Canadian Dollar, USD/CAD Talking Points:

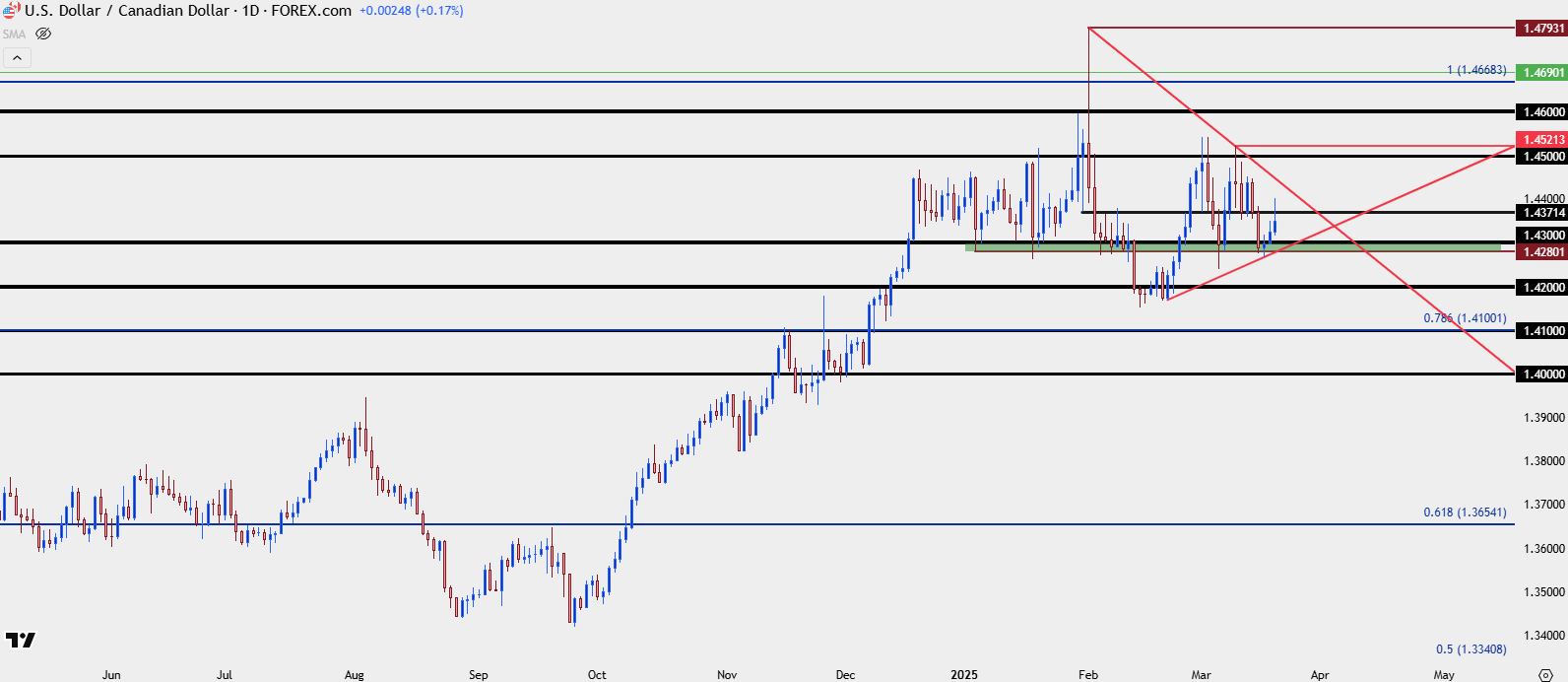

- USD/CAD showed another higher-low this week, further digesting into a symmetrical triangle ahead of the widely anticipated April 2 tariff date.

- There’s quite a bit of unknown around the matter and potential for ‘new’ drive brings along with it potential for volatility in markets. Mark Carney has announced snap elections for April 28th and that invites another variable into the mix.

- From a price action perspective, it’s the same story that’s been in-play for the past month with both higher-lows and lower-highs. This sets the table for a possible breakout when one side finally gets enough motivation to support momentum following a break. The question now is ‘when?’

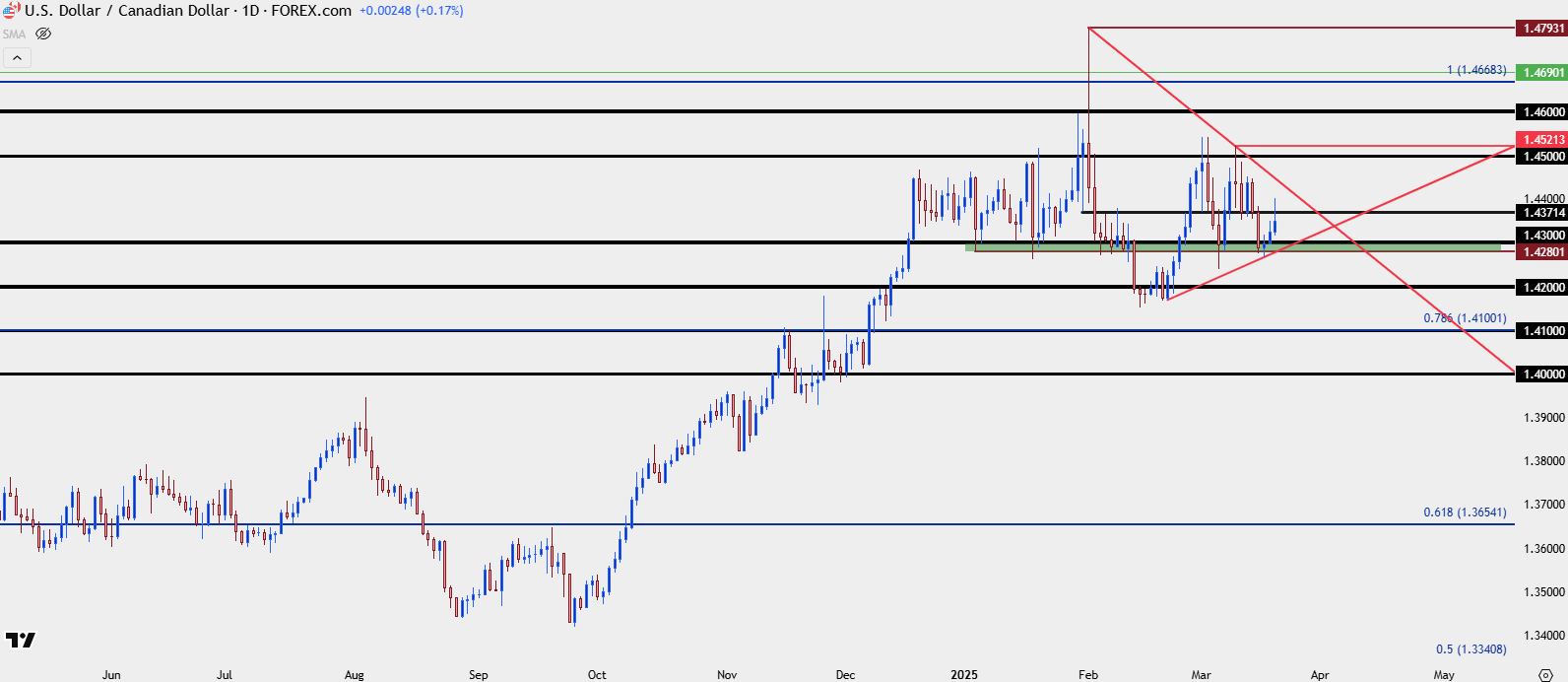

USD/CAD is continuing to digest following the massive start to 2025 trade. At this point it can be qualified as a bull pennant formation, as we have a symmetrical triangle taking place atop a bullish trend. Those can be tricky formations though, especially on a longer-term basis; but it can help to assign some element of directional bias to an otherwise directionless formation such as the symmetrical triangle.

USD/CAD Daily Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

There’s a lot going on around both Canada and the U.S. at the moment and there’s perhaps even more to be seen on April 2nd, when tariffs are, again, set to come into place on Canada from the United States. So far, this drama has produced several twists and turns with tariffs getting delayed or pushed back each time. But Canada looks to toe the line with retaliation so this could turn into a fight between the two economies.

There is still a lot of unknown though, such as what products will be tariffed and by how much; not to mention the actual execution of tariffs and how they will be implemented. There’s also been another recent change in the Canadian landscape as Mark Carney has taken over for Justin Trudeau, and he’s announced snap elections for April 28th. This topic remains a hot button in Canada, so I fully expect this to have sway over election results, to some degree.

This makes forecasting fundamentals considerably more difficult given just how much is unknown about how all of this will play out. And that’s perhaps why price action is so important here, because we can get a near real-time gauge on how markets are treating this driver. In USD/CAD right now, that would appear to be a relaxation of the panic that had hit earlier in the year, as the pair spiked to a fresh 20-plus year high.

I think the takeaway is that given the multiple delays and false starts on tariffs, combined with the pain in U.S. equity markets on the back of tariffs, there’s a under-the-surface desire to strike some sort of trade deal. With Trump continuing the conjecture around Canada as a 51st state, it seems as though he’s ‘over-asking’ in order to negotiate some sort of truce in which Canada and the U.S. strike a sort of preferential trade relationship. The idea of statehood for Canada has been widely rejected and it seems unlikely unless something significant had changed, but Trump starting negotiations by asking for more than he knows would be possible is not an unknown tactic, as he discussed this in his book The Art of the Deal. This way, both sides can compromise and walk away feeling as though they gained.

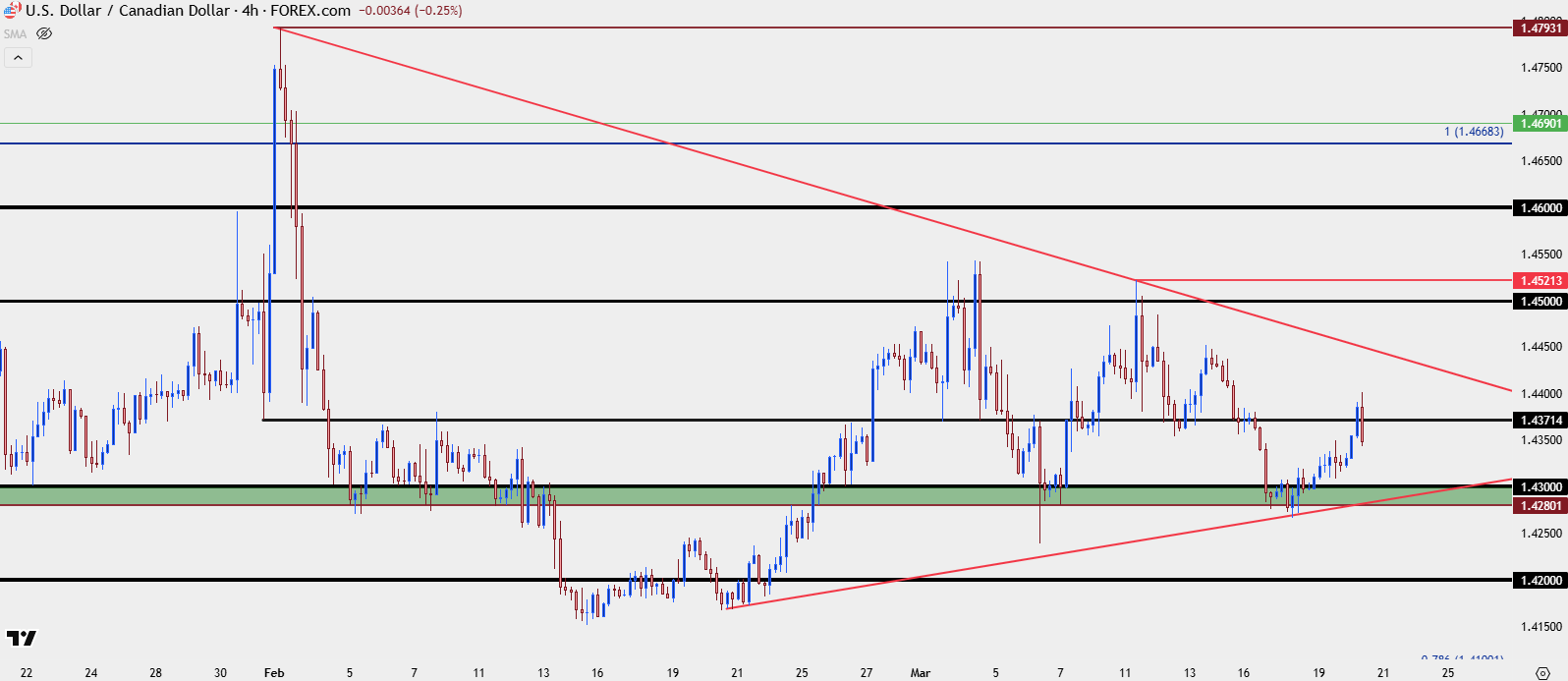

This would help to explain the lower-highs that have held in USD/CAD since that initial flare in February, with the 1.4500 level coming in more recently to cap the advance in the pair.

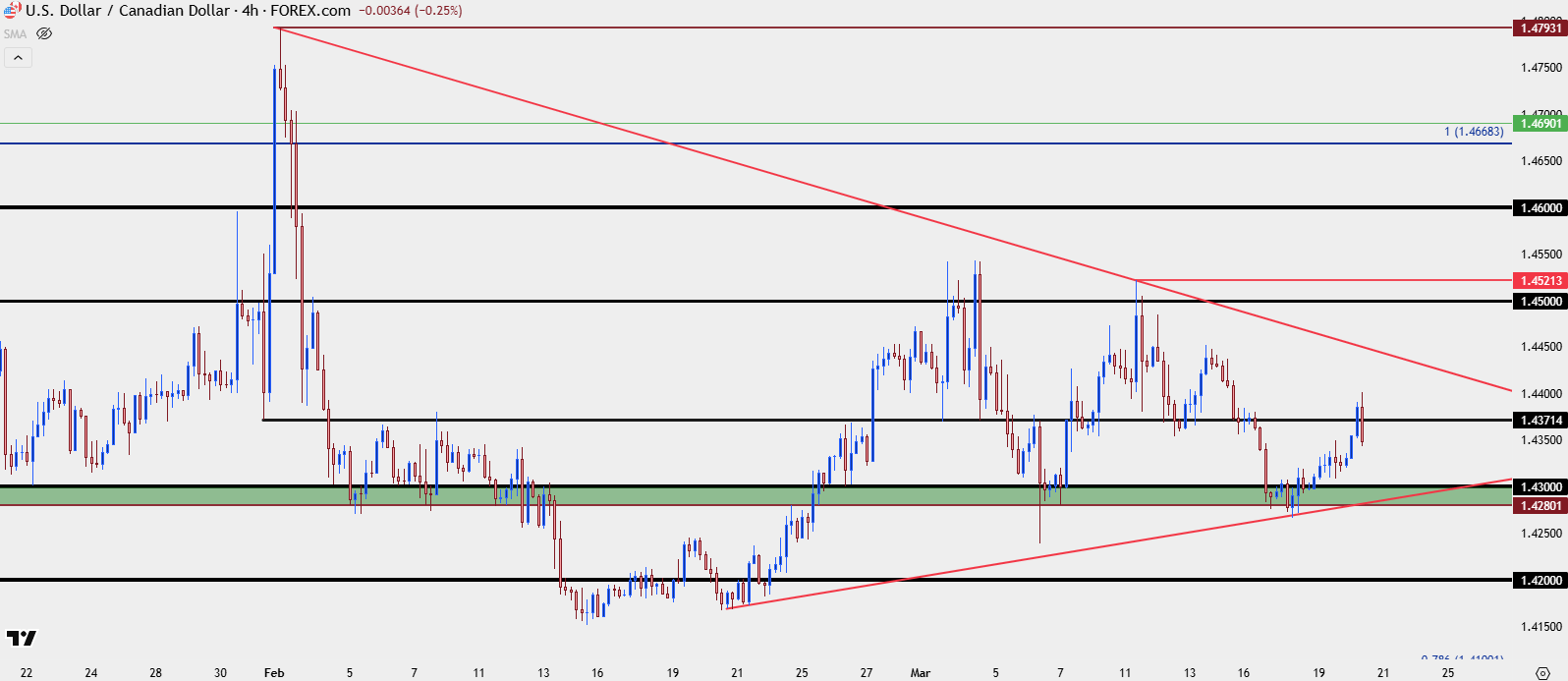

USD/CAD Four-Hour Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

USD/CAD Skipping to the End of the Story

My expectation is that USD/CAD will end up continuing the longer-term range that’s been in-play for the past nine years, and that’s been the case since November when this topic first started to take over the headlines. How we get there, however, can be a winding road and that doesn’t necessarily mean that a high is in-place; whether it is or not will likely revolve around just how far Trump wants to push the risk and that’s an unknown variable that must be respected at this point.

With that said, the 1.4500 level remains of interest for resistance, and if there’s another upper wick on a daily bar, particularly if that holds inside of the prior swing high of 1.4521, the door would be open for a downside swing. If bulls do force a larger break, there’s follow-through resistance potential at 1.4600, and then the longer-term swing highs of 1.4669-1.4690.

On the downside, caution should be exercised here as profit taking from the longer-term breakout has produced a couple of bear traps already; but the same 1.4280-1.4300 zone has so far held the higher-low, and a breach of that, particularly with a closed body on the daily, indicates potential for bearish continuation, which would then highlight 1.4200.

Bigger picture, it’s the 1.4000 level that can help to highlight return of the longer-term range, whenever bears do make a lasting push below that.

USD/CAD Daily Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

--- written by James Stanley, Senior Strategist

Canadian Dollar, USD/CAD Talking Points:

- USD/CAD showed another higher-low this week, further digesting into a symmetrical triangle ahead of the widely anticipated April 2 tariff date.

- There’s quite a bit of unknown around the matter and potential for ‘new’ drive brings along with it potential for volatility in markets. Mark Carney has announced snap elections for April 28th and that invites another variable into the mix.

- From a price action perspective, it’s the same story that’s been in-play for the past month with both higher-lows and lower-highs. This sets the table for a possible breakout when one side finally gets enough motivation to support momentum following a break. The question now is ‘when?’

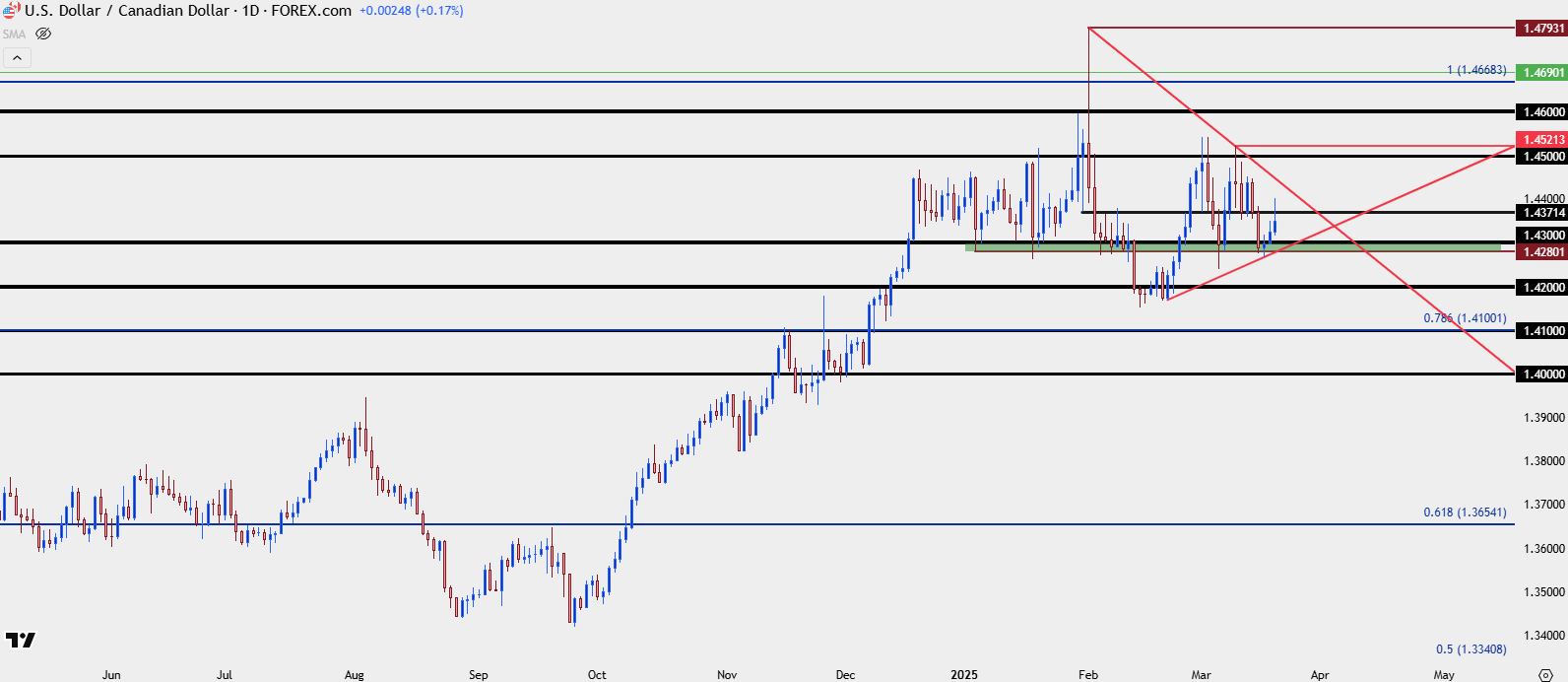

Indices AD

USD/CAD is continuing to digest following the massive start to 2025 trade. At this point it can be qualified as a bull pennant formation, as we have a symmetrical triangle taking place atop a bullish trend. Those can be tricky formations though, especially on a longer-term basis; but it can help to assign some element of directional bias to an otherwise directionless formation such as the symmetrical triangle.

USD/CAD Daily Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

There’s a lot going on around both Canada and the U.S. at the moment and there’s perhaps even more to be seen on April 2nd, when tariffs are, again, set to come into place on Canada from the United States. So far, this drama has produced several twists and turns with tariffs getting delayed or pushed back each time. But Canada looks to toe the line with retaliation so this could turn into a fight between the two economies.

There is still a lot of unknown though, such as what products will be tariffed and by how much; not to mention the actual execution of tariffs and how they will be implemented. There’s also been another recent change in the Canadian landscape as Mark Carney has taken over for Justin Trudeau, and he’s announced snap elections for April 28th. This topic remains a hot button in Canada, so I fully expect this to have sway over election results, to some degree.

This makes forecasting fundamentals considerably more difficult given just how much is unknown about how all of this will play out. And that’s perhaps why price action is so important here, because we can get a near real-time gauge on how markets are treating this driver. In USD/CAD right now, that would appear to be a relaxation of the panic that had hit earlier in the year, as the pair spiked to a fresh 20-plus year high.

I think the takeaway is that given the multiple delays and false starts on tariffs, combined with the pain in U.S. equity markets on the back of tariffs, there’s a under-the-surface desire to strike some sort of trade deal. With Trump continuing the conjecture around Canada as a 51st state, it seems as though he’s ‘over-asking’ in order to negotiate some sort of truce in which Canada and the U.S. strike a sort of preferential trade relationship. The idea of statehood for Canada has been widely rejected and it seems unlikely unless something significant had changed, but Trump starting negotiations by asking for more than he knows would be possible is not an unknown tactic, as he discussed this in his book The Art of the Deal. This way, both sides can compromise and walk away feeling as though they gained.

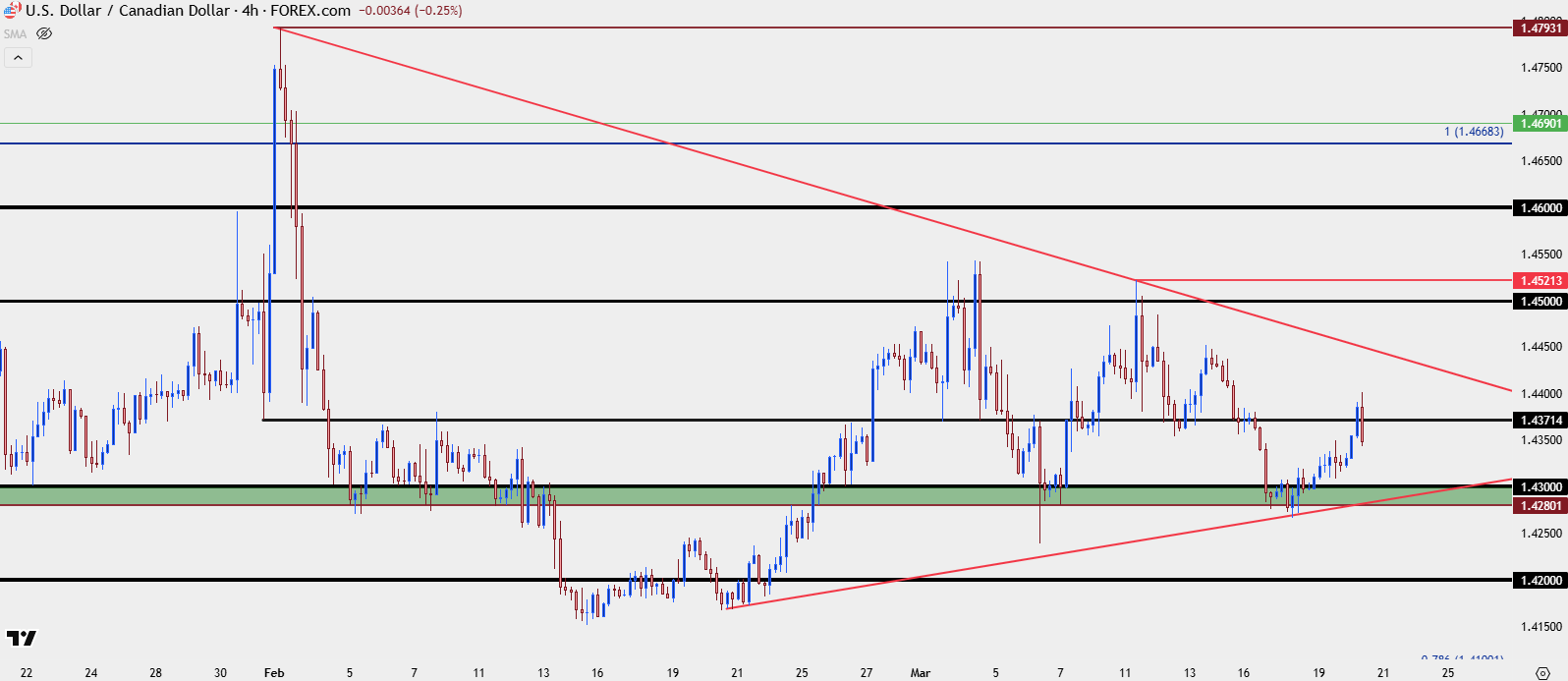

This would help to explain the lower-highs that have held in USD/CAD since that initial flare in February, with the 1.4500 level coming in more recently to cap the advance in the pair.

USD/CAD Four-Hour Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

USD/CAD Skipping to the End of the Story

My expectation is that USD/CAD will end up continuing the longer-term range that’s been in-play for the past nine years, and that’s been the case since November when this topic first started to take over the headlines. How we get there, however, can be a winding road and that doesn’t necessarily mean that a high is in-place; whether it is or not will likely revolve around just how far Trump wants to push the risk and that’s an unknown variable that must be respected at this point.

With that said, the 1.4500 level remains of interest for resistance, and if there’s another upper wick on a daily bar, particularly if that holds inside of the prior swing high of 1.4521, the door would be open for a downside swing. If bulls do force a larger break, there’s follow-through resistance potential at 1.4600, and then the longer-term swing highs of 1.4669-1.4690.

On the downside, caution should be exercised here as profit taking from the longer-term breakout has produced a couple of bear traps already; but the same 1.4280-1.4300 zone has so far held the higher-low, and a breach of that, particularly with a closed body on the daily, indicates potential for bearish continuation, which would then highlight 1.4200.

Bigger picture, it’s the 1.4000 level that can help to highlight return of the longer-term range, whenever bears do make a lasting push below that.

USD/CAD Daily Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

--- written by James Stanley, Senior Strategist

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview