Canadian Dollar Outlook: USD/CAD

USD/CAD continues to bounce back from a fresh monthly low (1.4235) to hold within the February range, but the ongoing shift in US trade policy may spark increased volatility in the exchange rate as President Donald Trump plans to impose reciprocal as well as auto tariffs on April 2.

Canadian Dollar Forecast: USD/CAD Continues to Coil with More Trump Tariffs on Tap

USD/CAD snaps the recent series of lower highs and lows after failing to hold within the opening range for March, and the exchange rate may track the flattening slope in the 50-Day SMA (1.4338) as it appears to be reversing ahead of the February low (1.4151).

Join David Song for the Weekly Fundamental Market Outlook webinar.

David provides a market overview and takes questions in real-time. Register Here

Looking ahead, the Canadian Dollar may face headwinds next month as the Trump tariffs cloud the outlook for global growth, and fears of a trade war may push the Bank of Canada (BoC) to further embark on its rate-cutting cycle as the ‘the pervasive uncertainty created by continuously changing US tariff threats is restraining consumers’ spending intentions and businesses’ plans to hire and invest.’

In turn, speculation for lower interest rates may drag on the Canadian Dollar ahead of the next BoC meeting on April 16, but Governor Tiff Macklem and Co. may adopt a wait-and-see approach as the central bank pledges to ‘assess the balance between the upward pressures on inflation from higher costs and the downward pressures from weaker demand.’

With that said, USD/CAD may consolidate over the remainder of the month as it still holds within the February range, but the exchange rate may face increased volatility over the coming days as the growing number of Trump tariffs raises the threat of a trade war.

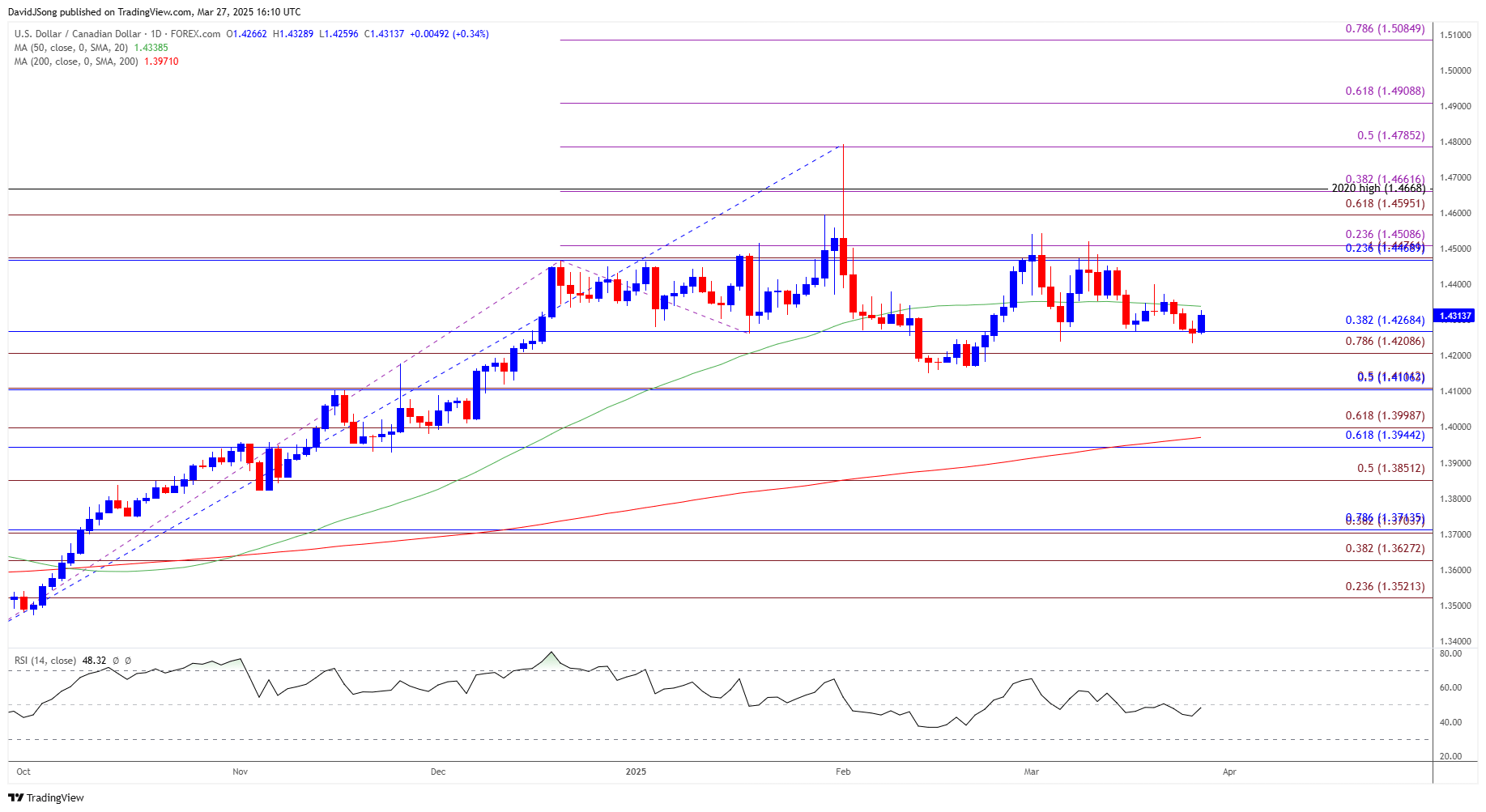

USD/CAD Price Chart – Daily

Chart Prepared by David Song, Senior Strategist; USD/CAD Price on TradingView

- USD/CAD may continue to trade within the February range as it defends the 1.4210 (78.6% Fibonacci extension) to 1.4270 (38.2% Fibonacci retracement) zone after failing to close above the 1.4470 (23.6% Fibonacci retracement) to 1.4510 (23.6% Fibonacci extension) region earlier this month.

- Nevertheless, a close above the 1.4470 (23.6% Fibonacci retracement) to 1.4510 (23.6% Fibonacci extension) region may push USD/CAD towards the 1.4600 (61.8% Fibonacci extension) to 1.4660 (38.2% Fibonacci extension) zone, with the next area of interest coming in around 1.4790 (50% Fibonacci extension).

- At the same time, a break/close below the 1.4210 (78.6% Fibonacci extension) to 1.4270 (38.2% Fibonacci retracement) zone may lead to a test of the February low (1.4151), with the next area of interest coming in around 1.4110 (50% Fibonacci retracement).

Additional Market Outlooks

US Dollar Forecast: Bearish EUR/USD Price Series Persists

USD/JPY Pulls Back Ahead of Monthly High with US PCE in Focus

British Pound Forecast: GBP/USD Coils with UK CPI on Tap

AUD/USD Halts Four-Day Selloff Ahead of Australia CPI

--- Written by David Song, Senior Strategist

Follow on Twitter at @DavidJSong