09:30 - Japanese Unemployment, jobs/applications rate

- 09:50 – Japanese foreigner bond and stock purchases, BOJ monetary base

- 11:30 – Australian producer prices q/q, retail sales q/q

- 19:00 – EU core CPI

- 22:30 – US nonfarm payrolls, unemployment

- 00:00 – US core durables

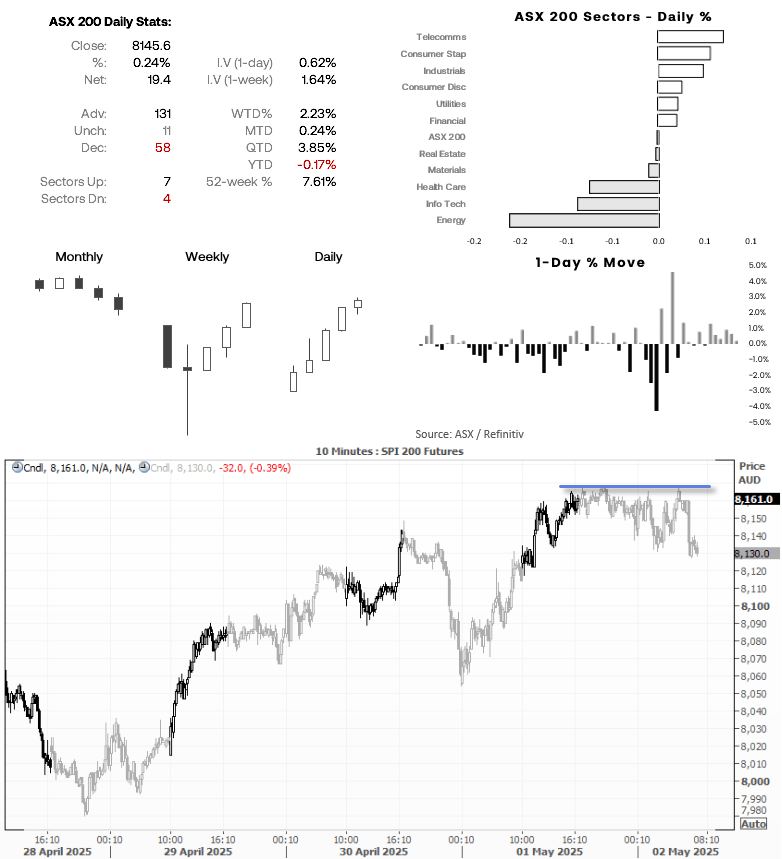

ASX 200 (Australian 200 Index) at a Glance

- The ASX 200 cash index rose for a sixth consecutive day (its best streak since September)

- 6 ASX sectors advanced, led by telecoms and consumer staples, 5 ASX sectors declined, led by energy and info tech

- The ASX 200 also on track for its third consecutive week high (its best streak in three months)

- ASX 200 futures (SPI 200) were -32 lower overnight (-0.39%) to suggest a gap lower at today’s open for the ASX cash index

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge