Canadian Dollar Outlook: USD/CAD

USD/CAD reverses ahead of the October low (1.3473) to pull the Relative Strength Index (RSI) above 30, with the exchange rate snapping the series of lower highs and lows carried over from last week.

Canadian Dollar Forecast: USD/CAD Reverses Ahead of October Low

In turn, USD/CAD may further retrace the decline from the monthly high (1.3743) as there appears to be a broad-based recovery in the Greenback, and the RSI may continue to show the bearish momentum abating as it moves away from oversold territory.

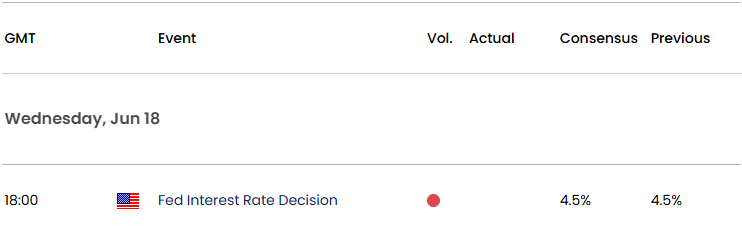

US Economic Calendar

However, the Federal Reserve rate decision may sway USD/CAD even though the central bank is expected to retain the current policy as Chairman Jerome Powell and Co. are scheduled to update the Summary of Economic Projections (SEP).

Join David Song for the Weekly Fundamental Market Outlook webinar.

David provides a market overview and takes questions in real-time. Register Here

More of the same from Fed officials may produce headwinds for the US Dollar as the ‘median participant projects that the appropriate level of the federal funds rate will be 3.9 percent at the end of this year,’ but a shift in the forward guidance for monetary policy may keep USD/CAD afloat should the Federal Open Market Committee (FOMC) show a greater willingness to keep US interest rates higher for longer.

With that said, fading expectations for a Fed rate-cut may lead to a larger recovery in USD/CAD, but the rebound in the exchange rate may turn out to be temporary should it continue to track the negative slope in the 50-Day SMA (1.3820).

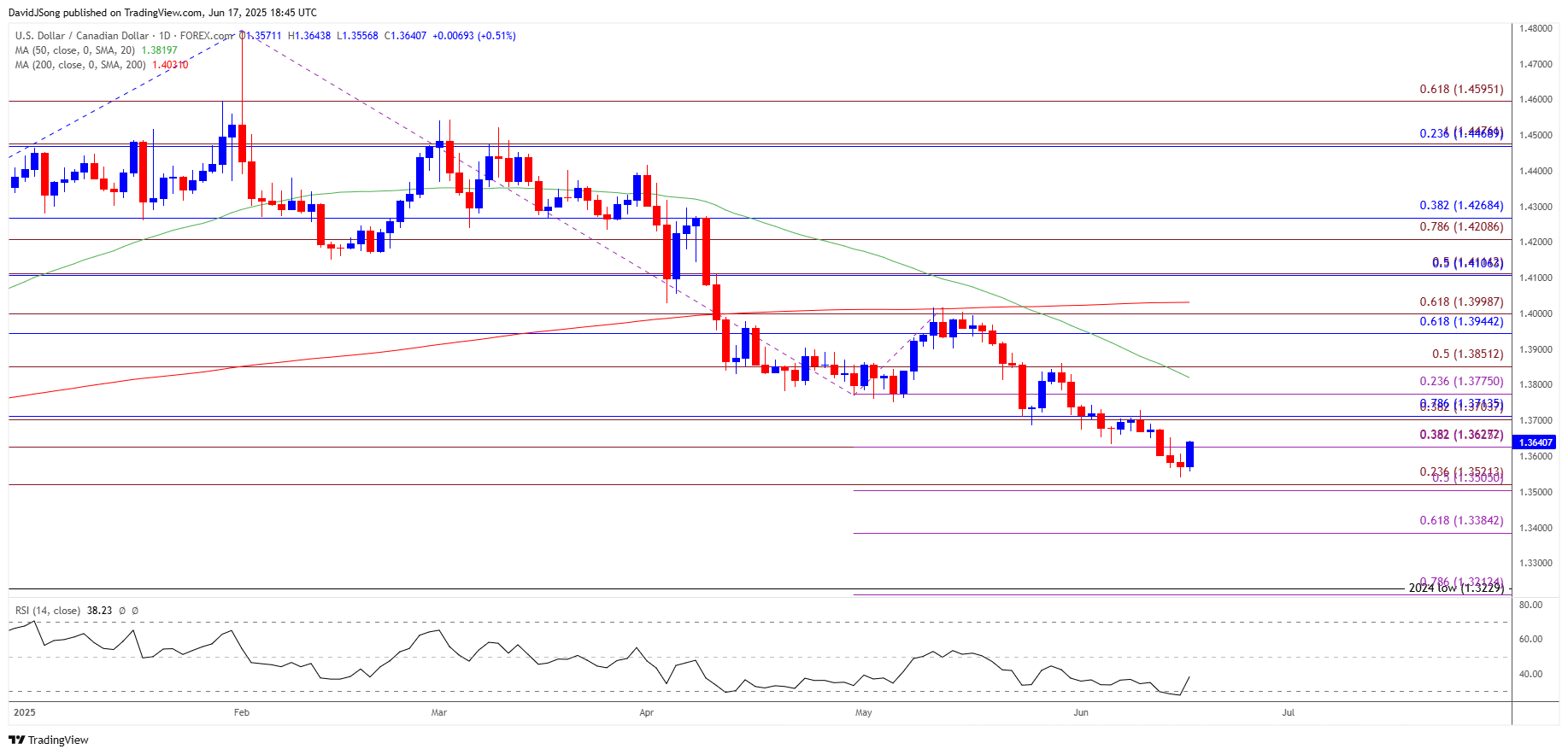

USD/CAD Price Chart – Daily

Chart Prepared by David Song, Senior Strategist; USD/CAD Price on TradingView

- USD/CAD no longer carves a series of lower highs and lows as it bounces back ahead of the 1.3510 (50% Fibonacci extension) to 1.3520 (23.6% Fibonacci extension) region, with a close above 1.3630 (38.2% Fibonacci extension) bringing the 1.3700 (38.2% Fibonacci extension) to 1.3710 (78.6% Fibonacci retracement) zone back on the radar.

- A breach of the month high (1.3743) may push USD/CAD toward 1.3780 (23.6% Fibonacci extension), but the exchange rate may continue to track the negative slope in the 50-Day SMA (1.3820) as it holds below the moving average.

- Need a break/close below the 1.3510 (50% Fibonacci extension) to 1.3520 (23.6% Fibonacci extension) region to open up the October low (1.3473), with the next area of interest coming in around the September low (1.3420).

Additional Market Outlooks

AUD/USD Coils After Trading to Fresh 2025 High

GBP/USD Susceptible to Slowing UK CPI Ahead of BoE Meeting

EUR/USD Outlook Hinges on Federal Reserve Forward Guidance

USD/JPY Weakness Persists with US PPI Unfazed by Higher Tariffs

--- Written by David Song, Senior Strategist

Follow on Twitter at @DavidJSong