Canadian Dollar Outlook: USD/CAD

USD/CAD falls to a fresh yearly low (1.3675) as US President Donald Trump plans to ‘raise the tariffs on steel and aluminum from 25% to 50%,’ with the recent selloff in the exchange rate pushing the Relative Strength Index (RSI) toward oversold territory.

Canadian Dollar Forecast: USD/CAD Selloff Persists Ahead of BoC Meeting

The weakness in USD/CAD may persist ahead of the Bank of Canada (BoC) meeting as it extends the series of lower highs and lows from last week, and more of the same from the central bank may fuel the recent decline in the exchange as Governor Tiff Macklem and Co. seem to be at or nearing the end of its rate-cutting cycle.

Canada Economic Calendar

The BoC is expected to keep the benchmark interest rate at 2.75% for the second consecutive meeting, and the central bank may endorse a wait-and-see approach in managing monetary policy as ‘Governing Council will continue to assess the timing and strength of both the downward pressures on inflation from a weaker economy and the upward pressures on inflation from higher costs.’

Join David Song for the Weekly Fundamental Market Outlook webinar.

David provides a market overview and takes questions in real-time. Register Here

In turn, USD/CAD may continue to reflect a bearish price series should the BoC stick to the same script, and the Relative Strength Index (RSI) may show the bearish momentum gathering pace should it push below 30 to indicate an oversold reading.

With that said, the BoC’s forward guidance for monetary policy may sway the near-term outlook for USD/CAD as the central bank is anticipated to keep interest rates on hold, but the Canadian Dollar may face headwinds if the central bank shows a greater willingness to implement lower interest rates.

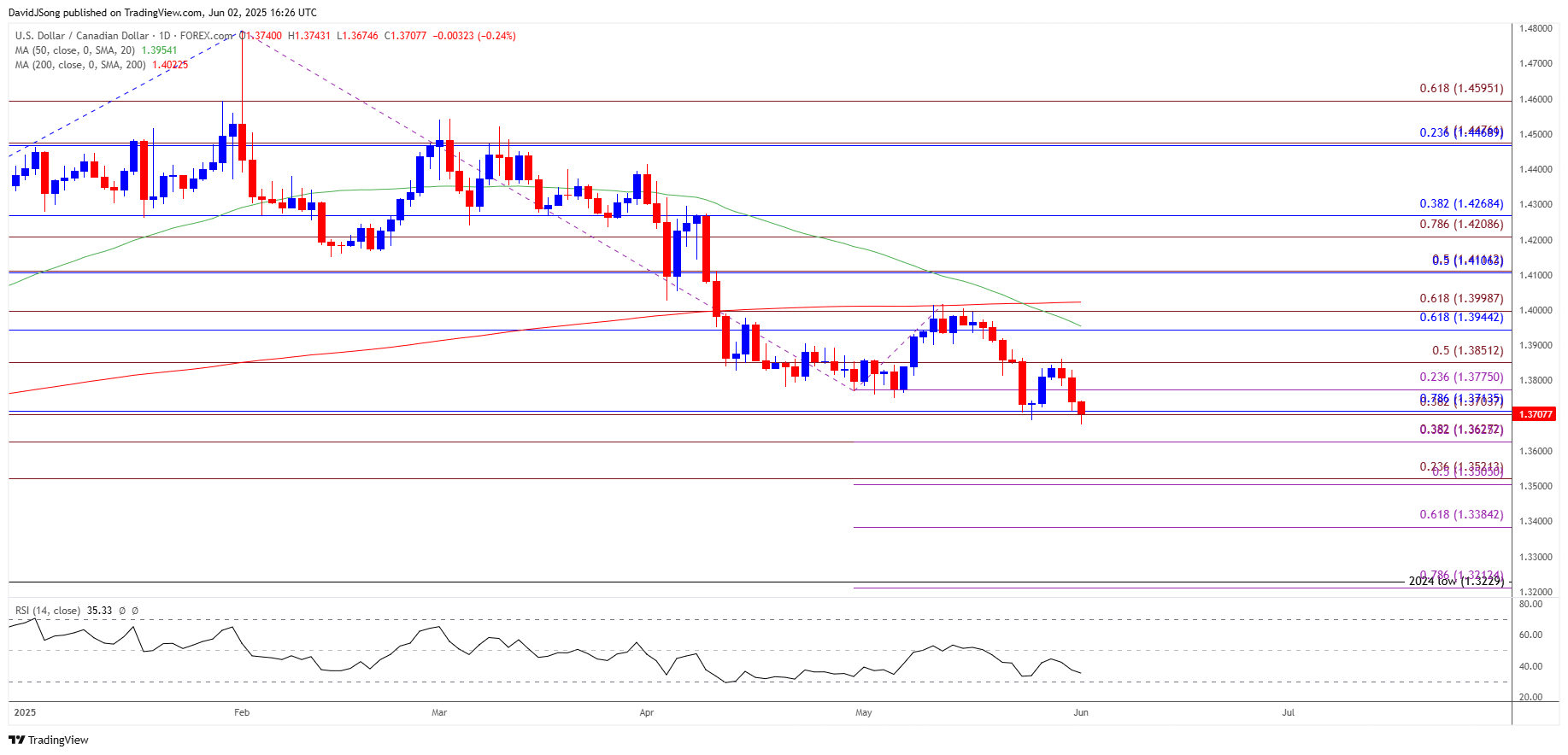

USD/CAD Price Chart – Daily

Chart Prepared by David Song, Senior Strategist; USD/CAD Price on TradingView

- USD/CAD extends the series of lower highs and lows from last week to register a fresh yearly low (1.3675), with a close below the 1.3700 (38.2% Fibonacci extension) to 1.3710 (78.6% Fibonacci retracement) region raising the scope for a move toward 1.3630 (38.2% Fibonacci extension).

- Next area of interest comes in around 1.3500 (50% Fibonacci extension) to 1.3520 (23.6% Fibonacci extension), but lack of momentum to close below the 1.3700 (38.2% Fibonacci extension) to 1.3710 (78.6% Fibonacci retracement) region may push USD/CAD back toward 1.3770 (23.6% Fibonacci extension).

- Need a move/close above 1.3850 (50% Fibonacci extension) to bring the 1.3940 (61.8% Fibonacci retracement) to 1.4000 (61.8% Fibonacci extension) zone on the radar, with the next area of interest coming in around the May high (1.4017).

Additional Market Outlooks

Gold Price Coils as Trump Warns of China Violation

EUR/USD Defends Rebound from Weekly Low to Hold Above 50-Day SMA

Australian Dollar Forecast: AUD/USD Halts Bearish Price Series

GBP/USD Holds Below February 2022 High for Now

--- Written by David Song, Senior Strategist

Follow on Twitter at @DavidJSong