AUD Summary

The Australian dollar underperformed on Wednesday despite being given every excuse to rally, sliding against the U.S. dollar and other majors despite a soft U.S. inflation report and an apparent breakthrough in trade negotiations between the United States and China. The underwhelming reaction may reflect broader scepticism toward the latest headlines, hinting that further upside may be hard won from here against the likes of the British pound and Canadian dollar.

Another Day, Another “Great” Deal

As markets have heard many times before, Donald Trump says the U.S. has struck a “great deal” with China following talks in London, locking in a framework agreement covering tariff rates, rare earths exports, and access for Chinese students at U.S. universities. Trump said the deal gives the U.S. “everything we need,” with China agreeing to supply key minerals up front. In return, the U.S. will maintain a combined 55% tariff rate on Chinese imports—made up of baseline reciprocal tariffs, fentanyl-linked levies, and existing levies from Trump’s first term.

While pitched as a breakthrough, the deal merely brings the two sides back to where they were following the Geneva meeting last month, when diverging interpretations of that agreement stalled progress. That may explain the muted market reaction, with traders seemingly left underwhelmed by the lack of fresh concessions or clarity on the August 10 deadline for a more comprehensive deal.

Nor was there little reaction to headlines released after the U.S. close, with Trump saying he was open to extending the July 8 deadline for reciprocal tariff rates with individual trade partners. Treasury Secretary Scott Bessent confirmed the administration may “roll the date forward” for countries negotiating in good faith, suggesting some flexibility remains on the table.

With only one deal finalised and around 17 still in play, the lack of progress, specifics and policy stability is arguably a headwind for risk appetite rather than a tailwind. The unwind of worst-case pricing may now be complete, leaving upside for riskier assets—including the Aussie dollar—far harder to come by.

GBP/AUD Delivers Key Bullish Reversal

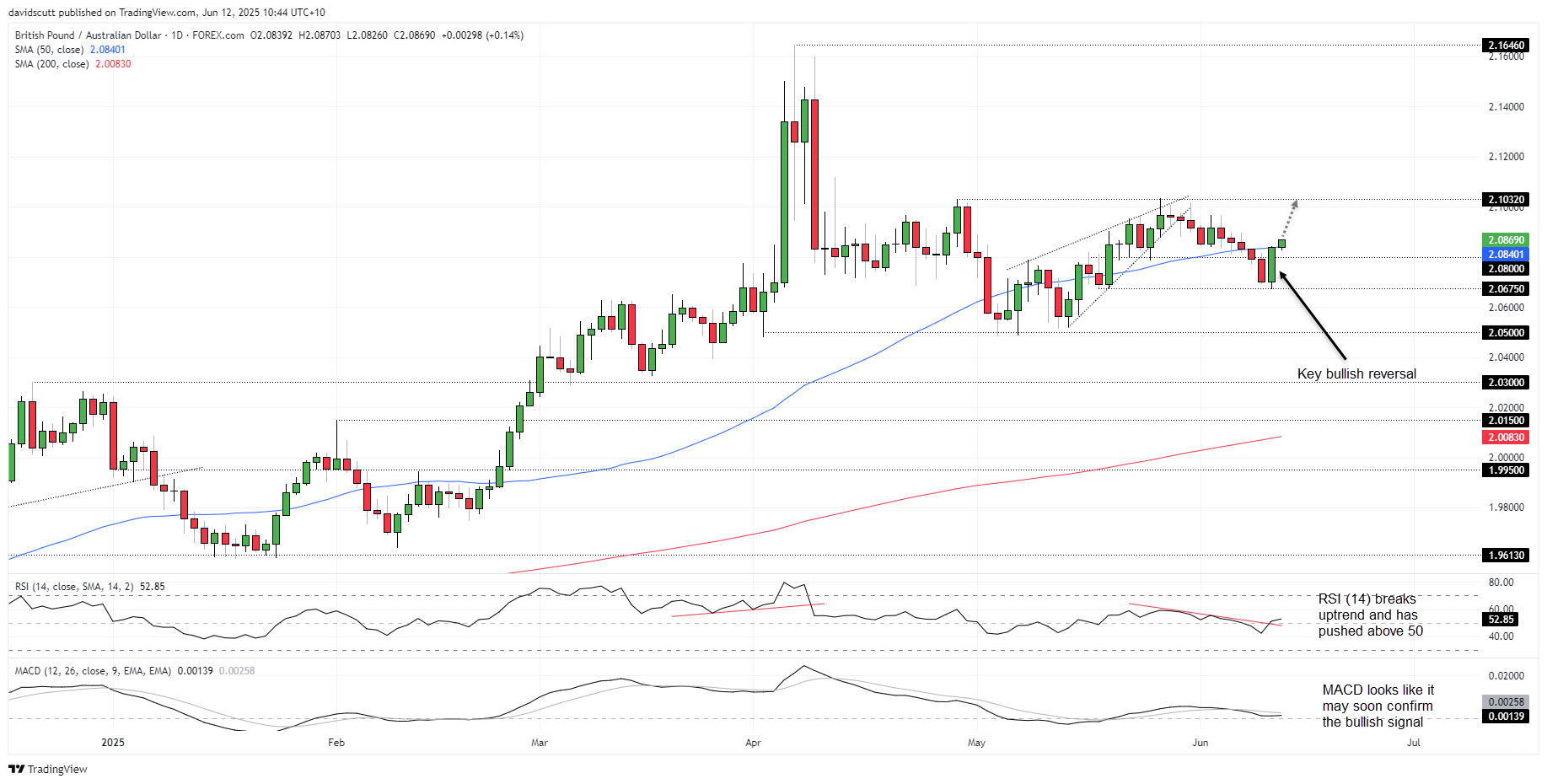

Source: TradingView

Reflecting the Aussie’s underperformance across the G10 FX universe on Wednesday, GBP/AUD printed a bullish key reversal on the daily timeframe, signalling directional risks may now be skewing higher. Momentum indicators are also getting on board, with RSI (14) breaking its downtrend and moving back above 50. MACD remains below the signal line but is starting to flicker higher, suggesting a bullish crossover may follow.

While momentum remains more neutral than outright bullish, upside is favoured now the price has broken horizontal resistance at 2.0800. Those considering bullish setups could look to buy ahead of 2.0800 with a stop beneath for protection, targeting a retest of the double top at 2.1032.

AUD/CAD Sell Signals Flash Red

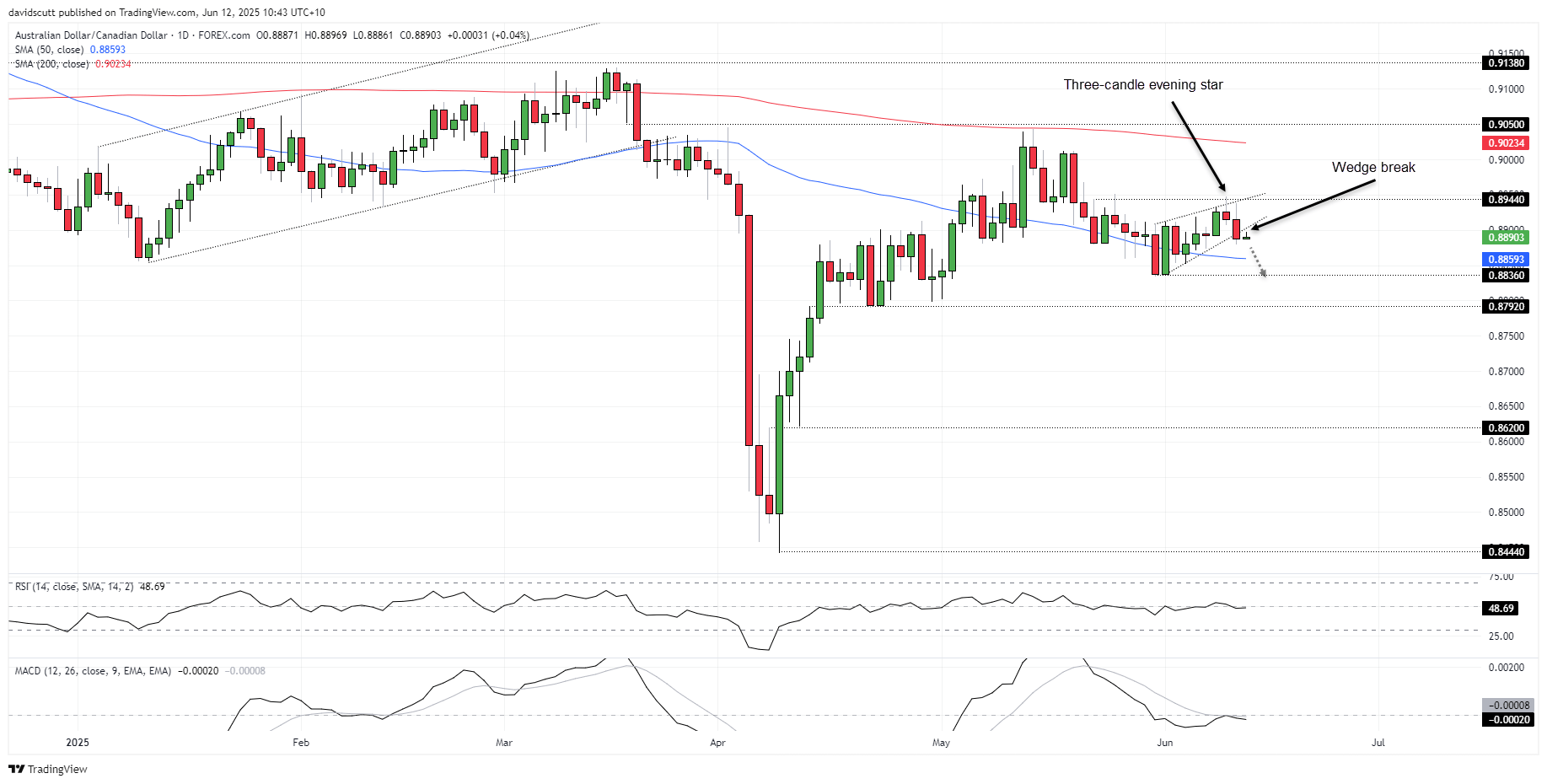

Source: TradingView

AUD/CAD also delivered a bearish Aussie signal on Wednesday with the completion of a three-candle evening star pattern, breaking down from the rising wedge it had been trading in over the past two weeks. The combination of these two bearish signals amplifies downside risks, even though momentum indicators are yet to confirm the price action.

Those considering short setups could look to establish positions beneath former wedge support with a stop above .8900 for protection. While the 50-day moving average currently sits near .8859, a more appealing target is the swing low at .8836. Beyond that, .8792 is another level to keep on the radar.

-- Written by David Scutt

Follow David on Twitter @scutty