Australian Dollar Outlook: AUD/USD

AUD/USD appears to be pulling back ahead of the December high (0.6515) as it struggles to retain the advance from the start of the week.

Australian Dollar Forecast: AUD/USD Pulls Back Ahead of December High

AUD/USD falls from a fresh yearly high (0.6450) even as Australia’s Consumer Price Index (CPI) holds steady at 2.4% in March, and the V-shape recovery in the exchange rate may start to unravel should it fail to defend the rebound from the weekly low (0.6356).

Join David Song for the Weekly Fundamental Market Outlook webinar.

David provides a market overview and takes questions in real-time. Register Here

Nevertheless, signs of persistent price growth keep the Reserve Bank of Australia (RBA) on the sidelines as ‘sustainably returning inflation to target within a reasonable timeframe is the Board’s highest priority,’ and AUD/USD may continue to trade to fresh yearly highs as the central bank seems to be in no rush to unwind its restrictive policy.

With that said, AUD/USD may stage further attempts to test the December high (0.6515) should it defend the advance from the weekly low (0.6356), but the threat of a US-China trade war may undermine the V-shape recovery in the exchange rate as it clouds the outlook for the Asia/Pacific region.

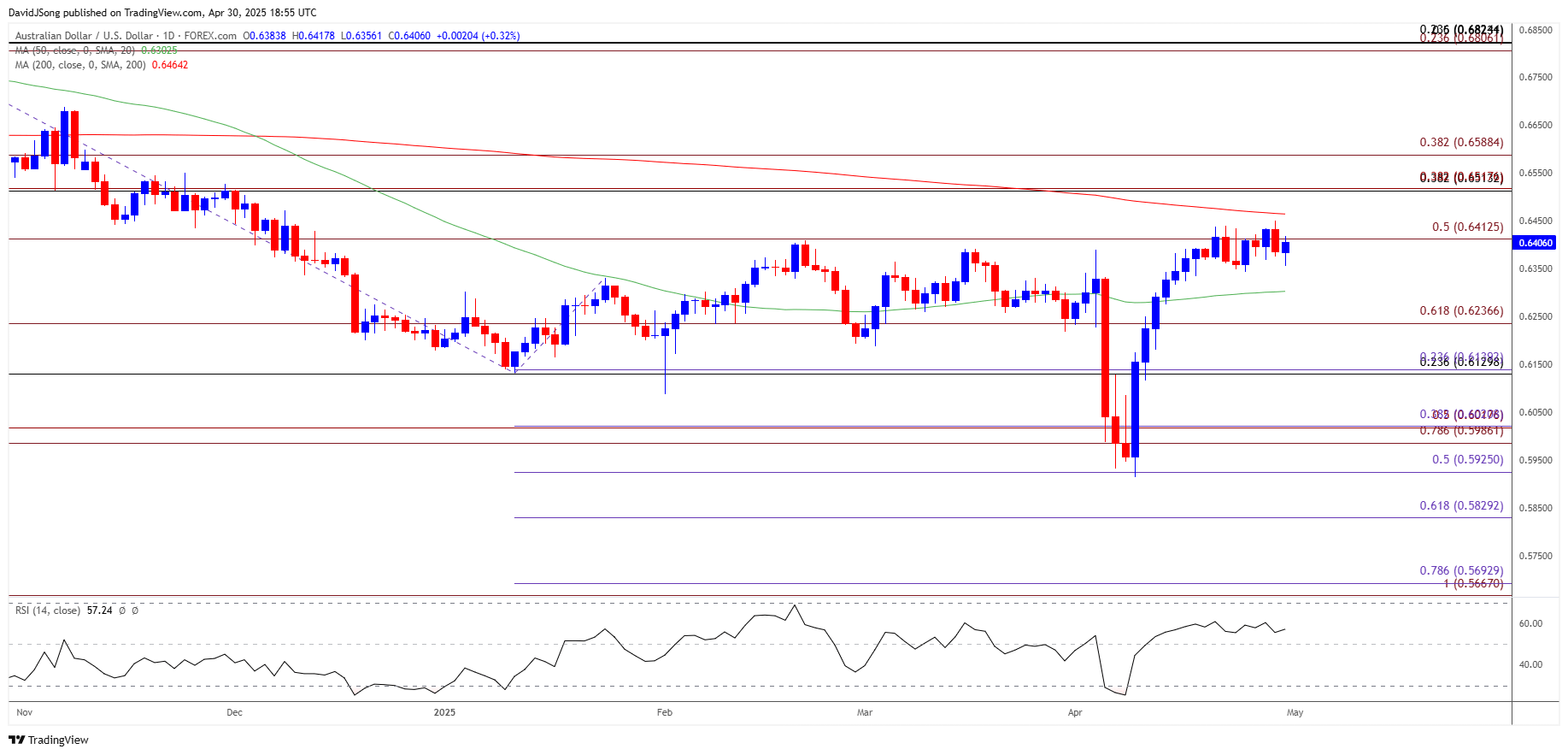

AUD/USD Price Chart – Daily

Chart Prepared by David Song, Senior Strategist; AUD/USD on TradingView

- AUD/USD is little changed from the start of the week as it falls from a fresh yearly high (0.6450), and failure to defend the rebound from the weekly low (0.6356) may push the exchange rate back towards 0.6240 (61.8% Fibonacci extension).

- A break/close below the 0.6130 (23.6% Fibonacci retracement) to 0.6140 (23.6% Fibonacci extension) region brings the 0.5990 (78.6% Fibonacci extension) to 0.6020 (38.2% Fibonacci extension) zone on the radar, but AUD/USD stage further attempts to test the December high (0.6515) should it defend the advance from the weekly low (0.6356).

- Need a break/close above the 0.6510 (38.2% Fibonacci retracement) to 0.6520 (38.2% Fibonacci extension) region to open up 0.6590 (38.2% Fibonacci extension), with the next area of interest coming in around the November high (0.6688).

Additional Market Outlooks

US Non-Farm Payrolls (NFP) Report Preview (APR 2025)

USD/JPY Defends Rebound from Monthly Low Ahead of BoJ Rate Decision

British Pound Forecast: GBP/USD on Cusp of Testing 2024 High

Euro Forecast: EUR/USD Defends Weekly Low Ahead of Euro Area GDP Report

--- Written by David Song, Senior Strategist

Follow on X at @DavidJSong