Australian Dollar Outlook: AUD/USD

AUD/USD stages a four-day rally as it extends the series of higher highs and lows from last week, but the recovery in the exchange rate may turn out to be temporary should it struggle to test the monthly high (0.6389).

AUD/USD Stages Four-Day Rally to Eye Monthly High

Keep in mind, the recent rise in AUD/USD pulled the Relative Strength Index (RSI) out of oversold territory, and the exchange rate may stage a larger recovery as US President Donald Trump pauses the reciprocal tariffs for 90 days.

Join David Song for the Weekly Fundamental Market Outlook webinar.

David provides a market overview and takes questions in real-time. Register Here

However, the ongoing transition in US policy may drag on the Australian Dollar as it clouds the outlook for the Asia/Pacific region, and the Reserve Bank of Australia (RBA) may come under pressure to implement lower interest rates amid the disruption in global trade.

In turn, the Australian Dollar may face headwinds ahead of the next RBA meeting on May 20 amid the threat of a US-China trade war, but Governor Michele Bullock and Co. may retain a wait-and-see approach as the ‘Board is resolute in its determination to sustainably return inflation to target.’

With that said, AUD/USD may test the monthly high (0.6389) as it attempts to extend the rally from last week, but the exchange rate may struggle to retain the advance from the monthly low (0.5915) should it snaps the bullish price series.

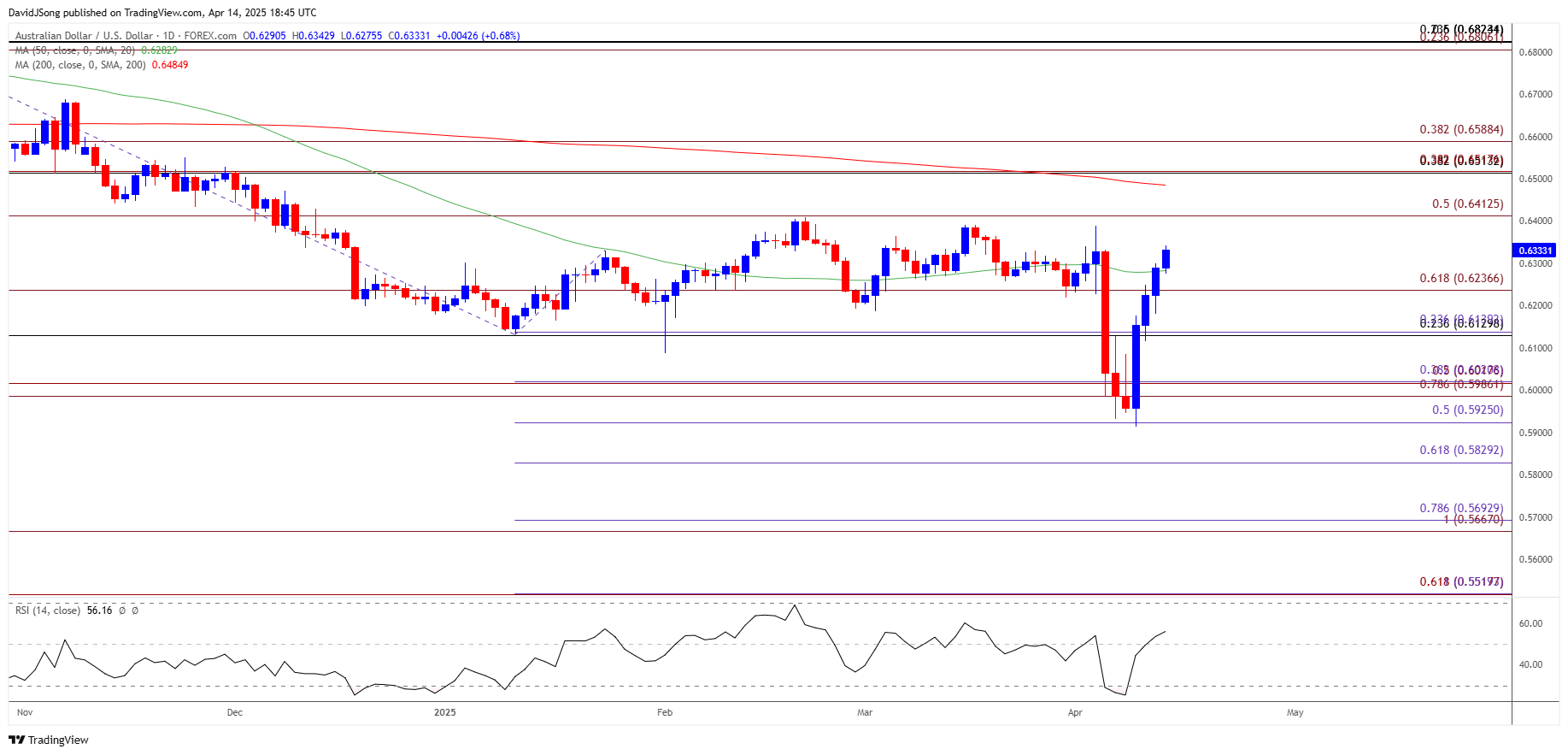

AUD/USD Price Chart – Daily

Chart Prepared by David Song, Senior Strategist; AUD/USD on TradingView

- AUD/USD may further retrace the decline from the monthly high (0.6389) as it carves a series of higher highs and lows, with a break/close above 0.6410 (50% Fibonacci extension) bringing the December high (0.6515) on the radar.

- A break/close above the 0.6510 (38.2% Fibonacci retracement) to 0.6590 (38.2% Fibonacci extension) zone opens up the November high (0.6688), but AUD/USD may continue to hold below the yearly high (0.6409) should it snap the bullish price series.

- Lack of momentum to hold above 0.6240 (61.8% Fibonacci extension) may push AUD/USD back towards the 0.6130 (23.6% Fibonacci retracement) to 0.6140 (23.6% Fibonacci extension) area, with the next region of interest coming in around 0.5990 (78.6% Fibonacci extension) to 0.6020 (38.2% Fibonacci extension).

Additional Market Outlooks

Canadian Dollar Forecast: USD/CAD Faces BoC Meeting Ahead of Canada Election

Euro Forecast: EUR/USD Clears 2024 High to Push RSI into Overbought Zone

GBP/USD Reverses Ahead of March Low to Stage Three-Day Rally

USD/JPY Eyes October Low as China Responds to Trump Tariffs

--- Written by David Song, Senior Strategist

Follow on X at @DavidJSong