View related analysis:

- USD, EUR, GBP, JPY Outlook: Weekly COT Report Highlights

- EUR/USD, USD/JPY, USD/CAD Outlook: US Dollar Slammed Ahead of PCE Inflation

- Japanese Yen Slips, Wall Street Futures Rally as US Court Blocks Trump’s Tariffs

- Gold at Technical Crossroads Ahead of GDP, PCE; ASX 200 Stalls at Resistance

- Australian Dollar Outlook: Higher CPI Unlikely to Deter RBA Cut

Australia’s retail trade slipped -0.1% in May according to the ABS, in further signs that the economy is slowing. It will be interesting to see if household spending contracts further when April’s data is released on Thursday, given it fell -0.3% in March. ANZ also reported that job adverts contracted for a second consecutive month in May, which points towards a slowing jobs market. On Tuesday we’ll see company profits and net exports contribution to GDP, which could help refine last-minute calls on Wedensday’s Q1 growth figures.

Australia’s GDP is forecast to have risen 1.5% y/y in Q1 and 0.4% q/q. Anything less simply bolsters bets of a July cut. RBA cash rate futures currently imply a 73% chance of a July cut and an end-of-year cash rate of 3.1%.

The RBA minutes are released on are unlikely to shed any new light of the prospects of a July cut given events this week. Odds of another 25bp cut on July 8 have fallen to 59% from 78% ahead of the monthly inflation report. While CPI remains within the RBA’s 2-3% target band, trimmed mean CPI rose to 2.7% from 2.6% and headline CPI rose remained at 2.4% compared to 2.3% expected. And that was before Trump’s tariffs were effectively cancelled and reinstated within 24 hours, spurring a bout of unwelcome volatility that the RBA were sure to have noted.

Federal Reserve (Fed) Chair Jerome Powell is to deliver remarks at the 75th anniversary of International Finance, though he is not expected to be commenting on monetary policy at this event. That said, traders will still be tuning in for any subtle cues, regardless. Though Powell’s recent comments have highlighted data dependence, and he’s unlikely to stray far from that line.

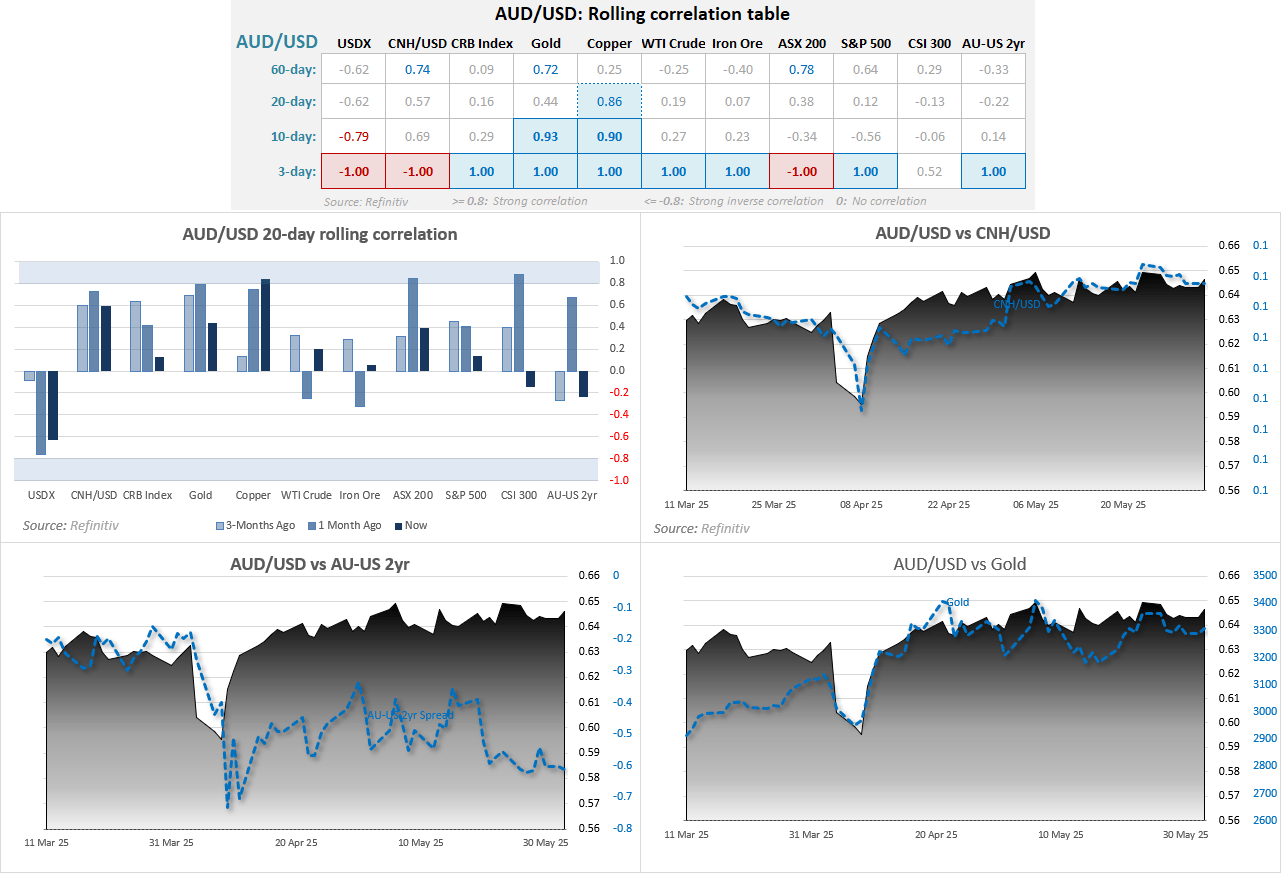

AUD/USD Correlations

The Chinese yuan, copper and gold continued to share a strong positive correlation with AUD/USD, and its relationship with the AU-US 2 year spread has effectively broken down.

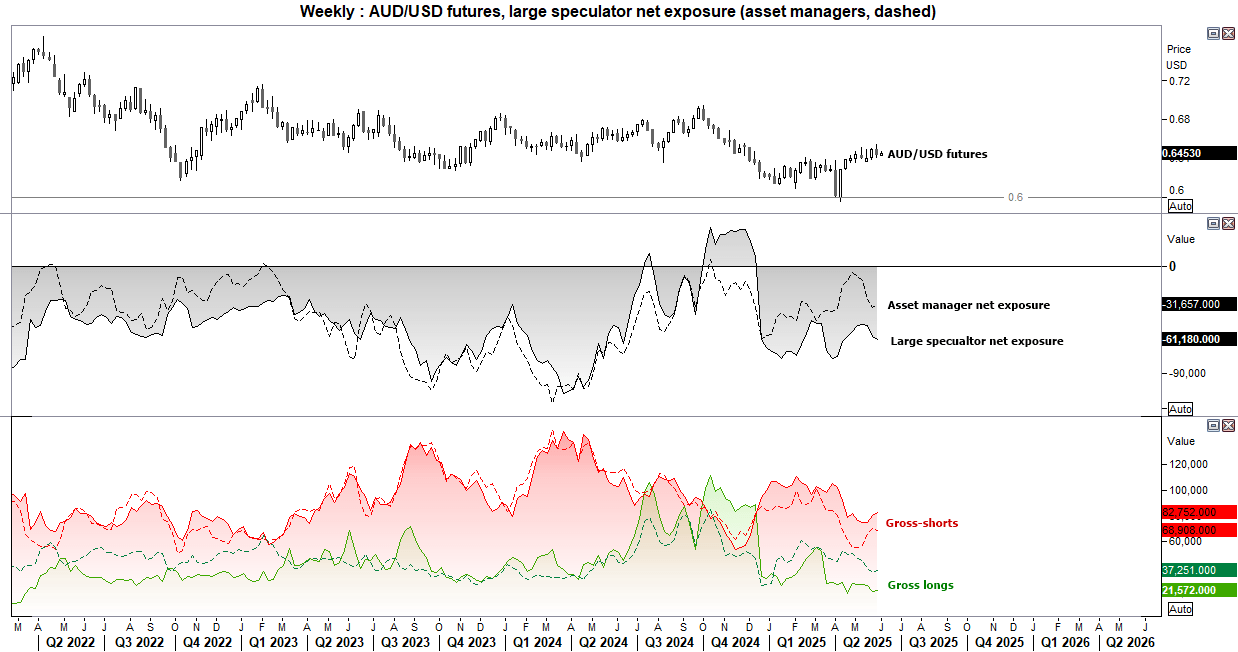

AUD/USD Futures – Market Positioning From The COT Report:

Only minor adjustments were made to AUD/USD futures positioning last week, with large speculators increasing their net-short exposure by 2.1k contracts and asset managers decreased their by -2.8k contracts.

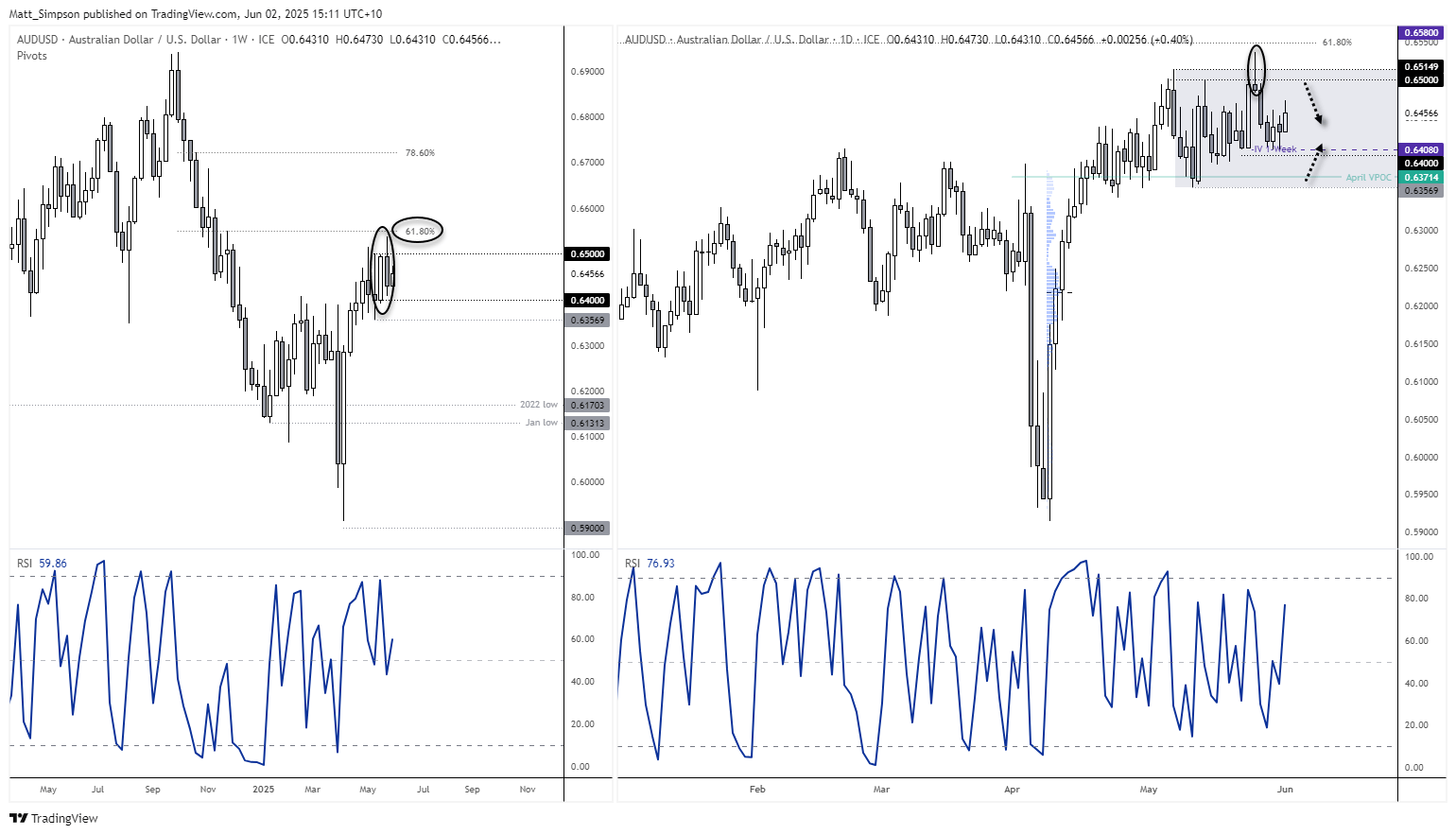

AUD/USD Technical Analysis

The v-bottom rally has stalled around a 61.8% Fibonacci level, with two false breaks of 65c. The sharp reversal back into the 64 – 65c range left a shooting star candle at its high, which could temp bears to fade into moves towards 65c. And with AUD/USD likely to remain rangebound of the foreseeable future, traders are likely to seek dips to 0.64000 or 0.6356 to trade the range is currently stuck in.

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge