Australia Dollar Outlook: AUD/USD

AUD/USD may consolidate over the coming days as it bounces back from a fresh weekly low (0.6187), but the exchange rate may struggle to retain the rebound from the February low (0.6088) as it no longer trades within an ascending channel.

AUD/USD Rebounds Even as Trump Tariffs Go into Effect for China

AUD/USD attempts to extend the advance from the start of the week even as President Donald Trump imposes tariffs on China, Australia’s largest trading partner, and it remains to be seen if the transition in US trade policy will influence the Reserve Bank of Australia (RBA) as ‘members expressed caution about the prospect of further policy easing.’

Join David Song for the Weekly Fundamental Market Outlook webinar.

David provides a market overview and takes questions in real-time. Register Here

It seems as though the RBA will gradually switch gears after implementing its first rate-cut since 2020 as ‘returning inflation to target remains the Board’s highest priority,’ but the weakening outlook for global growth may push Governor Michele Bullock and Co. to further unwind its restrictive policy as ‘economic outcomes had given members more confidence that they could return inflation to target at the same time as preserving most of the gains in the labour market with a lower cash rate.’

In turn, the threat of a trade war may continue to sway foreign exchange markets as China applies fresh tariffs on US exports, and the Australian Dollar may face headwinds ahead of the next RBA meeting on April 1 amid speculation for lower interest rates.

With that said, AUD/USD may struggle to retain the advance from the start of the week as it no longer trades within the ascending channel from earlier this year, but the exchange rate may track the flattening slope in the 50-Day SMA (0.6259) should it continue to hold above the February low (0.6088).

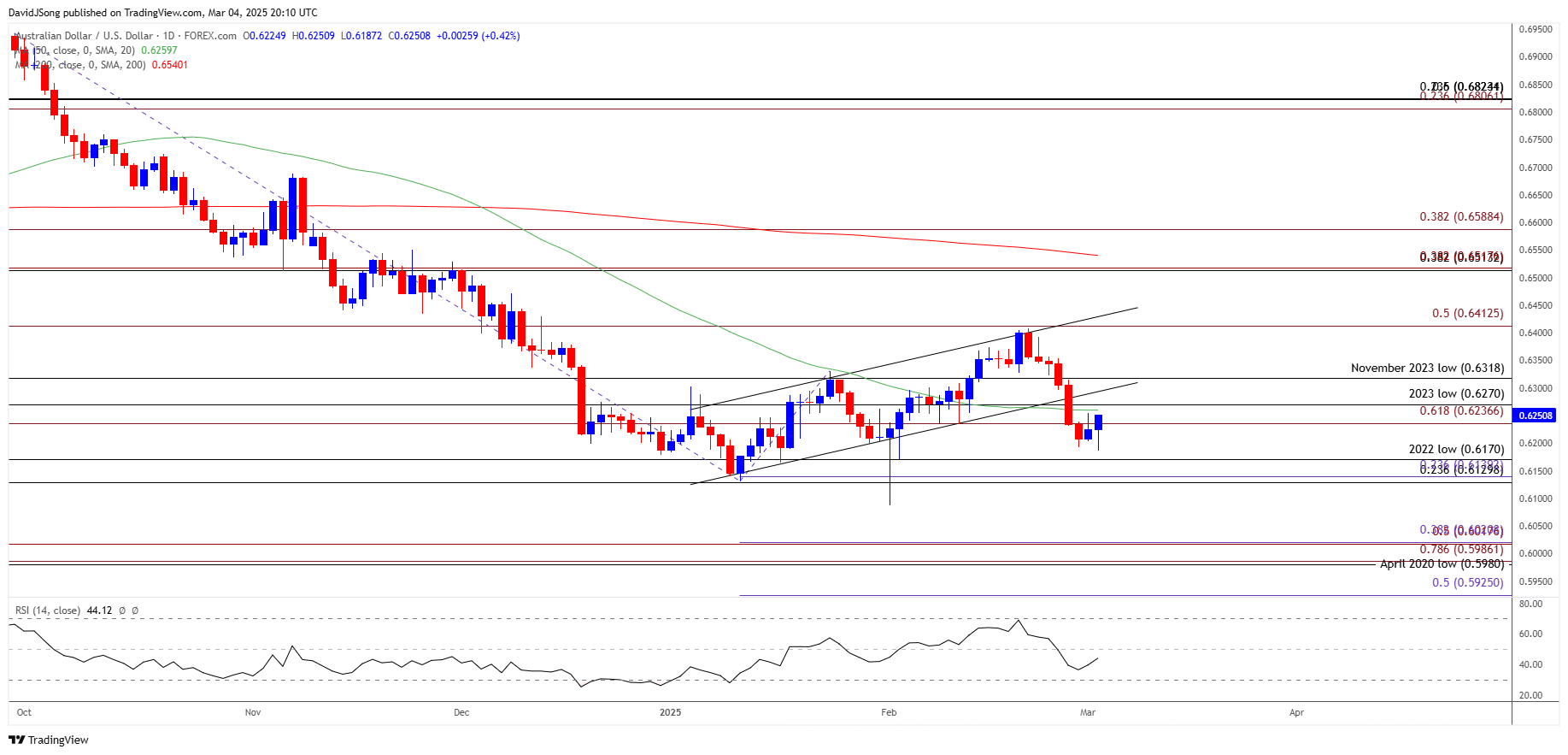

AUD/USD Price Chart – Daily

Chart Prepared by David Song, Senior Strategist; AUD/USD on TradingView

- AUD/USD attempts to extend the advance from the start of the week after registering a fresh weekly low (0.6187), with a close above the 0.6240 (61.8% Fibonacci extension) to 0.6270 (2023 low) zone bringing 0.6318 (November 2023 low) on the radar.

- Next area of interest coming in around the February high (0.6409), but the rebound from the weekly low (0.6187) may turn out to be temporary as AUD/USD no longer traders within an ascending channel.

- Lack of momentum to close above the 0.6240 (61.8% Fibonacci extension) to 0.6270 (2023 low) zone may push AUD/USD towards the 0.6130 (23.6% Fibonacci retracement) to 0.6170 (2022 low) region, with the next area of interest coming in around the February low (0.6088).

Additional Market Outlooks

GBP/USD Eyes December High as Ascending Channel Remains Intact

Canadian Dollar Forecast: USD/CAD Rally Persists with Trump Tariffs on Track

Euro Forecast: EUR/USD Vulnerable to ECB Rate Cut

US Dollar Forecast: USD/JPY Rebound Retrained by Slowdown in US PCE

--- Written by David Song, Senior Strategist

Follow on X at @DavidJSong