Canadian Dollar Outlook: USD/CAD

USD/CAD seems to be coiling within a narrow range as it holds above the weekly low (1.3900), but the exchange rate may struggle to retain the rebound from earlier this month should it respond to the negative slope in the 50-Day SMA (1.4083).

Canadian Dollar Forecast: USD/CAD Coils Above of Weekly Low

USD/CAD climbs to a fresh session high (1.4004) following an unexpected 0.1% rise in US Retail Sales, and the exchange rate may attempt to break out of the range bound price action from earlier this week as there appears to be a shift in US Dollar sentiment.

The ongoing change in US fiscal policy may continue to sway USD/CAD as the Trump administration avoids a trade war, and the recent recovery in the US Dollar may persist as the shock posed by higher tariffs seems to have been transitory.

Join David Song for the Weekly Fundamental Market Outlook webinar.

David provides a market overview and takes questions in real-time. Register Here

In turn, the Federal Reserve may keep US interest rates on hold as ‘the new Administration is in the process of implementing substantial policy changes in four distinct areas: trade, immigration, fiscal policy, and regulation,’ and the Greenback may stage a further recovery amid waning expectations for an imminent Fed rate cut.

With that said, USD/CAD may further retrace the decline from the April high (1.4415) as it appears to be coiling above the weekly low (1.3900), but the exchange rate may track the negative slope in the 50-Day SMA (1.4083) if it struggles to push above the moving average.

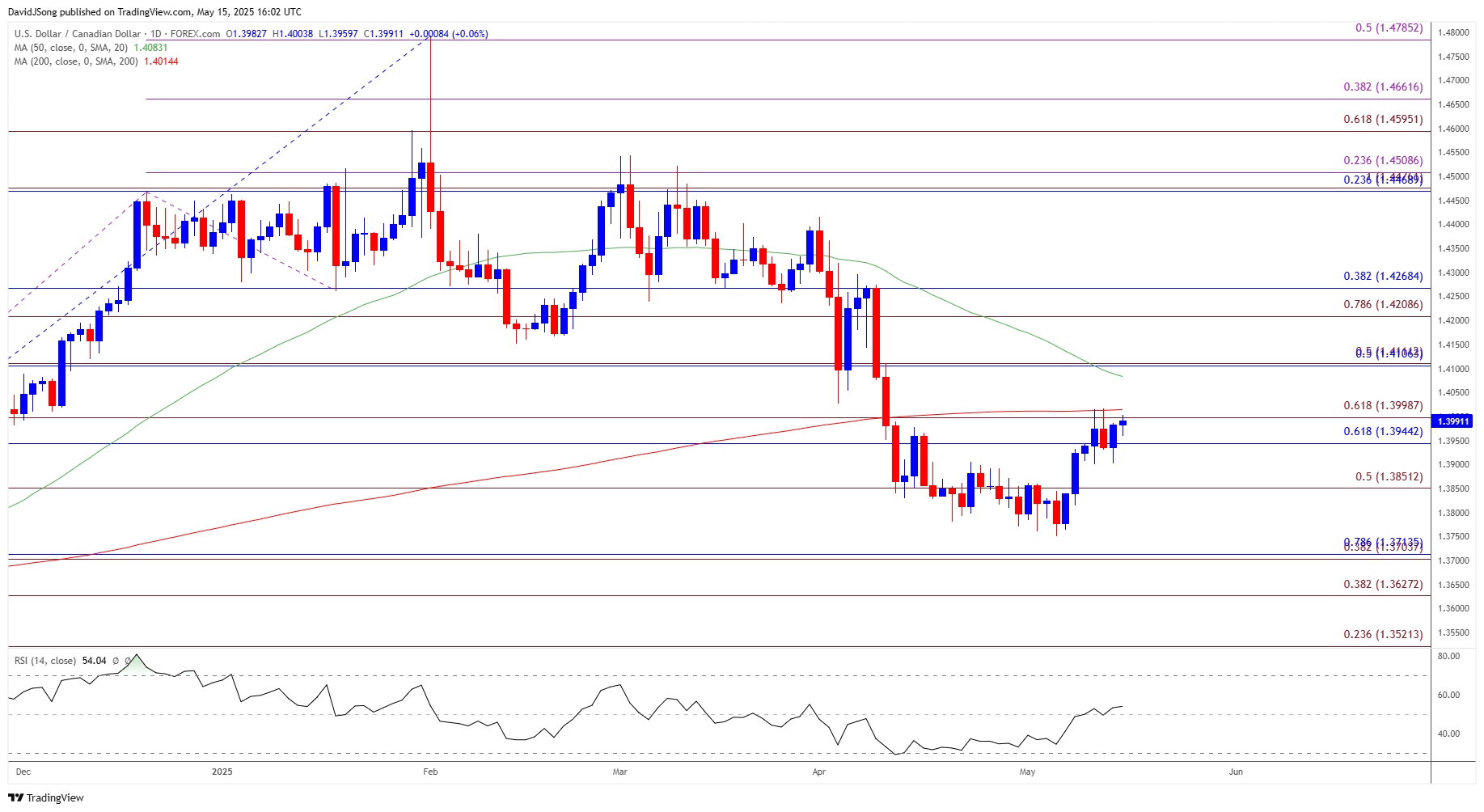

USD/CAD Price Chart – Daily

Chart Prepared by David Song, Senior Strategist; USD/CAD Price on TradingView

- The range bound price action in USD/CAD may turn out to be temporary as it seems to be defending the advance from the weekly low (1.3900), with a close above the 1.3940 (61.8% Fibonacci retracement) to 1.4000 (61.8% Fibonacci extension) zone to bring 1.4110 (50% Fibonacci retracement) on the radar.

- Next area of interest comes in around the 1.4210 (78.6% Fibonacci extension) to 1.4270 (38.2% Fibonacci retracement), but USD/CAD may respond to the negative slope in the 50-Day SMA (1.4083) should it continue to hold below the moving average.

- Lack of momentum to close above the 1.3940 (61.8% Fibonacci retracement) to 1.4000 (61.8% Fibonacci extension) zone may push USD/CAD back toward the weekly low (1.3900), with a move/close below 1.3850 (50% Fibonacci extension) raising the scope for a move toward the monthly low (1.3751).

Additional Market Outlooks

US Dollar Forecast: USD/JPY Reverses Ahead of April High

Australian Dollar Forecast: AUD/USD Defends V-Shape Recovery

EUR/USD Rebounds Following Failed Attempt to Close Below 50-Day SMA

GBP/USD on Track to Test Positive Slope in 50-Day SMA

--- Written by David Song, Senior Strategist

Follow on Twitter at @DavidJSong