View related analysis:

- Nasdaq 100 Forecast: Asset Managers Ramp Up Bearish Tech Bets

- EUR/USD forecast: Its pre-ECB surge did not come without a warning

- Bullish Bets on the Euro and Yen Continue to Rise: COT Report

- AUD/USD weekly outlook: 10 March 2025

US inflation surprised to the downside on Wednesday, which was a nice break from the flurry of tariff headlines which has kept investors on edge this month. It also helped appetite for risk lean forward and detach itself from the ropes it had pinned to, but I would stop short of declaring a risk-on rally. It was just a nice break from current themes, which investors are likely becoming fatigued from.

Core CPI rose 0.2% m/m in February, below 0.3% expected and 0.4% prior. It also slowed to 3.1% y/y, below 3.2% expected and 3.1% prior. Still, this is a minor victory with tariffs being rolled out and weaker consumer sentiment and growth prospects for the US and global economy.

The Canadian dollar was the strongest FX major on Wednesday after the Bank of Canada (BOC) delivered a less-than-dovish 25bp cut, taking their cash rate to 2.75%. Noting that the economy will be subject to more uncertainty than usual, they will be carefully assessing the strength of upwards and downwards inflation and monitoring inflation expectations more closely. This is exactly in line with my own expectations in light of tariffs, which force central banks to take a more cautious approach to easing as they battle the contrasting themes of lower growth and rising inflation.

Economic events in focus (AEDT)

- 08:45 – New Zealand visitors and migrations

- 10:50 – Japanese foreign stock and bond purchases

- 11:00 – Australian inflation expectations (Melbourne Institute)

- 11:30 – Australian building approvals

- 13:00 – RBA Assistant Governor Jones speaks

- 18:30 – Swiss Producer Prices

- 20:50 – ECB’s de Guindos Speaks

- 21:00 – EU Industrial Production

- 23:30 – US Core Producer Prices

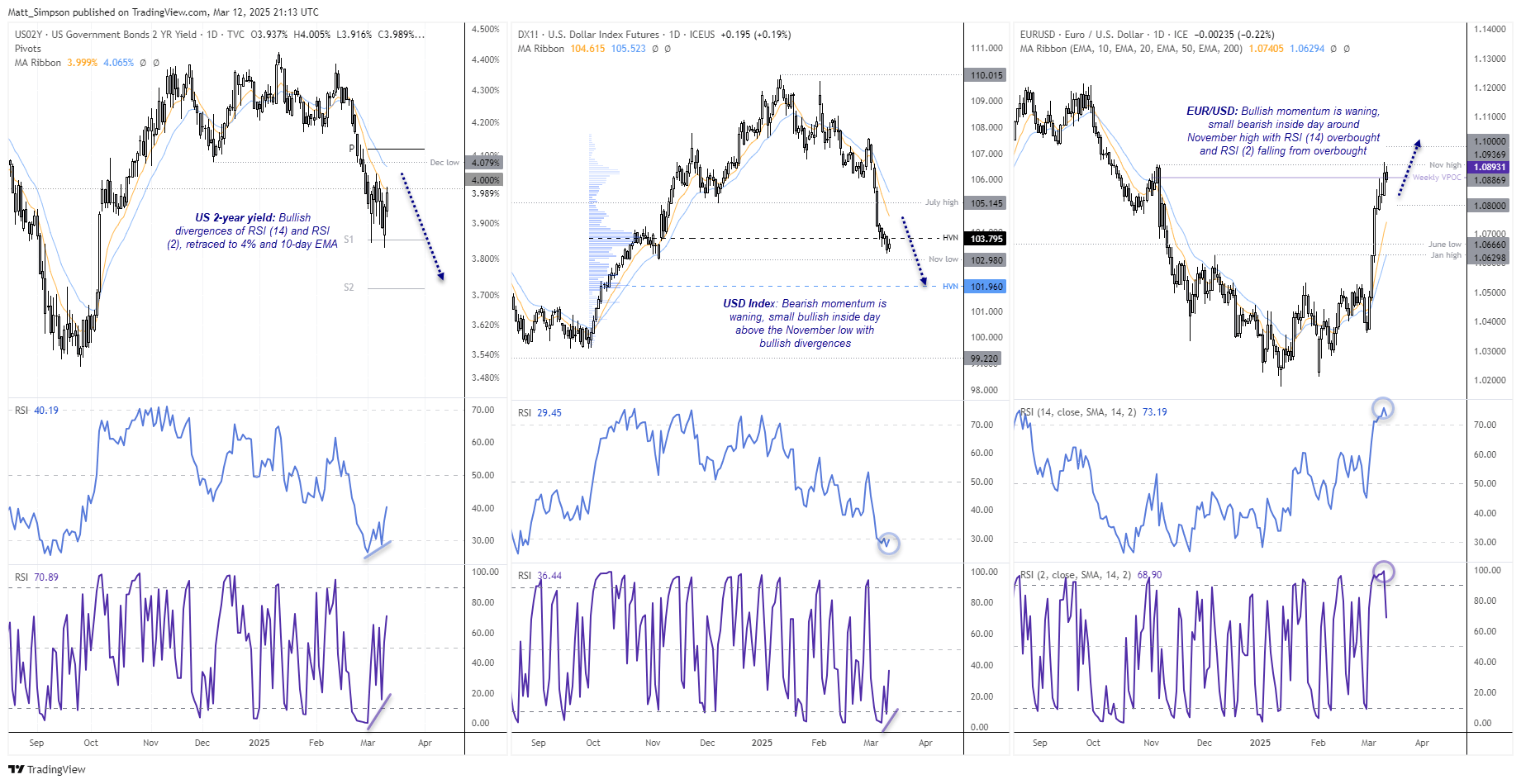

US 2-year, US dollar index, EUR/USD technical analysis

Tariffs have been the predominant driver for currency sentiment in recent weeks, over yield differentials. But with the US 2-year yield building a base and the likelihood of ‘tariff fatigue’ creeping in, perhaps they will begin to take some notice for a brief while. The US 2-year yield has formed a double bottom around its monthly S1 pivot and retraced back up to its 10-day EMA, with bullish divergences on the daily RSI (14) and RSI (2) forming on the daily chart in the oversold zone. If the US 2-year continues to retrace higher or consolidate, it bolsters the case for a pullback higher on the US dollar index and retracement lower on EUR/USD over the near term.

By Tuesday’s low, the US dollar index had fallen -6.2% from its January high which places it in a similar depth to the two prior pullbacks of the past two years. And yesterday’s small bullish inside day shows a slight hesitancy for it to test the November low. The RSI (14) is heavily oversold and a bullish divergence is forming on the daily RSI (2). While prices could still have a stab at the 103 handle, the oversold conditions of the US dollar alongside retracing yields to me suggests we could be approaching a small inflection point higher on the USD index

EUR/USD reached my 1.09 target on Tuesday and also briefly traded above the November high by a cats-whisker. Yet a small bearish inside day formed on Wednesday to show euro bulls pausing for breath before reconsidering their move to 1.10. This Is not really a cause for alarm to the bullish structure, but with prices pausing at such a key high then it is perfectly plausible to expect even a minor shakeout from current levels before the move resumes.

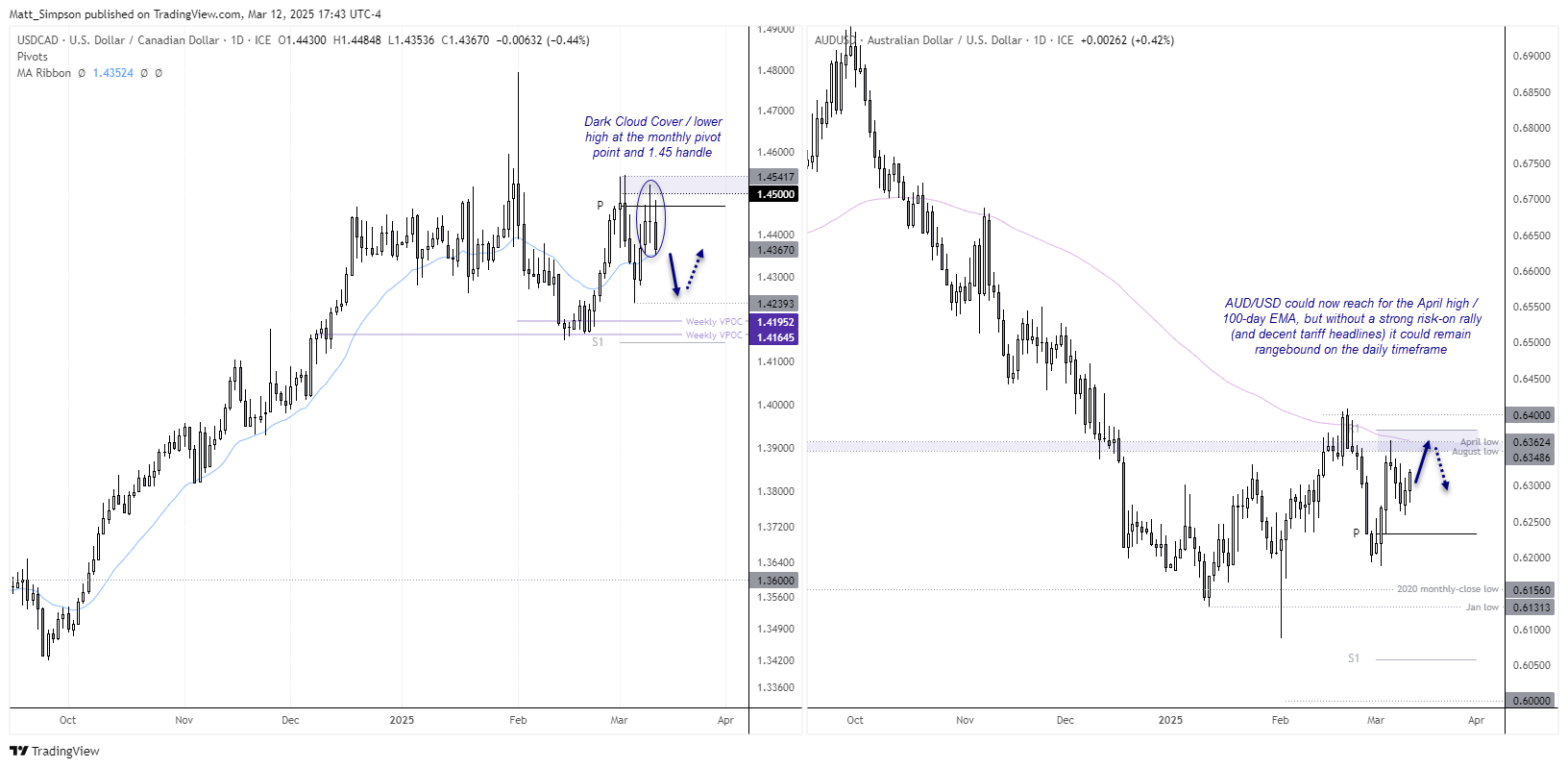

USD/CAD, AUD/USD technical analysis

Commodity FX took advantage of ongoing tariff discussions between the US and Canada, with CAD, AUD and NZD being the strongest majors on Wednesday. And we could find their strength continues should Canada walk away with more favourable terms than the 50% levy on steel and aluminium that Trump threatened them with.

USD/CAD was lower in line with my bias after the BOC shed doubt over further cuts, although it has found support at the 20-day EMA. Still Tuesday’s doji is also a lower high, and yesterday’s bearish range expansion means a dark cloud cover pattern has now formed which will be confirmed with a break beneath yesterday’s low. Bears could target 1.43, break of which brings the 1.4239 low into focus.

AUD/USD rose for a second day and closed above 63c. If Wall Street and pick itself up further from its lows, AUD/USD could be headed for the April high and 100-day EMA around 0.6362. But we’d likely need a surprisingly good set of risk-on tariff headlines before we can expect a retest or break of 64c. And that could see AUD/USD remaining trapped in range for the foreseeable future.

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge