- Bitcoin surges to record highs during Asian trade

- Trump tax bill nears House vote, adding to U.S. debt concerns

- Breakout may encourage fresh longs, if it sticks

Bitcoin has rocketed to record highs in Asia as Donald Trump’s signature ‘big, beautiful’ tax bill moves closer to becoming law, adding to simmering concerns about the U.S. fiscal trajectory. If the breakout sticks, it may encourage additional bulls to join the charge higher.

Trump Tax Bill Faces House Vote Amid Debt Doubts

The U.S. House of Representatives will attempt to pass President Donald Trump’s tax and spending package in the early hours of Thursday, following weeks of internal Republican wrangling. The bill includes an extension of Trump’s 2017 tax cuts, new tax breaks, increased military and border spending, and tighter eligibility for Medicaid and food assistance programs.

The U.S. Congressional Budget Office estimates the legislation could add $3.8 trillion to the federal debt over the next decade, which already exceeds $36 trillion. The bill would also raise the U.S. debt ceiling by $4 trillion.

The vote comes days after Moody’s downgraded the U.S. credit rating to Aa1, citing concerns over the government’s worsening fiscal position. As noted earlier, long-end U.S. Treasury yields have started reflecting structural fiscal concerns rather than the growth and inflation outlook. The confluence of rising issuance and higher deficits is pushing investors toward hard assets with limited supply. Gold may be glistening, but Bitcoin is booming.

BTC/USD Breakout—Will it Stick?

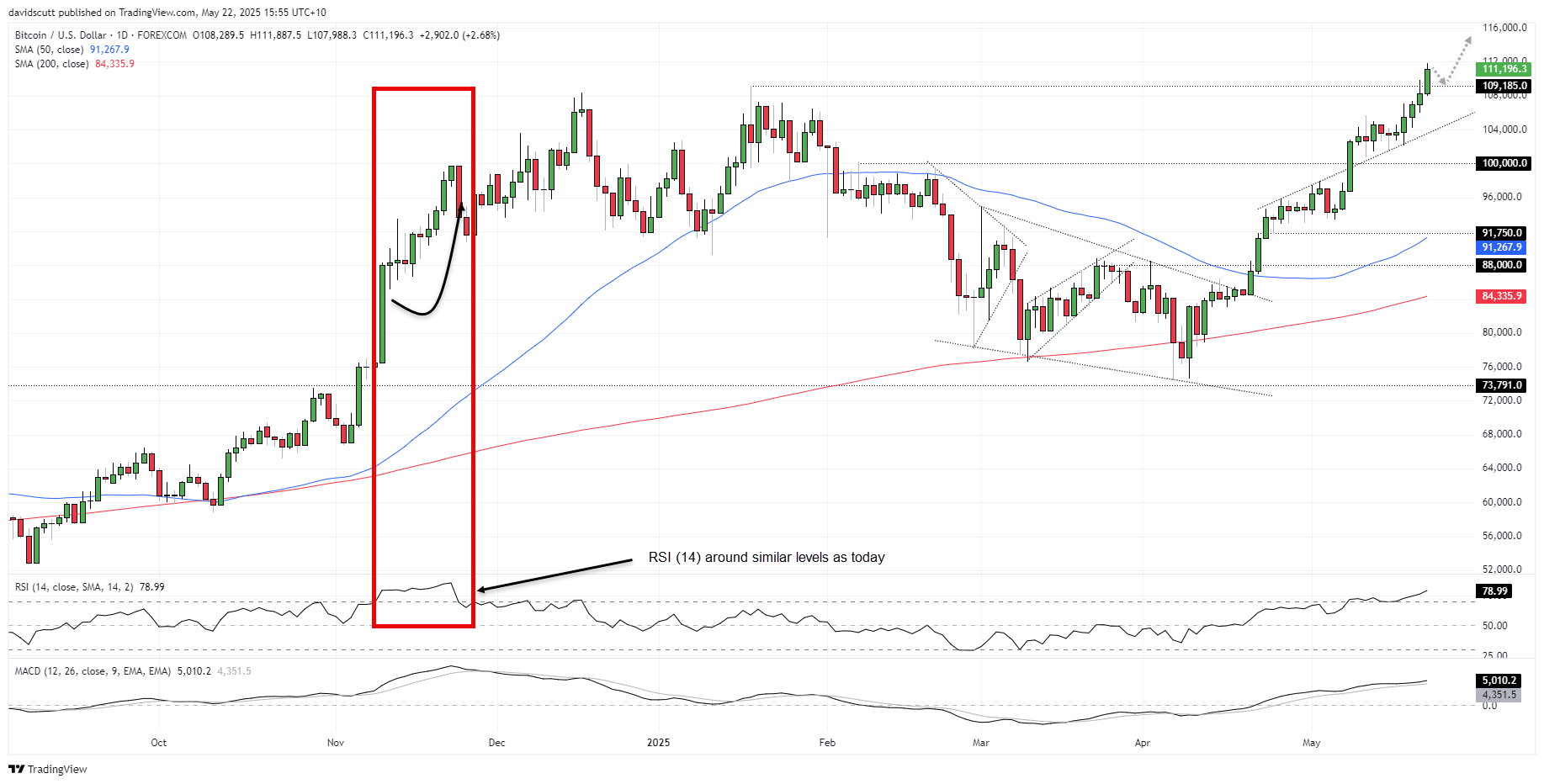

Source: TradingView

While bulls would have nervous as Bitcoin reversed back below the former record high of $109,185 late Wednesday, mirroring false breaks of the past, a fresh wave of buying during the Asian session has undoubtably improved the mood.

Some traders may buy immediately on the breakout but given Bitcoin’s history of false breaks around these levels, it’s preferable to wait for a close above the former record high before committing to long positions.

Pullbacks towards Wednesday’s high around $109900 would provide a decent entry level, allowing for a stop to be placed below the former record high for protection against reversal.

While some prefer extension targets, bitcoin has had a knack of delivering obvious topping patterns when it’s traded at record highs previously, be they single-candle such as shooting stars or bearish engulfers or multi-candle like evening stars. It’s up to the desired risk reward you’re after, but if you see one or one forming, consider taking profit if you’re not a ‘hodler’.

Momentum indicators are bullish and trending higher, although RSI (14) is overbought on the dailies. While that reminds of reversal risk, previous episodes where RSI (14) sat around these levels did not result in immediate pullbacks.

If bitcoin were to have another failure at these levels, it would make a strong case for switching to a bearish bias. Beyond the former record high, big figures such as $105,000 and $100,000 would be in focus.

-- Written by David Scutt

Follow David on Twitter @scutty