British Pound Outlook: GBP/USD

GBP/USD falls from a fresh yearly high (1.3005) to pull the Relative Strength Index (RSI) back from overbought territory, but the exchange rate may stage further attempts to test the November high (1.3048) as it still holds above the ascending channel from earlier this year.

British Pound Forecast: GBP/USD Vulnerable to Dovish Bank of England (BoE)

GBP/USD bounces along channel resistance ahead of the Federal Reserve interest rate decision as it struggles to retain the advance from the start of the week, and the fresh forecasts from Chairman Jerome Powell and Co. may sway foreign exchange markets as the central bank is slated to update the Summary of Economic Projections (SEP).

Join David Song for the Weekly Fundamental Market Outlook webinar.

David provides a market overview and takes questions in real-time. Register Here

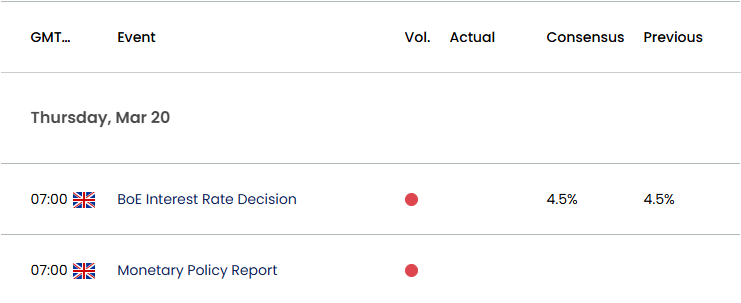

At the same time, the Bank of England (BoE) is anticipated to keep UK interest rates on hold following the 25bp rate-cut at the February meeting, and the central bank may endorse a wait-and-see approach as the ongoing transition in US trade policy clouds the outlook for the global economy.

UK Economic Calendar

In turn, waning expectations for an imminent BoE rate-cut may keep GBP/USD afloat, but Governor Andrew Bailey and Co. may continue to strike a dovish forward guidance as ‘a gradual and careful approach to the further withdrawal of monetary policy restraint is appropriate.’

With that said, GBP/USD may struggle to retain the advance from the start of the week should the BoE prepare UK households and businesses for lower interest rates, but the exchange rate may stage further attempts to test the November high (1.3048) as it bounces along channel resistance.

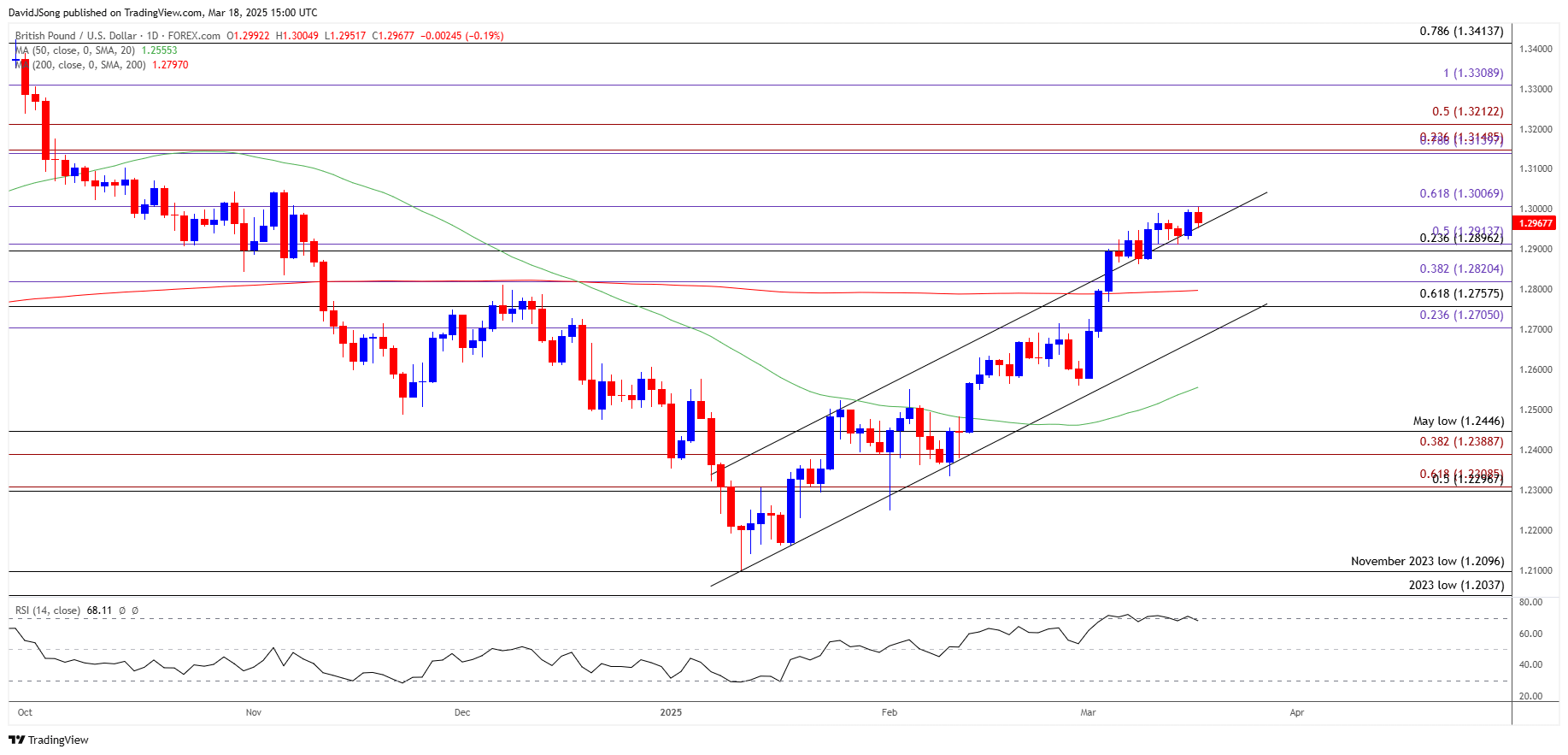

GBP/USD Price Chart –Daily

Chart Prepared by David Song, Senior Strategist; GBP/USD on TradingView

- GBP/USD carves a series of higher highs and lows to register a fresh yearly high (1.3005), with a break/close above 1.3010 (61.8% Fibonacci extension) raising the scope for a move towards the November high (1.3048).

- Need a break/close above the 1.3140 (78.6% Fibonacci extension) to 1.3210 (50% Fibonacci extension) zone to open up 1.3310 (100% Fibonacci extension), but the Relative Strength Index (RSI) may show the bullish momentum abating as it struggles to hold in overbought territory.

- Lack of momentum to break/close above 1.3010 (61.8% Fibonacci extension) may keep GBP/USD in a narrow range, but failure to hold above the 1.2900 (23.6% Fibonacci retracement) to 1.2910 (50% Fibonacci extension) region may push the exchange rate back towards 1.2820 (38.2% Fibonacci extension).

Additional Market Outlooks

Canadian Dollar Forecast: USD/CAD Coils Ahead of Reciprocal Trump Tariffs

EUR/USD Rebounds Ahead of Weekly Low to Keep RSI in Overbought Zone

USD/JPY Rebound in Focus with BoJ Expected to Hold Interest Rate

Gold Record High Price Pushes RSI Towards Overbought Zone

--- Written by David Song, Senior Strategist

Follow on Twitter at @DavidJSong