Australian Dollar Outlook: AUD/USD

AUD/USD struggles to retain the advance from the start of the week as the Reserve Bank of Australia (RBA) shows a greater willingness to further unwind its restrictive policy, but the exchange rate may stage another test of the December high (0.6515) as it appears to be defending the V-shape recovery from last month.

Australian Dollar Forecast: AUD/USD Struggles Following RBA Rate Cut

It seems as though the RBA will continue to switch gears after implementing a 25bp rate cut earlier this week as the central bank drops its hawkish forward guidance and states that ‘the risks to inflation have become more balanced.’

Join David Song for the Weekly Fundamental Market Outlook webinar.

David provides a market overview and takes questions in real-time. Register Here

In turn, the RBA may prepare Australian households and businesses for lower interest rates as Governor Michele Bullock and Co. insist that ‘monetary policy is well placed to respond decisively to international developments if they were to have material implications for activity and inflation in Australia,’ and the Australian Dollar may face headwinds ahead of the next meeting in July as the US and China, Australia’s largest trading partner, struggle to reach an agreement.

With that said, AUD/USD may struggle to retain the rebound the monthly low (0.6357) as the ongoing shift in US trade policy clouds the outlook for the Asia/Pacific region, but the range bound price action in the exchange rate may turn out to be temporary should it defend the V-shape recovery from the April low (0.5915).

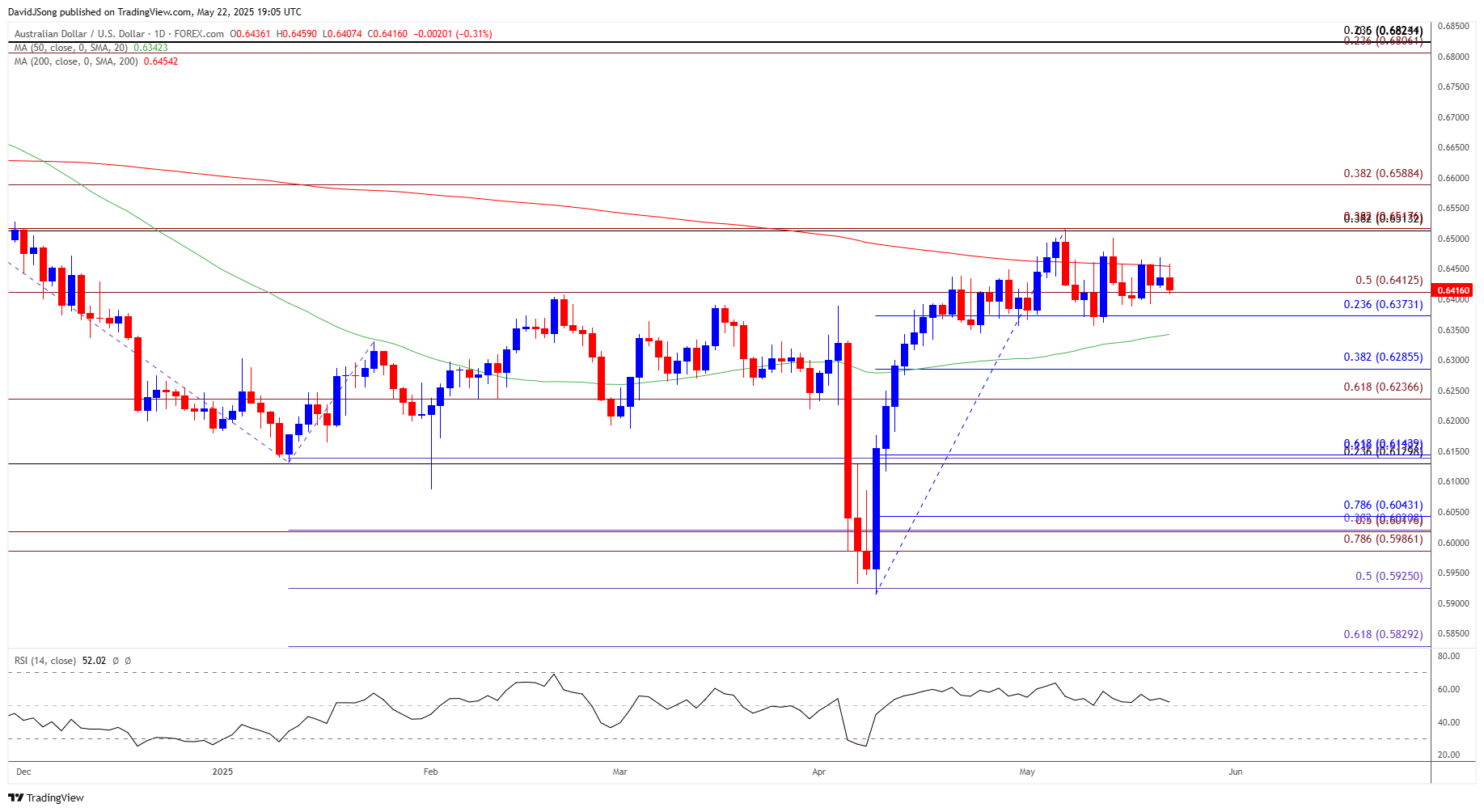

AUD/USD Price Chart – Daily

Chart Prepared by David Song, Senior Strategist; AUD/USD on TradingView

- AUD/USD seems to be stuck in a narrow range after testing the December high (0.6515), and the exchange rate may continue to consolidate as long as it holds above the weekly low (0.6392).

- However, lack of momentum to hold above the 0.6370 (23.6% Fibonacci retracement) to 0.6410 (50% Fibonacci extension) zone may lead to a test of the monthly low (0.6357), with the next area of interest coming in around 0.6240 (61.8% Fibonacci extension) to 0.6290 (38.2% Fibonacci retracement).

- At the same time, a break/close above the 0.6510 (38.2% Fibonacci retracement) to 0.6520 (38.2% Fibonacci extension) region opens up 0.6590 (38.2% Fibonacci extension), with the next area of interest coming in around the November high (0.6688).

Additional Market Outlooks

Canadian Dollar Forecast: USD/CAD Bounces Back Ahead of Monthly Low

US Dollar Forecast: USD/CHF Falls Toward Monthly Low

GBP/USD Rallies to Fresh Yearly High as UK CPI Shoots Higher

--- Written by David Song, Senior Strategist

Follow on X at @DavidJSong