- Markets focused on Fed policy beyond Powell

- USD pressured by tariffs, deficit concerns, and risk of unconventional monetary policy

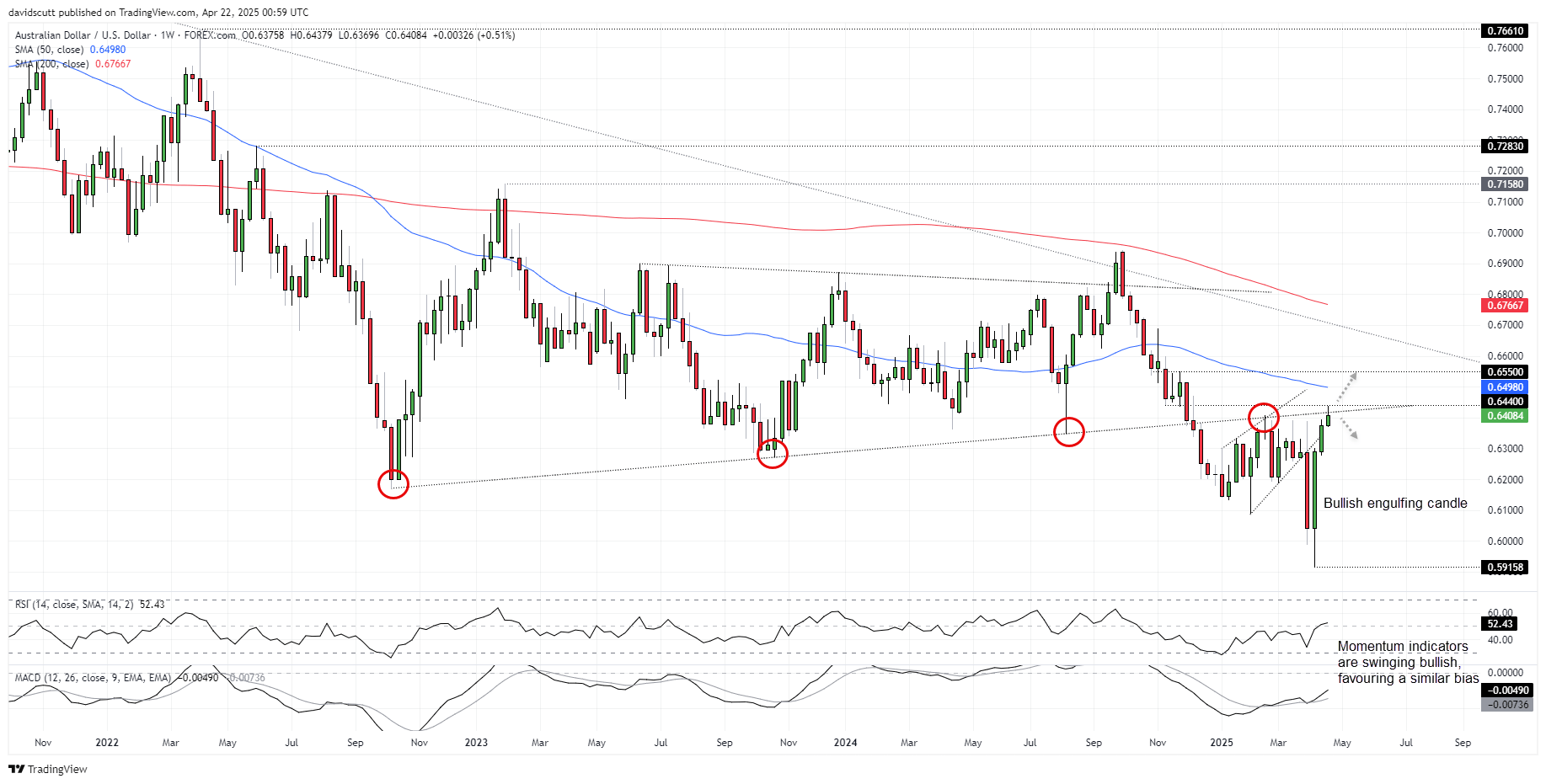

- AUD/USD testing 2022 uptrend with bullish momentum building

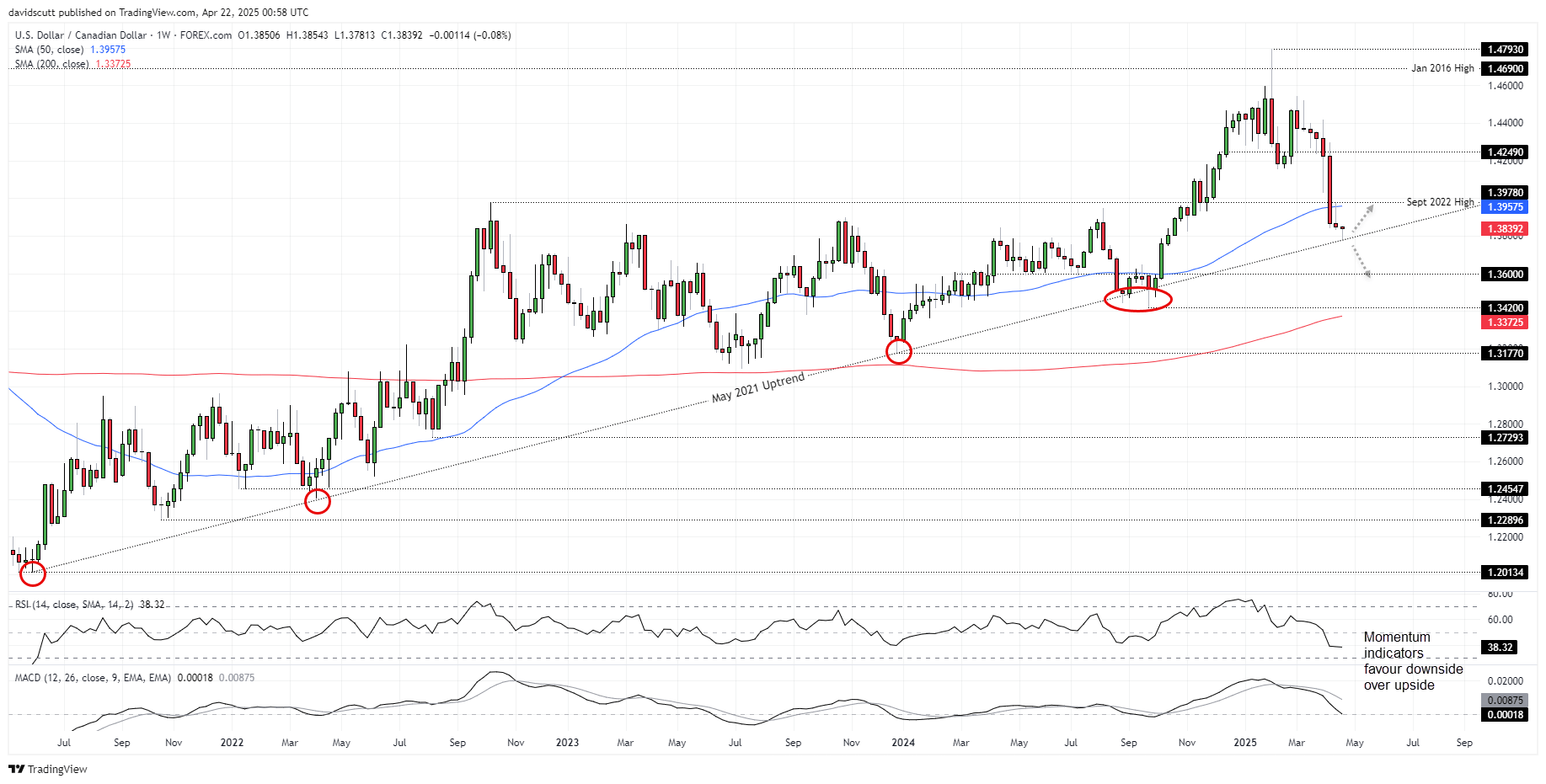

- USD/CAD holding key 2021 support but downside bias remains

Summary

With markets viewing the U.S. dollar as a sell-on-rallies play, traders are looking past Powell’s tenure to what policy might look like under a pro-Trump Fed chair. Fiscal largesse, tariff-driven inflation, and the potential for unconventional policies such as yield curve control are weighing on the dollar and Treasuries alike. Against that backdrop, AUD/USD and USD/CAD sit at pivotal technical levels, with weekly charts showing bullish momentum building in the Aussie while USD/CAD teeters on uptrend support that has held strong for years.

Monetary Policy Beyond Powell

Rather than Donald Trump’s attacks on Federal Reserve Chairman Jerome Powell being the catalyst behind the latest wave of U.S. dollar selling, it’s more likely traders are looking beyond whether Powell leaves his post early to what monetary policy settings may look like under a more pro-Trump chair.

Everyone expects inflation will pick up because of newly implemented import tariffs—the only real area of debate is how long the inflationary impact will last. Asking the Fed to cut rates aggressively in such an environment has undoubtedly contributed to the sell-off in longer-dated Treasuries, especially with fiscal stimulus also likely later in the year. With growing concerns about the ability to cut U.S. government expenditure, deficits already measured in the trillions of dollars per year could conceivably become larger, not smaller. Who would be willing to fund it?

Of course, the Fed is a source of potential Treasury demand, especially if chaired by someone more aligned with Donald Trump’s vision for the economy. It could introduce yield curve control to artificially pin Treasury yields down—a move that may keep debt financing costs low. But the trade-off would likely be acute U.S. dollar weakness as the monetary base is increased to fund Treasury purchases and yield differentials move against the United States.

Along with mistrust sparked by erratic trade policy, these concerns likely explain much of the price action seen in debt and FX markets recently. It feels like traders are trying to hedge against the risk of either U.S. dollar weakness and/or worsening fiscal position. And unless the concerns are addressed—which seems unlikely in the near term—it’s difficult to see the U.S. dollar gaining any meaningful traction outside of sharp countertrend rallies sparked by lopsided short-term positioning.

For the first time in a long time, the USD is a sell-on-rallies play against almost everything.

In this note, we look at the technical picture for AUD/USD and USD/CAD—among the laggards of the G10 FX universe in the shift away from the U.S. dollar. Weekly timeframes are used to help reduce noise in these headline-driven markets.

AUD/USD Tests Key Uptrend

Source: TradingView

AUD/USD sits at a key level on the charts, banging up against the dominant uptrend dating back to October 2022.

You can see from past price interaction how pivotal this trendline has been, initially acting as support before flipping to resistance after being broken late last year. The bullish engulfing weekly candle from early April flagged what’s since played out, hinting this fresh attempt to break the trendline may have more legs than those seen in recent months. Momentum also leans bullish, with both RSI (14) and MACD trending higher even if the latter remains marginally in negative territory.

If AUD/USD can break and hold above the uptrend, it may draw in additional bulls from the sidelines, opening the door to a move towards .6550—a zone the pair chopped around in during late 2024. If the price cannot hold above the trendline, the bullish bias would be invalidated, opening the door for potential short setups.

USD/CAD Unwind Stalls at Key Uptrend

Source: TradingView

The bearish unwind in USD/CAD faces a key moment this week, with the price now testing uptrend support dating back to May 2021. The initial interaction saw the price bounce on Monday—as has often been the case when tested over the past four years.

While that may suggest it’s time to reset longs looking for a push higher, in this macro environment, and with momentum indicators such as RSI (14) and MACD turning bearish, the prospects for a sustained upside move appear limited. If anything, price and momentum signals favour continued downside.

A clean break and hold beneath the uptrend may trigger a fresh wave of selling, putting a retest of 1.3600 or the September 2024 swing low of 1.3420 on the cards. Alternatively, if the pair can’t break the uptrend, the near-term risk shifts towards a squeeze higher, potentially towards 1.3978.

-- Written by David Scutt

Follow David on Twitter @scutty