Australian Dollar Outlook: AUD/USD

AUD/USD may struggle to retain the advance from the start of the week as the Reserve Bank of Australia (RBA) is expected to deliver a 25bp rate cut.

Australian Dollar Forecast: AUD/USD Vulnerable to RBA Rate Cut

AUD/USD bounces back ahead of the monthly low (0.6357) to snap the recent series of lower highs and lows, and the exchange rate may attempt to retrace the decline from the monthly high (0.6515) as it defends the V-shape recovery from April.

Join David Song for the Weekly Fundamental Market Outlook webinar.

David provides a market overview and takes questions in real-time. Register Here

Australia Economic Calendar

However, the RBA is anticipated to lower the cash rate to 3.85% from 4.10%, and the central bank may prepare Australian households and businesses for a further adjustment in monetary policy amid the ongoing negotiations between the US and China, Australia’s largest trading partner.

In turn, developments coming out of the RBA may drag on the Australian Dollar should Governor Michele Bullock and Co. deliver a rate cut paired with a dovish forward guidance, but the central bank may retain a gradual approach in unwinding its restrictive policy as ‘sustainably returning inflation to target within a reasonable timeframe is the Board’s highest priority.’

With that said, AUD/USD may extend the advance from the start of the week on a hawkish RBA rate cut, but the exchange rate may give back the V-shape recovery from April should it struggle to hold above the monthly low (0.6357).

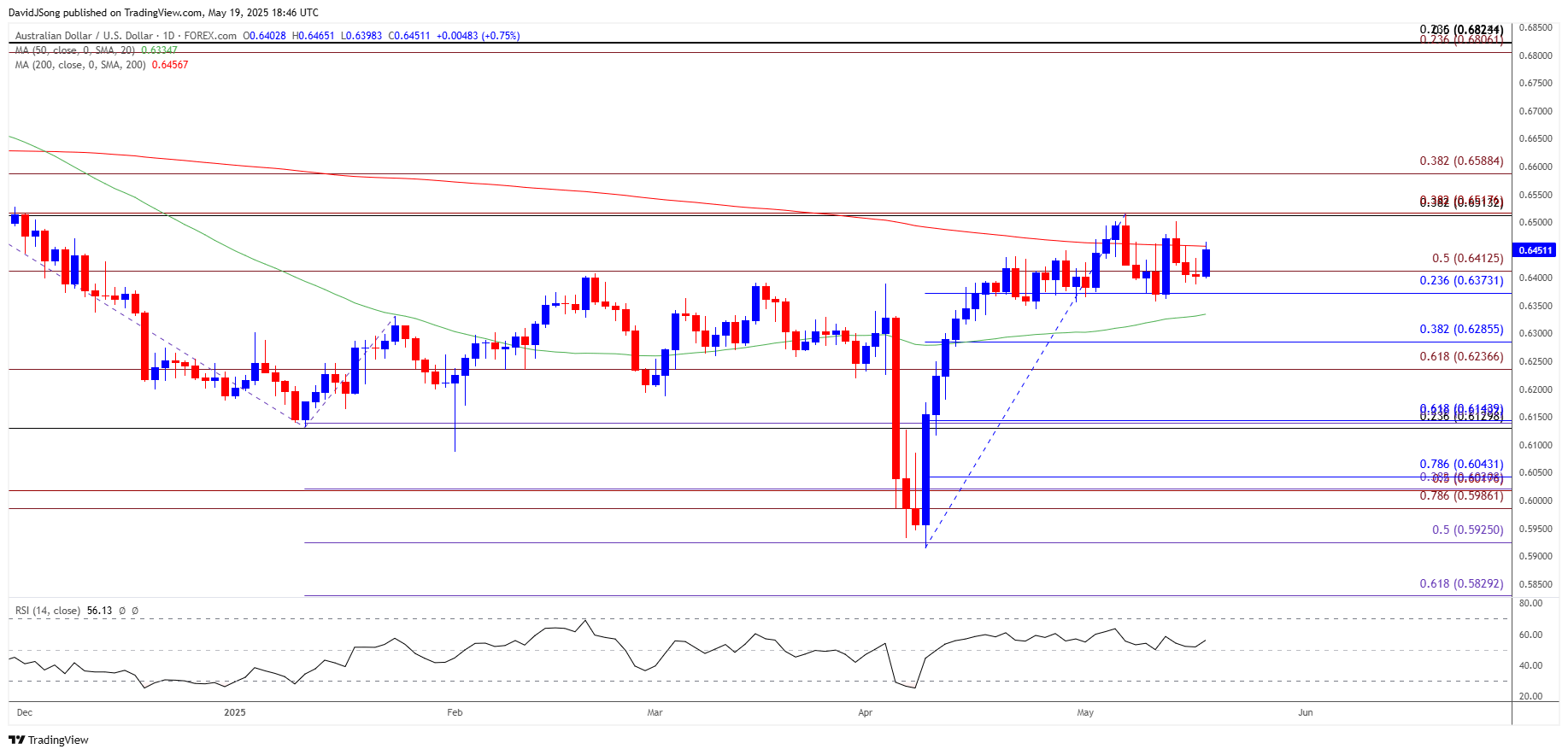

AUD/USD Price Chart – Daily

Chart Prepared by David Song, Senior Strategist; AUD/USD on TradingView

- AUD/USD may test the December high (0.6515) again as it bounces back ahead of the monthly low (0.6357), with a break/close above the 0.6510 (38.2% Fibonacci retracement) to 0.6520 (38.2% Fibonacci extension) region bringing 0.6590 (38.2% Fibonacci extension) on the radar.

- Next area of interest coming in around the November high (0.6688), but lack of momentum to hold above the 0.6370 (23.6% Fibonacci retracement) to 0.6410 (50% Fibonacci extension) zone may lead to a test of the monthly low (0.6357).

- Need a break/close below the 0.6240 (61.8% Fibonacci extension) to 0.6290 (38.2% Fibonacci retracement) region to open up the 0.6130 (23.6% Fibonacci retracement) to 0.6140 (23.6% Fibonacci extension) zone, with the next area of interest coming in around 0.5990 (78.6% Fibonacci extension) to 0.6040 (78.6% Fibonacci retracement).

Additional Market Outlooks

USD/JPY Decline Persists amid US Credit Rating Downgrade

Canadian Dollar Forecast: USD/CAD Defends Weekly Low Ahead of Canada CPI

Gold Price Struggles to Close Below 50-Day SMA

GBP/USD Defends Rebound from Weekly Low to Hold Above 50-Day SMA

--- Written by David Song, Senior Strategist

Follow on X at @DavidJSong