View related analysis:

- AUD/USD Weekly Outlook: Trimmed Mean Inflation in Focus

- S&P/ASX 200, Hang Seng Analysis: Price Action Setups

- USD/JPY, CAD/JPY, AUD/JPY Price Action Setups

- Japanese Yen (JPY) Sentiment Could Be at an Extreme: COT Report

Economic events in focus (AEDT)

- 17:00 – Spanish CPI

- 19:00 – BOE Deputy Governor Woods Speaks

- 19:40 – MPC Member Ramsden Speaks

- 20:00 – EU Consumer Confidence, Inflation Expectations

- 22:30 – US Trade Balance

- 23:00 – US House Prices

- 00:00 – US Consumer Confidence, JOLTS Job Openings

- 00:30 – US Fed Atlanta GDPnow

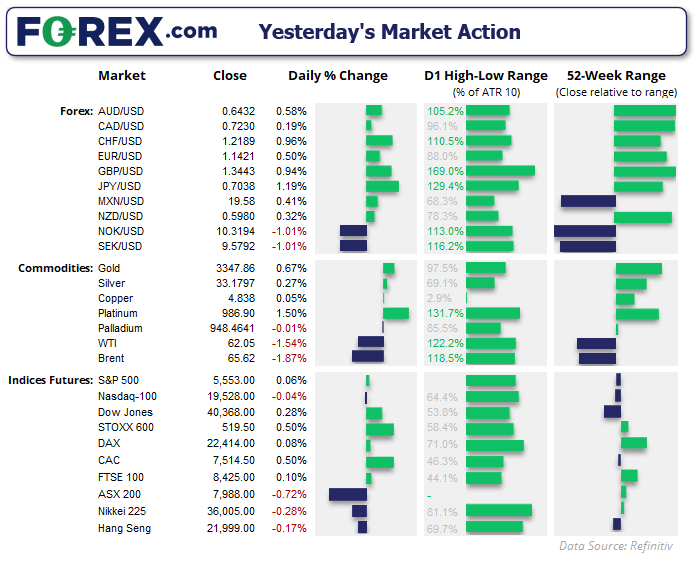

ASX 200 at a glance

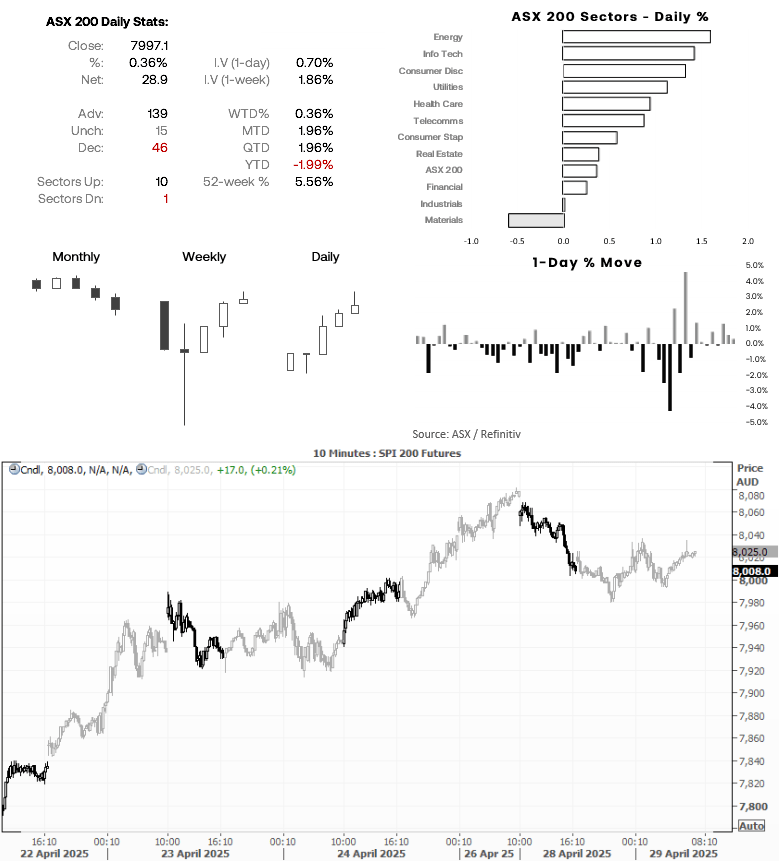

- The ASX 200 cash index rose for a third day on Monday, though the day closed with a small shooting star candle to warn of trend exhaustion

- The ASX also saw a false break above the March high, December low and 8,000 handle and the daily RSI (2) has been overbought since last Wednesday

- So while 10 of the 11 ASX 200 sectors advanced (led by energy and info tech) along with 139 stocks to the 46 that declined, there is a hesitancy for bulls to push forward around current levels

- ASX 200 futures (SPI 200) rose 17 points overnight, though they formed a 2-bear bearish reversal on Monday (Dark Cloud Cover)

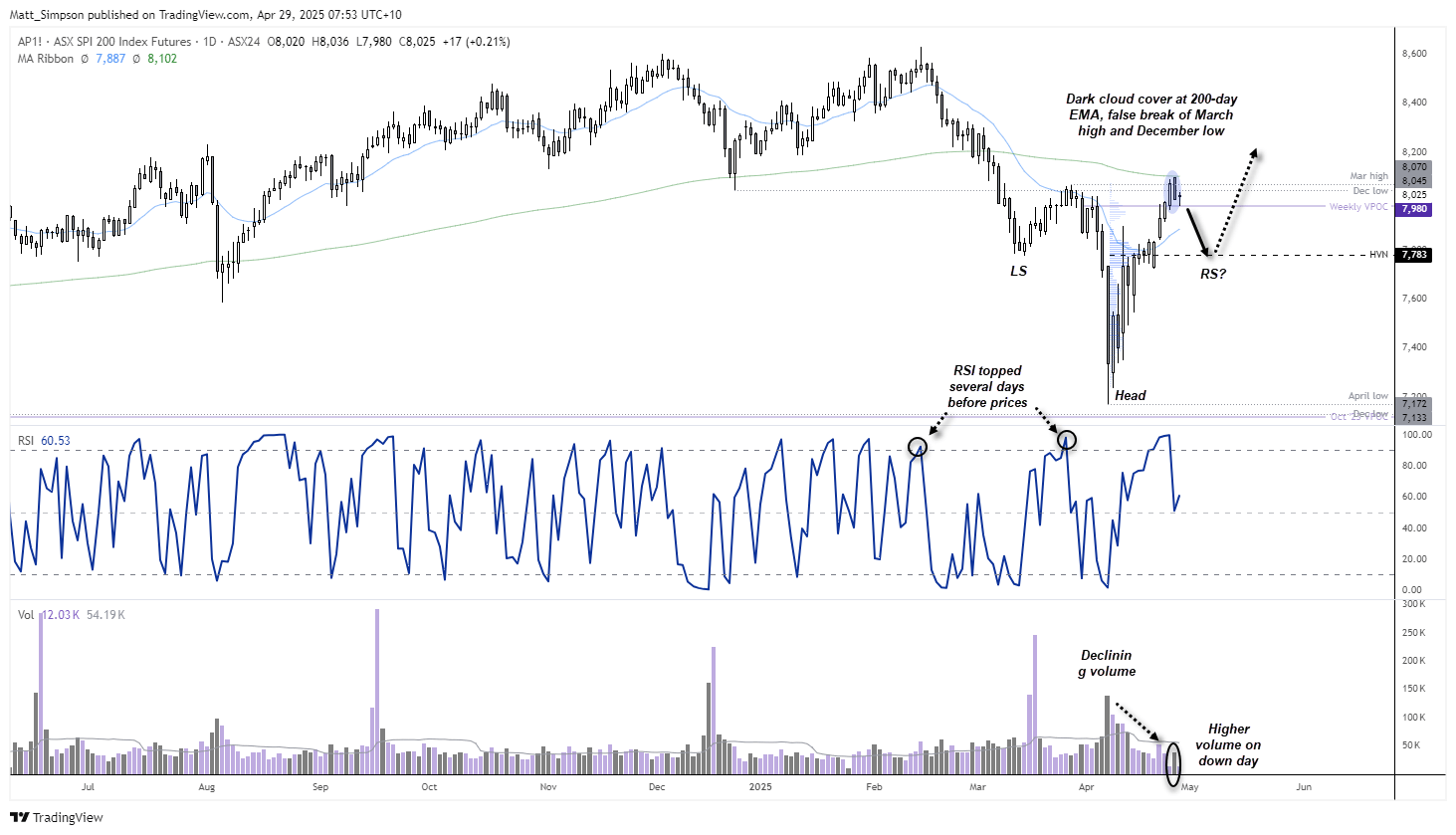

ASX 200 Futures (SPI 200) Technical Analysis

ASX futures have rallied nearly 13% from the April low, though resistance has been met almost perfectly at the 200-day EMA. A two-bar bearish reversal pattern (Dark Cloud Cover) has also formed around the March high and December low. While daily trading volumes declined during the rally, volumes increased overnight as prices fell — suggesting bearish initiation and hinting that the ASX could be nearing an inflection point.

The daily RSI (2) has pulled back from overbought territory. Notably, it took four days between the RSI topping out and the ASX 200 falling from its March 26 high, highlighting the potential for a delayed reaction.

A break beneath the weekly VPOC (7980) could see the ASX retrace towards the 20-day EMA (7887) or the 7900 handle, near the 7783 high-volume node (HVN). If prices do retrace, I will also be watching for a swing low to form as part of a potential ‘right shoulder’ of an inverted head and shoulders bottom.

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge