Australian Dollar Outlook: AUD/USD

AUD/USD threatens the December high (0.6515) ahead of the Federal Reserve interest rate decision as it climbs to a fresh yearly high (0.6515).

Australian Dollar Forecast: AUD/USD Threatens December High

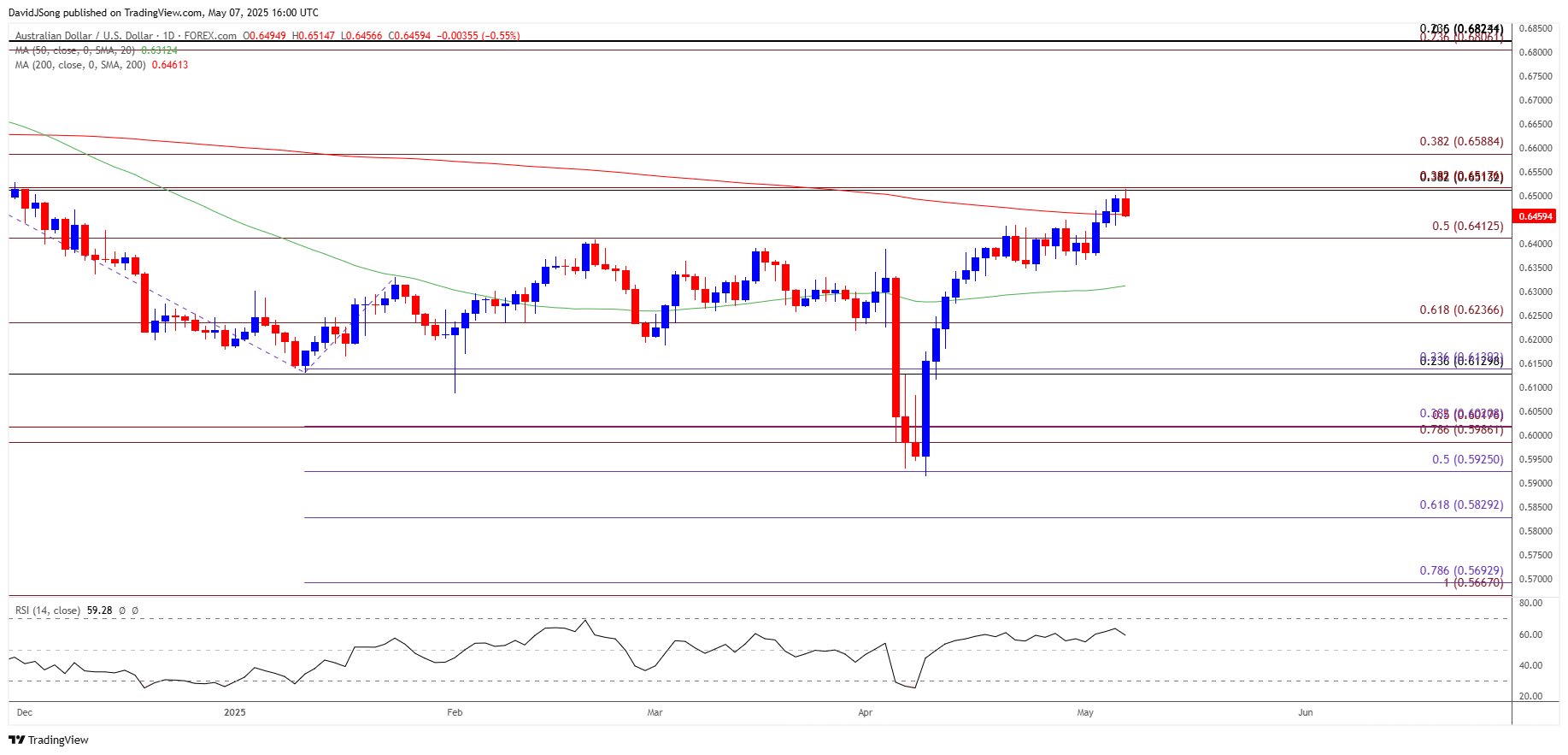

AUD/USD extends the advance from the start of the week to trade above the 200-Day SMA (0.6462) for the first time since November, and the exchange rate may attempt to retrace the decline from the November high (0.6688) as it defends the V-shape recovery from last month.

Join David Song for the Weekly Fundamental Market Outlook webinar.

David provides a market overview and takes questions in real-time. Register Here

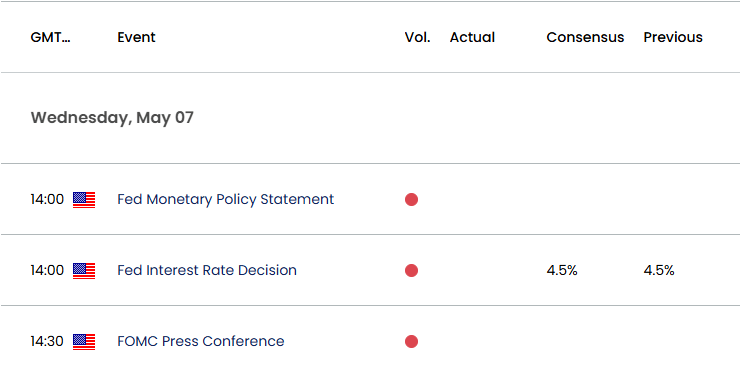

US Economic Calendar

However, developments coming out of the US may sway AUD/USD as the Federal Reserve is expected to keep US interest rates on hold, and the central bank may continue to endorse a wait-and-see approach should Chairman Jerome Powell reiterate that ‘we do not need to be in a hurry to adjust our policy stance.’

In turn, more of the same from the Federal Open Market Committee (FOMC) may derail the recent rally in AUD/USD as it curbs speculation for an imminent rate cut, but the Fed may stay on track to unwind its restrictive policy as the economy contracts 0.3% in the first quarter of 2025.

With that said, AUD/USD may extend the V-shape recovery from last month should the Fed offer a dovish forward guidance, and the exchange rate may appreciate over the remainder of the week as it threatens the December high (0.6515).

AUD/USD Price Chart – Daily

Chart Prepared by David Song, Senior Strategist; AUD/USD on TradingView

- AUD/USD extends the recent series of higher highs and lows to test the December high (0.6515), with a move/close above the 0.6510 (38.2% Fibonacci retracement) to 0.6520 (38.2% Fibonacci extension) region opening up 0.6590 (38.2% Fibonacci extension).

- Next area of interest coming in around the November high (0.6688), but lack of momentum to move/close above the 0.6510 (38.2% Fibonacci retracement) to 0.6520 (38.2% Fibonacci extension) region may push AUD/USD back towards 0.6410 (50% Fibonacci extension).

- Failure to defend the monthly low (0.6366) would bring 0.6240 (61.8% Fibonacci extension) on the radar, with the next area of interest coming in around 0.6130 (23.6% Fibonacci retracement) to 0.6140 (23.6% Fibonacci extension).

Additional Market Outlooks

Canadian Dollar Forecast: USD/CAD Reverses Ahead of Monthly High

EUR/USD Defends Rebound from Monthly Low Ahead of Fed Rate Decision

USD/JPY Rebound Unravels with Fed Rate Decision on Tap

British Pound Forecast: GBP/USD Selloff Stalls Ahead of BoE Meeting

--- Written by David Song, Senior Strategist

Follow on X at @DavidJSong