Canadian Dollar Outlook: USD/CAD

USD/CAD extends the rally following the US-UK trade deal to register a fresh monthly high (1.3945), and the exchange rate may further retrace the decline from the April high (1.4415) as it breaks out of the descending channel carried over from last month.

Canadian Dollar Forecast: USD/CAD Breaks Out of Descending Channel

USD/CAD extends the recent series of higher highs and lows following the limited reaction to the 7.4K rise in Canada Employment, and the recent rise in exchange rate may reflect a potential change in US Dollar sentiment as President Donald Trump states ‘many trade deals in the hopper.’

Join David Song for the Weekly Fundamental Market Outlook webinar.

David provides a market overview and takes questions in real-time. Register Here

In turn, the rally in USD/CAD may persist should the Trump administration strike further trade deals, and developments coming out of the US may continue to sway the as the update to the US Consumer Price Index (CPI) is anticipated to persistent inflation.

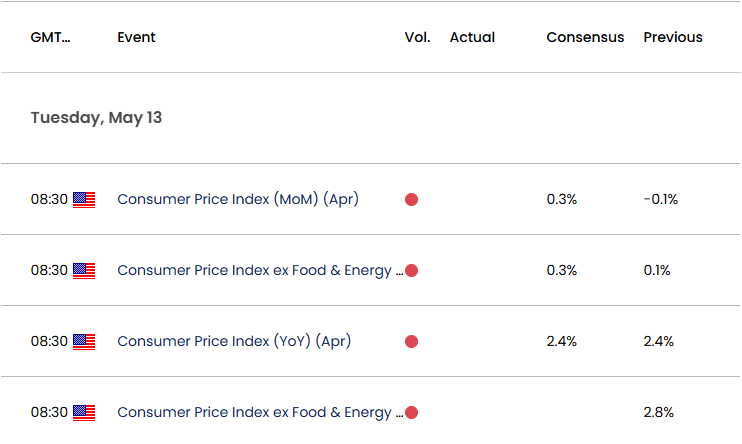

US Economic Calendar

The US CPI is expected to hold steady at 2.4% per annum in April, and evidence of sticky price growth may keep the Federal Reserve on the sidelines as Chairman Jerome Powell insists that ‘we are well positioned to wait for greater clarity before considering any adjustments to our policy stance.’

As a result, waning expectations for an imminent Fed rate cut may keep USD/CAD afloat, but a softer-than-expected CPI print may produce headwinds for the US Dollar as it fuels speculation for lower US interest rates.

With that said, USD/CAD may give back the rebound from the monthly low (1.3751) if it struggles to extend the recent series of higher highs and lows, but the exchange rate may continue to retrace the decline from the April high (1.4415) as it no longer trades within a descending channel.

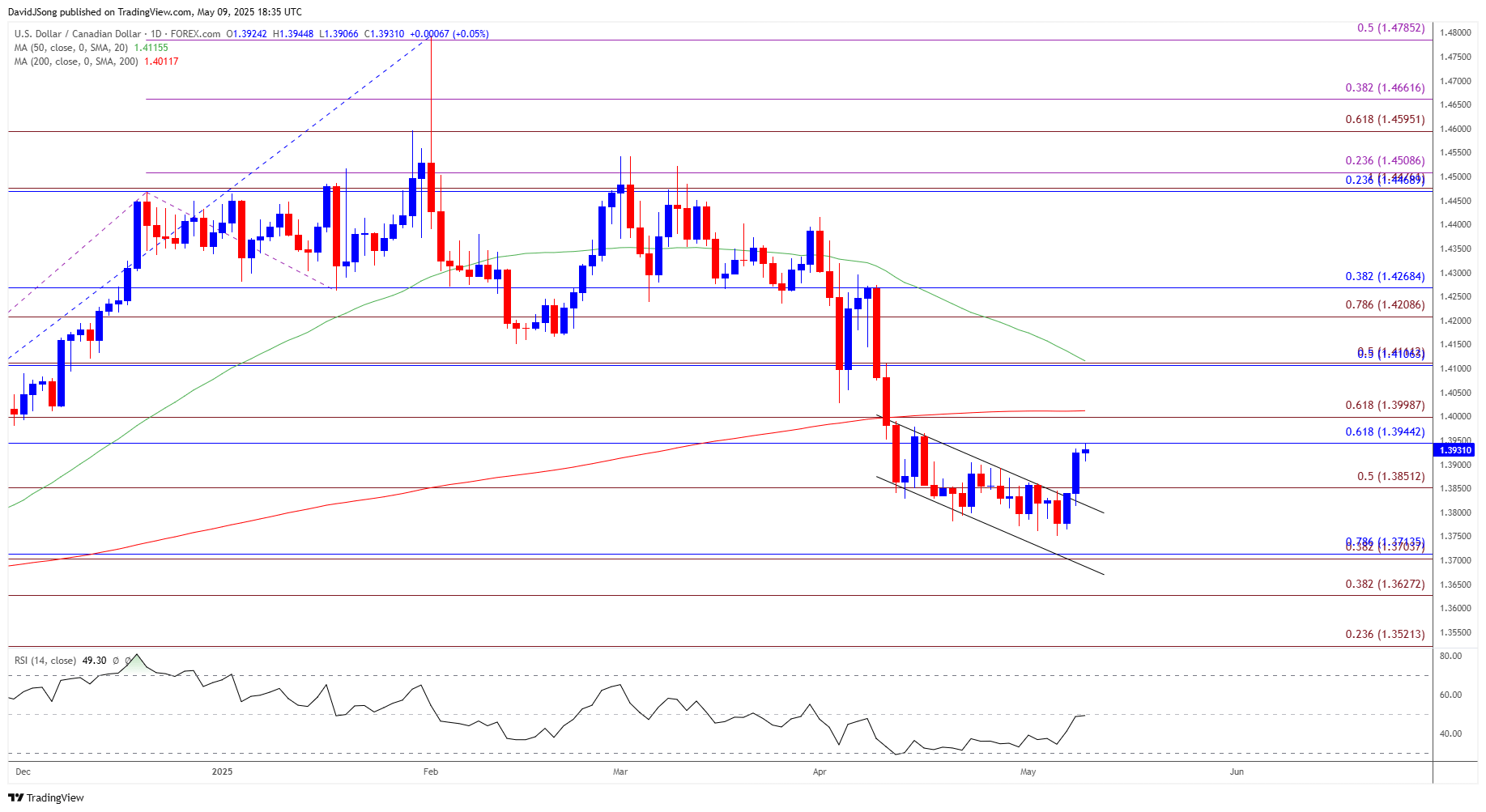

USD/CAD Price Chart – Daily

Chart Prepared by David Song, Senior Strategist; USD/CAD Price on TradingView

- USD/CAD climbs to fresh monthly high (1.3945) as it stages a three-day rally, and a break/close above the 1.3940 (61.8% Fibonacci retracement) to 1.4000 (61.8% Fibonacci extension) zone may push the exchange rate towards 1.4110 (50% Fibonacci retracement).

- A breach above the 1.4210 (78.6% Fibonacci extension) to 1.4270 (38.2% Fibonacci retracement) brings the April high (1.4415) on the radar, but lack of momentum to push/close above the 1.3940 (61.8% Fibonacci retracement) to 1.4000 (61.8% Fibonacci extension) zone may keep USD/CAD below the 50-Day SMA (1.4116).

- As a result, USD/CAD may threaten the bullish price series should it struggle to hold above 1.3850 (50% Fibonacci extension), with a breach below the monthly low (1.3751) opening up the 1.3700 (38.2% Fibonacci extension) to 1.3710 (78.6% Fibonacci retracement) region.

Additional Market Outlooks

USD/JPY Falls from Fresh Monthly High to Hold Below 50-Day SMA

Gold Price Weakness Keeps RSI Out of Overbought Territory

GBP/USD Post-BoE Rebound Unravels amid US-UK Trade Deal

Australian Dollar Forecast: AUD/USD Threatens December High

--- Written by David Song, Senior Strategist

Follow on Twitter at @DavidJSong