The Australian dollar has steadily climbed this week, supported by broader market sentiment. However, price action now suggests that AUD/USD and AUD/JPY may be running out of steam. With key resistance levels being tested and early signs of bearish reversals emerging, traders may begin to question the sustainability of the Aussie’s recent strength.

View related analysis:

- AUD/USD Outlook: Headwinds from China Data and RBA Policy

- US Dollar Outlook: Don’t Write Off the USD Just Yet

- Gold Outlook: Seasonal Weakness and Fading Momentum Hint at June Pullback

- USD/CAD, AUD/JPY Outlook: Trade Hopes Fuel Commodity FX Strength

AUD/USD, AUD/JPY: Aussie Exhaustion Signals a Pullback?

AUD/USD Technical Analysis: Australian Dollar vs US Dollar

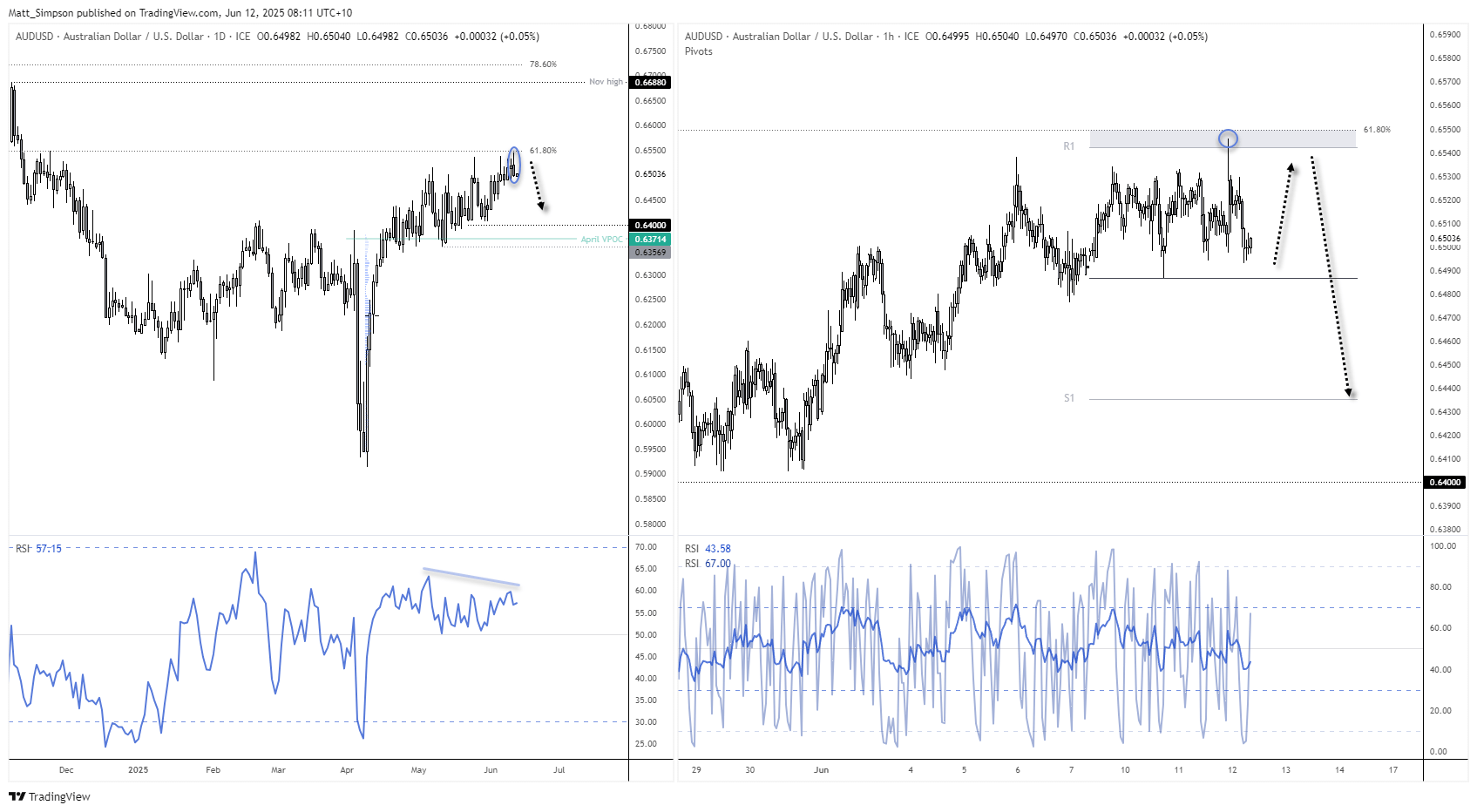

The Australian dollar (AUD/USD) continues to grind higher, but price action still carries the hallmarks of a broader sideways range. Despite printing fresh highs, this slow and steady climb often precedes a sharper downside move.

While the upper boundary of the range has shifted from 0.64 to 0.65 and now approaches 0.6550, there are signs that bearish momentum could soon return. Importantly, AUD/USD is now testing the longer-term 61.8% Fibonacci retracement level at 0.6549 — a zone that may act as strong resistance. A rejection from this level could spark a swift downside move in the Australian dollar against the US dollar, even if only temporarily.

Notably, Wednesday’s spike higher in AUD/USD stalled between the 61.8% Fibonacci retracement level and the monthly R1 pivot point — a confluence that adds weight to this resistance zone. Currently, AUD/USD is hovering just above the monthly pivot point at 0.6487, which could act as a short-term support level and trigger a minor bounce.

However, unless broader sentiment shifts significantly, bears may look to fade rallies towards the upper end of the current intraday range. On the 1-hour chart, this could offer tactical short opportunities in the Australian dollar against the US dollar as momentum stalls near key resistance levels.

AUD/JPY Technical Analysis: Australian Dollar vs Japanese Yen

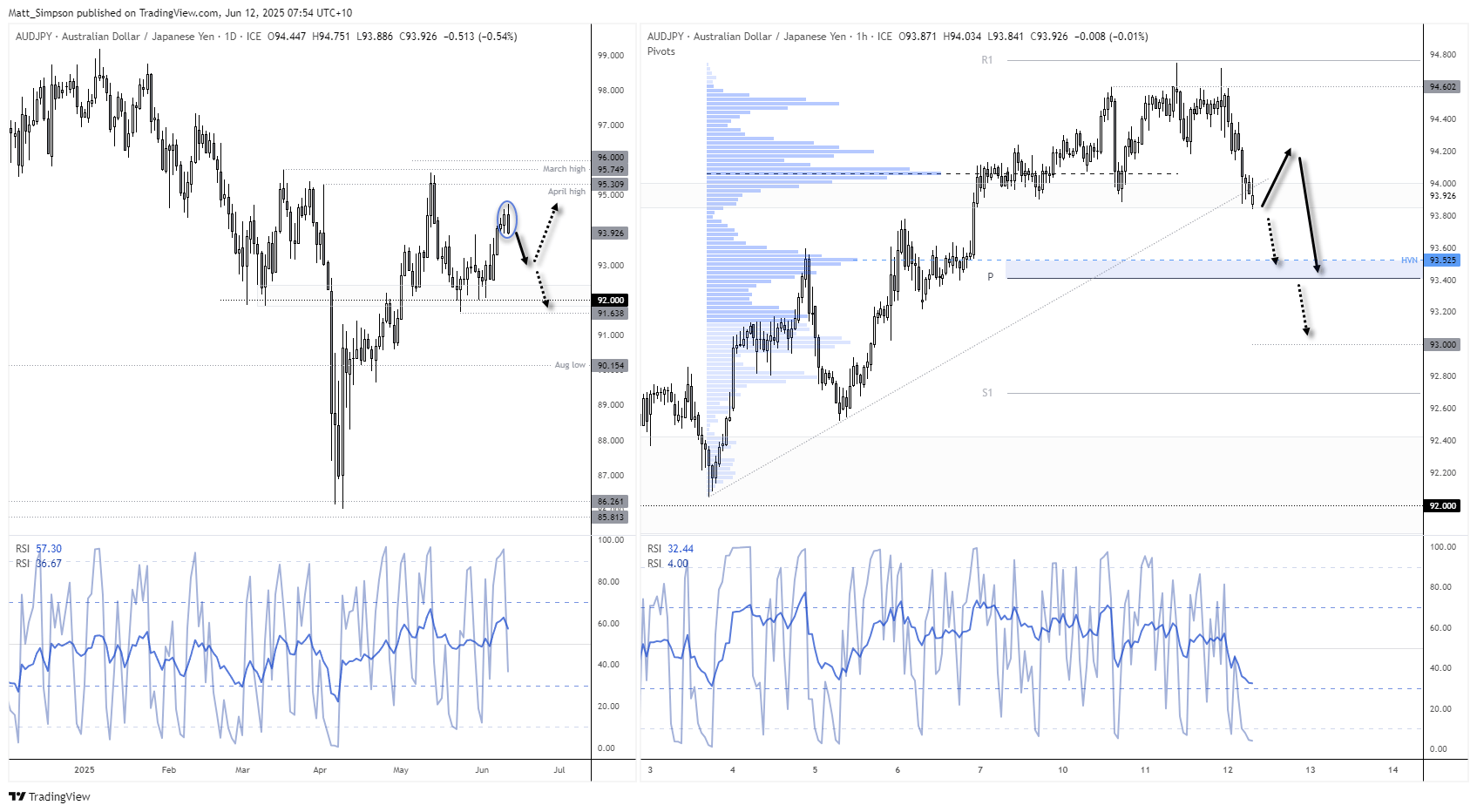

I had expected AUD/JPY to continue higher in the face of persistent Japanese yen weakness. Clearly, that has not been the case, with AUD/JPY forming a bearish engulfing candle on Wednesday — a clear signal that the Australian dollar may be losing momentum against the yen. As such, I’m inclined to be on guard for a deeper pullback heading into the weekend, unless a bout of risk-on sentiment revives demand for the Aussie.

The 1-hour chart shows the bullish trendline from the 3 June low is already under pressure. Given price is meandering around this trendline during low liquidity conditions, some patience is warranted — we could see choppy price action around this area. Still, the bearish engulfing candle keeps the bias tilted lower, and my preference is to fade minor rebounds off the trendline or watch for evidence of an intraday swing high within Wednesday’s range.

The monthly pivot point at 93.40 and a nearby high-volume node (HVN) at 93.53 form an immediate support zone for AUD/JPY bears. A break beneath this area could bring the 93.00 handle into focus, especially if risk sentiment deteriorates further.

EUR/AUD Technical Analysis: Euro vs Australian Dollar

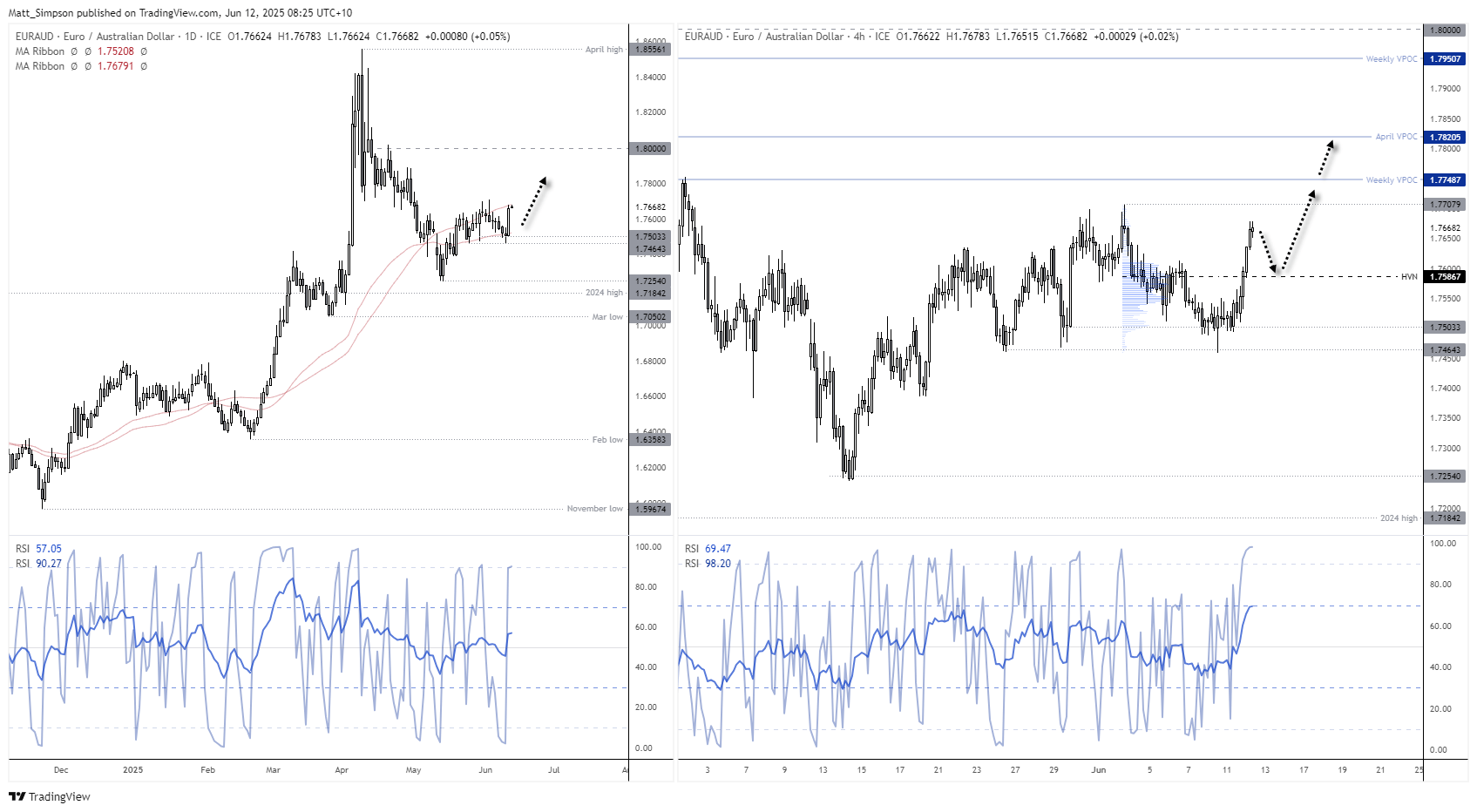

EUR/AUD posted its strongest daily gain in three weeks on Wednesday, rising 0.8% and closing firmly above the 1.76 handle. This move represents a clear bullish range expansion from Tuesday’s narrow Doji candle and saw the euro dollar use the 50-day EMA as a launchpad. It also revives a previously stated bullish outlook for EUR/AUD, with upside potential towards 1.80 against the Australian dollar.

Still, the 50-day simple moving average (SMA) capped the day’s advance, suggesting that an intraday pullback could be in play while prices remain beneath the 1.77 resistance level. The 4-hour RSI (2) is deeply overbought, and the RSI (14) is approaching its overbought zone. Traders bullish on the euro dollar may look to fade pullbacks in EUR/AUD towards the 1.7586 high-volume node (HVN) or the 1.7500 support level.

Should a swing low materialise, potential upside targets for EUR/AUD include the weekly and monthly VPOCs (volume points of control) around 1.7750, 1.7820, and 1.7950.

Economic Events in Focus (AEST / GMT+10)

- 08:45: NZD Electronic Card Retail Sales (May) (NZD/USD, AUD/NZD)

- 09:50: JPY BSI Large Manufacturing Conditions, Foreign Investment Flows (USD/JPY, EUR/JPY, Nikkei 225)

- 11:00: AUD MI Inflation Expectations (Jun) (AUD/USD, ASX 200)

- 16:00: GBP GDP, Trade Balance, Industrial & Manufacturing Production (Apr) (GBP/USD, FTSE 100)

- 19:00: EUR ECB's Schnabel Speaks (EUR/USD, EUR/GBP)

- 20:00: GBP Thomson Reuters IPSOS PCSI (Jun) (GBP/USD)

- 21:00: GBP NIESR Monthly GDP Tracker (May) (GBP/USD)

- 22:00: EUR German Current Account, ECB’s De Guindos & Schnabel Speeches (EUR/USD, DAX)

- 22:30: USD PPI, Core PPI, Jobless Claims (May) (USD, Gold, S&P 500, Nasdaq 100, Dow Jones)

- 00:15: EUR ECB’s Elderson Speaks (EUR/USD)

- 00:30: USD Natural Gas Storage (WTI Crude Oil, Natural Gas, USD)

- 01:00: USD Cleveland CPI (May) (USD)

- 02:00: USD WASDE Report (USD, Corn, Wheat, Soybeans)

- 03:00: USD 30-Year Bond Auction (USD, US Treasury Bonds)

- 04:00: USD 10-Year Note Auction (USD, US Treasury Bonds)

- 06:30: USD Fed Balance Sheet, Reserve Balances (USD)

View the full economic calendar

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge