Canadian Dollar Outlook: USD/CAD

USD/CAD may threaten the range bound price action carried over from last week as Canada’s Consumer Price Index (CPI) warns of sticky inflation.

Canadian Dollar Forecast: USD/CAD Falls amid Sticky Canada Inflation

USD/CAD attempts to extend the decline from the start of the week as Canada’s CPI prints at 1.7% in April versus forecasts for a 1.6% reading, with the core rate of inflation widening to 2.5% from 2.2% per annum in March.

According to Statistics Canada, ‘moderating the slowdown in the CPI in April were higher prices for travel tours (+6.7%) and food purchased from stores (+3.8%),’ and it remains to be seen if the rise in US tariffs will force a response from the Bank of Canada (BoC) as the central bank appears to be at or nearing the end of its rate-cutting cycle.

Join David Song for the Weekly Fundamental Market Outlook webinar.

David provides a market overview and takes questions in real-time. Register Here

Recent remarks from the BoC suggest the central bank will stick to a wait-and-see approach as the ‘Governing Council will proceed carefully, with particular attention to the risks and uncertainties facing the Canadian economy,’ and USD/CAD may give back the rebound from the monthly low (1.3751) as signs of higher price growth curbs speculation for a BoC rate cut.

With that said, USD/CAD may respond to the negative slope in the 50-Day SMA (1.4055) should it continue to hold below the moving average, but the ongoing transition in US fiscal policy may lead to a shift in US Dollar sentiment as the Trump administration avoids a trade war.

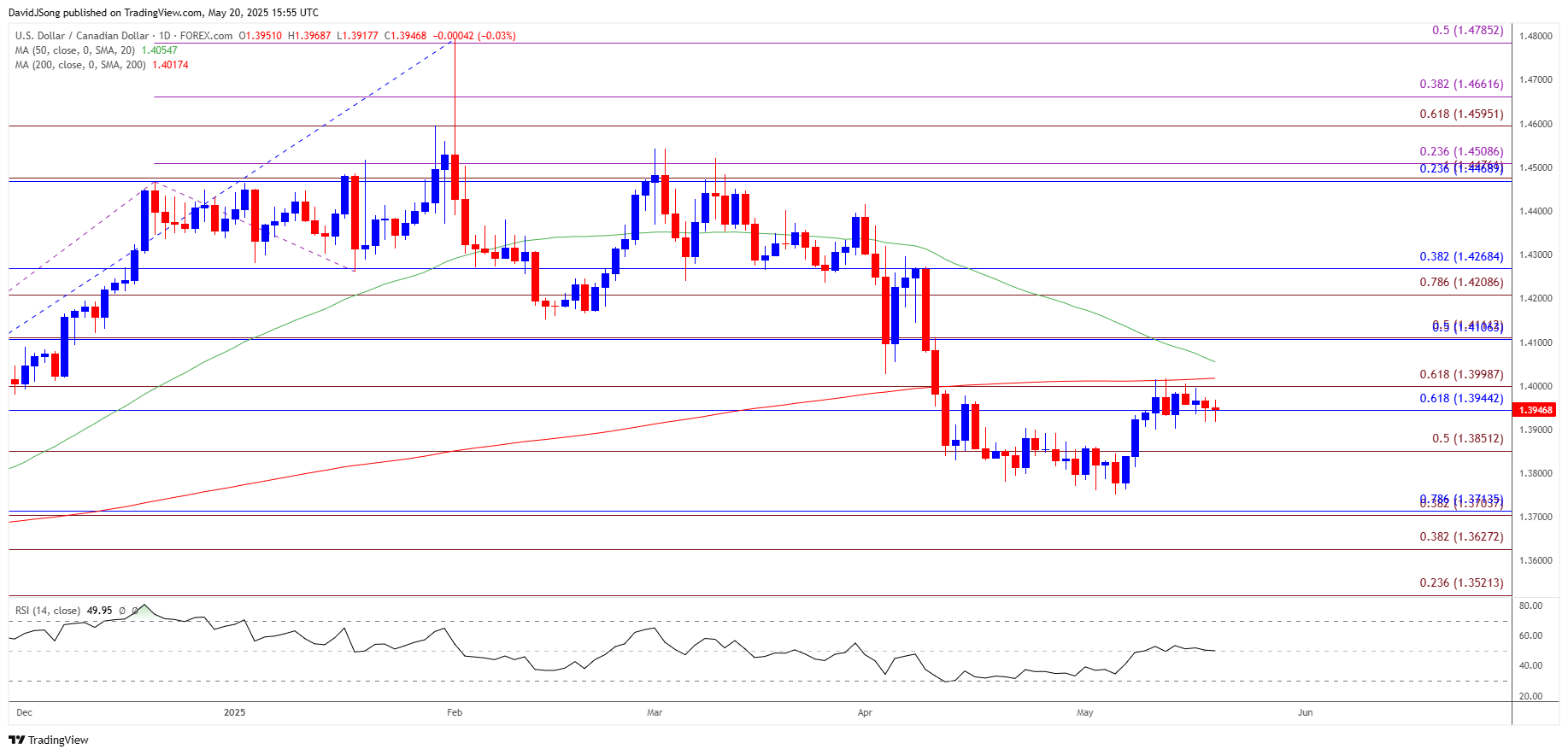

USD/CAD Price Chart – Daily

Chart Prepared by David Song, Senior Strategist; USD/CAD Price on TradingView

- USD/CAD seems to be stuck in a narrow range following the failed attempts to close above the 1.3940 (61.8% Fibonacci retracement) to 1.4000 (61.8% Fibonacci extension) zone, but lack of momentum to hold above the last week’s low (1.3900) may push the exchange rate toward 1.3850 (50% Fibonacci extension).

- A breach of the monthly low (1.3751) opens up the 1.3700 (38.2% Fibonacci extension) to 1.3710 (78.6% Fibonacci retracement) region, with the next area of interest coming in around 1.3630 (38.2% Fibonacci extension).

- At the same time, a close above the 1.3940 (61.8% Fibonacci retracement) to 1.4000 (61.8% Fibonacci extension) zone may push USD/CAD toward 1.4110 (50% Fibonacci retracement), with the next area of interest coming in around 1.4210 (78.6% Fibonacci extension) to 1.4270 (38.2% Fibonacci retracement).

Additional Market Outlooks

Australian Dollar Forecast: AUD/USD Vulnerable to RBA Rate Cut

USD/JPY Decline Persists amid US Credit Rating Downgrade

Gold Price Struggles to Close Below 50-Day SMA

GBP/USD Defends Rebound from Weekly Low to Hold Above 50-Day SMA

--- Written by David Song, Senior Strategist

Follow on Twitter at @DavidJSong