View related analysis:

- 2025 could be one heck of a ride if bearish AUD/JPY clues are correct

- Traders Placed Bets Against VIX and Swiss Franc Ahead of Tariffs: COT Report

- AUD/USD Bears Eye Sustainable Move to the 50s Amid Tariff Turmoil

- CHF Beats Yen for Safety as Tariffs Take Second Quarter to the Slaughter

- If Consumers Don’t Consume, a Recession Could be Presumed

They say investors don’t like uncertainty, but one thing we can be sure of is that uncertain times lie ahead. A flurry of contrasting headlines hit traders’ screens on Monday, pulling sentiment in both directions. Risk was initially given a bump on hopes of a 90-day tariff pause for all countries (excluding China), until the White House quashed the idea, calling it fake news.

Trump responded to China’s 34% revenge tariff with a threat of an additional 50% levy on Chinese imports, unless China revoked its own retaliatory move.

Eyes are now on China to see if—or how—they respond to Trump’s latest threats. Their 34% retaliatory tariff was never going to sit well with Trump, and in true Trump fashion, he has upped the ante with a threat of a further 50% tariff. Should China respond by increasing their own tariffs on the US, volatility is likely to remain elevated—the question is whether it will continue to rise.

Headlines of a Federal Reserve “closed-door meeting” caused a bit of a stir, given these tend to occur during times of panic. Though the meeting was actually scheduled before the recent market turbulence, making it headline fodder at best. And despite Trump’s best attempts to pressure the Fed into cutting rates, it seems they’re in no rush to act.

Don’t expect the Fed to act just yet

On Friday, Jerome Powell said it was a great time to “step back” and gain more clarity on the situation. And FOMC member Kugler leaned a bit more hawkish on Monday, saying tariffs will be “consequential” and that the Fed is already beginning to see some increase in prices.

Fed funds futures currently give a June cut the slight edge, with a 50.3% probability, compared with a 48.7% chance of a cut in May.

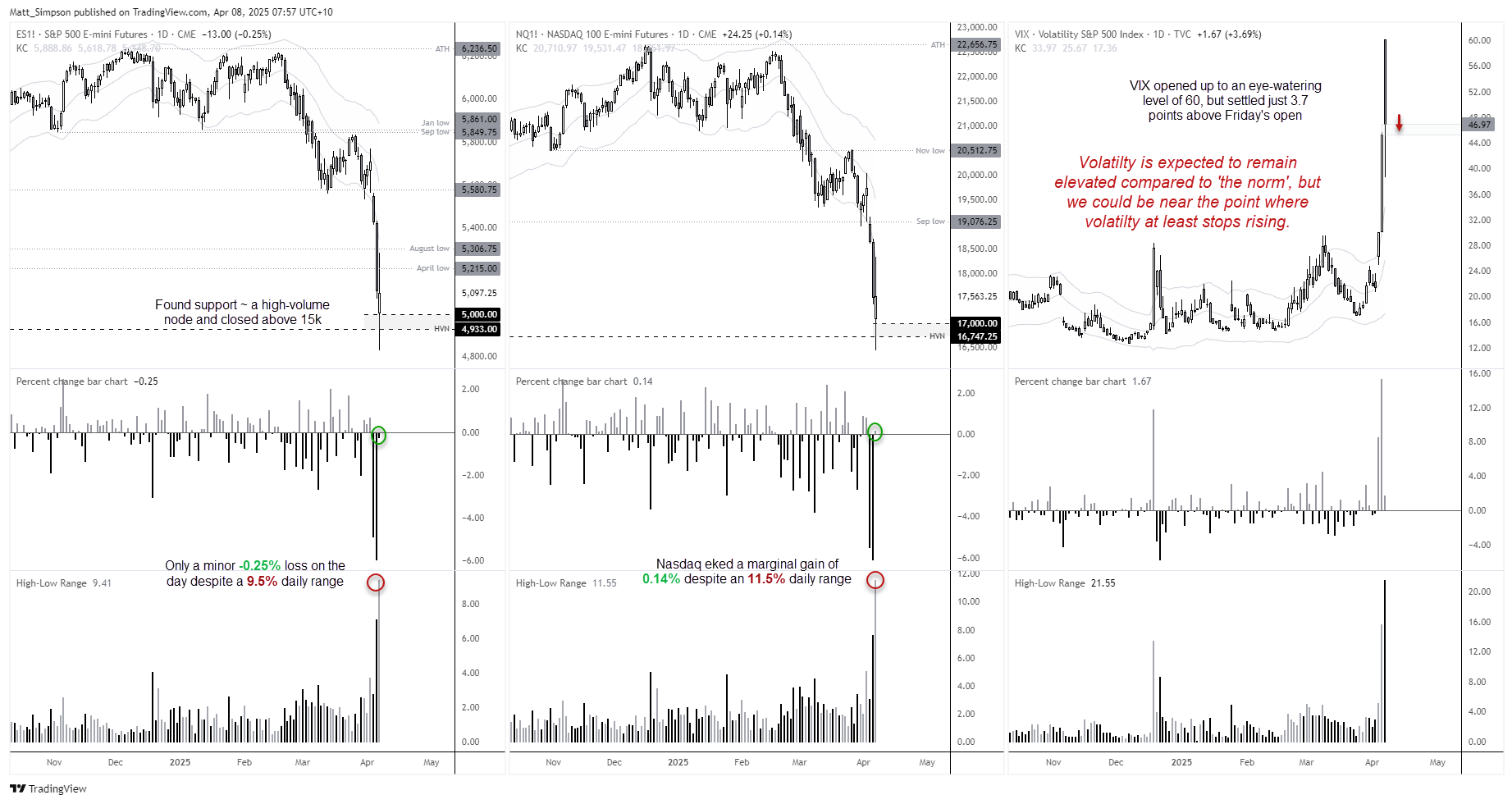

Volatility to remain elevated, but it might stop rising

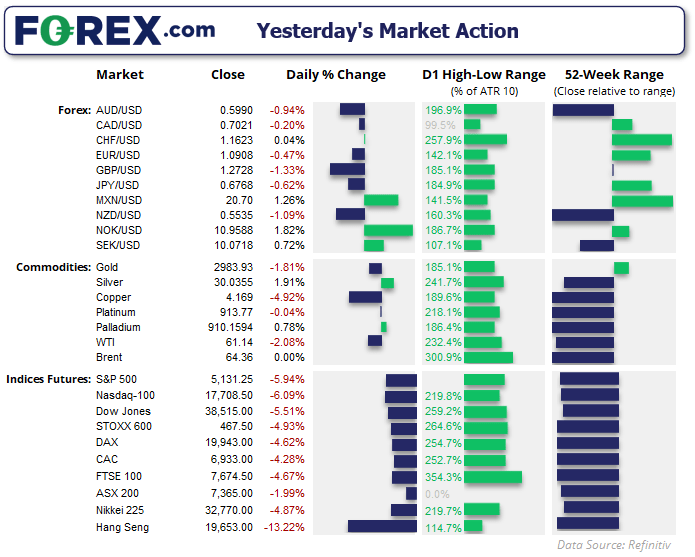

Monday was another volatile day for traders by historical standards, but in some ways less severe than the volatility seen on Friday. While the daily range for S&P 500 futures hit a 5-year high of 15%, it closed just 0.25% down from Friday and gained 1.75% from the week’s open. Nasdaq 100 futures had a daily range of 11% but eked out a marginal gain of 0.14%. And while the VIX opened at an eye-watering level of 60, it settled at 46.97—just above Friday’s close.

These metrics by no means suggest that the worst is over, but there is generally only so much one-way traffic markets can sustain before a pause and rethink is required. Monday appears to mark such an occasion. And with Trump officials claiming countries are presenting excellent deals in light of the tariffs, negotiations are underway—and that brings a glimmer of hope for investors.

AUD/JPY technical analysis

The daily chart shows AUD/JPY printed a strong close beneath the August low on Friday, which keeps my bearish target of at least 82 later this year alive and well. However, support was found around the 86 handle on Monday, with a wide-legged doji and the daily RSI (2) curled up from oversold. The fact it held above support and closed flat despite a highly volatile day could be seen as weakness from bears over the near term.

The 1-hour chart shows Monday’s low also held above the monthly S4 pivot, which is a level rarely tested – let along so early in the month. This also points to an oversold condition.

While price action is messy on the 1-hour chart, the bias is for it to have another crack at the 90 handle. Bulls could seek dips towards the monthly S3 pivot.

Given the clear choppiness of price action and 2-way trade, wider stops may be required and for traders to remain nimble with smaller targets.

Economic events in focus (AEDT)

- 09:50 – Japanese current account, bank lending

- 10:30 – Australian consumer sentiment - Westpac (April)

- 11:30 – Australian business confidence – NAB (march)

- 20:00 – US small business optimism – NFIB (March)

- 04:00 – FOMC Daly Speaks

ASX 200 at a glance

- The ASX 200 fell -4.4% on Monday to mark its most bearish day since May 2020, though a post-open recovery means its daily range spanned 7%

- All 11 ASX 200 sectors declined, led by Energy and Financials

- Its daily trading volume was its most aggressive in two weeks and 40% above its 20-day average

- Keep an eye on China headlines, because if the Hang Seng and A50 continue lower then there’s a reasonable chance the ASX 200 will follow too

- The best bet for a relief rally is for China to not retaliate further (or downscale their US tariffs)

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge