The Australian dollar remains vulnerable this week as fresh signs of deflation from China and soft Q1 GDP data fuel expectations of a July rate cut from the Reserve Bank of Australia (RBA). With AUD/USD repeatedly failing to hold above 65c, traders now turn their focus to upcoming US inflation figures for clues on the Federal Reserve’s next move. Together, these macro forces are keeping the Aussie trapped within a familiar range — and tipping the balance toward downside risks.

AUD/USD Outlook: Headwinds from China Data and RBA Policy

The Reserve Bank of Australia Look Set to Cut In July

Australia’s sluggish growth in Q1 has likely cemented another 25bp cut from the RBA on July 4. Barring an upside surprise from monthly CPI report on June 25.

- Real GDP rose just 0.2% q/q (0.6% prior) and remained steady at 1.3% y/y.

- Consumption was also a mere 0.2% (0.5% prior)

- Manufacturing and services PMIs were barely expansionary

- Retail sales were also sluggish in May

- Odds of an RBA cut in July have risen to 86%, according to the RBA cash rate futures

AUD/USD Vulnerable as China Inflation Data Points to Deflation

There’s lots of talk about deflation in China. If true, it points to softer global growth and deflation (to at least disinflation elsewhere). Which is a far cry from the highly inflationary environment we were promised due to Trump’s tariffs. China release CPI and PPI figures on Monday, with inflation expected to have contracted -0.2% in May (-0.1% prior) and producer prices to have sunk -3.1% y/y in May (-2.7% y/y prior). This could weigh on AUD/USD if this trend persists. Even if not, it is hard to see how it is bullish for the Australian dollar.

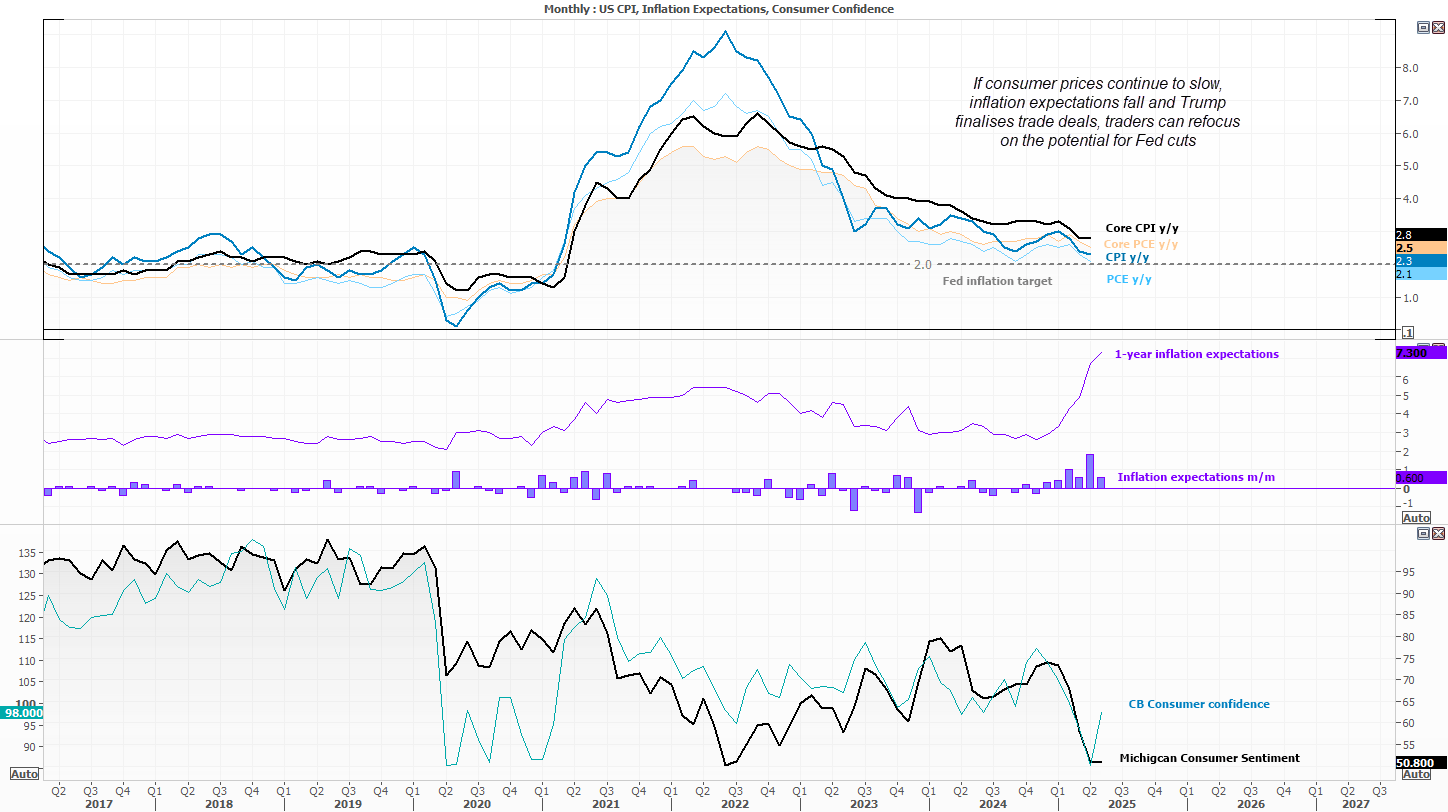

US inflation is the main economic event this week

Trump’s tariffs have not proven as inflationary as many had feared, with the latest core PCE price index rising just 0.1% in May — marking a three-year low of 2.5% y/y and reflecting sluggish consumer spending. If President Trump manages to secure trade deals and draw a line under the trade war, recession concerns may ease considerably. That would allow traders to refocus on Federal Reserve policy. A softer US CPI report this week could bolster expectations for a Fed rate cut.

The University of Michigan consumer sentiment report is likely to show a rebound on Friday, though form very low levels. The Conference Board’s own sentiment report snapped a 5-month losing streak in May, with its 12.3 m/m increase being its fastest in over three years.

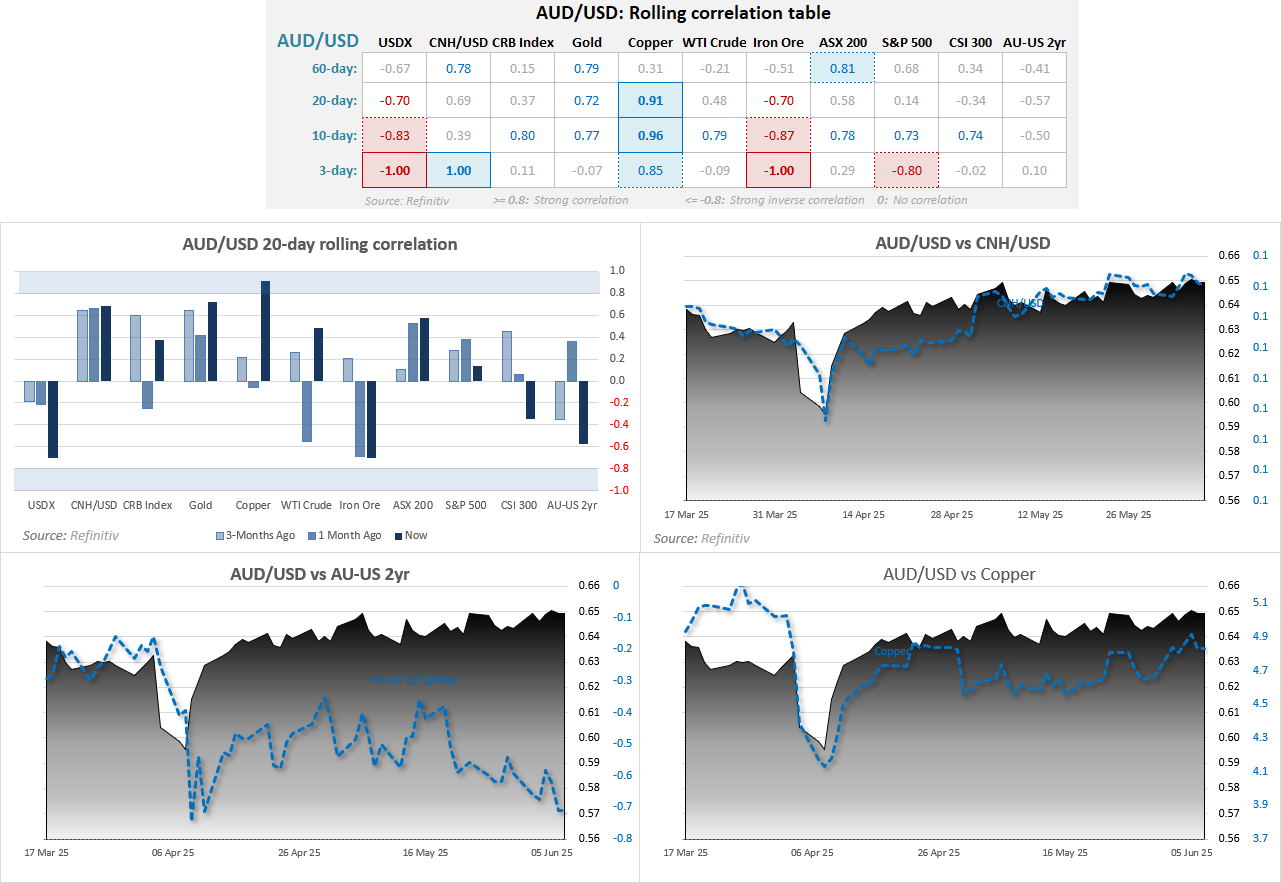

AUD/USD correlations:

- The correlation between the Australian dollar and Chinese yuan is losing its potency, with the 10-day correlation slipping to 0.39 (1.0 = perfect correlation, -1.0 = perfect inverse).

- However, it remains robust over the 60-day period at 0.78.

- The broader trend between AUD/USD and CNH/USD still looks visually strong, with USD/CNH finding support at 7.164 and the Aussie once again pulling back from the 65c level.

- The positive correlation between copper and AUD/USD that we noted last week remains intact, but the relationship with gold has seemingly broken down for now.

- The correlation between yield differential between the US and Australia have continued to diminish.

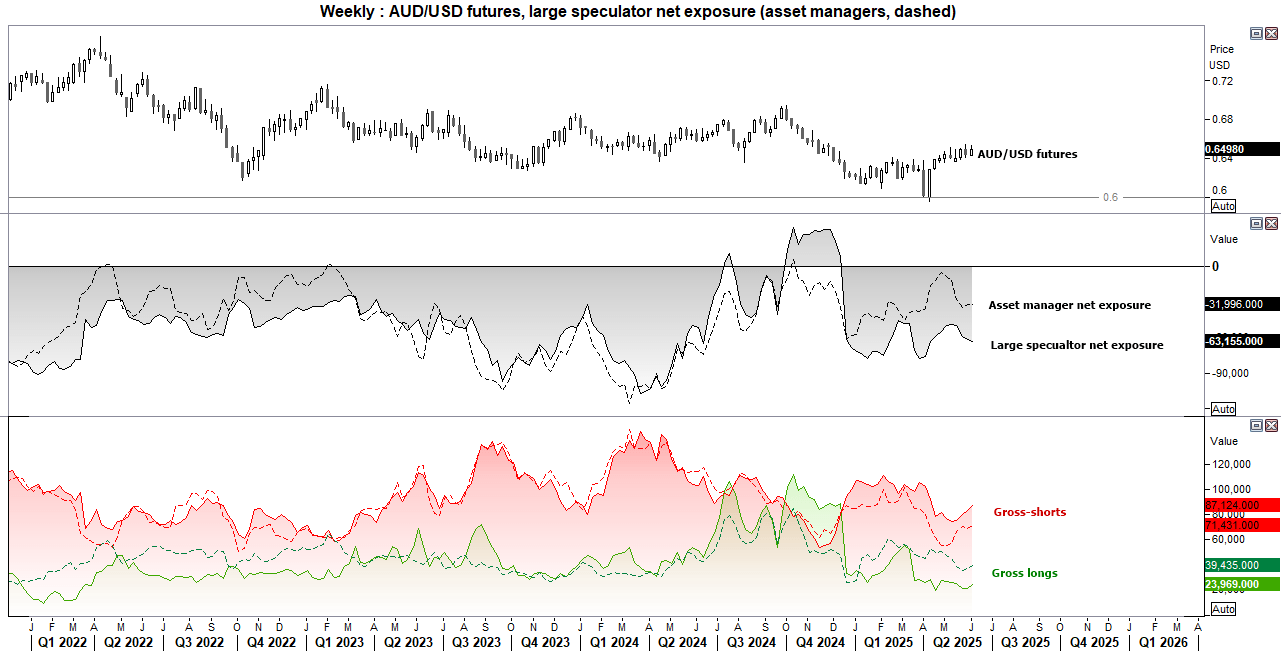

AUD/USD Futures – Market Positioning From The COT Report:

- Once again, week-over-week changes to AUD/USD net-short exposure have been minimal and borderline insignificant.

- Large speculators increased net-short exposure by approximately 2,000 contracts, while asset managers trimmed theirs by just 340 contracts.

- Both groups increased gross long and short positions, so although volumes ticked higher, it offers no clear directional bias.

- This aligns with price action, which remains trapped within the familiar 0.64–0.65 range.

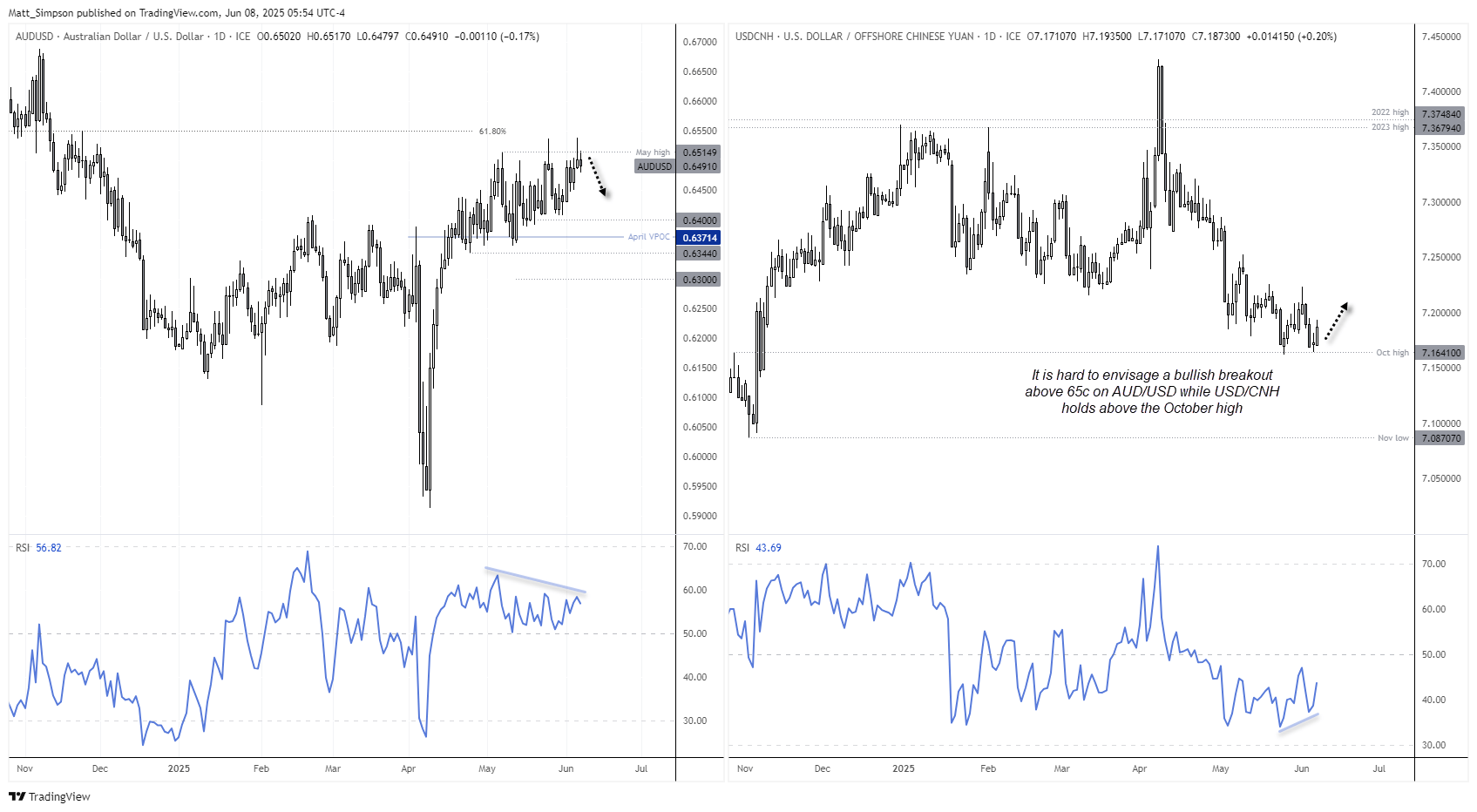

AUD/USD Technical Analysis

The Australian dollar has spent most of the past two weeks consolidating within the 0.64–0.65 range. While daily momentum has edged higher over the past week, yet another false intraday break above 65c was met with a bearish reversal candle — classic hallmarks of a “sucker punch” for AUD/USD bulls.

More importantly, the US dollar appears poised for a bounce, while USD/CNH continues to hold above key support at the October high (7.1640). It’s difficult to envision a sustainable breakout above 65c for AUD/USD while the Chinese yuan remains firm at that level.

Unless this backdrop shifts, the preference remains to fade rallies toward 65c and seek dips closer to 64c. It may not be glamorous, but so far, it’s been working.

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge