AUD/JPY is holding steady above a key technical zone as traders await the latest Australian employment report. Despite a soft risk backdrop, the pair has resisted downside pressure, with price action coiling near the 94 handle.

Today’s data calendar is headlined by Australia’s May labour market report, where a soft print could bolster expectations for a July rate cut from the RBA. Elsewhere, New Zealand GDP, the Swiss National Bank’s expected 25bp rate cut, and the Bank of England’s policy decision are also in focus — alongside a raft of central bank speeches across Europe. Markets will be watching for any surprises that shift sentiment or impact rate expectations.

View related analysis:

- Japanese Yen Slides: USD/JPY, AUD/JPY Rally on Risk Optimism

- Japanese Yen Cross Currents: EUR/JPY, GBP/JPY, CHF/JPY, CAD/JPY

- AUD/USD Weekly Forecast: Fed Decision and Australian Jobs Eyed

- US Dollar Outlook: Don’t Write Off the USD Just Yet

AUD/JPY Technical Analysis: Australian Dollar vs Japanese Yen

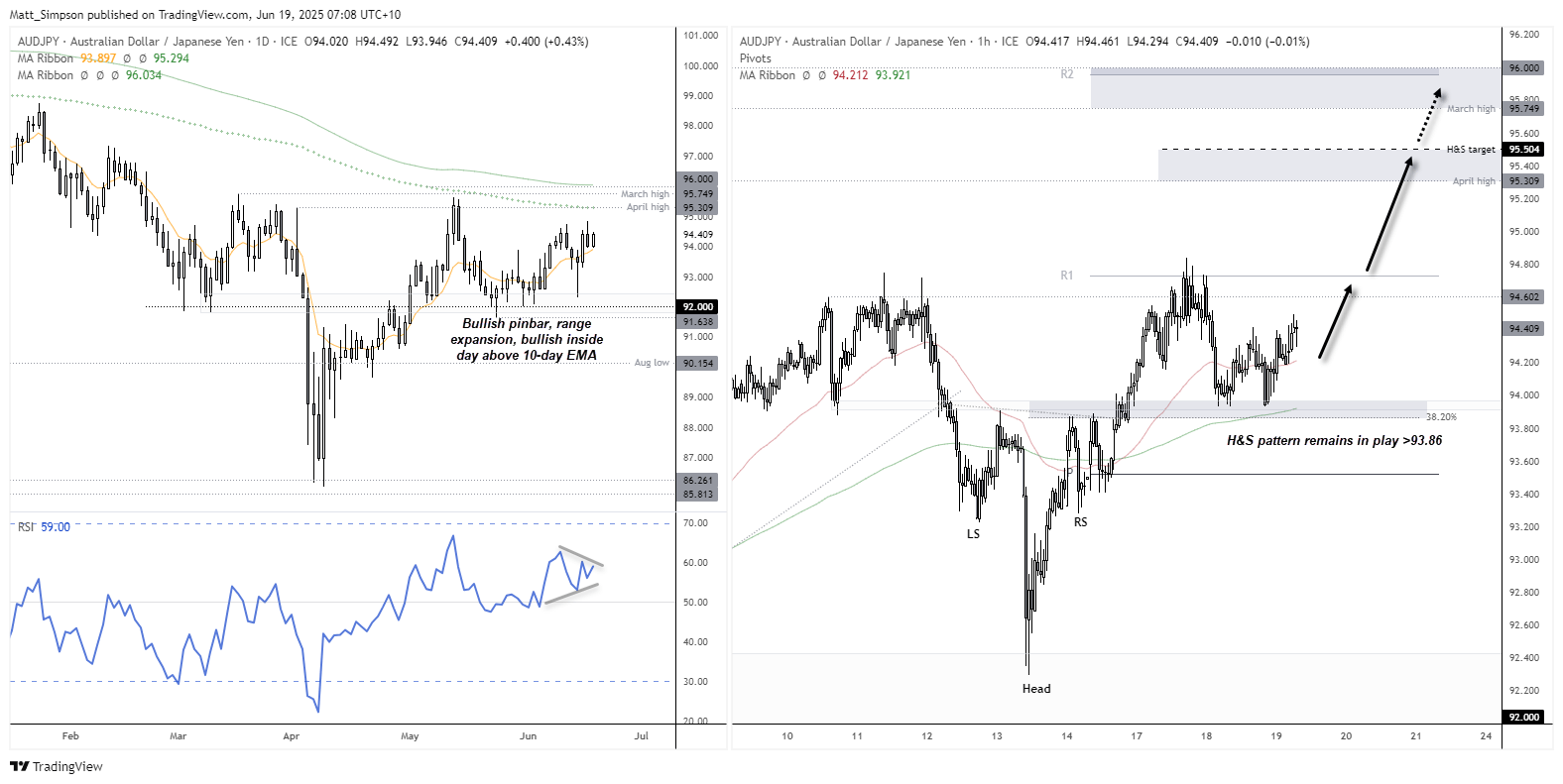

Earlier this week, I highlighted the series of higher lows on the daily chart around the 92 support level — a pivotal zone for AUD/JPY since March. The bullish range expansion day that snapped its 3-day losing streak gave reason to anticipate a move toward the 200-day EMA (95.30) or even the 200-day SMA (96.03) near the 96 handle.

While AUD/JPY hasn’t yet surged higher, it has remained supported during a bout of risk-off sentiment. A small bullish inside day has formed about 94 and the daily RSI (14) is coiling up to suggest range expansion could await. Should risk appetite improve, the Australian dollar could finally break higher against the Japanese yen.

The 1-hour chart shows an inverted head and shoulders (H&S) pattern remain in play while prices hold above 93.86. A double bottom formed around the 1-hour 200-bar EMA and 38.2% Fibonacci level, so perhaps the corrective low has been seen. The bias remains bullish while prices hold above yesterday’s low, a break above yesterday’s high brings the April high and 200-day EMA into focus near the H&S target (95.50). Should appetite for risk continue, a move to 96 is also feasible over the near term.

Economic Events in Focus (AEST / GMT+10)

Australian employment data has remained robust overall. But with softer growth, inflation and business sentiment indicators creeping into the mix, employment will have to soften at some point. Odds are skewed in favour of aa 25bp cut from the Reserve Bank of Australian (RBA) in July, and a rise of unemployment coupled with a jobs miss could surely cement it. That said, employment has frequently surprised to the upside, and that could help support the near-term AUD/JPY bullish bias if it does so again today.

Of the three central bank decisions today, only the Swiss National Bank (SNB) is expected to cut their interest by 25bp. The Bank of England (BOE) are expected to hold their cash rate at 4.25% and Norges Bank hold their at 4.5%.

08:45 NZD GDP (Q1) (NZD/USD, NZD/JPY)

09:50 JPY Foreign Bond and Equity Investment (USD/JPY, Nikkei 225)

11:30 AUD Employment & Labour Market Data (May) (AUD/USD, ASX 200)

13:35 JPY 5-Year JGB Auction (USD/JPY, Nikkei 225)

16:00 CHF Trade Balance (May) (USD/CHF, SMI)

17:30 CHF SNB Interest Rate Decision (Q2), SNB Monetary Policy Assessment (USD/CHF, SMI)

17:30 EUR ECB President Lagarde Speaks (EUR/USD, DAX)

18:00 CHF SNB Press Conference (USD/CHF, SMI)

18:00 NOK Interest Rate Decision (USD/NOK)

18:30 EUR German Buba Vice President Buch Speaks (EUR/USD, DAX)

18:40 EUR Spanish Bond Auctions (5Y, 8Y, 10Y) (EUR/USD, IBEX 35)

19:00 EUR German Buba President Nagel Speaks (EUR/USD, DAX)

19:00 EUR French Bond Auction (6Y), Construction Output (Apr) (EUR/USD, CAC 40)

19:45 EUR ECB's De Guindos Speaks (EUR/USD, DAX)

20:30 EUR ECB President Lagarde Speaks (EUR/USD, DAX)

21:00 GBP BoE Rate Decision & MPC Votes (GBP/USD, FTSE 100)

21:00 EUR German Buba Vice President Buch Speaks (EUR/USD, DAX)

View the full economic calendar

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge