Canadian Dollar, USD/CAD Talking Points:

- U.S. Dollar weakness is back this week and the market that I’ve been tracking for that theme has been USD/CAD.

- The pair put in a clean hold of the 1.4000 level with zero daily closes above that price, and as DXY sellers came back USD/CAD dropped by more than 200 pips from last week’s highs.

- The longer-term range in USD/CAD remains attractive and this can keep the pair as a venue for USD-weakness scenarios.

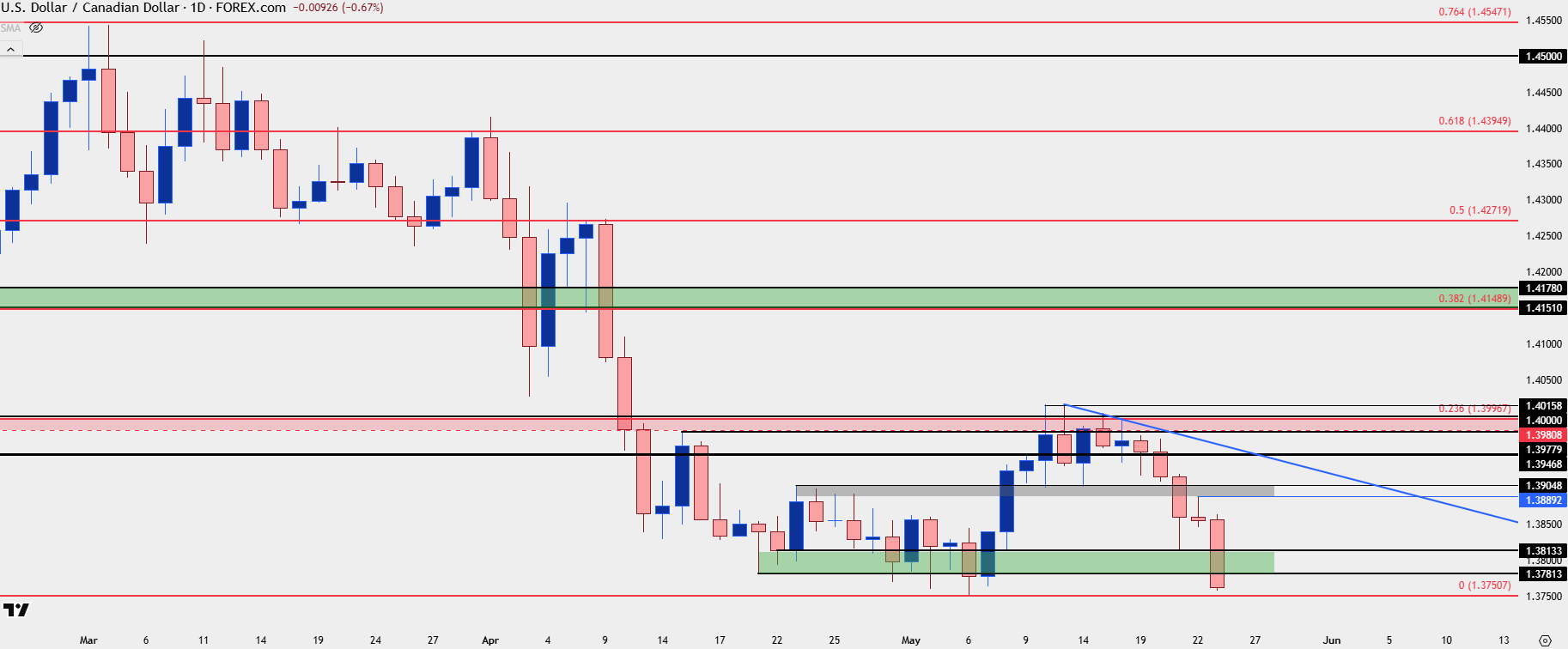

USD/CAD has traded lower every day this week on the heels of last week’s resistance at the 1.4000 psychological level. This was a big zone and a price that I had been highlighting as resistance potential for some time. After the swing high on Tuesday the 13th, it produced a series of lower-highs with the 1.4000 price holding the highs after, and this week sellers were able to stretch as short-term support was breached and USD/CAD fell towards 2025 lows.

USD/CAD Daily Chart

Chart prepared by James Stanley; data derived from Tradingview

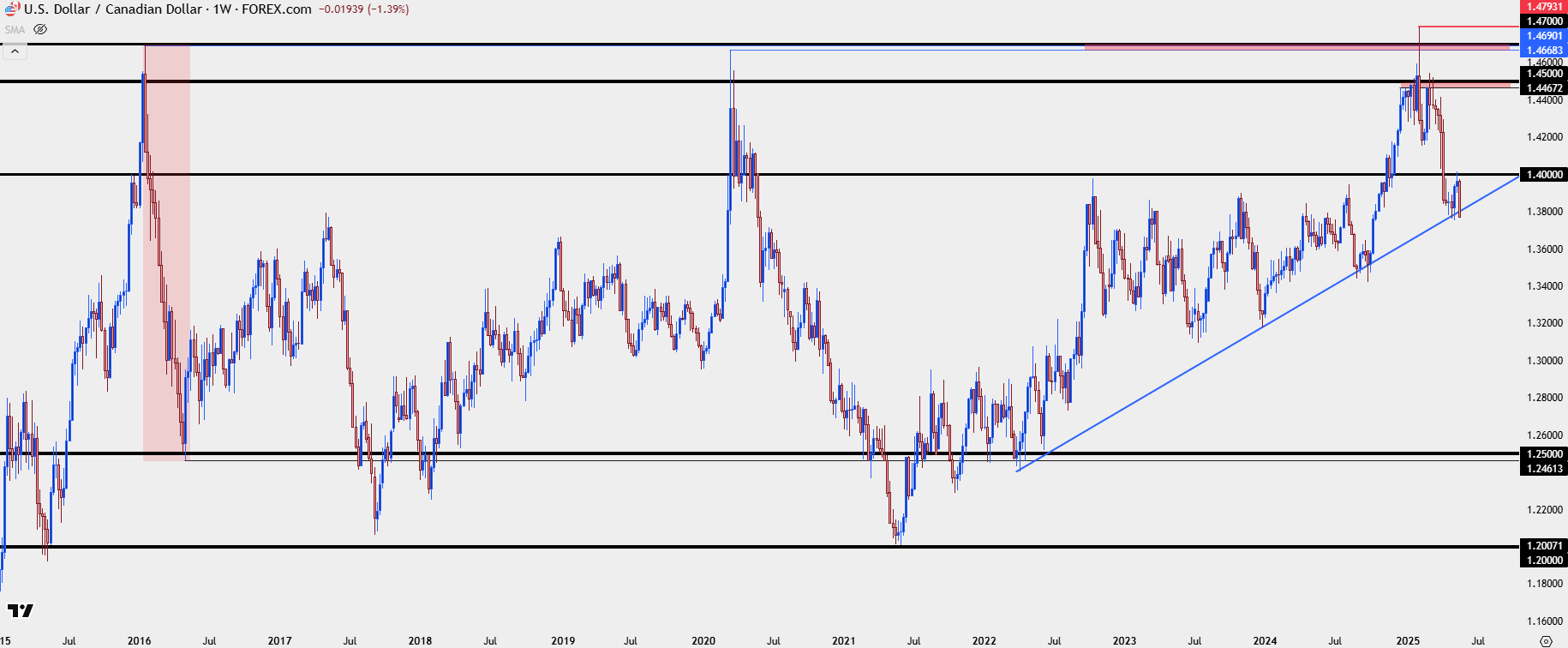

USD/CAD Bigger Picture

It’s been a bearish outlay for the USD so far this year and that is in stark contrast to the strength that the currency was showing as it came into 2025. And at this point there’s now the threat or possibility of a greater show of carry unwind in USD/JPY, which could drive more weakness into the currency.

If we do get that scenario of considerable USD-weakness, USD/CAD remains an attractive venue for bearish continuation, as the decade-long range remains intact even after the flare of strength earlier in the year.

Notably – bulls couldn’t hold the move above 1.4500 for long, and prices soon dipped down below 1.4000 in April. Since then, sellers have defended that price and the door remains open to longer-term range continuation in the pair.

USD/CAD Weekly Price Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

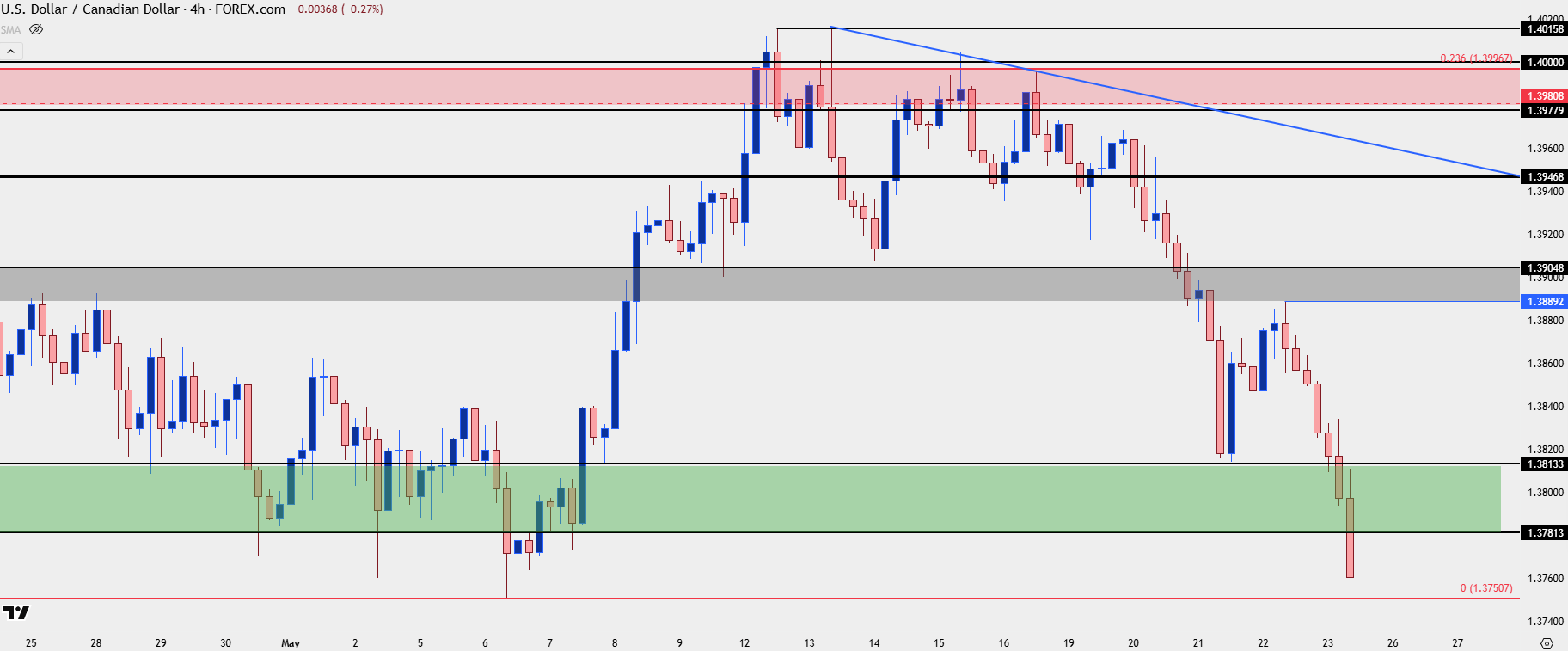

USD/CAD Shorter-Term Strategy

USD/CAD is in the process of breakdown right now and the pair is fast approaching its 2025 low at the 1.3750 psychological level. That can be a tough move to chase, but for USD-bears, this would keep the door open for breakdown themes.

For those looking to play pullbacks, there’s an aggressive spot of lower-high resistance potential at 1.3781 and another slightly less-aggressive level at 1.3813, which had showed as support briefly earlier in the week. Above that, I’m tracking a zone from 1.3890 up to 1.3905, and ideally this is the resistance that bears would hold in deeper pullback scenarios in order to retain control.

USD/CAD Four-Hour Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

--- written by James Stanley, Senior Strategist