British Pound Outlook: GBP/USD

GBP/USD approaches the upper bound of an ascending channel as it attempts to retrace the decline from the monthly high (1.3015), but data prints coming out of the UK may drag on the British Pound as the Consumer Price Index (CPI) is anticipated to show slowing inflation.

British Pound Forecast: GBP/USD Coils with UK CPI on Tap

GBP/USD seems to be coiling within a narrow range after failing to test the November high (1.3048), and the exchange rate may continue to track the channel formation from earlier this year as the 50-Day SMA (1.2625) establishes a positive slope.

Join David Song for the Weekly Fundamental Market Outlook webinar.

David provides a market overview and takes questions in real-time. Register Here

In turn, the range bound price action in GBP/USD may turn out to be temporary as the Bank of England (BoE) insists that ‘a gradual and careful approach to the further withdrawal of monetary policy restraint is appropriate,’ and the central bank may keep UK interest rates on hold at its next meeting on May 8 as ‘monetary policy will need to continue to remain restrictive for sufficiently long until the risks to inflation returning sustainably to the 2% target in the medium term have dissipated further.’

UK Economic Calendar

However, the UK CPI may sway the Monetary Policy Committee (MPC) as both the headline and core rate of inflation are anticipated to slow in February, and evidence of easing price growth may generate a bearish reaction in the British Pound as it fuels speculation for a BoE rate-cut.

As a result, GBP/USD may consolidate over the remainder of the month amid the failed attempt to test the November high (1.3048), but a higher-than-expected CPI print may keep the British Pound afloat as it encourages Governor Andrew Bailey and Co. to keep UK interest rates on hold.

With that said, GBP/USD may break out of the range bound price action should it retrace the decline from the monthly high (1.3015), but failure to defend the weekly low (1.2895) may push the exchange rate towards the lower bound of the ascending channel.

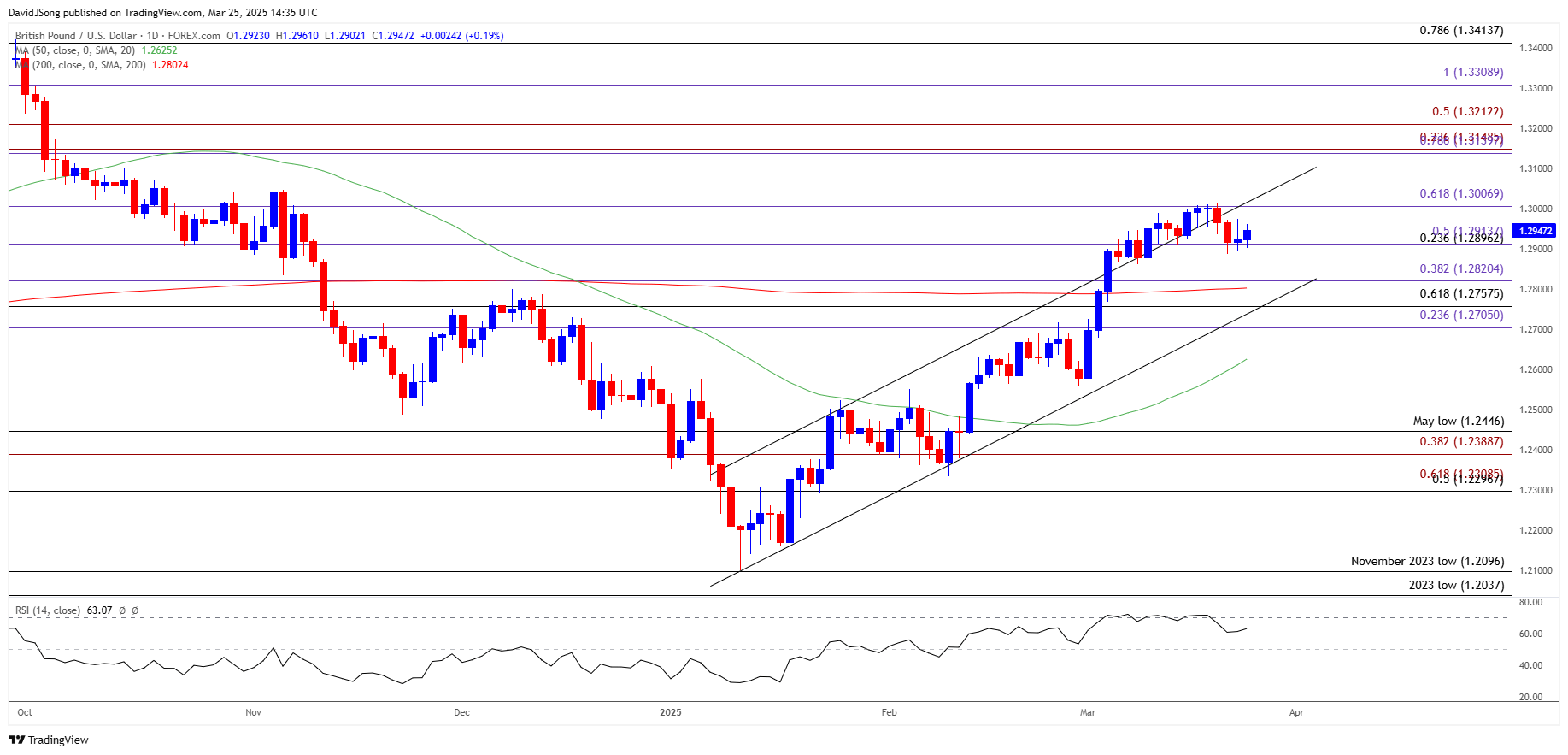

GBP/USD Price Chart –Daily

Chart Prepared by David Song, Senior Strategist; GBP/USD on TradingView

- GBP/USD appears to be stuck in a narrow range following the failed attempts to close below the 1.2900 (23.6% Fibonacci retracement) to 1.2910 (50% Fibonacci extension) region, and the exchange rate may continue to track sideways amid the lack of momentum to close above 1.3010 (61.8% Fibonacci extension).

- Nevertheless, GBP/USD may extend the advance from the start of the month as the ascending channel from earlier this year remains intact, with a close above 1.3010 (61.8% Fibonacci extension) raising the scope for a test of the November high (1.3048).

- Next area of interest comes in around 1.3140 (78.6% Fibonacci extension) to 1.3210 (50% Fibonacci extension), but a close below the 1.2900 (23.6% Fibonacci retracement) to 1.2910 (50% Fibonacci extension) region may push GBP/USD towards 1.2820 (38.2% Fibonacci extension).

Additional Market Outlooks

AUD/USD Halts Four-Day Selloff Ahead of Australia CPI

Canadian Dollar Forecast: USD/CAD Breakout Looms on Trump Tariffs

EUR/USD Post-Fed Weakness Pulls RSI Back from Overbought Zone

Gold Price Rally Pushes RSI Back into Overbought Territory

--- Written by David Song, Senior Strategist

Follow on Twitter at @DavidJSong