British Pound Technical Forecast: GBP/USD Weekly Trade Levels

- British Pound rips to resistance at the 2024 highs- threat for price inflection ahead

- GBP/USD remains constructive while above yearly moving average- U.S. Core PCE / NFPs on tap into monthly cross

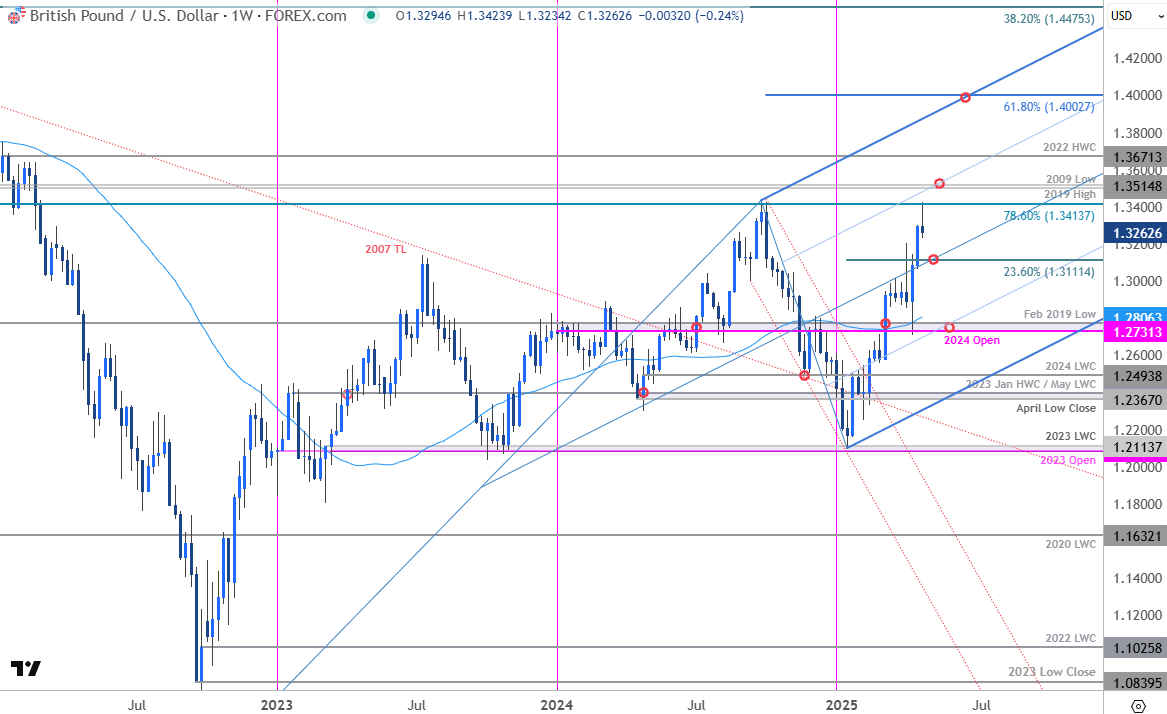

- Resistance 1.3414, 1.3500/15(key), 1.3671- Support 1.3112, 1.2731-1.2806 (key), 1.2494

The British Pound may be poised to snap a two-week winning streak as GBP/USD responds to technical resistance near the 2024 swing high. A ten-day rally is on the defensive for a second day and the focus is on a possible test of trend support in the weeks ahead. Battle lines drawn into the close of the month on the GBP/USD weekly technical chart.

Review my latest Weekly Strategy Webinar for an in-depth breakdown of this Sterling setup and more. Join live on Monday’s at 8:30am EST.British Pound Price Chart – GBP/USD Weekly

Chart Prepared by Michael Boutros, Sr. Technical Strategist; GBP/USD on TradingView

Technical Outlook: In my last British Pound Weekly Forecast we noted that GBP/USD had, “broken out of a multi-month downtrend with the advance threatening a larger recovery in the weeks ahead. From a trading standpoint, losses should be limited to 1.2367 IF price is heading higher on this stretch – look to reduce long-exposure / raise protective stops on rally towards the 52-week moving average.” Sterling ripped through the yearly moving average three-weeks later with the subsequent rally extending more than 10.9% off the January lows. The advance takes price into technical resistance this week at the 78.6% retracement of the 2021 decline / 2024 swing high at 1.3414/34- risk for possible exhaustion / price inflection off this mark.

Initial support rests with the 23.6% retracement at 1.3112- note that the median-line of a proposed pitchfork extending off the 2022 low converges on this threshold over the next few weeks. Losses below the medina-line would threaten a larger pullback towards 1.2731-1.2806- a region defined by the 2024 yearly open, the February 2019 swing low, and the 52-week moving average. A break / close below this threshold would be needed to suggest a more significant high was registered this week / a larger trend reversal is underway (bullish invalidation).

A topside break here exposes key resistance at the 2019 high / 2009 low at 1.3500/14- note that the 75% parallel converges on this threshold and a breach / close above this slope would be needed to mark uptrend resumption. Subsequent resistance objectives eyed at the 2022 high-week close (HWC) at 1.3671 and the 61.8% extension of the 2022 advance at 1.4003.

Bottom line: The Sterling breakout has responded to initial resistance here- risk for near-term price inflection. From a trading standpoint, a good zone to reduce long-exposure / raise protective stops- losses should be limited to the median-line IF price is heading higher on this stretch with a breach / close above 1.3515 ultimately needed to fuel the next major leg of the advance.

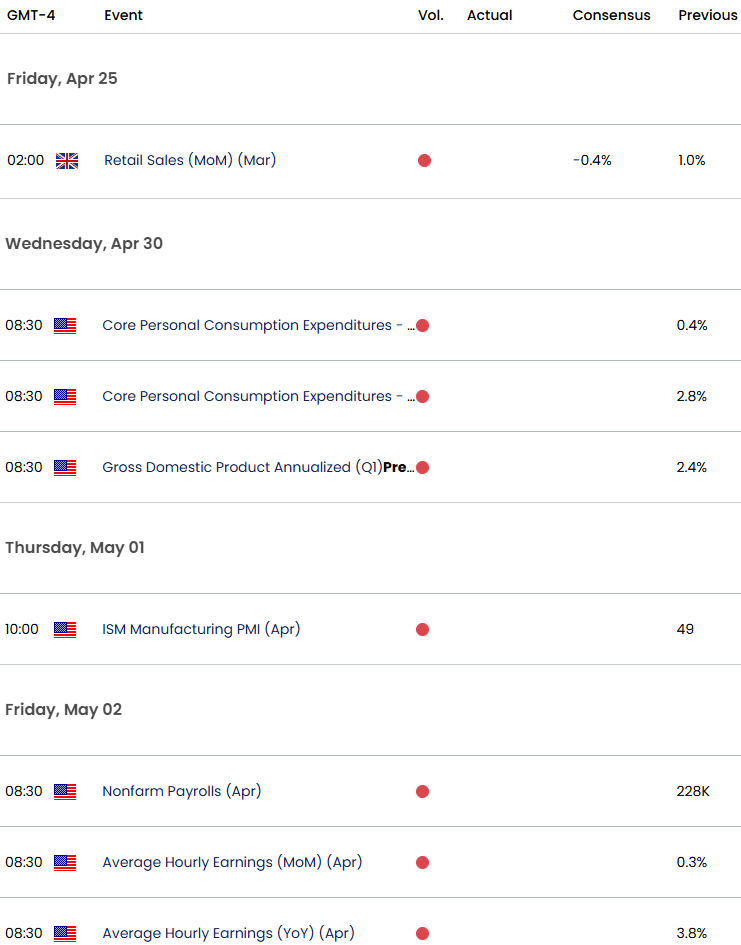

Keep in mind we get the release of key U.S. inflation data (Core PCE) and Non-Farm Payrolls into the monthly cross next week. Stay nimble into the releases and watch the weekly closes for guidance here. I’ll publish an updated British Pound Short-term Outlook once we get further clarity on the near-term GBP/USD technical trade levels.

GBP/USD Economic Data Releases

Economic Calendar - latest economic developments and upcoming event risk.

Active Weekly Technical Charts

- Canadian Dollar (USD/CAD)

- Euro (EUR/USD)

- US Dollar Index (DXY)

- Australian Dollar (AUD/USD)

- Japanese Yen (USD/JPY)

- Gold (XAU/USD)

- S&P 500, Nasdaq, Dow

- Crude Oil (WTI)

--- Written by Michael Boutros, Sr Technical Strategist with FOREX.com

Follow Michael on X @MBForex