Canadian Dollar Outlook: USD/CAD

USD/CAD may attempt to break out of the range bound price action from earlier this week as the update to Canada’s Consumer Price Index (CPI) is anticipated to show a further slowdown in inflation.

Canadian Dollar Forecast: USD/CAD Coils Above of Weekly Low

USD/CAD seems to be defending the advance from the weekly low (1.3900) as it continues to coil within a narrow range, and recent recovery in the exchange rate may indicate a potential shift in US Dollar sentiment as the Trump administration avoids a trade war.

Join David Song for the Weekly Fundamental Market Outlook webinar.

David provides a market overview and takes questions in real-time. Register Here

Canada Economic Calendar

Looking ahead, data prints coming out of Canada may sway USD/CAD as the CPI is seen narrowing to 1.6% in April from 2.3% the month prior, and evidence of slower price growth may produce headwinds for the Canadian Dollar as it raises the Bank of Canada’s (BoC) scope to pursue an accommodative policy.

In turn, speculation for lower interest rates may keep USD/CAD afloat ahead of the next BoC meeting in June, but a higher-than-expected CPI print may generate a bullish reaction in the Canadian Dollar as it encourages Governor Tiff Macklem and Co. to retain the current policy.

With that said, USD/CAD may track the negative slope in the 50-Day SMA (1.4075) should it fail to defend the advance from the weekly low (1.3900), but the exchange rate may attempt to retrace the decline from the April high (1.4415) as there appears to be a shift in US Dollar sentiment.

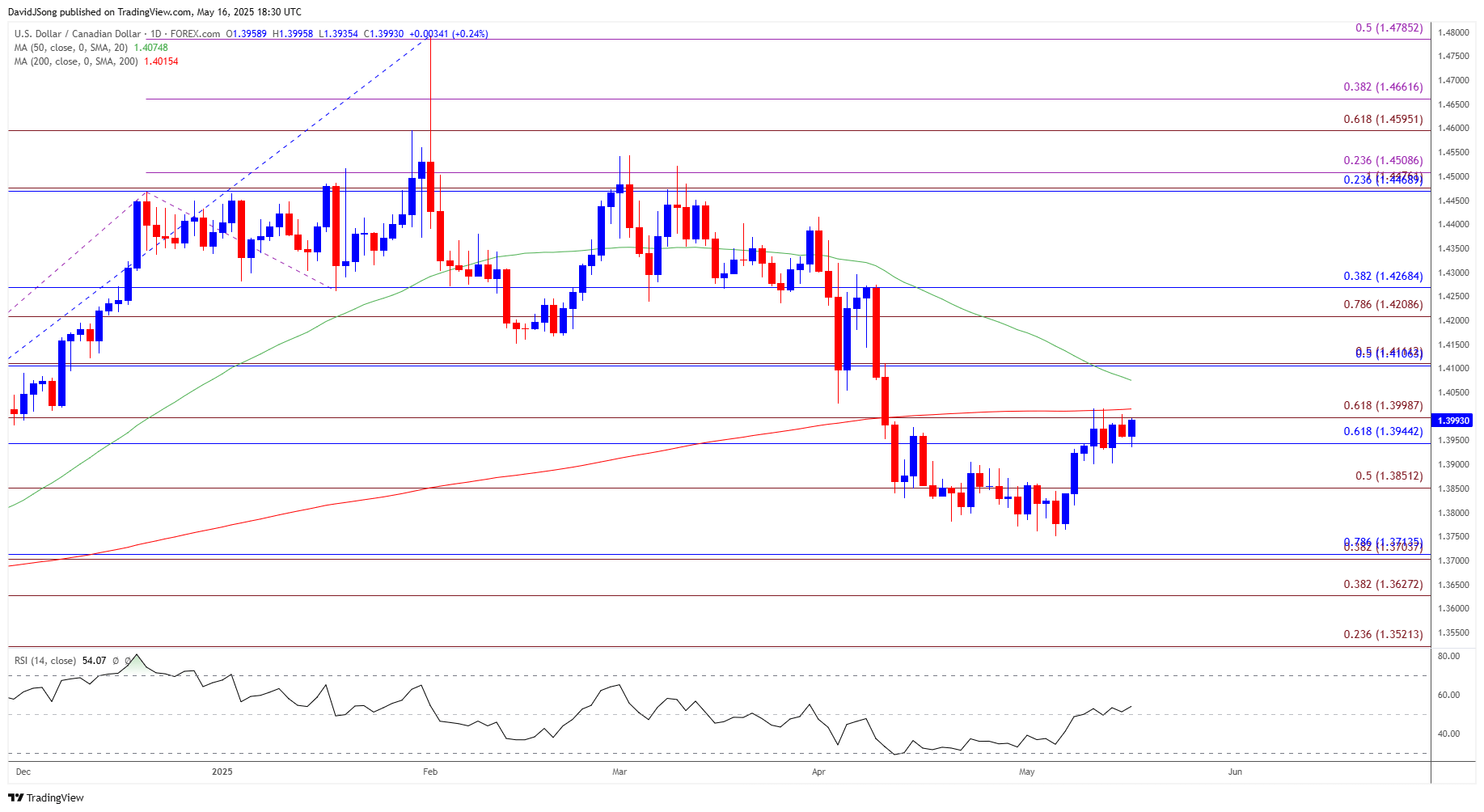

USD/CAD Price Chart – Daily

Chart Prepared by David Song, Senior Strategist; USD/CAD Price on TradingView

- USD/CAD continues to defend the advance from the weekly low (1.3900), with a close above the 1.3940 (61.8% Fibonacci retracement) to 1.4000 (61.8% Fibonacci extension) zone bringing 1.4110 (50% Fibonacci retracement) on the radar.

- Next region of interest comes in around the 1.4210 (78.6% Fibonacci extension) to 1.4270 (38.2% Fibonacci retracement), but lack of momentum to close above the 1.3940 (61.8% Fibonacci retracement) to 1.4000 (61.8% Fibonacci extension) zone may keep USD/CAD below the 50-Day SMA (1.4075).

- Failure to defend the weekly low (1.3900) may push USD/CAD towards 1.3850 (50% Fibonacci extension), with the next area of interest coming in around the monthly low (1.3751).

Additional Market Outlooks

Gold Price Struggles to Close Below 50-Day SMA

GBP/USD Defends Rebound from Weekly Low to Hold Above 50-Day SMA

US Dollar Forecast: USD/JPY Reverses Ahead of April High

Australian Dollar Forecast: AUD/USD Defends V-Shape Recovery

--- Written by David Song, Senior Strategist

Follow on Twitter at @DavidJSong