Australian Dollar Outlook: AUD/USD

AUD/USD is little changed from the start of the week as it holds in a narrow range, and the Reserve Bank of Australia (RBA) interest rate decision may keep the exchange rate afloat as the central bank is expected to retain the current policy.

Australian Dollar Forecast: AUD/USD Coils Ahead of RBA Rate Decision

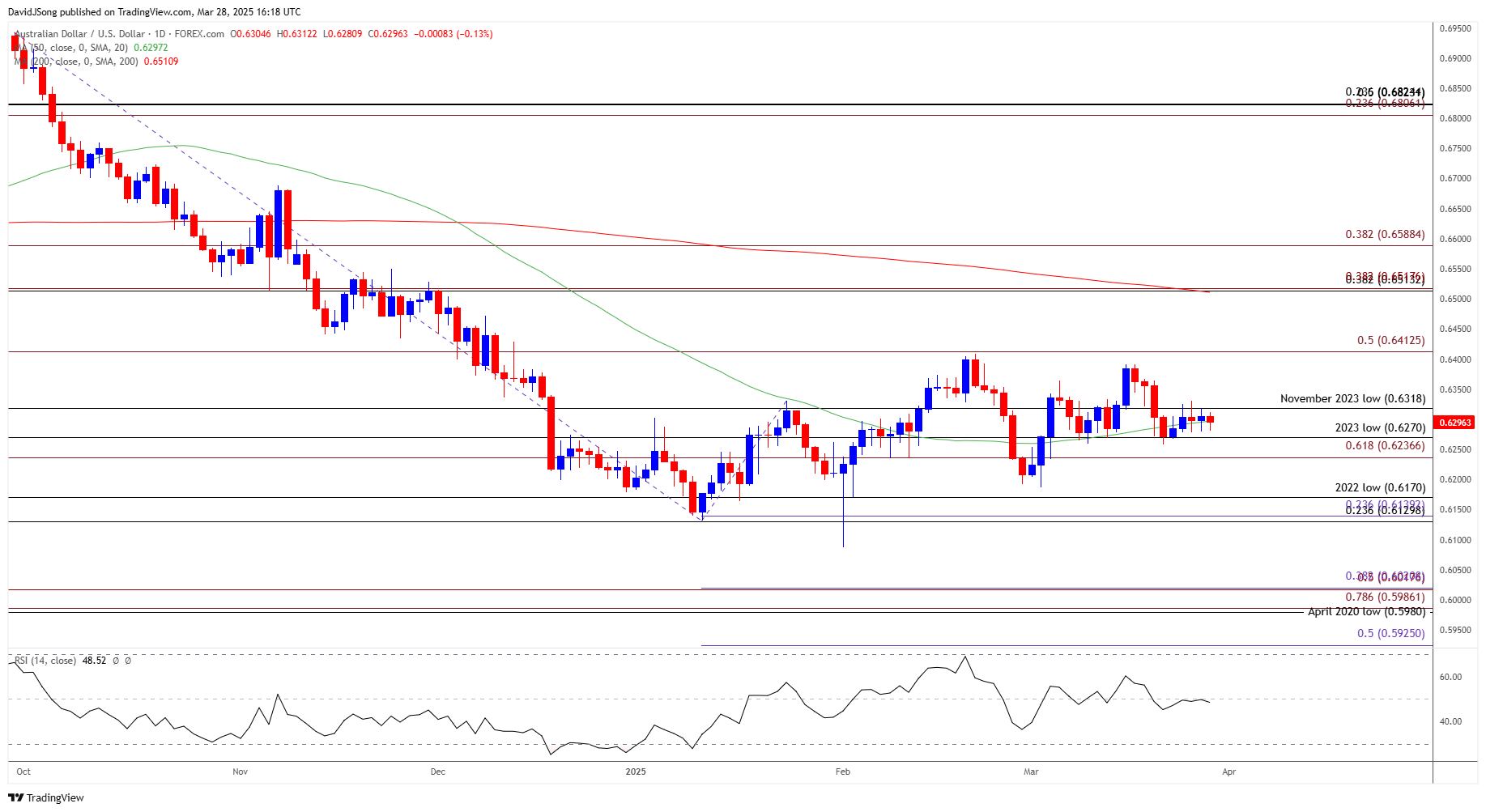

AUD/USD seems to be tracking the flattening slope in the 50-Day SMA (0.6297) as it still trades within the February range, and exchange rate may continue to move sideways as the RBA warns that ‘the Board remains cautious on prospects for further policy easing’ after implementing a rate-cut for the first time since 2020.

Join David Song for the Weekly Fundamental Market Outlook webinar.

David provides a market overview and takes questions in real-time. Register Here

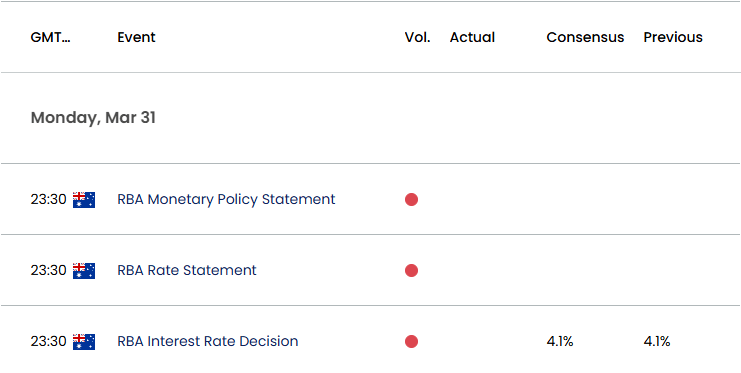

Australia Economic Calendar

In turn, the RBA is expected to keep the cash rate at 4.10% in April as ‘sustainably returning inflation to target within a reasonable timeframe remains the Board’s highest priority,’ and more of the same from Governor Michele Bullock and Co. may generate a bullish reaction in the Australian Dollar as the central bank refrains from a rate-cutting cycle.

However, the RBA may further unwind its restrictive policy this year as the transition in US trade policy clouds the outlook for global growth, and a dovish forward guidance may drag on AUD/USD should the central bank prepare Australian households and businesses for lower interest rates.

With that said, AUD/USD may struggle to retain the advance from the monthly low (0.6187) as the RBA starts to change its policy, but the exchange rate may consolidate over the remainder of the month as it seems to be tracking the flattening slope in the 50-Day SMA (0.6397).

AUD/USD Price Chart – Daily

Chart Prepared by David Song, Senior Strategist; AUD/USD on TradingView

- Keep in mind, AUD/USD still trades within the February range, with the exchange rate holding above the monthly low (0.6187) as it defends the 0.6240 (61.8% Fibonacci extension) to 0.6270 (2023 low) zone.

- A close above 0.6318 (November 2023 low) may push AUD/USD back towards the monthly high (0.6391), with the next area of interest coming in around the February high (0.6409).

- Nevertheless, a break/close above 0.6410 (50% Fibonacci extension) may lead to a test of the December high (0.6515), with the next area of interest coming in around 0.6590 (38.2% Fibonacci extension).

- At the same time, failure to defend the 0.6240 (61.8% Fibonacci extension) to 0.6270 (2023 low) zone, may push AUD/USD towards the 0.6130 (23.6% Fibonacci retracement) to 0.6170 (2022 low) region, with the next area of interest coming in around the February low (0.6088).

Additional Market Outlooks

Canadian Dollar Forecast: USD/CAD Continues to Coil with More Trump Tariffs on Tap

US Dollar Forecast: Bearish EUR/USD Price Series Persists

USD/JPY Pulls Back Ahead of Monthly High with US PCE in Focus

British Pound Forecast: GBP/USD Coils with UK CPI on Tap

--- Written by David Song, Senior Strategist

Follow on X at @DavidJSong