Canadian Dollar Outlook: USD/CAD

USD/CAD extends the series of lower highs and lows from last week to register a fresh yearly low (1.3829), and the exchange rate may face increased volatility ahead of Canada’s federal election should the Bank of Canada (BoC) adjust the forward guidance for monetary policy.

Canadian Dollar Forecast: USD/CAD Faces BoC Meeting Ahead of Canada Election

USD/CAD may attempt to test the November low (1.3821) as the Relative Strength Index (RSI) flirts with oversold territory, and a move below 30 is likely to be accompanied by a further decline in the exchange rate like the price action from last year.

Join David Song for the Weekly Fundamental Market Outlook webinar.

David provides a market overview and takes questions in real-time. Register Here

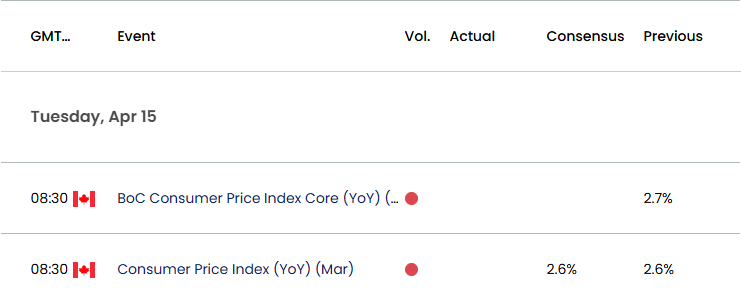

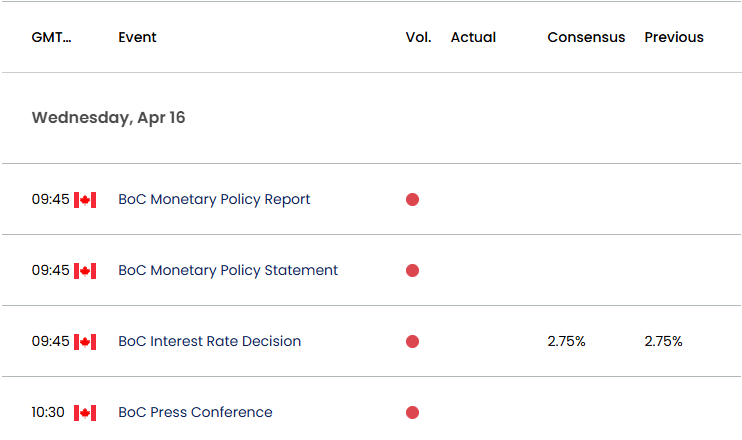

Canada Economic Calendar

Looking ahead, the update to Canada’s Consumer Price Index (CPI) may sway USD/CAD as the headline reading is expected to hold steady at 2.6% in March, and signs of sticky inflation may push the BoC to the sidelines as the central bank pledges to ‘ensure that higher prices do not lead to ongoing inflation.’

In turn, the BoC may keep its benchmark interest rate at 2.75% as the ‘Governing Council will be carefully assessing the timing and strength of both the downward pressures on inflation from a weaker economy and the upward pressures on inflation from higher costs,’ and the fresh forecasts coming out of the central bank may generate a bullish reaction in the Canadian Dollar should Governor Tiff Macklem and Co. adopt a wait-and-see approach.

At the same time, the BoC may keep the door open to implement lower interest rates as the ongoing shift in US trade policy clouds the outlook for global growth, and USD/CAD may stage a rebound ahead of the elections on April 28 if the central bank offers a dovish forward guidance.

With that said, lack of momentum to test the November low (1.3821) may keep the RSI out of oversold territory, but USD/CAD may continue to trade to fresh yearly lows as it still reflects a bearish price series.

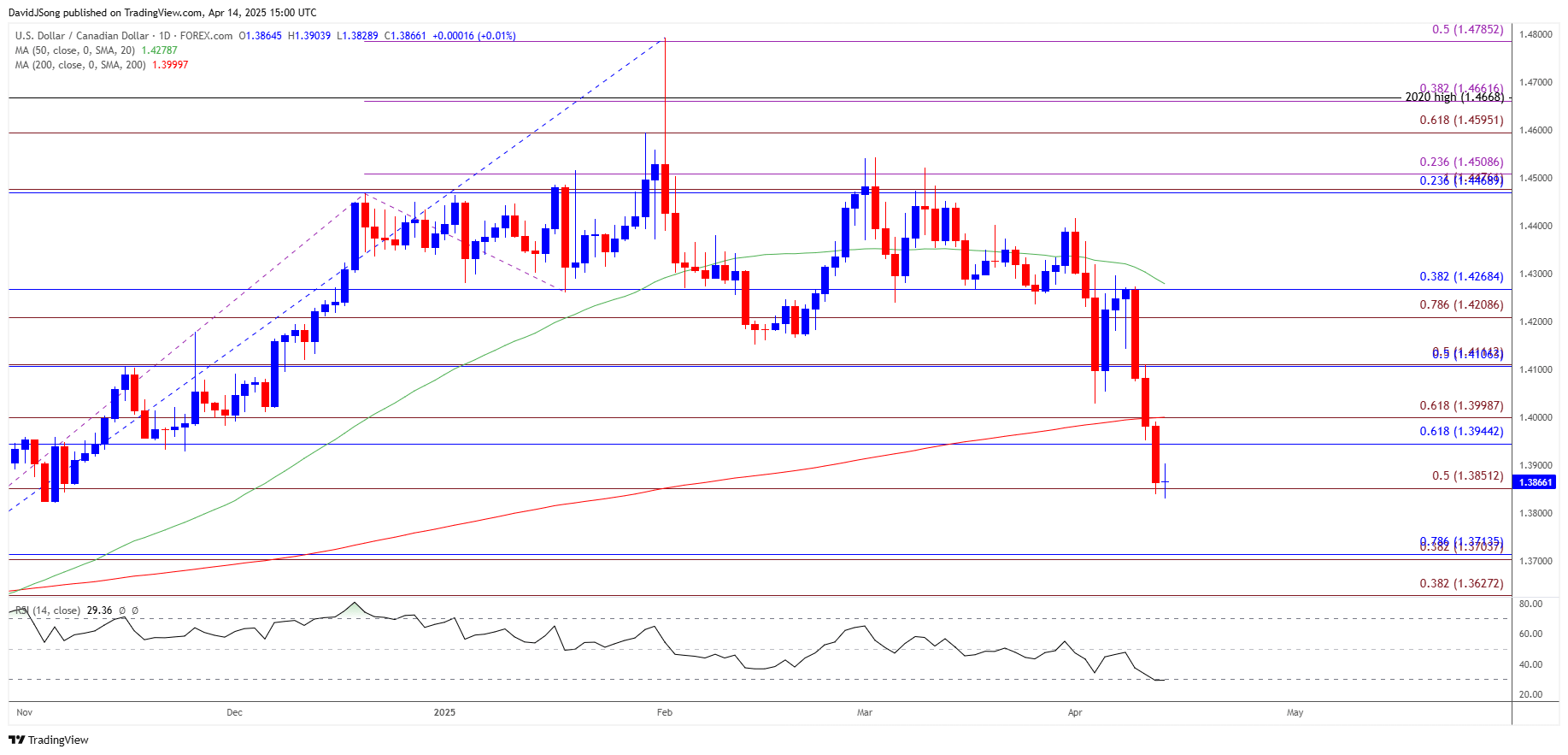

USD/CAD Price Chart – Daily

Chart Prepared by David Song, Senior Strategist; USD/CAD Price on TradingView

- USD/CAD may test the November low (1.3821) as it extends the series of lower highs and lows from last week, with a close below 1.3850 (50% Fibonacci extension) opening up the 1.3700 (38.2% Fibonacci extension) to 1.3710 (78.6% Fibonacci retracement) region.

- Next area of interest comes in around 1.3630 (38.2% Fibonacci extension), but lack of momentum to close below 1.3850 (50% Fibonacci extension) may curb the bearish price series in USD/CAD.

- Need a move/close above the 1.3940 (61.8% Fibonacci retracement) to 1.4000 (61.8% Fibonacci extension) zone to bring 1.4110 (50% Fibonacci retracement) on the radar, with the next area of interest coming in around 1.4210 (78.6% Fibonacci extension) to 1.4270 (38.2% Fibonacci retracement).

Additional Market Outlooks

Euro Forecast: EUR/USD Clears 2024 High to Push RSI into Overbought Zone

GBP/USD Reverses Ahead of March Low to Stage Three-Day Rally

USD/JPY Eyes October Low as China Responds to Trump Tariffs

AUD/USD Selloff Persists as US Threatens Additional 50% Tariff for China

--- Written by David Song, Senior Strategist

Follow on Twitter at @DavidJSong