Canadian Dollar Outlook: USD/CAD

USD/CAD bounces back ahead of the monthly low (1.3751) to halt the selloff from earlier this week, but the exchange rate may track the negative slope in the 50-Day SMA (1.4033) as it holds below the moving average.

Canadian Dollar Forecast: USD/CAD Bounces Back Ahead of Monthly Low

USD/CAD struggles to extend the recent series of lower highs and lows as the US House of Representatives passes the ‘big, beautiful bill’ with a 215-214 vote, and the shift in US fiscal policy may continue to sway the exchange rate as the Bank of Canada (BoC) warns that ‘short-term inflation expectations have moved up, as businesses and consumers anticipate higher costs from trade conflict and supply disruptions.’

Join David Song for the Weekly Fundamental Market Outlook webinar.

David provides a market overview and takes questions in real-time. Register Here

In turn, the BoC may stick to the sidelines as its next meeting on June 4 as Canada’s Consumer Price Index (CPI) proved to be higher-than-expected in April, and the rebound USD/CAD may turn out to be temporary as the central bank seems to be at or nearing the end of its rate-cutting cycle.

With that said, USD/CAD may continue to give back the advance from the monthly low (1.3751) should it track the negative slope in the 50-Day SMA (1.4033), but the exchange rate may consolidate over the remainder of the week as it no longer carves a bearish price series.

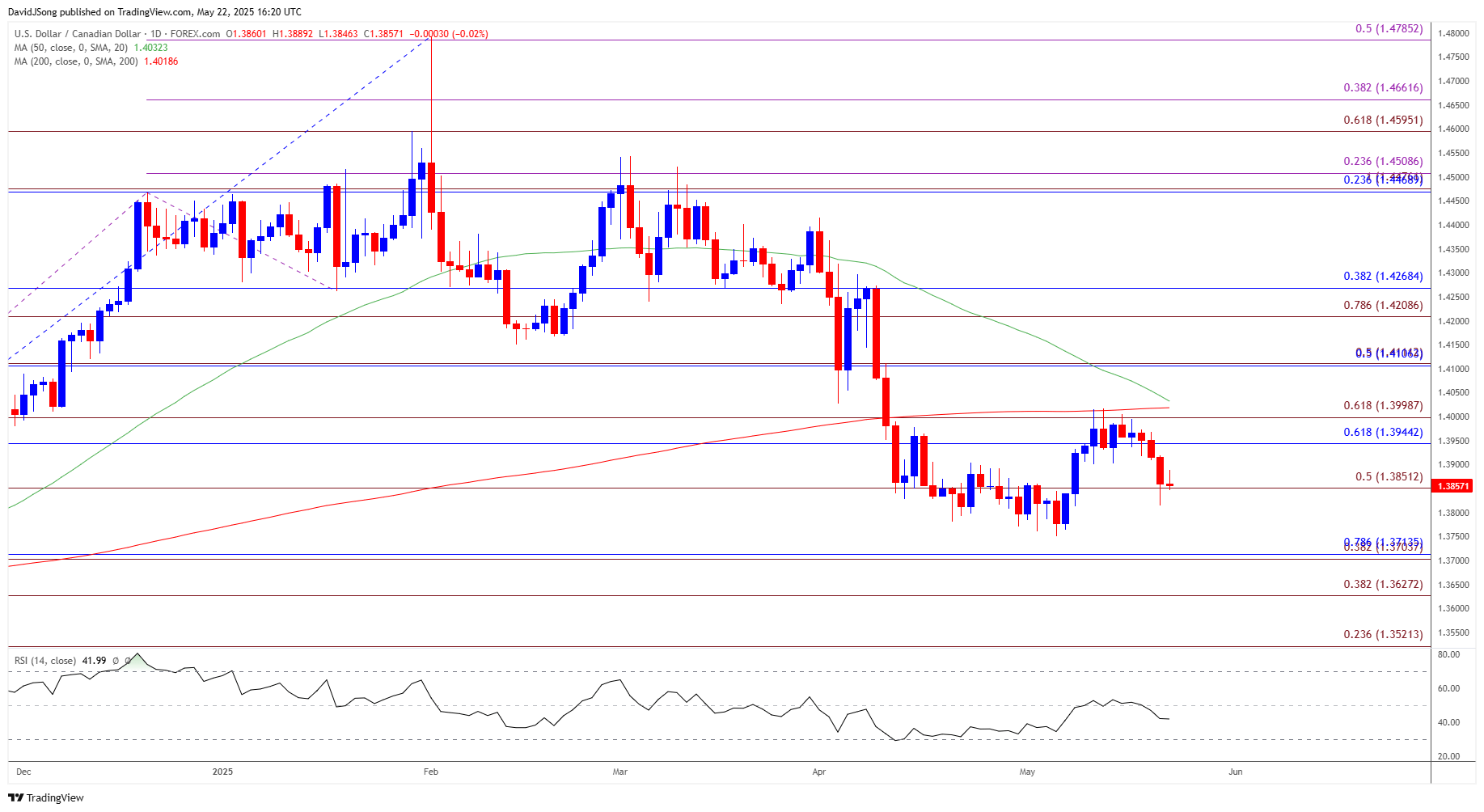

USD/CAD Price Chart – Daily

Chart Prepared by David Song, Senior Strategist; USD/CAD Price on TradingView

- USD/CAD seems to be defending the rebound from the weekly low (1.3814) as it no longer carves a series of lower highs and lows, and lack of momentum to close below 1.3850 (50% Fibonacci extension) may push the exchange rate back toward the monthly high (1.4017).

- Need a close above the 1.3940 (61.8% Fibonacci retracement) to 1.4000 (61.8% Fibonacci extension) zone to bring 1.4110 (50% Fibonacci retracement) on the radar, with the next area of interest coming in around 1.4210 (78.6% Fibonacci extension) to 1.4270 (38.2% Fibonacci retracement).

- At the same time, a close below 1.3850 (50% Fibonacci extension) may push USD/CAD toward the monthly low (1.3751), with a break/close below the 1.3700 (38.2% Fibonacci extension) to 1.3710 (78.6% Fibonacci retracement) region opening up 1.3630 (38.2% Fibonacci extension).

Additional Market Outlooks

US Dollar Forecast: USD/CHF Falls Toward Monthly Low

GBP/USD Rallies to Fresh Yearly High as UK CPI Shoots Higher

US Dollar Forecast: EUR/USD Bounces Back Ahead of Monthly Low

USD/JPY Decline Persists amid US Credit Rating Downgrade

--- Written by David Song, Senior Strategist

Follow on Twitter at @DavidJSong