Australian Dollar Outlook: AUD/USD

AUD/USD seems to be defending the V-shape recovery from April as it attempts to retrace the decline from the monthly high (0.6515).

Australian Dollar Forecast: AUD/USD Defends V-Shape Recovery

AUD/USD extends the rebound from the weekly low (0.6357) as an unexpected slowdown in the US Consumer Price Index (CPI) drags on the US Dollar, and the exchange rate may continue to threaten the December high (0.6515) as the ongoing transition in trade policy clouds the outlook for economic activity.

Join David Song for the Weekly Fundamental Market Outlook webinar.

David provides a market overview and takes questions in real-time. Register Here

Australia Economic Calendar

At the same time, data prints coming out of Australia may also sway AUD/USD as the economy is anticipated to add 25.0K jobs in April, and signs of a strong labor market may keep the Reserve Bank of Australia (RBA) on the sidelines as ‘sustainably returning inflation to target within a reasonable timeframe is the Board’s highest priority.’

In turn, a positive development may keep AUD/USD as it curbs speculation for an RBA rate-cut, but a weaker-than-expected employment report may produce headwinds for the Australian Dollar as it puts pressure on Governor Michele Bullock and Co. to implement lower interest rates.

With that said, AUD/USD may consolidate over the remainder of the week as it failed to push above the December high (0.6515) earlier this month, but the exchange rate may further retrace the decline from the monthly high (0.6515) as it seems to be defending the recovery from the April low (0.5915).

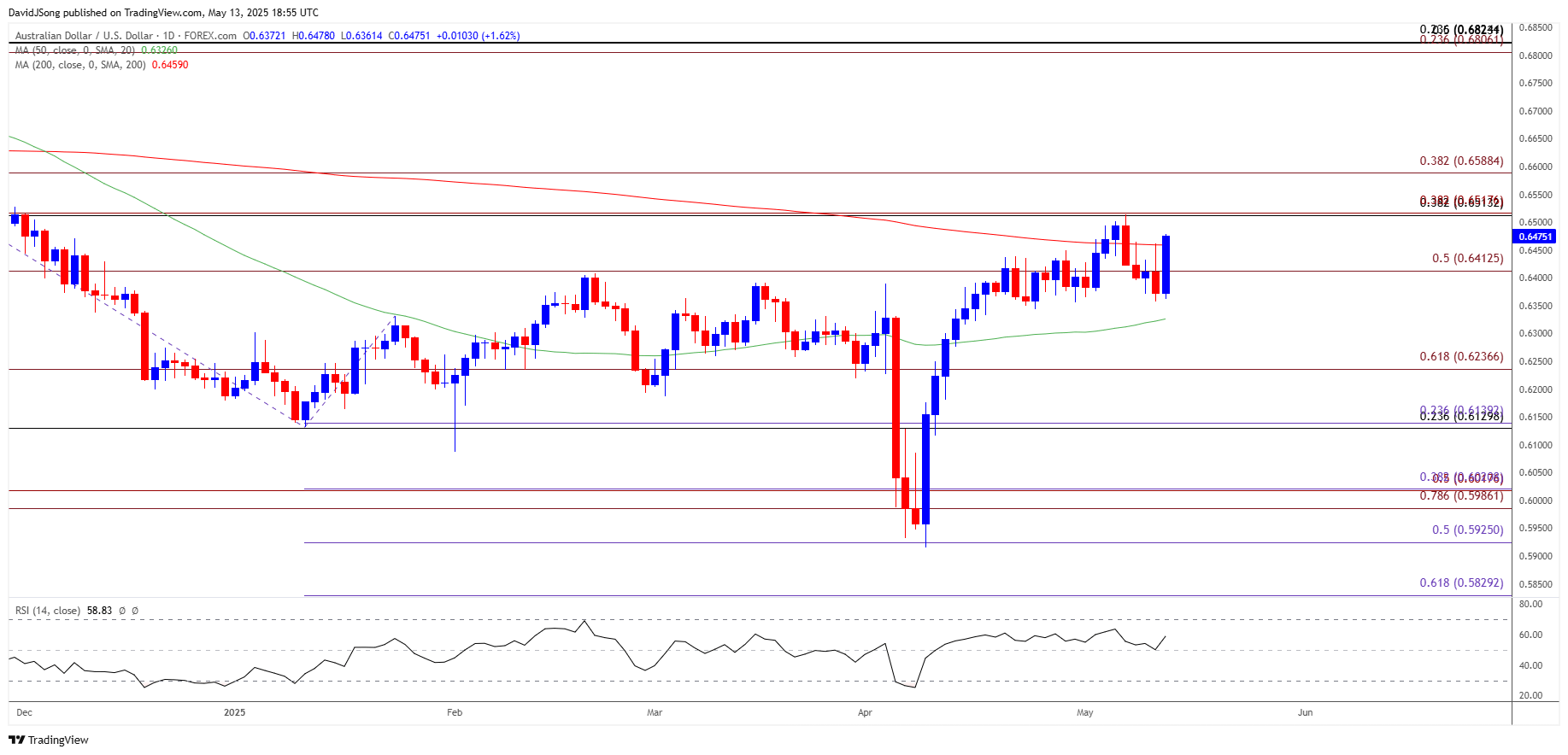

AUD/USD Price Chart – Daily

Chart Prepared by David Song, Senior Strategist; AUD/USD on TradingView

- AUD/USD appears to be on track to test the December high (0.6515) again as it bounces back from a fresh monthly low (0.6357), with a break/close above the 0.6510 (38.2% Fibonacci retracement) to 0.6520 (38.2% Fibonacci extension) region opening up 0.6590 (38.2% Fibonacci extension).

- Next area of interest coming in around the November high (0.6688), but AUD/USD may struggle to retain the rebound from the monthly low (0.6357) should it fail to push above the December high (0.6515).

- Need a move/close below 0.6410 (50% Fibonacci extension) to bring 0.6240 (61.8% Fibonacci extension) back on the radar, with the next area of interest coming in around 0.6130 (23.6% Fibonacci retracement) to 0.6140 (23.6% Fibonacci extension).

Additional Market Outlooks

GBP/USD on Track to Test Positive Slope in 50-Day SMA

Canadian Dollar Forecast: USD/CAD Breaks Out of Descending Channel

USD/JPY Falls from Fresh Monthly High to Hold Below 50-Day SMA

Gold Price Weakness Keeps RSI Out of Overbought Territory

--- Written by David Song, Senior Strategist

Follow on X at @DavidJSong