Shortly after reaching its all-time high above the $110,000 level, Bitcoin has started to show a series of continuous bearish moves, accumulating three consecutive sessions of losses and a price drop of over 4%. This emerging bearish bias has remained steady, driven in part by profit-taking at highs and ongoing economic uncertainty.

Dynamics in the Bitcoin Market

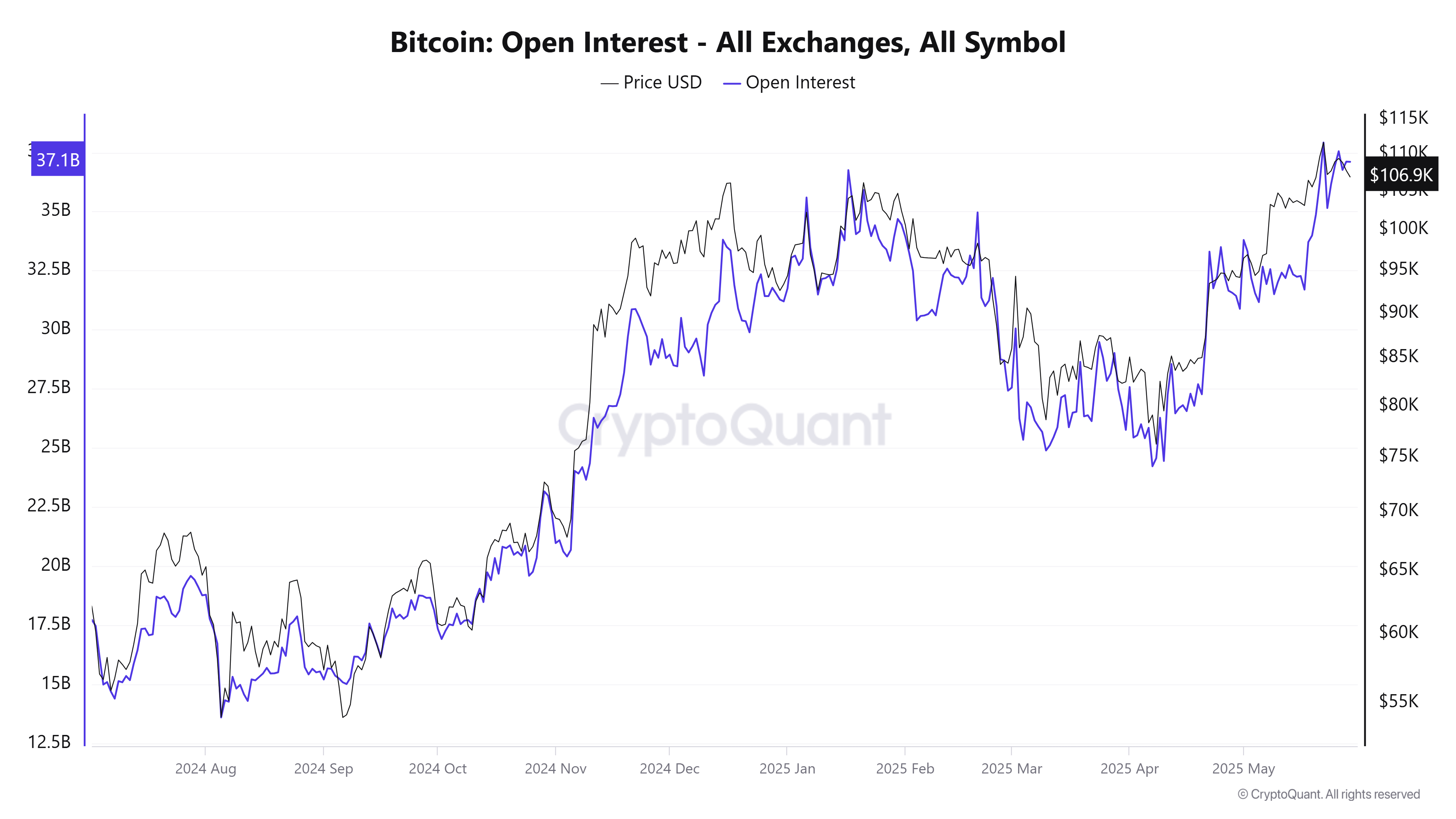

Bitcoin has seen strong buying interest in recent weeks, reflected in the “Open Interest – All Exchanges” indicator, which measures the total value of open positions. This indicator, along with the price, has reached new short-term highs, signaling elevated market activity that helped push the cryptocurrency beyond previous historical peaks.

Source: Cryptoquant

However, the fact that Open Interest remains at such high levels may indicate that most buying positions are already active, limiting the room for new entries. This situation could signal that profit-taking at recent highs has already begun, especially after the indicator’s recent decline. Additionally, the lack of room for new buying positions may be creating a phase of price stabilization for Bitcoin.

As Open Interest remains elevated, this could suggest that the room for new demand is becoming increasingly limited. If profit-taking continues, it may signal more significant selling pressure in upcoming BTC sessions.

How Is Market Confidence?

This week, several key events have unfolded around the trade war narrative. Initially, new threats were directed at Europe, followed by reports that the White House is engaged in a legal dispute over tariff enforcement. These developments have added to the uncertainty about the near-term outlook of the conflict.

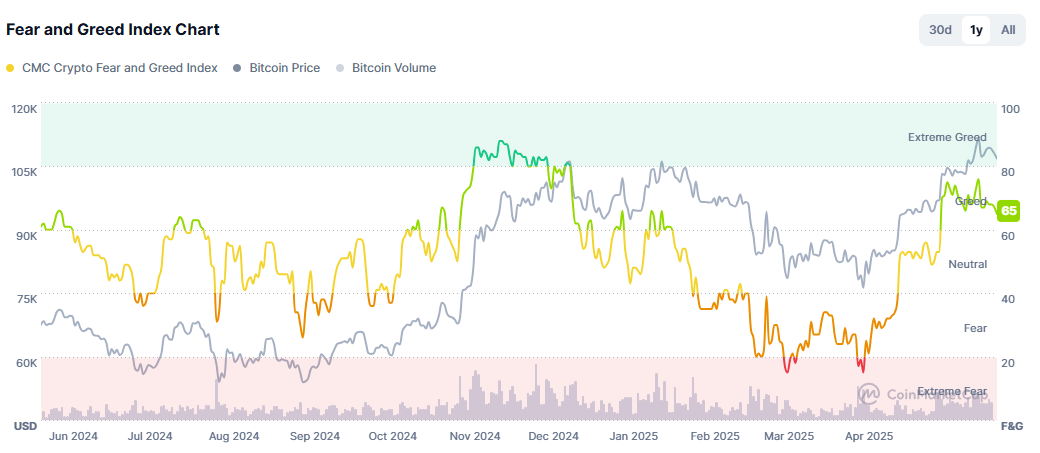

As a result, confidence appears to have weakened in the crypto market as well. The Crypto Fear & Greed Index is currently at 65, approaching the “neutral” zone after nearly touching “extreme greed”. This decline reflects a notable drop in confidence over recent sessions, which has contributed to the price stagnation of Bitcoin, preventing it from reaching new highs.

Source: Coinmarketcap

If the index continues to decline, this could reflect a progressive rise in selling positions, further reducing confidence and reinforcing the current bearish bias in BTC’s short-term trend.

Bitcoin Technical Outlook

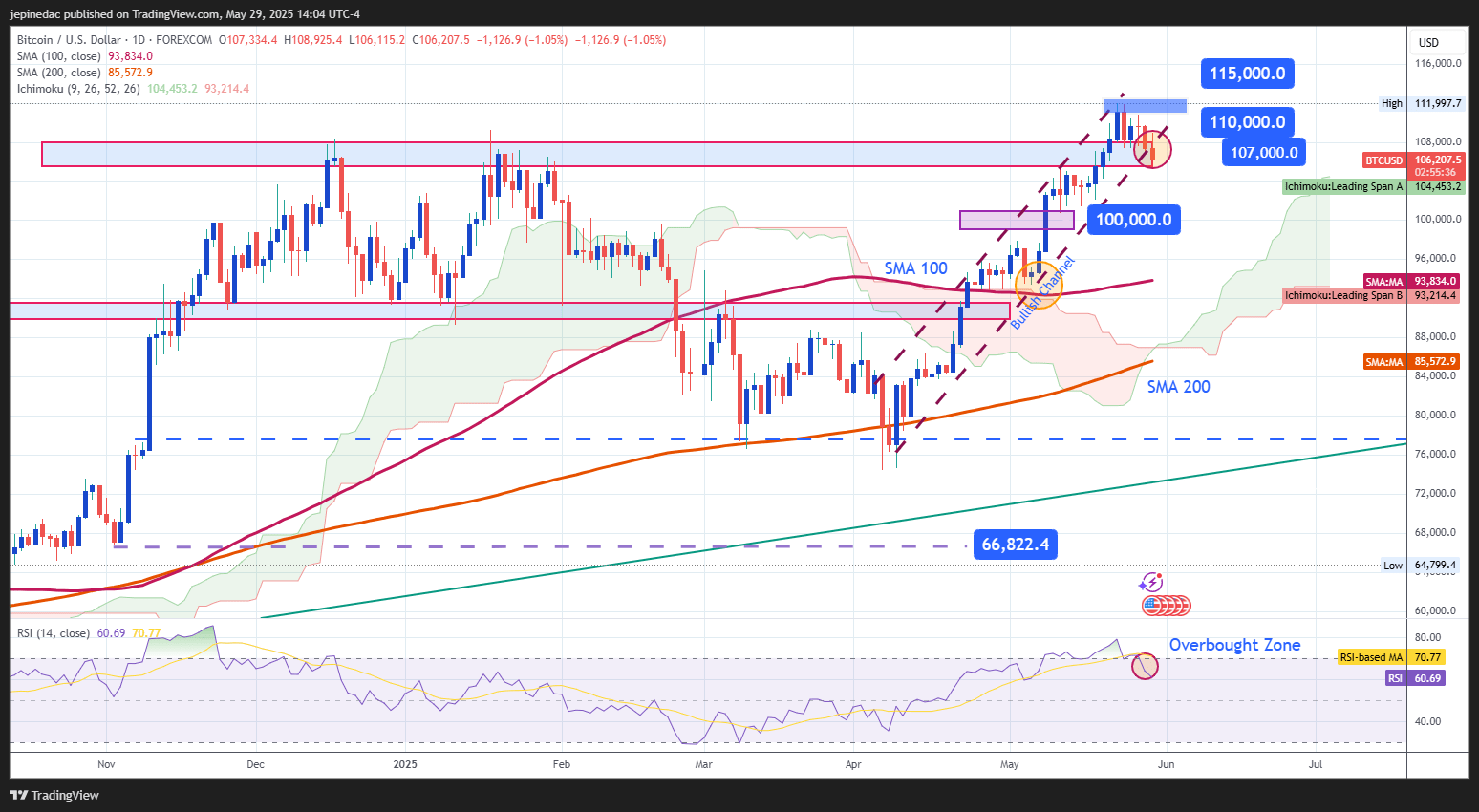

Source: StoneX, Tradingview

- Uptrend Channel at Risk: Since early April, Bitcoin has held a solid upward channel, with price action remaining above the psychological $100,000 level. However, the recent bearish bias has led the price to test the lower boundary of the channel, and if selling pressure continues, it could break this structure and pave the way for a more pronounced downtrend in the short term.

- RSI: The Relative Strength Index (RSI) has exited the overbought zone (above 70) and is now showing a consistently downward slope, suggesting a pause in bullish momentum. If the RSI continues to fall toward the 50 level, it could further highlight the lack of clear direction around current all-time highs.

Key Levels:

- 110,000 – Main Resistance: This level corresponds to the latest all-time high. Sustained movement above it could reaffirm the bullish trend and open the door to a new buying phase.

- 107,000 – Immediate Barrier: A nearby resistance zone. Continued price action below this level could support further selling pressure in the coming sessions.

- 100,000 – Key Support: A psychological support level, aligned with previous consolidation zones. A sustained drop to this level could trigger a new bearish trend.

Written by Julian Pineda, CFA – Market Analyst

Follow him at: @julianpineda25