Canadian Dollar Outlook: USD/CAD

USD/CAD appears to be coiling within the opening range for June as it falls from a fresh weekly high (1.3729), but the exchange rate may track the negative slope in the 50-Day SMA (1.3880) as it holds below the moving average.

Canadian Dollar Forecast: USD/CAD Coils Within June Opening Range

USD/CAD seems to be defending the decline following the Bank of Canada (BoC) meeting as it pulls back ahead of the monthly high (1.3743), and the range bound price action in the exchange rate may turn out to be temporary as Governor Tiff Macklem and Co. appear to be at or nearing the end of its rate-cutting cycle.

Join David Song for the Weekly Fundamental Market Outlook webinar.

David provides a market overview and takes questions in real-time. Register Here

In turn, USD/CAD may struggle to retain the advance from the October low (1.3473) as the Federal Reserve keeps the door open to implement lower interest rates, and data prints coming out of the US may sway the exchange rate as the Consumer Price Index (CPI) is expected to show sticky inflation.

US Economic Calendar

The update to the US CPI is anticipated to show an uptick in both the headline and core reading for inflation, and signs of persistent price growth may encourage the Federal Open Market Committee (FOMC) to keep US interest rates on hold as ‘the tariff increases announced so far have been significantly larger than anticipated.’

In turn, USD/CAD may attempt to retrace the decline from the start of the month if the US CPI curb speculation for an imminent Fed rate-cut, but a softer-than-expected inflation report may drag on the Greenback as it puts pressure on FOMC to cut US interest rates.

With that said, USD/CAD may snap the range bound price action as it holds below the 50-Day (1.3880), and the exchange rate may continue to give back the advance from the October low (1.3473) as it seems to be tracking the negative slope in the moving average.

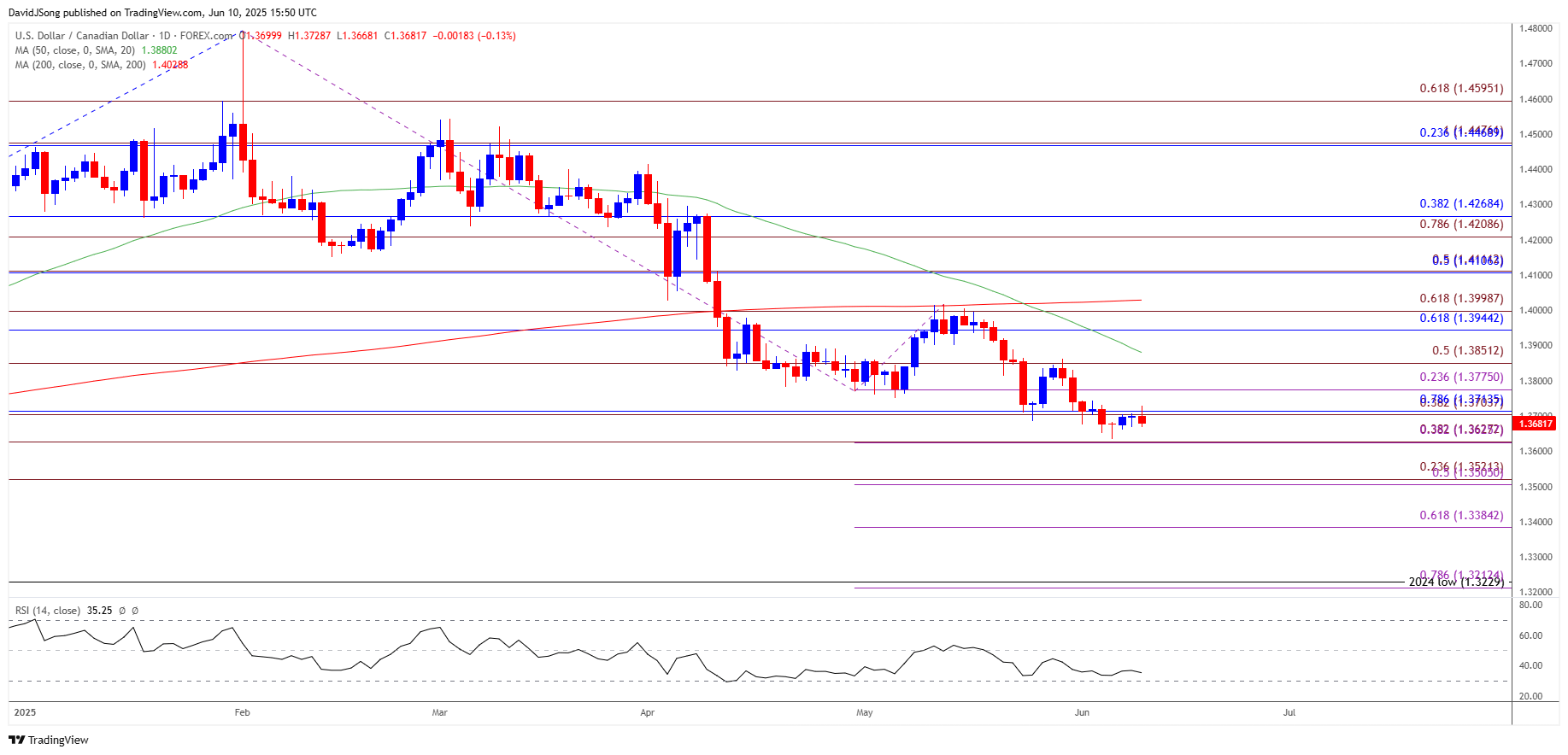

USD/CAD Price Chart – Daily

Chart Prepared by David Song, Senior Strategist; USD/CAD Price on TradingView

- USD/CAD pulls back from a fresh weekly high (1.3729) to snap the recent series of higher highs and lows, with a break/close below 1.3630 (38.2% Fibonacci extension) bringing the 1.3510 (50% Fibonacci extension) to 1.3520 (23.6% Fibonacci extension) region on the radar.

- Next area of interest comes in around the October low (1.3473), but failure to push/close below 1.3630 (38.2% Fibonacci extension) may keep USD/CAD within the opening range for June.

- Nevertheless, a move/close above 1.3780 (23.6% Fibonacci extension) may push USD/CAD back toward 1.3850 (50% Fibonacci extension), with the next area of interest coming in around 1.3940 (61.8% Fibonacci retracement) to 1.4000 (61.8% Fibonacci extension).

Additional Market Outlooks

AUD/USD Climbs Toward Monthly High amid US-China Trade Talk

GBP/USD Vulnerable to Rise in UK Unemployment Rate

Euro Forecast: EUR/USD Post-ECB Rally Eyes April High

US Dollar Forecast: USD/CHF Clears May Low

--- Written by David Song, Senior Strategist

Follow on Twitter at @DavidJSong