View related analysis:

- Japanese Yen Sinks, US Dollar Surges Ahead of US-China Talks

- AUD/USD, USD/CAD, NZD/USD: An Engulfing Day for Commodity FX

- AUD/USD Weekly Outlook: Yuan Correlation Supports Aussie Strength

- Japanese Yen Bulls Still Pushing Their Luck: COT Report

Australian Data in Focus: Jobs, Wages, and Sentiment Ahead of RBA Decision

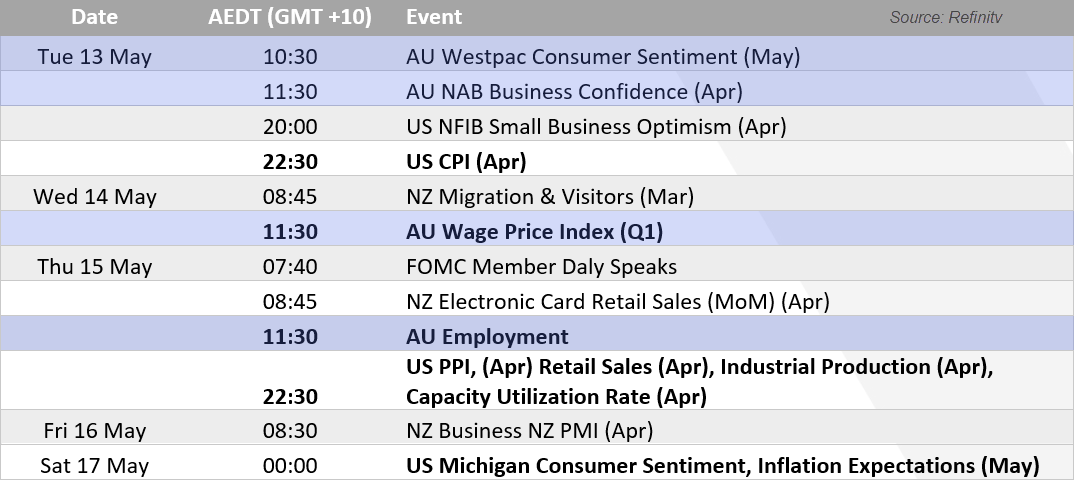

The four main economic data points next week include sentiment for consumer and business, wage price index and employment. I don’t see any of these derailing an RBA cut on May 20, but they do of course help us keep a pulse on the economy.

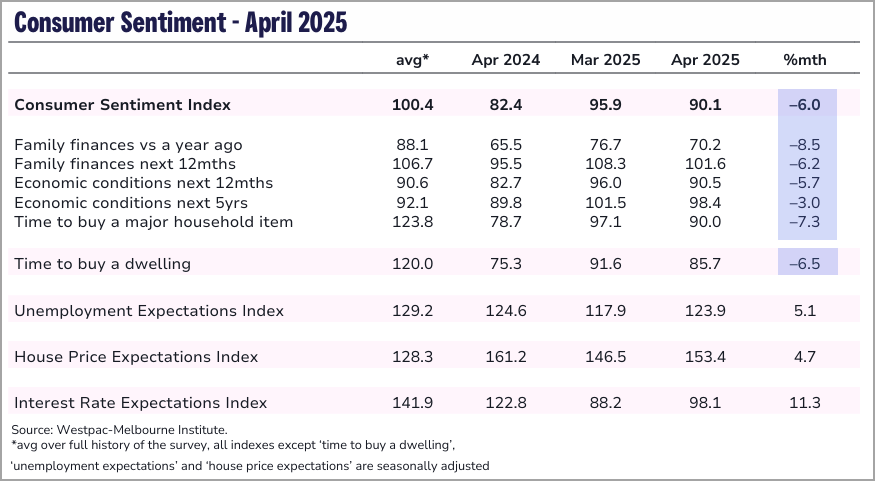

“Tariff turmoil” saw Australian consumer confidence fall by -6% in April—its steepest monthly decline in nearly two years, according to the Westpac survey. All sub-indices declined over the month, with the ‘family finances compared to a year ago’ gauge plunging -8.5%. I doubt we’ll see a strong print for consumer confidence this week, though the rebound in risk sentiment might help soften the blow. The ASX 200 has rallied around 15% since the April low (which formed the day ahead of the Westpac sentiment report) and AUD/USD is up around 10%.

The wage price index is likely to show wages rising at a slower pace, though it’s rarely a market mover for AUD/USD traders.

Thursday’s employment report, however, warrants attention—although it seems more likely than not to deliver another set of robust figures. I’m personally struggling to find a tradie available for work, and one I spoke to didn’t even have time to provide a quote. But with trimmed-mean inflation now within the Reserve Bank of Australia’s (RBA) 2–3% target band and consumer sentiment shifting, a rate cut on May 20 appears increasingly likely.

US CPI and Retail Sales in Focus for AUD/USD Traders

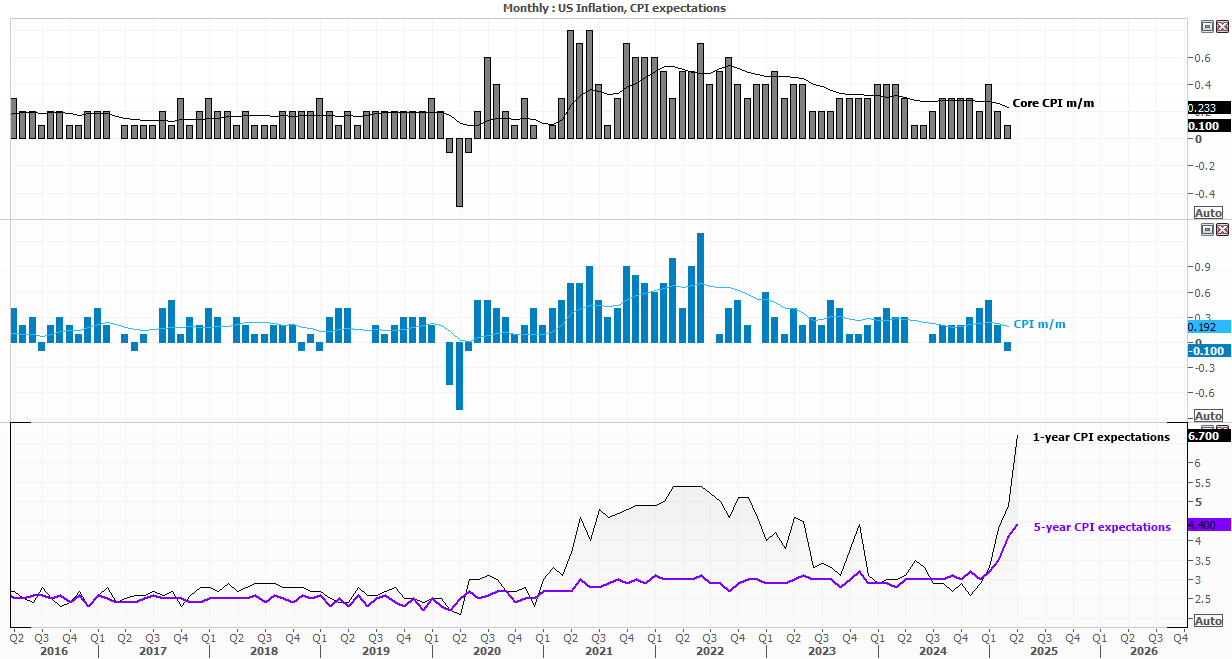

Consumer prices are the main event from the US this week. Contrary to tariff-induced fears, April’s CPI data was softer than expected. Core CPI rose just 0.1%—a nine-month low—while the annual rate of core inflation slowed to 2.8% year-on-year, its lowest level since March 2021. CPI also contracted by -0.1%, its first sub-zero print in nearly four years.

While another soft CPI print could bolster expectations of a Federal Reserve (Fed) rate cut, the Fed is unlikely to signal any moves until there is clarity on a potential US–China trade deal. Fed fund futures currently imply a 50.4% chance of a cut in July, or 44.1% of one in September.

Retail sales might produce another solid set of figures as shoppers bring forward purchases due to the threat of tariffs. Inflation expectations are also expected to remain high in Friday’s consumer sentiment report from the University of Michigan.

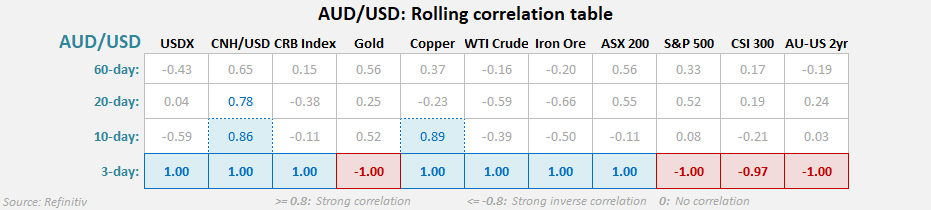

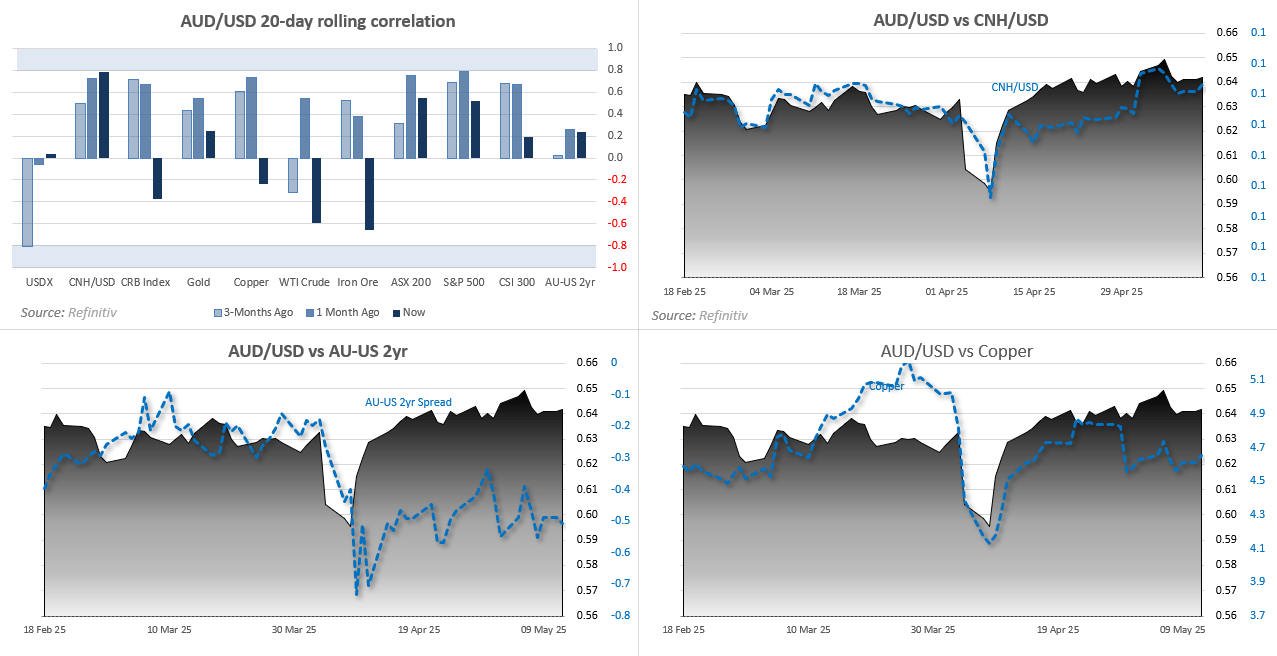

AUD/USD Correlations

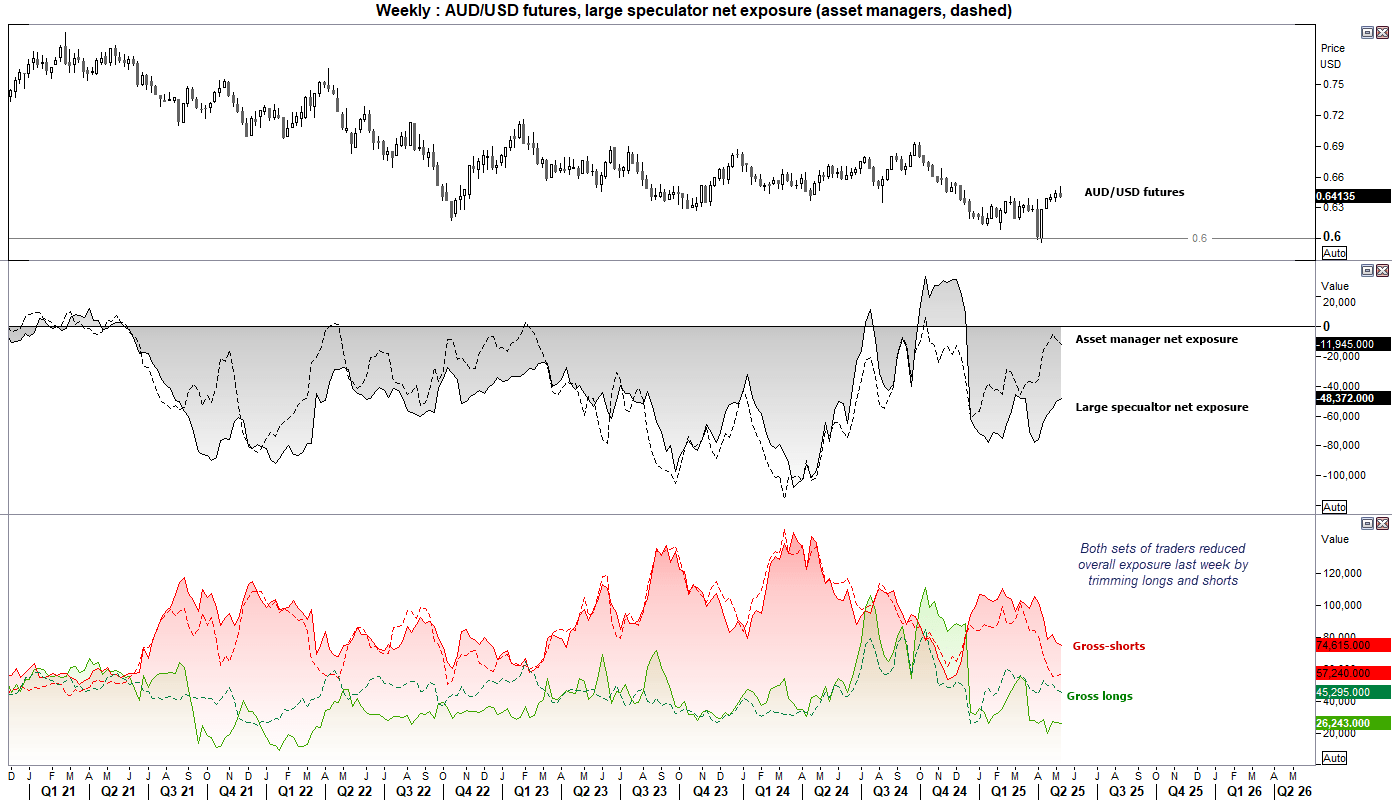

- Asset managers increased their net-short exposure to AUD/USD by 3.5k contracts last week.

- However, they reduced overall exposure—trimming longs by 4% (-1.8k contracts) and shorts by 3% (-1.8k contracts).

- Large speculators also trimmed gross longs by 1.3% (-359 contracts) and shorts by 2.5% (-1.9k contracts), resulting in a 1.5k contract reduction in net-short exposure.

AUD/USD Futures: COT Report Shows Reduction in Market Positioning

- Asset managers increased their net-short exposure to AUD/USD by 3.5k contracts last week

- Though they actually reduced their overall exposure, trimming longs by -4% (-1.8k contracts) and shorts by -3% (-1.8k contracts)

- Large speculators also trimmed gross longs by -1.3% (-359 contracts) and shorts by -2.5% (-1.9k contracts), sending net-short exposure lower by -1.5k contracts

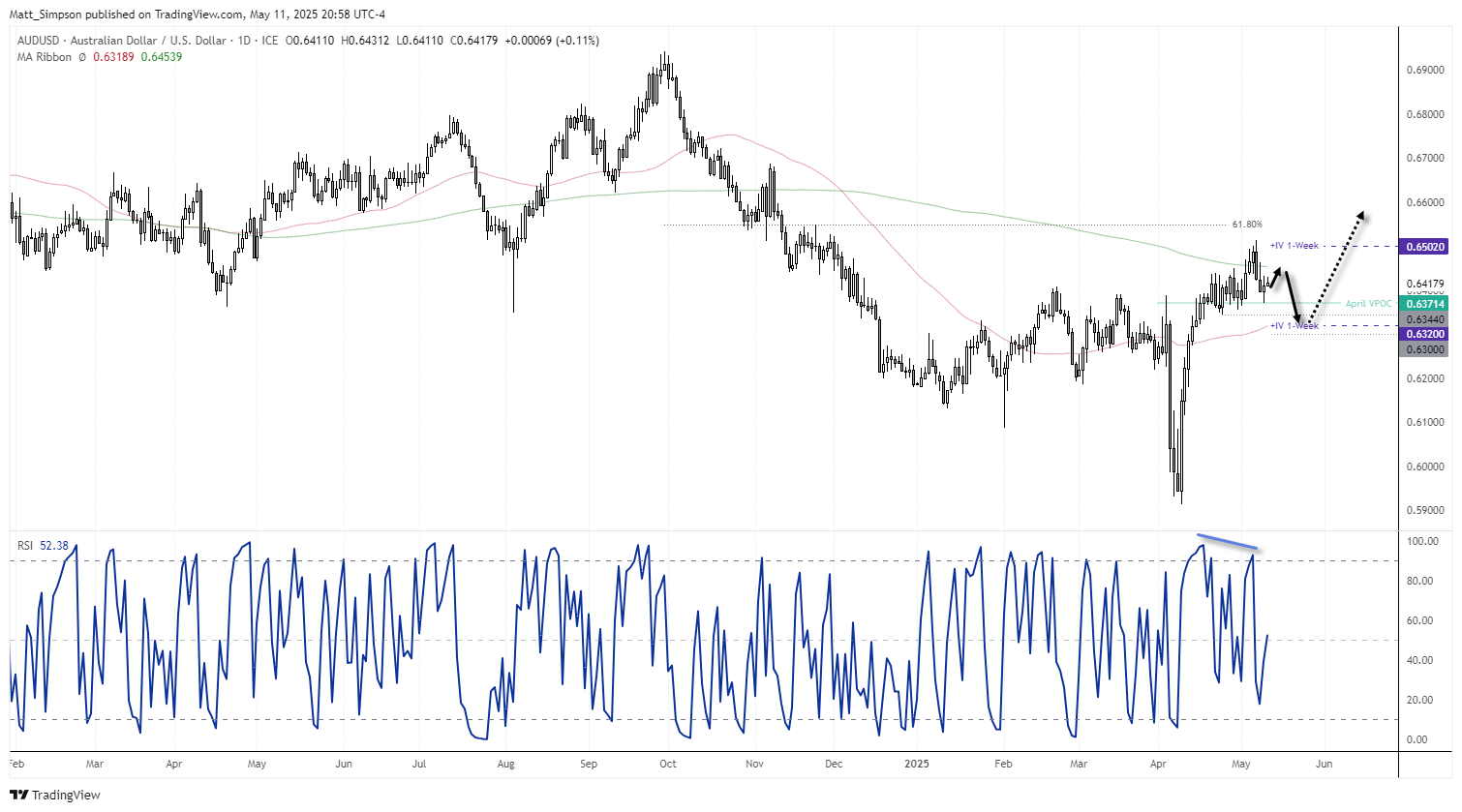

AUD/USD Technical Analysis

AUD/USD reached my initial downside target at the April VPOC (volume point of control) of 0.6371, which provided support on Friday. The pair opened bid on Monday, supported by positive headlines surrounding US–China trade talks—though concrete details have yet to emerge. Still, should AUD/USD break above Friday’s high, a retest of the 200-day SMA (simple moving average) at 0.6454 could be on the cards.

However, I suspect the retracement in AUD/USD is not yet complete, leaving the pair vulnerable to another leg lower. The daily RSI (2) has yet to reach oversold, after a bearish divergence preceded the recent selloff.

A break beneath the 0.6344 low opens the door for a move towards 0.6300, near the 50-day SMA and lower implied volatility band. Conversely, a sustained break above the 200-day SMA would suggest another attempt at the 0.65 handle.