Over the past four trading sessions, Bitcoin’s price has risen by more than 7%, surpassing its previous all-time highs. This new bullish bias has gained strength as discussions advance in the United States around a potential regulatory framework for certain types of cryptocurrencies. Confidence has grown significantly, pushing BTC to new historical highs in the short term.

Genius Act

This week, the U.S. Senate made progress on the "Genius Act", a legislative proposal aimed at establishing initial regulation for the stablecoin market. The Trump administration has shown support for regulating digital currencies, with the goal of integrating their use into specific government functions.

These political developments have started to boost confidence and demand across the crypto ecosystem, as they are seen as a major step toward transparency and security, helping to further differentiate crypto markets from traditional ones.

This surge in confidence has notably benefited Bitcoin, which remains the most dominant cryptocurrency in the market. However, it’s worth noting that the recent price movement has been driven primarily by an initial wave of optimism. If confidence begins to stabilize, selling pressure could emerge near the all-time high zones.

Confidence on the Rise

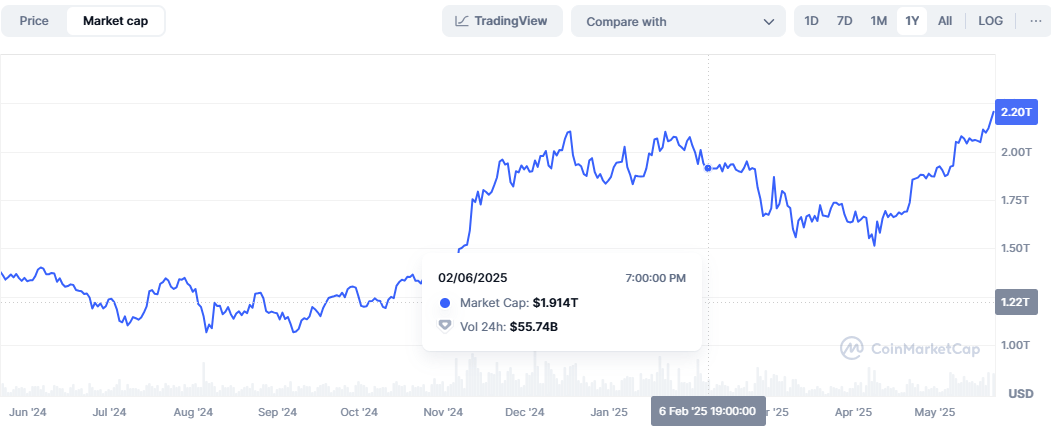

Bitcoin’s market capitalization is now approaching $2.2 trillion, reflecting a steady inflow of capital into the cryptocurrency. This marks the highest market cap in BTC's history, confirming strong demand and reinforcing investor confidence. This momentum has helped keep buying interest elevated in recent trading sessions.

Source: Coinmarketcap

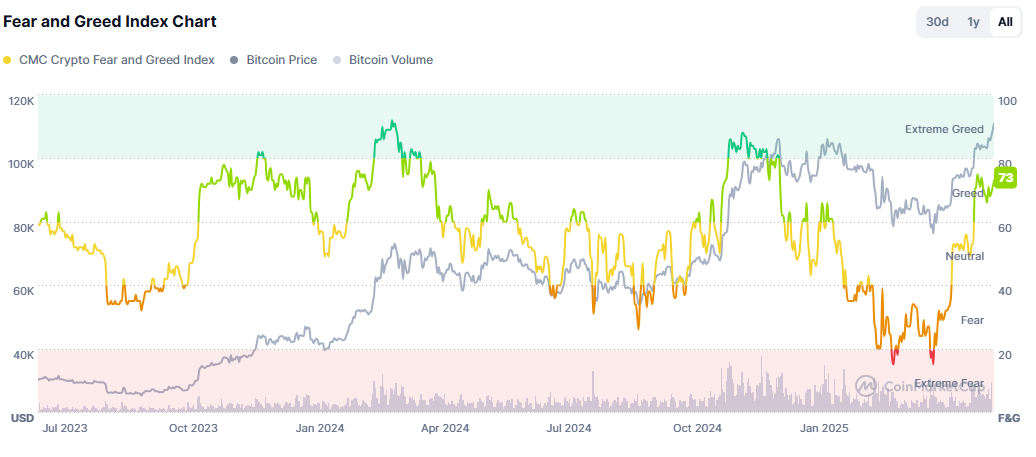

Meanwhile, the Fear & Greed Index for cryptocurrencies continues to hover near the 80-point level, which marks the transition between "greed" and "extreme greed". In recent sessions, the index has shown steady upward movement, reflecting a strong bullish sentiment across the market.

Source: Coinmarketcap

If both market capitalization and the confidence index maintain their current momentum, it could translate into increased appetite for BTC in the short term, supporting sustained buying pressure in the sessions ahead.

Bitcoin Technical Outlook

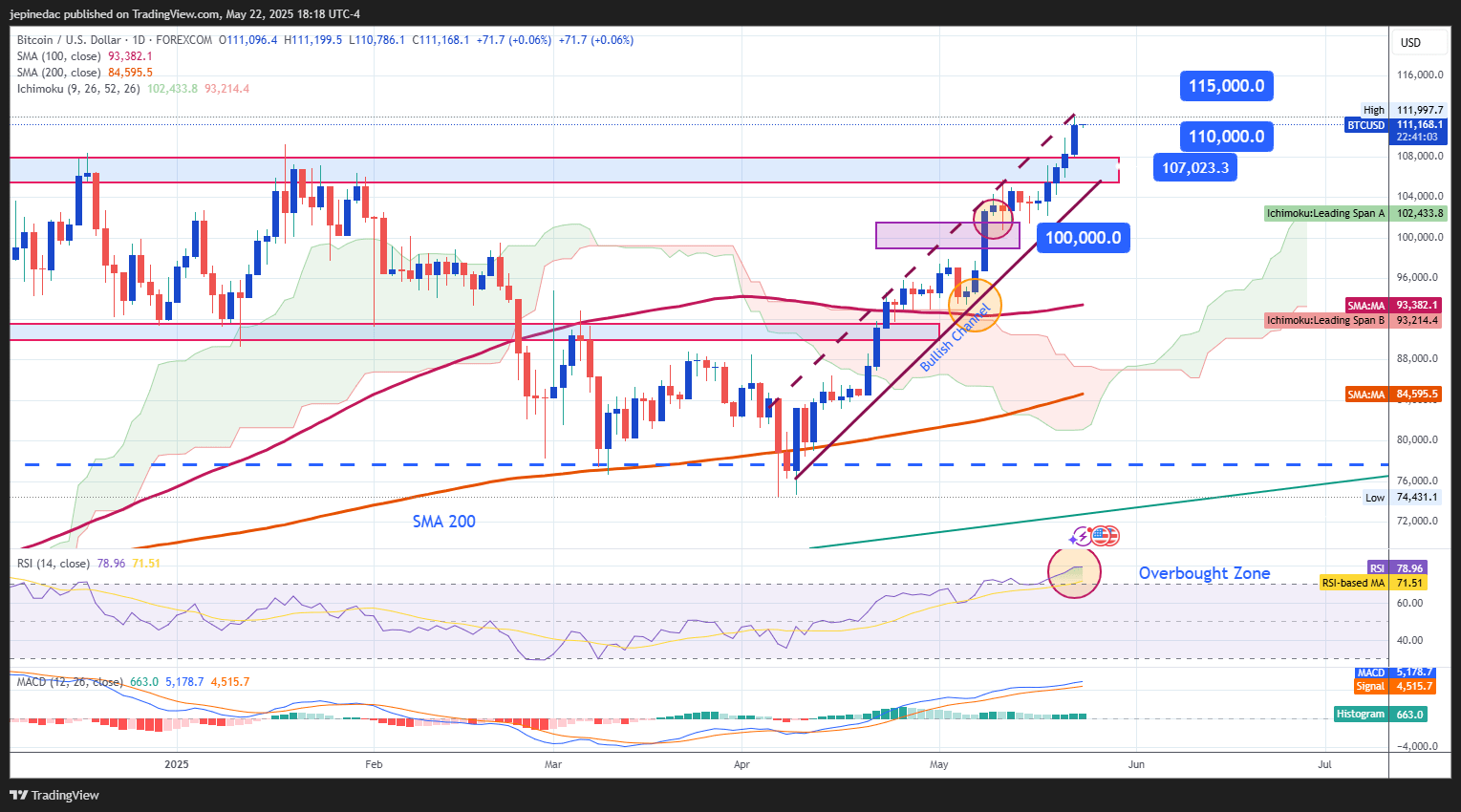

Source: StoneX, Tradingview

- Key Bullish Channel: Since April 9, Bitcoin has established a solid uptrend, consistently trading above $100,000 per unit. So far, there are no significant signs of selling pressure threatening this structure, which remains the dominant technical formation in the short term. If confidence persists, BTC could even set new record highs on the chart.

- RSI: The RSI line has risen steadily and is now above the 70 level, indicating overbought conditions. This suggests that buying momentum has created an imbalance, which could pave the way for potential corrective pullbacks.

- MACD: The MACD histogram has started to show lower highs, while Bitcoin’s price continues to make higher highs. This technical divergence signals a market imbalance that could lead to short-term corrective moves, especially as BTC attempts to consolidate new highs.

Key Levels:

- $110,000 – Current Resistance: This level represents the new all-time high zone. It’s a potential area where pullbacks may occur if bullish momentum starts to cool.

- $115,000 – Tentative Resistance: A nearby psychological level that could act as a round-number barrier. Sustained moves above this level could lead to an even steeper rally.

- $107,000 – Key Support: Former all-time high area, now acting as a relevant technical support. A breakdown below this level could put the short-term bullish structure at risk.

Written by Julian Pineda, CFA – Market Analyst

Follow him at: @julianpineda25