Canadian Dollar, USD/CAD Talking Points:

- USD/CAD tested the 1.4000 handle multiple times last week and sellers have so far continued to hold the currency below the big figure on a daily close basis.

- The bigger question now is broader USD trends. A late downgrade from Moody’s on Friday cast a bearish tone on the USD to start this week, but so far the Dollar has held higher-low support. If bulls can continue that move, USD/CAD may have a larger pullback in store, highlighting the 1.4149-1.4178 zone of prior support.

- USD/CAD remains as one of the more attractive pairs for USD-weakness scenarios, in my opinion, and I’ll be looking in-depth at both USD/CAD and broader USD markets in the weekly webinar. Click here to register.

The U.S. Dollar took a hit to start this week following a late downgrade from Moody’s on Friday. Yields on 30-year Treasury Bonds tested above 5% and a number of markets saw an initial reaction that has since pared back. In the currency market, that reaction was a push of USD-weakness that, so far, has remained contained with EUR/USD holding resistance and USD/JPY grasping at support.

USD/CAD, on the other hand, has held below the 1.4000 level and for USD-bears or for those looking for USD-weakness scenarios to get another shot-in-the-arm, there’s continued context for bearish continuation that remains at-play.

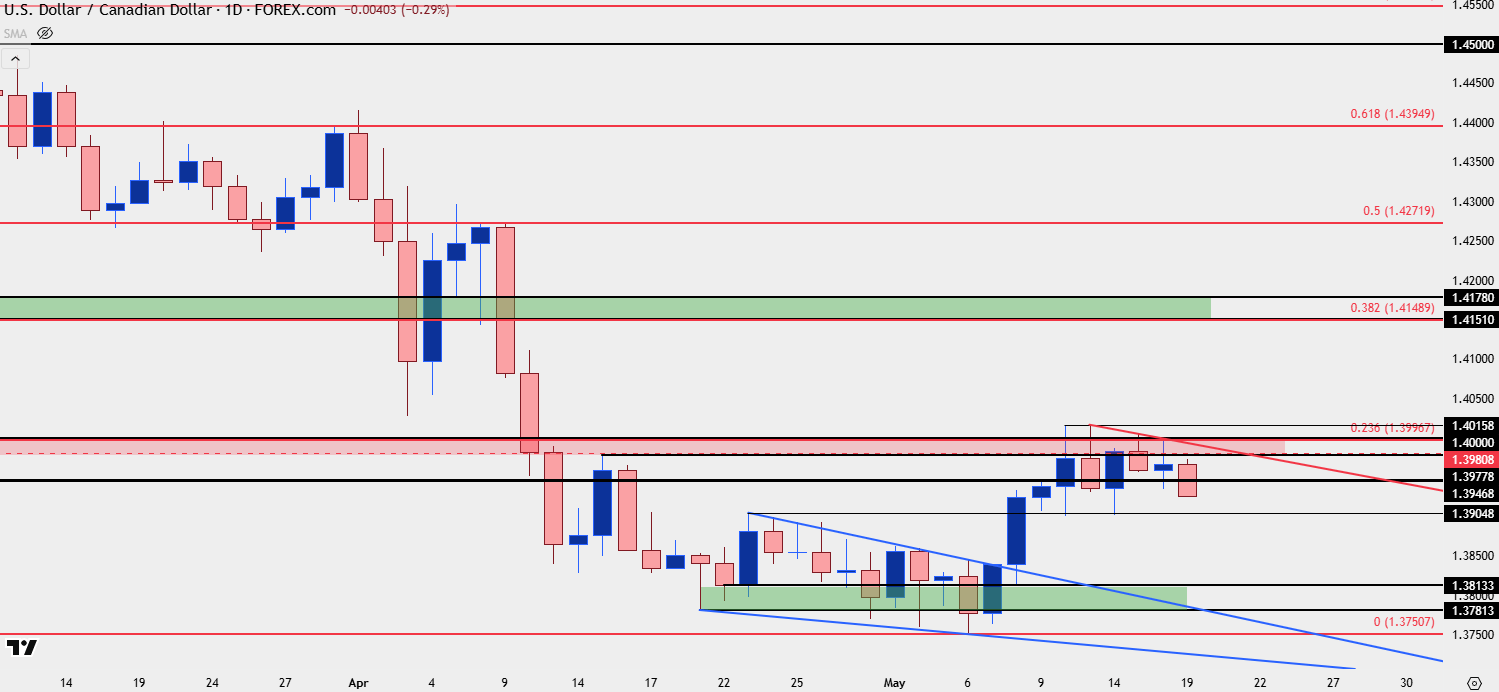

I looked into the pair on Friday and before that I had written a longer piece on USD/CAD and broader U.S. Dollar trends on Wednesday. At this point, the big takeaway has been a recent series of lower-highs that’s built since last Tuesday, combined with four consecutive daily rejections at the 1.4000 psychological level.

USD/CAD Daily Price Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

USD/CAD Congestion Clean Up

The bearish trend in USD/CAD through April and early-May was pronounced and clear, and even as the USD started to show signs of recovery in late-April USD/CAD sellers continued to push. But as a case of RSI divergence built on the daily chart to go along with a falling wedge, sellers were clearly losing momentum and price snapped back as the USD rally took on another push of strength, with four consecutive green weekly candles.

But as I had been highlighting the bigger question was whether USD/CAD sellers would step in to defend lower-highs and so far, that’s been the case with the hold at 1.4000.

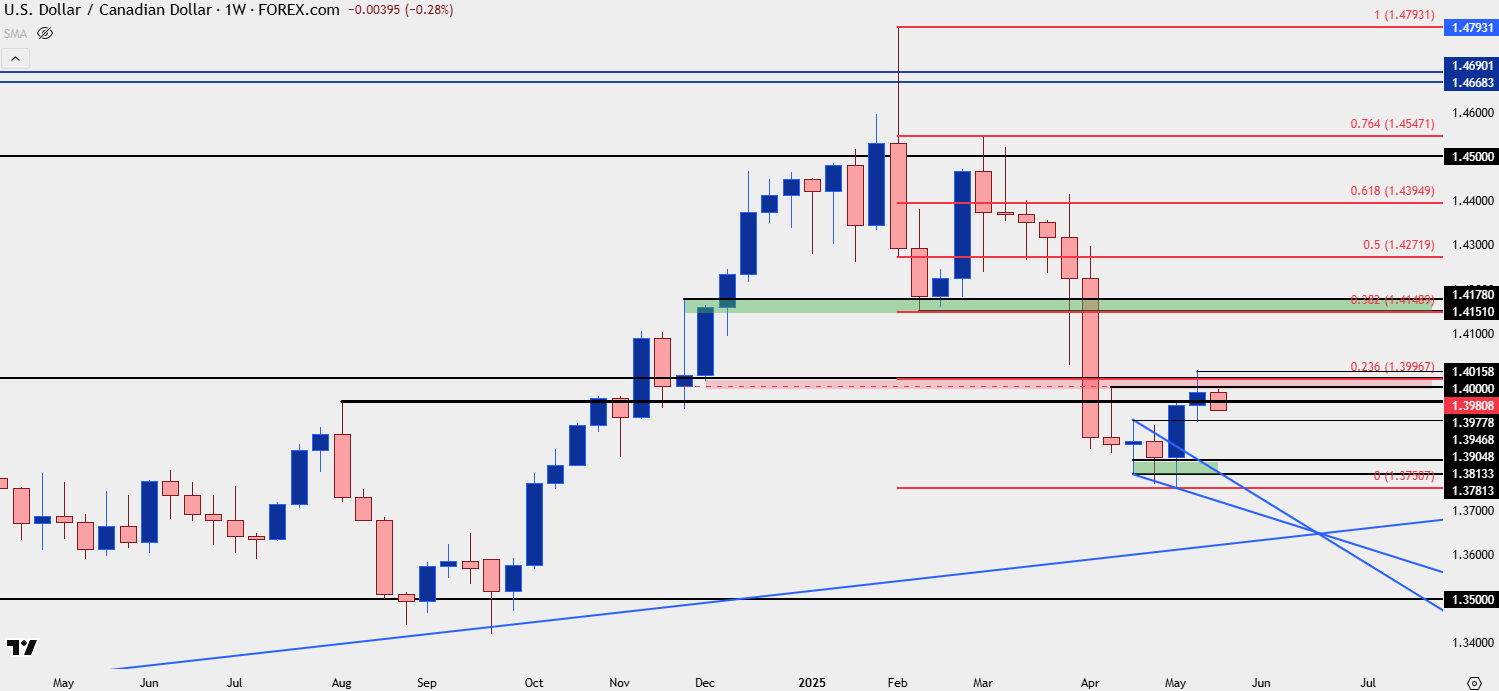

The bigger question is USD dynamics, and if we are seeing USD bears take another step forward then the short-side trend in USD/CAD remains attractive. But, if we are in front of a continued USD rally, it’s going to be difficult for USD/CAD bears to remain in-control and instead, there’s a deeper area of resistance on the chart, around the 1.4149-1.4178 area, which was resistance-turned-support and is now confluent with the 38.2% retracement of the 2025 sell-off.

USD/CAD Weekly Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

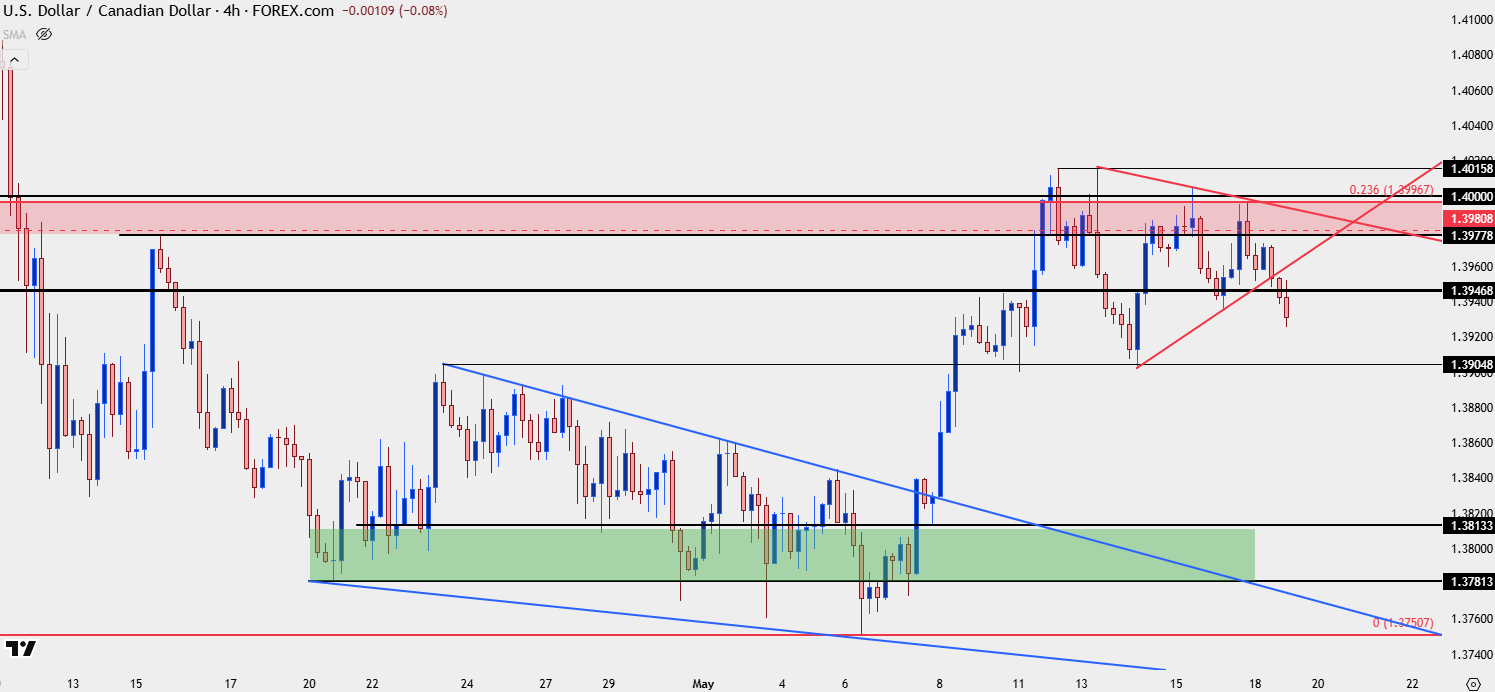

USD/CAD Shorter-Term

At this point bears have continued to hold lower-high resistance at the 1.4000 level and after last week’s digestion, there’s a clear push as sellers have posed a breakdown to a lower-low. This keeps bears in order for short-term trends and the next major level ahead is the 1.3905 prior swing-low, this was resistance in late-April and then became support twice in May. If sellers can breach that, the next areas of support are the 1.3781-1.3813 zone that had held the lows previously, and then the 1.3750 psychological level that marks the 2025 low and was last in-play two weeks ago.

USD/CAD Four-Hour Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

--- written by James Stanley, Senior Strategist