Canadian Dollar Outlook: USD/CAD

USD/CAD reverses ahead of the monthly high (1.3863) to register a fresh yearly low (1.3751), and the weakness in the exchange rate may persist as it appears to be trading within a descending channel.

Canadian Dollar Forecast: USD/CAD Reverses Ahead of Monthly High

As a result, USD/CAD may continue to give back the advance from the October low (1.3473) on the back of US Dollar weakness, and a further decline in the exchange rate may push the Relative Strength Index (RSI) back toward oversold territory.

Join David Song for the Weekly Fundamental Market Outlook webinar.

David provides a market overview and takes questions in real-time. Register Here

A move below 30 in the RSI is likely to be accompanied by a further decline in USD/CAD like the price action from last year, but developments coming out of the US may sway the exchange rate as the Federal Reserve is expected to keep US interest rates on hold.

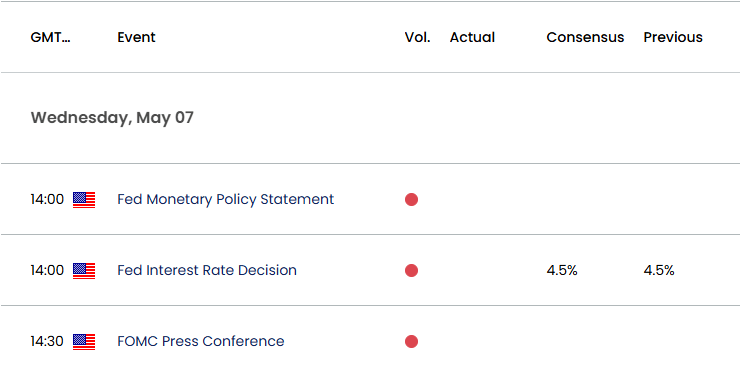

US Economic Calendar

The Federal Open Market Committee (FOMC) may stick to the sidelines as the ongoing shift in trade policy clouds the outlook for the US economy, and central bank may continue to endorse a wait-and-see approach should Chairman Jerome Powell reiterate that ‘we do not need to be in a hurry to adjust our policy stance.’

In turn, more of the same from the Federal Open Market Committee (FOMC) may generate a bullish reaction in the US Dollar as it curbs speculation for an imminent rate cut, but the Fed may stay on track to unwind its restrictive policy as the economy contracts 0.3% in the first quarter of 2025.

With that said, USD/CAD may continue to give back the advance from the October low (1.3473) should the Fed strike a dovish forward guidance, and the exchange rate may track the descending channel as the 50-Day SMA (1.4146) establishes a negative slope.

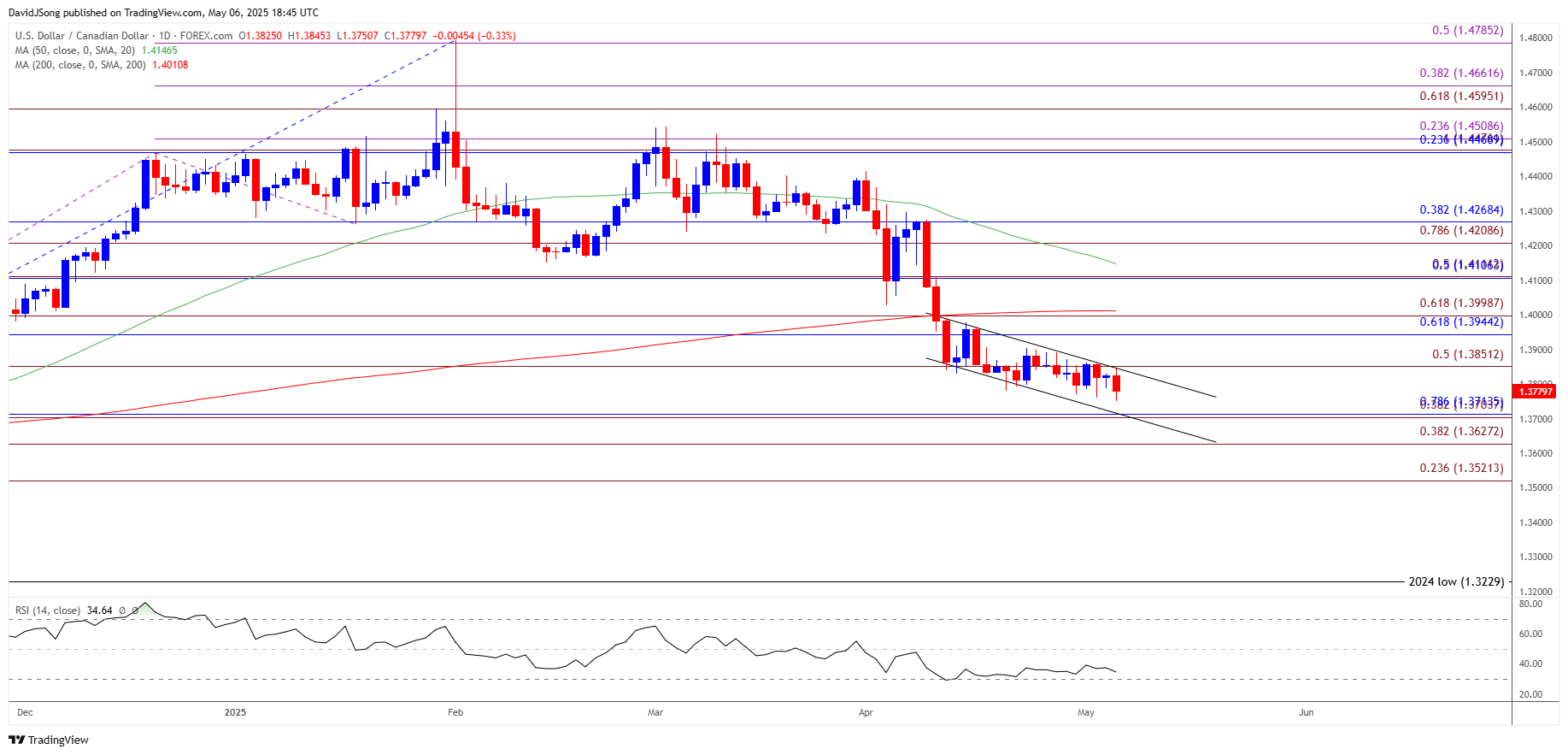

USD/CAD Price Chart – Daily

Chart Prepared by David Song, Senior Strategist; USD/CAD Price on TradingView

- USD/CAD seems to be trading within a descending channel as it struggles to hold above 1.3850 (50% Fibonacci extension), with a break/close below the 1.3700 (38.2% Fibonacci extension) to 1.3710 (78.6% Fibonacci retracement) region opening up 1.3630 (38.2% Fibonacci extension).

- A break/close below 1.3520 (23.6% Fibonacci extension) brings the October low (1.3473) on the radar, but USD/CAD may threaten the descending channel should it retrace the decline from the monthly high (1.3863).

- A breach of channel resistance may push USD/CAD back towards the 1.3940 (61.8% Fibonacci retracement) to 1.4000 (61.8% Fibonacci extension) zone, with the next area of interest coming in around 1.4110 (50% Fibonacci retracement).

Additional Market Outlooks

EUR/USD Defends Rebound from Monthly Low Ahead of Fed Rate Decision

USD/JPY Rebound Unravels with Fed Rate Decision on Tap

British Pound Forecast: GBP/USD Selloff Stalls Ahead of BoE Meeting

Canadian Dollar Forecast: USD/CAD Vulnerable to Fresh Yearly Lows

--- Written by David Song, Senior Strategist

Follow on Twitter at @DavidJSong