Canadian Dollar Technical Forecast: USD/CAD Weekly Trade Levels

- USD/CAD rebound off key technical support extends nearly 2% off yearly low

- USD/CAD rally now testing initial resistance hurdles- risk for exhaustion / price inflection ahead

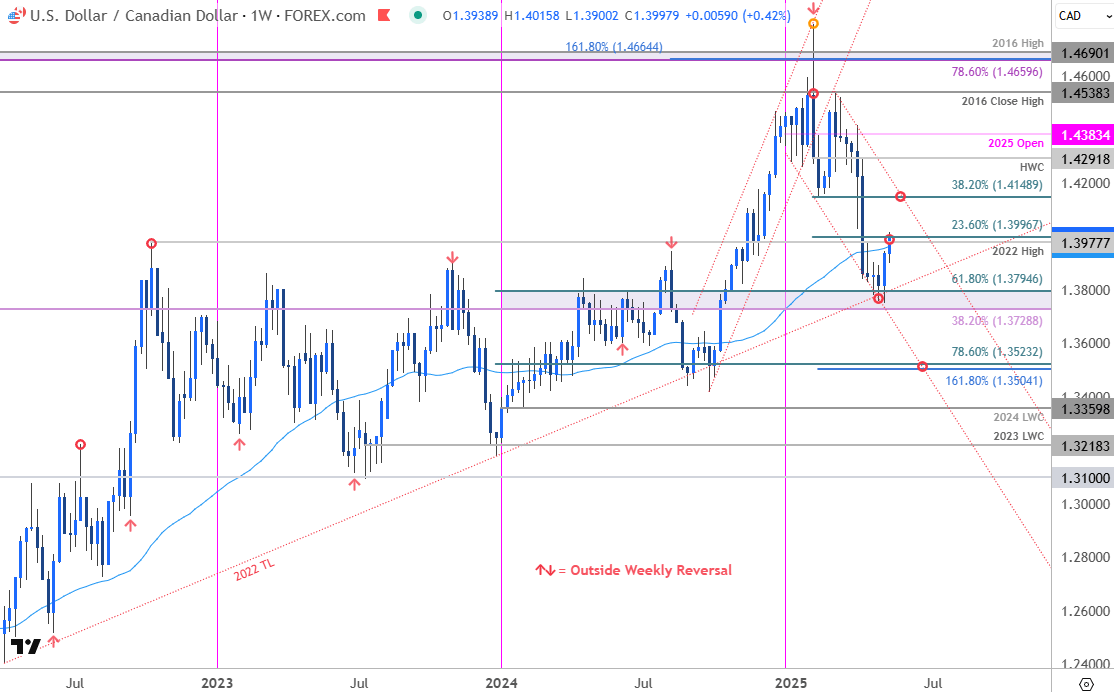

- Resistance 1.3978/97, 1.4149 (key), 1.4292– Support 1.39, 1.3729/95 (key), 1.3504/23

The Canadian Dollar is under assault with USD/CAD attempting to mark a fifth consecutive daily advance. A rebound off key technical support is now testing the first major hurdle and the focus is on possible price inflection off this zone in the days ahead. Battle lines drawn on the USD/CAD weekly technical chart.

Review my latest Weekly Strategy Webinar for an in-depth breakdown of this Loonie setup and more. Join live on Monday’s at 8:30am EST.Canadian Dollar Price Chart – USD/CAD Weekly

Chart Prepared by Michael Boutros, Sr. Technical Strategist; USD/CAD on TradingView

Technical Outlook: In last month’s Canadian Dollar Technical Forecast we noted that, “A three-month sell-off takes USD/CAD into technical support at a multi-year uptrend- risk for possible downside exhaustion / price inflection here.” Price marked an outside-weekly reversal off key support last week with USD/CAD rallying more than 1.9% off the lows. The advance is now testing initial resistance hurdles at 1.3962/97- a region defined by the 52-week moving average, the 2022 swing high, and the 23.6% retracement of the yearly range.

The immediate focus is on a reaction off this mark with key resistance eyed just higher at the 38.2% retracement near 1.4150. Note that the March channel line converges on this threshold over the next few weeks and a breach / close above would be needed to suggest a more significant low as registered last week / a larger trend reversal is underway. Subsequent resistance objectives seen at the high-week close (HWC) at 1.4292 and the 2025 yearly open at 1.4383.

Initial weekly support rests at the 1.39-hande with key support unchanged at 1.3729/95- a region defined by the 38.2% retracement of the 2021 advance and the 61.8% retracement of the late-2023 advance. A break / weekly close below this pivot zone would threaten another bout of accelerated declines with initial support objectives seen at 1.618% extension of the February decline / 78.6% retracement at 1.3504/23.

Bottom line: USD/CAD has responded to confluent uptrend support with the recovery now testing initial resistance- risk for possible price inflection here. From a trading standpoint, losses should be limited to the 1.39-handle IF price is heading higher on this stretch with a close above this pivo zone needed to fuel the next leg of the advance. Watch the weekly closes for guidance here. Review my latest Canadian Dollar Short-term Outlook for a closer look at the near-term USD/CAD technical trade levels.

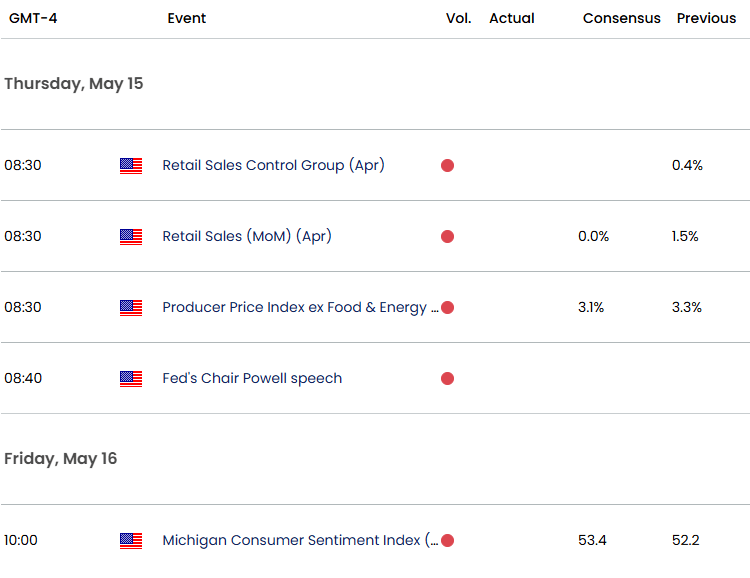

US/ Canada Economic Data Release

Economic Calendar - latest economic developments and upcoming event risk.

Active Weekly Technical Charts

- Gold (XAU/USD)

- US Dollar Index (DXY)

- Euro (EUR/USD)

- S&P 500, Nasdaq, Dow

- Swiss Franc (USD/CHF)

- Japanese Yen (USD/JPY)

- Crude Oil (WTI)

- Australian Dollar (AUD/USD)

- British Pound (GBP/USD)

--- Written by Michael Boutros, Sr Technical Strategist with FOREX.com

Follow Michael on X @MBForex