- AUD/USD rejected at uptrend resistance for the third time

- Bearish candles forming despite bullish momentum signals

- NZD/USD fades again above .6000 with divergence building

- Trade sentiment key near-term driver

Summary

The V-shaped recovery in AUD/USD and NZD/USD has stalled with price action turning increasingly bearish, warning of growing downside risks. With little top-tier economic data due over the remainder of the week, sentiment around U.S. trade negotiations is likely to remain the dominant driver.

The Trump Administration's recent shift to a more conciliatory tone with key trading partners like China, combined with easing fears over the potential departure of Fed Chair Jerome Powell, has helped lift the U.S. dollar over the past two sessions. This rebound may therefore mark the early stages of a broader trend.

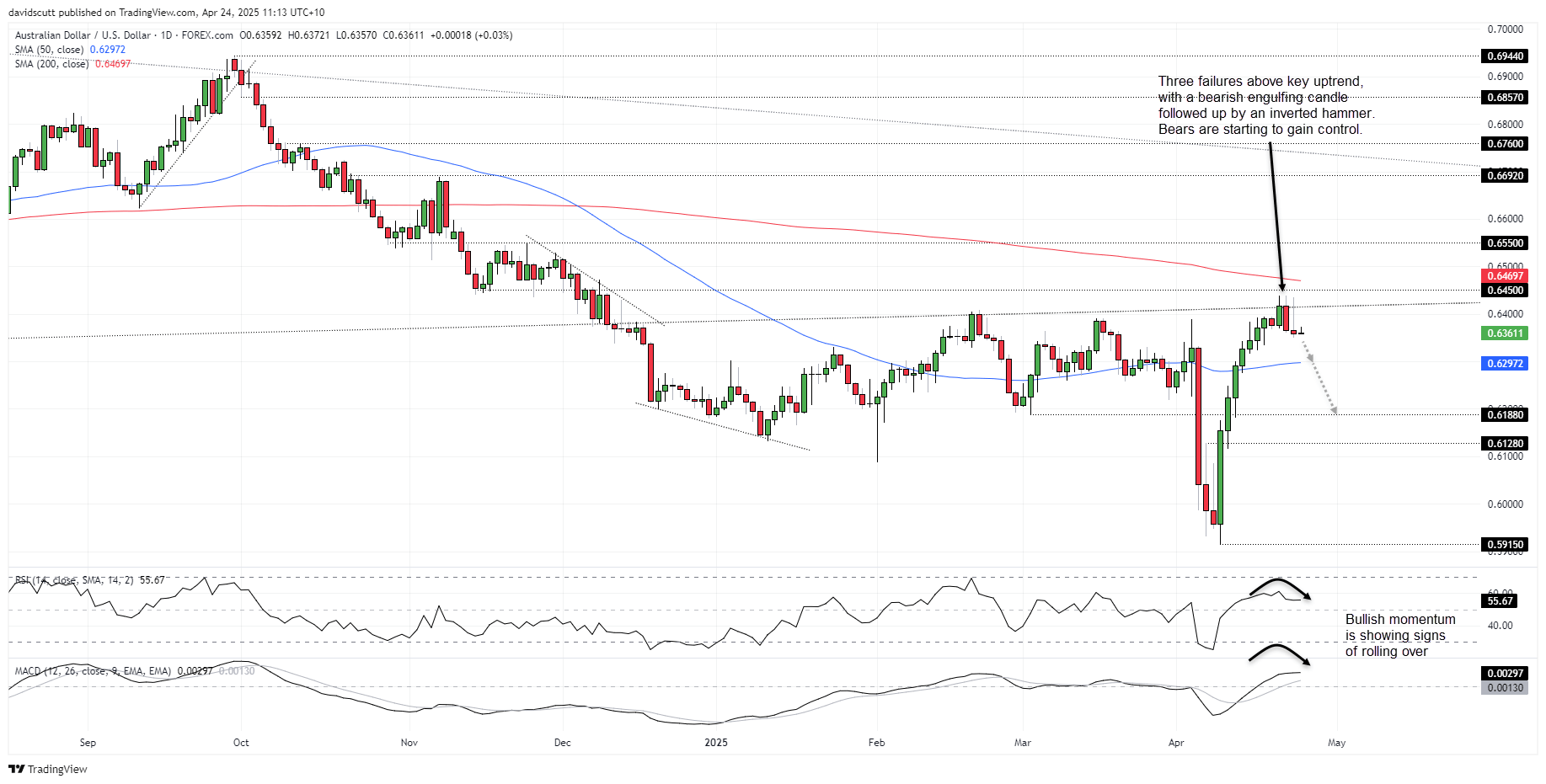

AUD/USD Reversal Risk Grows

Source: TradingView

After three failed attempts to break above the October 2022 uptrend resistance, downside risks for AUD/USD are building. Tuesday’s bearish engulfing candle, followed by Wednesday’s inverse hammer, suggests bears may be starting to take control.

Momentum indicators such as MACD and RSI (14) still lean bullish but are beginning to roll over—another sign the rebound from this month’s multi-year lows may be fizzling out.

Those contemplating bearish setups could initiate shorts on moves towards .6400 targeting the 50-day moving average or .6188, depending on your desired risk reward. A stop above this week’s highs would offer protection against reversal.

A sustained break and close above the October 2022 trendline would invalidate the bearish case, opening the door for fresh longs looking for an extension of the bullish bounce.

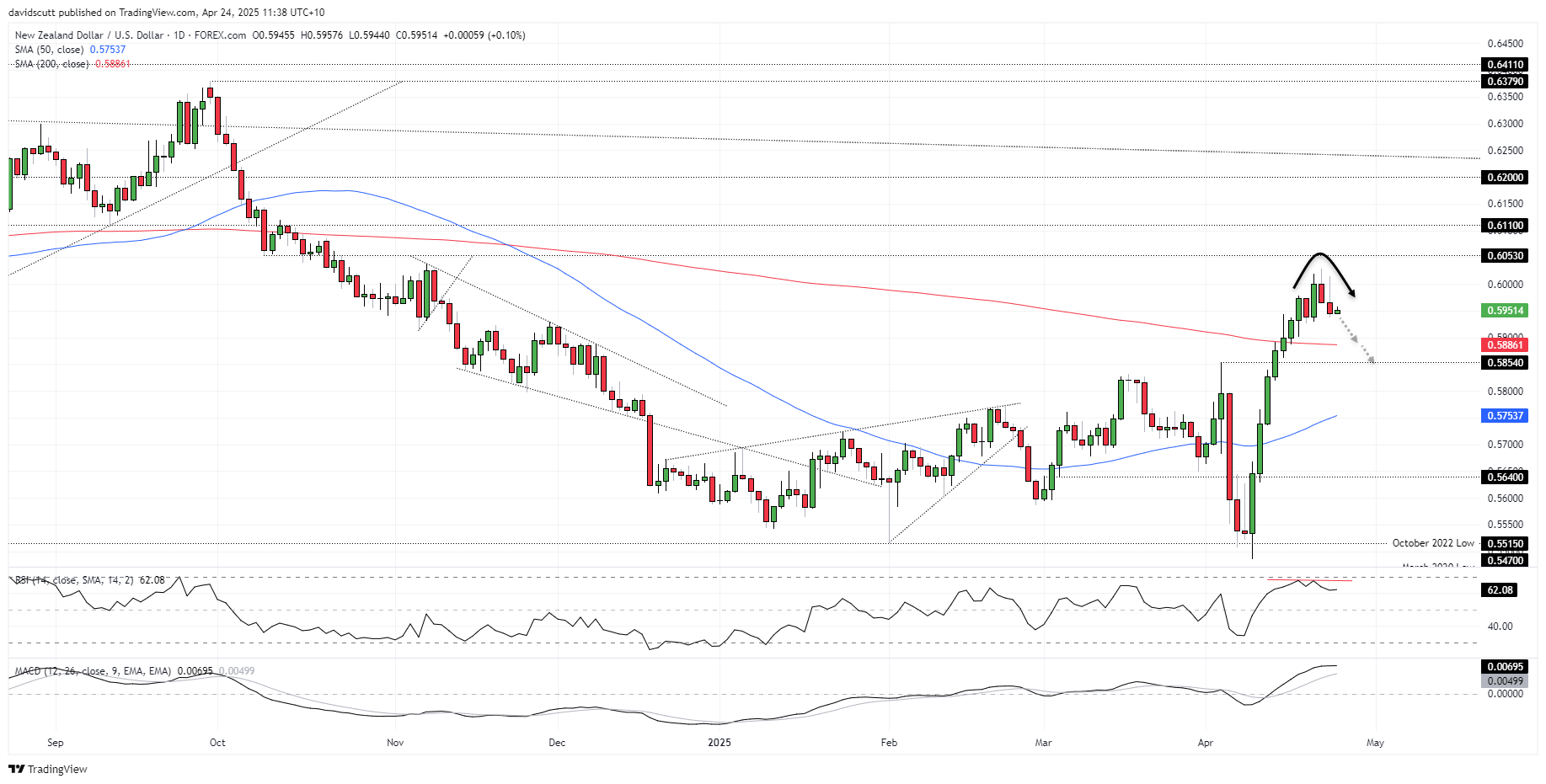

NZD/USD Struggles Above .6000

Source: TradingView

NZD/USD has repeatedly struggled to hold above .6000 this week, with bears overpowering bulls on probes above the figure. While price action was mixed early in the week, Wednesday’s inverted hammer suggests downside risks are rising. Slight bearish divergence between price and RSI (14) adds weight to the view, even though momentum signals remain net bullish for now.

Given where the Kiwi sits, getting short around these levels does not screen as a high probability setup, suggesting patience may be warranted until better entry levels present themselves.

A move towards .6000 would offer a more attractive setup, allowing for positions to be established beneath the level with a stop above Tuesday’s high for protection against reversal. While bids have been noted below .5940 recently, the 200-day moving average screens as a more suitable target with .5854 another after that.

-- Written by David Scutt

Follow David on Twitter @scutty