After two weeks of strong buying pressure, Bitcoin’s price action appears to have stalled in the short term, stabilizing around the $103,000 area. So far, the cryptocurrency has failed to revisit its all-time highs above $106,000. The neutral bias currently dominating Bitcoin in the short term is closely tied to the recent rebound in confidence toward the U.S. dollar, one of its main competitors as a store of value.

Is Neutrality Returning?

The past three weeks have been pivotal for Bitcoin, as its bullish momentum remained firm following the easing of trade tensions, allowing it to maintain levels above $100,000, a price not seen in nearly three months. This rally has also been reflected in Bitcoin ETF flows, which have seen over $5 billion in net inflows over the past three weeks, highlighting growing institutional interest in the asset.

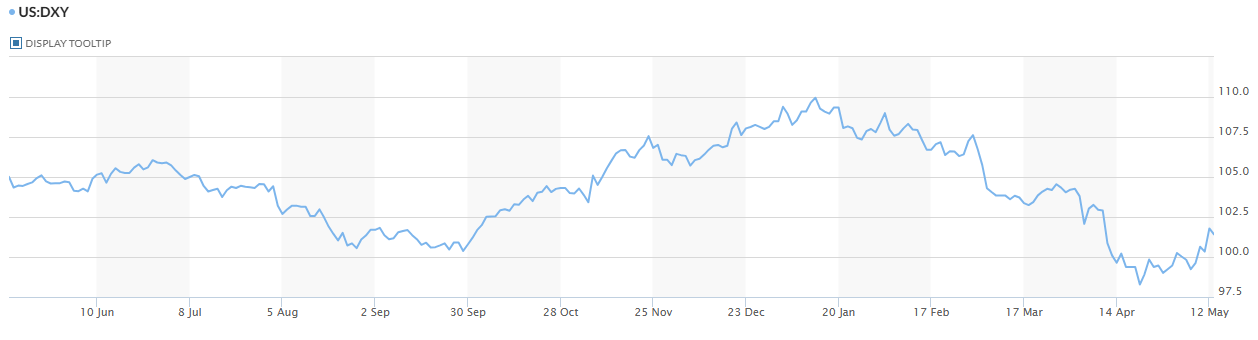

However, this same increase in confidence has also helped boost the U.S. dollar, which had previously been one of the currencies most affected by the trade war. The DXY index, which measures the dollar’s strength, is currently holding above the 100-point level after reaching recent lows, signaling a sustained short-term recovery for the dollar.

Source: Market Watch

This renewed strength in the dollar appears to be limiting Bitcoin’s upward momentum, preventing it from reclaiming its all-time highs. If demand for the dollar continues to grow steadily, this could generate selling pressure on BTC in upcoming trading sessions.

What’s the Current Sentiment in the Crypto Market?

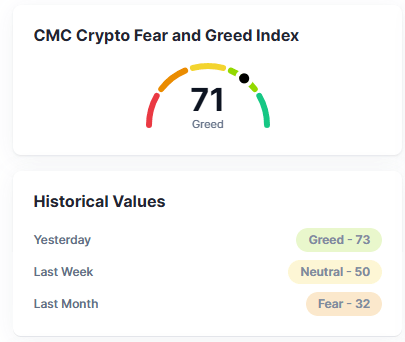

At present, the CoinMarketCap Fear & Greed Index for cryptocurrencies stands at 71, placing it in the “greed” zone. This marks a notable improvement from the previous month, when the index was at 32, in the “fear” zone.

Source: Coinmarketcap

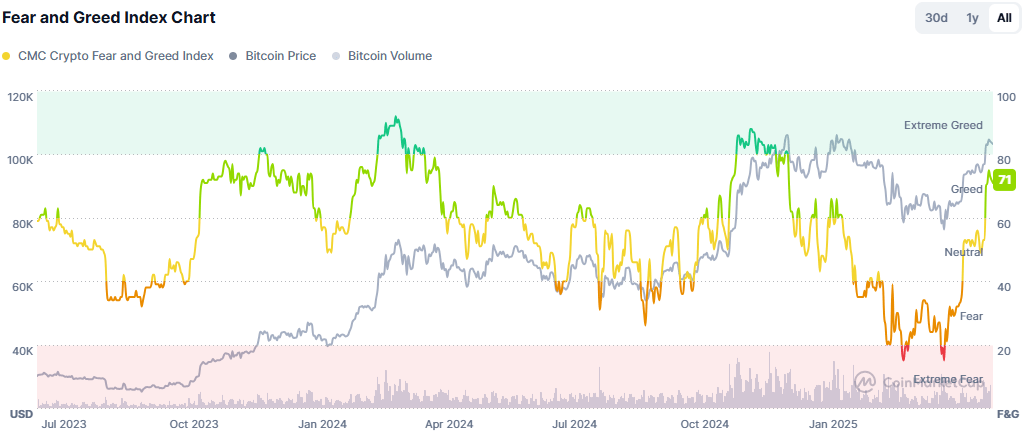

Over the past month, sentiment has steadily improved, shifting from extreme fear to renewed risk appetite, as reflected by the index’s current level. This rise in confidence has coincided with Bitcoin’s strong bullish performance in recent weeks. However, the rapid pace of sentiment growth may now be signaling the beginning of a neutral or consolidation phase in BTC price action.

Source: Coinmarketcap

If the index manages to stay in the “greed” zone over the next few sessions, it’s likely that Bitcoin’s buying strength could stabilize again, potentially paving the way for another upward leg. Conversely, if the index begins to show signs of decline, this could trigger renewed selling pressure, especially around the all-time high zone.

Bitcoin Technical Outlook

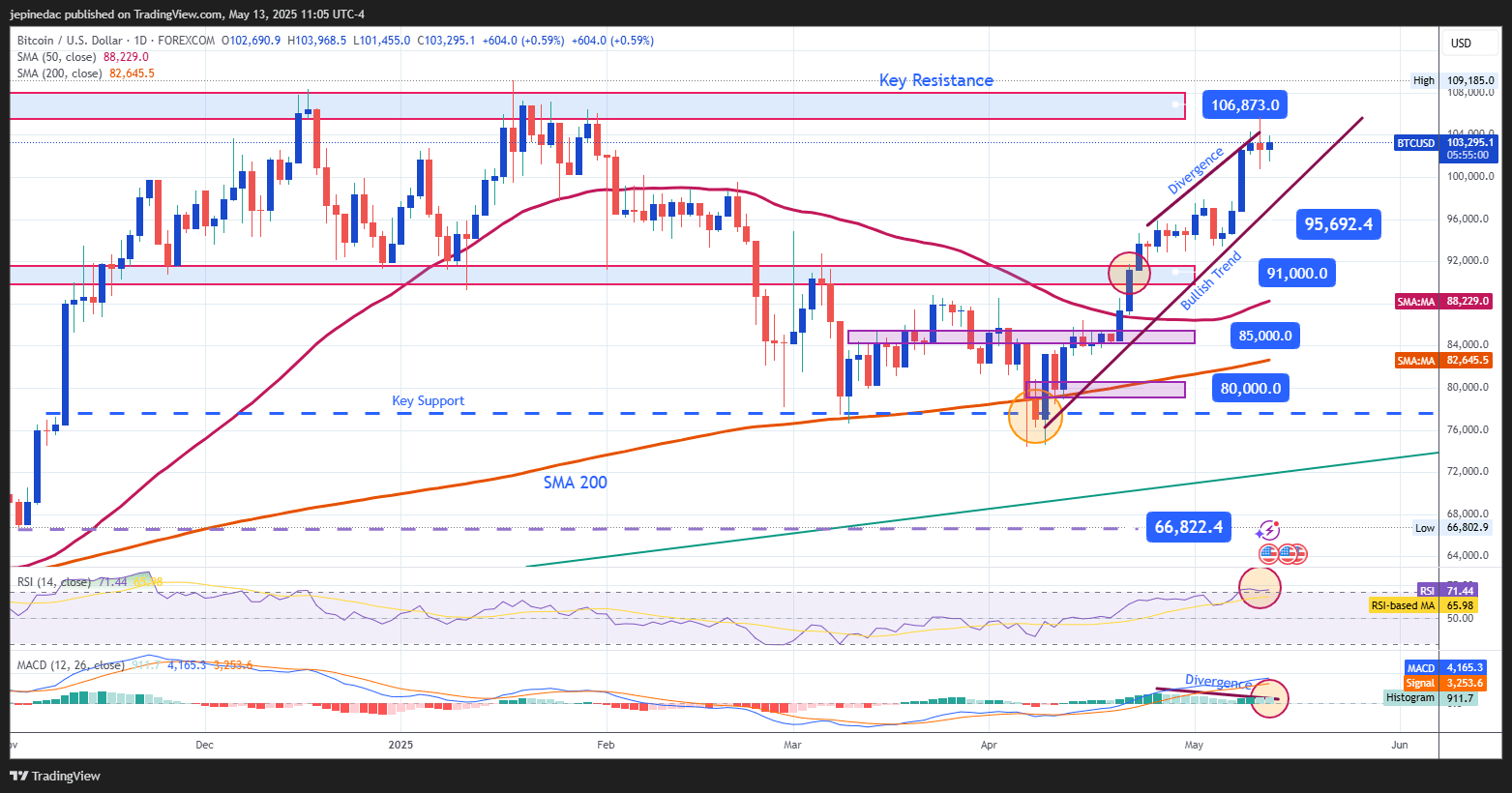

Source: StoneX, Tradingview

- Bullish Trend: Since April 9, Bitcoin has formed a consistent bullish trend, with price movements remaining above $100,000 per unit. For now, there are no major selling signals that threaten this formation, which remains the most relevant technical structure in the short term.

- RSI: The RSI line has steadily climbed and is currently sitting above the 70 level, indicating overbought conditions. This suggests that buying momentum has created an imbalance, which could open the door to short-term bearish corrections.

- MACD: The MACD histogram has begun to show lower highs, while Bitcoin’s price continues to set higher highs. This technical divergence points to a market imbalance and could lead to corrective downside movements in the short term.

Key Levels:

- $106,000 – Main Resistance: This level represents Bitcoin’s all-time high zone. A sustained breakout above it could reignite strong buying momentum and extend the ongoing bullish trend.

- $95,000 – Nearby Support: This level aligns with a recent consolidation zone and may act as a barrier against short-term pullbacks.

- $91,000 – Key Support: This marks the lowest level of the past month. A drop to this area could jeopardize the current bullish structure and trigger a more significant bearish bias.

Written by Julian Pineda, CFA – Market Analyst

Follow him at: @julianpineda25