Momentum has clearly shifted against the New Zealand dollar, with NZD/USD falling to a two-week low despite broad weakness in the US dollar index. Bearish divergences and trendline breaks hint at a deeper correction — and the Australian dollar may be next. AUD/USD has stalled beneath key resistance, with similar bearish RSI signals emerging. With geopolitical tensions weighing on risk appetite and the US dollar finding safe-haven bids, the stage may be set for AUD/USD to follow NZD/USD lower.

View related analysis:

- AUD/JPY Eyes Breakout as Bulls Defend Support Ahead of Jobs Data

- Japanese Yen Cross Currents: EUR/JPY, GBP/JPY, CHF/JPY, CAD/JPY

- AUD/USD, USD/CNH Outlook: US Dollar Hits Technical Juncture Ahead of FOMC

- Gold Price Outlook: Can Bearish Technical Setup and June Weakness Align?

Middle East Escalation Weighs on Risk Sentiment as AUD/USD Eyes Key Levels

Wall Street futures initially fell over 1% on Thursday when President Trump said he will decide within “two weeks” over whether the US will get involved. Meanwhile, Israel bombed nuclear targets in Iran while Iran targeted Isreal’s hospitals, making Monday’s hopes of a ceasefire like a forgotten memory. Regardless, gold and crude oil prices closed the day flat, although oi process initially rose ~4%.

I’ll be the optimist on the assumption that this is the latest TACO trade (Trump always chickens out). Trump would add aggressive tariffs with a tight deadline, extend that deadline then agree to a much better deal – usually resulting in a risk-on move. Only this time no real pressure has been applied, yet already we have a 2-week deadline which provides time to work things behind the scenes and hopefully come up with a resolution without the US being directly involved.

However, appetite for risk was dented on Thursday and traders seem likely to strike a cautious tone heading into the weekend.

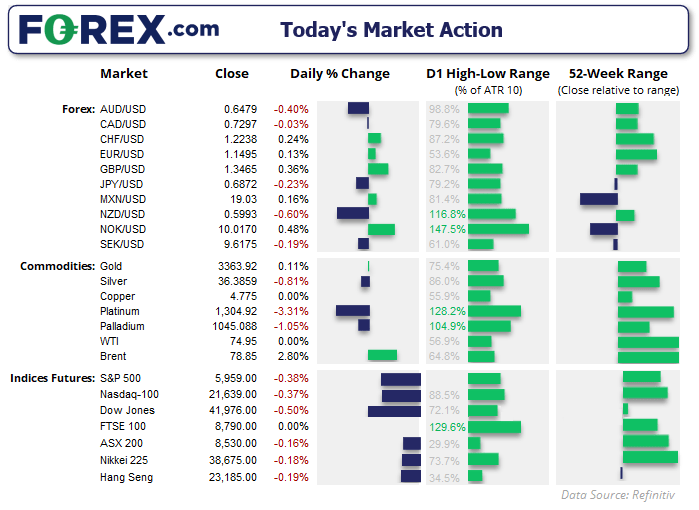

- Wall Street futures were lower, with Nasdaq 100 initially falling as much as -1.6% before closing the day at -0.6%, while the S%P 500 was -0.5% lower

- The Swiss franc (CHF) was the strongest FX major as it took safe-haven flows and bets that the SNB were at (or very close to) their terminal interest rate following a 25bp cut to 0%

- The British pound (GBP/USD) was the strongest FX major after the Bank of England (BOE) held rates and far fewer MPC members voted to cut

- The New Zealand dollar (NZD/USD) and Australian dollar (AUD/USD) were the weakest FX majors on Thursday amid risk-off trade

- WTI crude oil closed -0.5% lower, despite an rise of nearly 4.5% earlier in the day

SNB Cuts to 0% as BOE Warns of Rising Risks

The Swiss National Bank (SNB) cut its interest rate by 25bp to 0%, as expected. While they continue to threaten markets with the prospect of negative rates, the consensus is that the SNB is at or near the end of its easing cycle. They acknowledged the “undesirable” effects of negative rates and noted that the low interest rate environment is weighing on bank profitability. This allowed the Swiss franc to flourish as the go-to safe-haven currency amid the latest Middle East headlines.

The Bank of England (BOE) held their cash rate at 4.25%, though warned of slower lower pay, risks of a soft labour market and higher energy prices stemming form the Middle East conflict. Three Monetary Policy Committee (MPC) member votes to cut, down from seven at the last meeting, while six voted for now change (up from two).

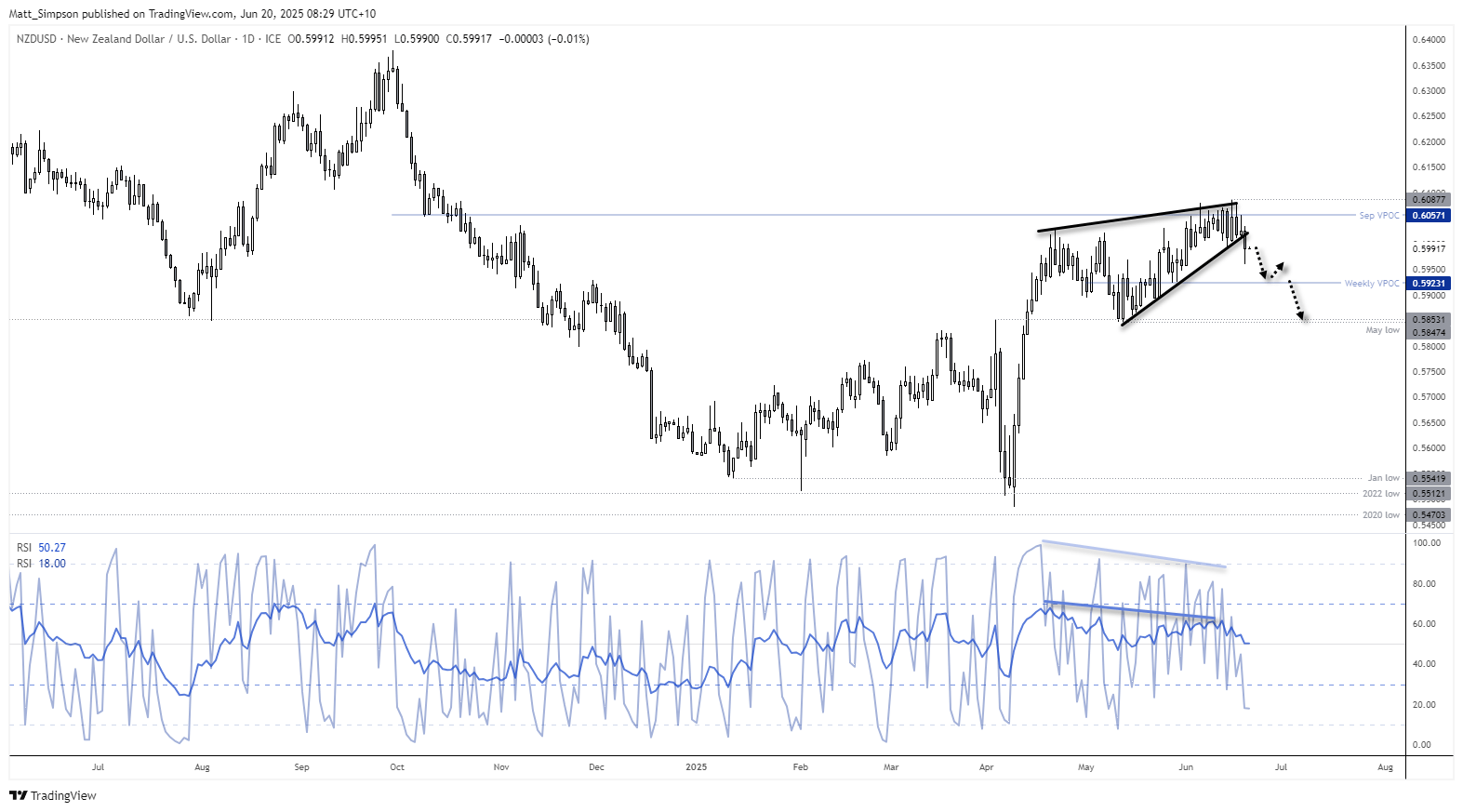

NZD/USD Technical Analysis: New Zealand Dollar vs US Dollar

Momentum has turned against the New Zealand dollar, with NZD/USD falling to a two-week low on Thursday — despite a softer US dollar index. Its rally stalled near the September volume point of control (VPOC), allowing bearish divergences to form on both the daily RSI (14) and RSI (2). With prices now trading back below the 0.60 handle, I’m eyeing a move toward the weekly VPOC at 0.5922.

While it’s debatable whether the current structure qualifies as a textbook rising wedge pattern, price action has at least broken an internal trendline. If the broader bearish reversal setup plays out, it implies a minimum downside target at the May low of 0.5847 — the base of the wedge.

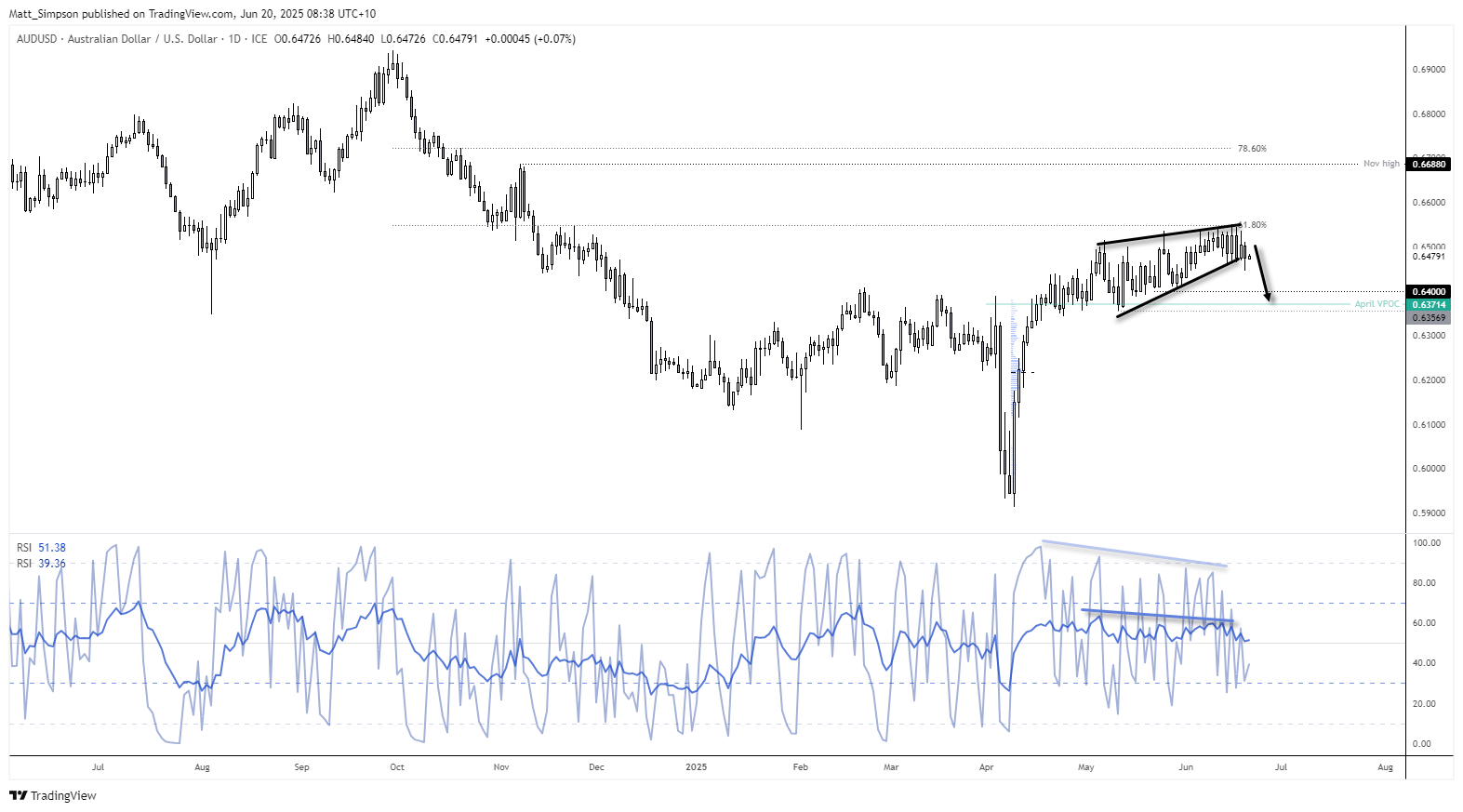

AUD/USD Technical Analysis: Australian Dollar vs US Dollar

The question now is whether the Australian dollar will follow the New Zealand dollar. Given my core bias for a higher US dollar (potentially linked to TACO), I suspect it will.

AUD/USD has repeatedly struggled around 0.6550, and its rally from the v-bottom low has all but come to a stop. Like NZD/USD, bearish divergences have formed on the daily RSIs, and my bias is to fade into moves towards the cycle highs in anticipation of a move down to at least 64c, or the lows around 0.6357.

View the full economic calendar

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge