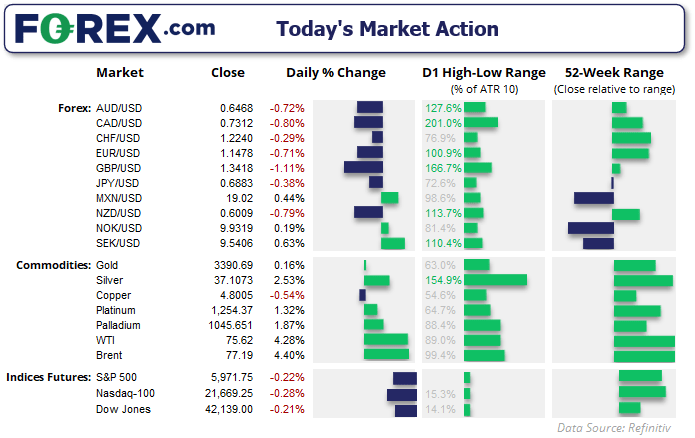

The US dollar surged on Tuesday, cementing its status as the safe-haven of choice amid renewed fears of military escalation in the Middle East. While ceasefire hopes have faded, market focus has shifted to the Federal Reserve’s upcoming policy decision. The combination of geopolitical stress, rising oil prices, and fading Fed cut bets lifted the greenback broadly — even against traditional safe-havens like the yen and Swiss franc. For AUD/USD and USD/CNH, the next move hinges on whether the Fed delivers a less-dovish surprise or softens its tone as economic cracks widen.

View related analysis:

- USD Net Shorts Hit Record as AUD Bears Rise, CAD and EUR Gain – COT Report

- AUD/USD Weekly Forecast: Fed Decision and Australian Jobs Eyed

- US Dollar Outlook: Don’t Write Off the USD Just Yet

- Gold Price Outlook: Can Bearish Technical Setup and June Weakness Align?

US Dollar Becomes Safe-Haven of Choice Amid Escalating Middle East Tensions

The US dollar became the safe-haven currency of choice for traders on Tuesday, amid rising concerns that the United States may become directly involved in the Israel–Iran conflict. Hopes of a ceasefire have faded, and former President Trump is now calling for Iran’s “unconditional surrender.” He claims the US has full control over Iranian airspace and knows the whereabouts of Supreme Leader Khamenei — though he added they do not intend to “take him out (kill), at least for now.”

The greenback was the strongest major currency on the day, even rallying against traditional safe-havens such as the Swiss franc and Japanese yen. While several factors are at play, the move likely reflects a combination of safe-haven flows and short-covering, as traders scale back expectations for a dovish Federal Reserve (Fed) message.

With the US potentially backing Israel militarily and crude oil prices having surged 20% last week, elevated energy costs could lift inflation expectations. That scenario would complicate the Fed’s path to easing and may prompt policymakers to adopt a more cautious tone in this week’s policy statement and Staff Economic Projections (SEP), even if the broader bias remains toward eventual rate cuts.

Fed Faces Dovish Pressure as US Data Disappoints

That said, signs of a slowing US economy are increasingly apparent in the latest economic data. While the Federal Reserve’s dot plot could still support a rate cut in September — in line with current market pricing — I’m not leaning toward a dovish surprise just yet, even as cracks in the US economy continue to widen.

- Core retail sales contracted -0.3% in May, missing its 0.2% estimate and April’s figure being downgraded to 0% from 0.1%.

- Retail sales including volatile items fell -0.9% m/m, worse than the -0.5% expected and April’s figure was downgraded to -0.1% from 0.1%.

- Industrial production also fell -0.2% in May.

US Dollar at a Crossroads as AUD/USD and USD/CNH Await Breakout Direction

With markets gripped by geopolitical risks and shifting expectations for Federal Reserve policy, the US dollar is approaching a pivotal level. Which way it breaks should have a direct impact on the Australian dollar’s ability to pull back or break higher. Though the depth of any move on AUD/USD is also likely to be governed by moves in USD/CNH.

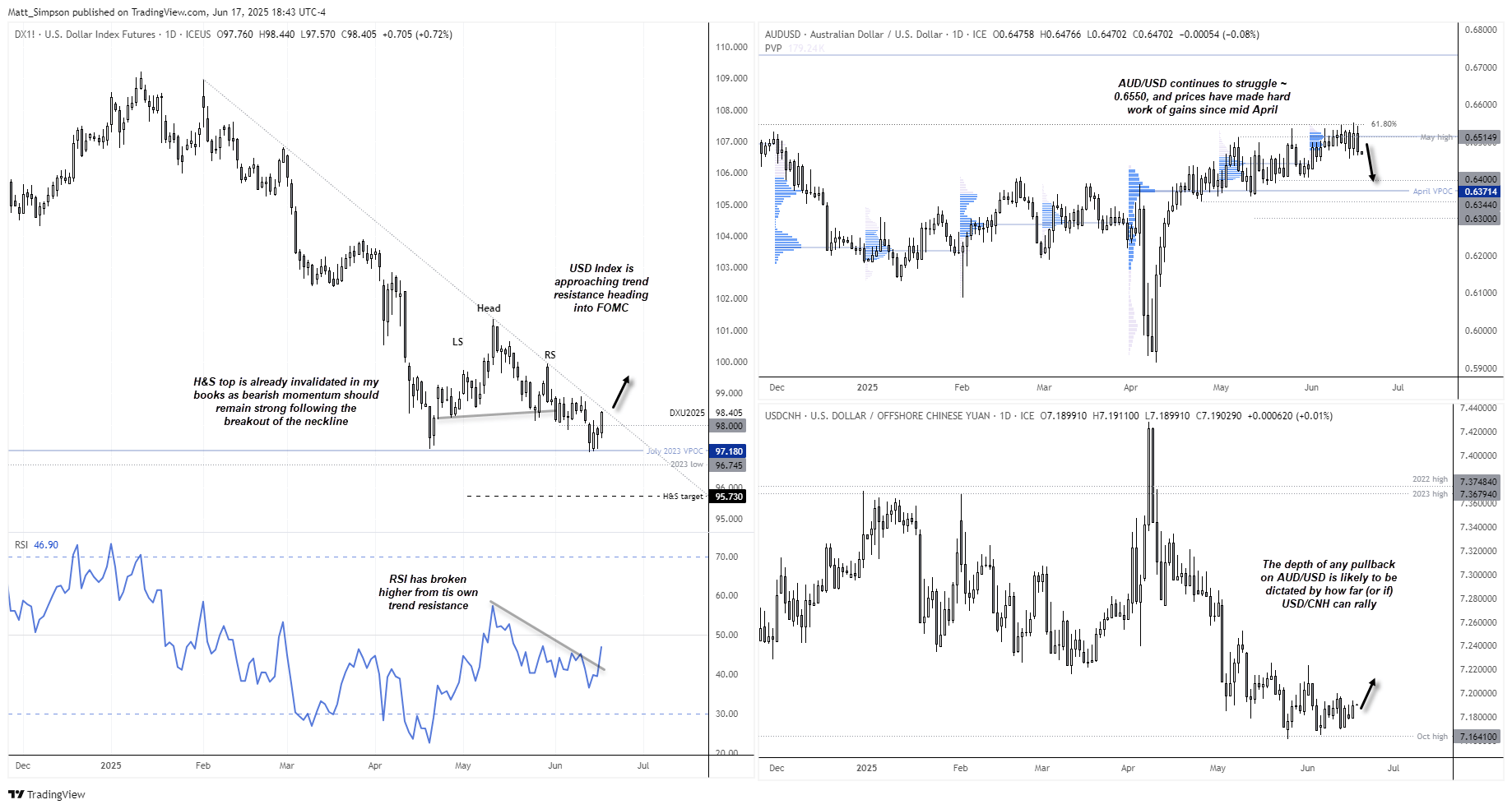

US Dollar Index (DXY) Technical Analysis

A 1.35% rally has unfolded on the US Dollar Index (DXY) since last week’s low, where support was once again found at the July 2023 volume point of control (VPOC). While a head and shoulders top had previously suggested a bearish continuation, that setup is increasingly questionable — as momentum should remain firmly negative after a neckline break. Instead, USD bulls are now eyeing a potential breakout above trend resistance.

The US dollar appears to be at a critical inflection point. A confirmed breakout above resistance would bring the 99.00 and 100.00 handles into focus. However, if the Federal Reserve delivers the dovish tone markets are anticipating — and if the US avoids direct escalation in the Middle East — then a break back below 97.00 becomes the more likely scenario.

That said, as highlighted in previous updates, my broader USD outlook remains tilted toward a bounce, driven by stretched bearish positioning among traders.

AUD/USD Technical Analysis: Australian Dollar vs US Dollar

There’s plenty of chop at the top where the Australian dollar is concerned. The day-to-day direction of AUD/USD is closely tied to sentiment driven by Middle East headlines — risk-on news sends it higher, while negative developments push it lower. So far, AUD/USD has failed to deliver a daily close above 0.6530, and intraday highs continue to stall around the 0.6550 level.

If my view of a stronger US dollar proves correct, then AUD/USD is likely to break lower within this established range. Notably, we’ve yet to see a meaningful pullback, and bullish momentum has remained lacklustre since mid-April — right around the time its V-bottom recovery began to lose steam and change character.

USD/CNH Technical Analysis: US Dollar vs Chinese Yuan

However, the depth of any pullback in AUD/USD is likely to depend on whether the Chinese yuan also weakens. USD/CNH typically shares an inverse correlation with AUD/USD, so it’s notable that USD/CNH is holding above key support at the October high of 7.1641, while the Australian dollar struggles to break higher and the US dollar index continues to find support.

Should the US dollar extend its safe-haven bid and force short-covering among bearish traders, we could see USD/CNH break higher — which would, in turn, apply renewed pressure on AUD/USD, potentially dragging it back toward the 0.6400 handle.

Economic Events in Focus (AEST / GMT+10)

- 08:27 NZD Current Account (Q1) (NZD/USD, NZD/JPY)

- 09:50 JPY Reuters Tankan Index (Jun), Trade Balance, Core Machinery Orders, Exports/Imports (Apr/May) (USD/JPY, Nikkei 225)

- 11:00 AUD MI Leading Index (May) (AUD/USD, ASX 200)

- 13:00 NZD RBNZ Offshore Holdings (May) (NZD/USD, NZD/JPY)

- 16:00 GBP Core CPI (May) (GBP/USD, FTSE 100)

- 17:30 EUR ECB's Elderson Speaks (EUR/USD, DAX)

- 18:00 EUR Current Account (Apr) (EUR/USD, DAX)

- 18:30 GBP House Price Index (YoY) (GBP/USD, FTSE 100)

- 19:00 EUR Core CPI (May) (EUR/USD, DAX)

- 19:30 EUR German 30-Year Bund Auction (EUR/USD, DAX)

- 21:00 USD MBA Mortgage Data (USD, S&P 500, Nasdaq 100)

- 22:30 USD Building Permits & Jobless Claims (May) (USD, S&P 500, Gold)

- 00:30 USD Crude Oil & Inventory Reports (USD, Crude Oil, Gold)

- 00:30 EUR German Buba President Nagel Speaks (EUR/USD, DAX)

- 01:00 EUR ECB's Lane Speaks (EUR/USD, DAX)

- 01:15 CAD BoC Gov Macklem Speaks (USD/CAD, TSX)

- 03:30 CAD BOC Summary of Deliberations (USD/CAD, TSX)

- 04:00 USD Fed Interest Rate decision, FOMC Economic Projections, FOMC Statement, (USD, S&P 500, Gold, Crude Oil)

- 04:00 EUR ECB's De Guindos Speaks (EUR/USD, DAX)

- 04:30 USD FOMC Press Conference (USD, Nasdaq 100, Gold)

View the full economic calendar

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge