Canadian Dollar Outlook: USD/CAD

USD/CAD extends the selloff from earlier this week as Canada Prime Minister Mark Carney pledges to ‘fight U.S. tariffs, protect Canadian workers and industries, and build the strongest economy in the G7,’ and the exchange rate appears to be on track to test the December low (1.3991) as it carves a series of lower highs and lows.

Canadian Dollar Forecast: USD/CAD Selloff Persists as PM Carney Pledges to Fight Trump Tariffs

USD/CAD no longer trades within the February range as it tumbles to a fresh yearly low (1.4027), with the recent weakness in the exchange rate pushing the Relative Strength Index (RSI) to its lowest level since September.

Join David Song for the Weekly Fundamental Market Outlook webinar.

David provides a market overview and takes questions in real-time. Register Here

A move below 30 in the RSI is likely to be accompanied by a further decline in USD/CAD like the price action from last year, and the Canadian Dollar may continue to appreciate ahead of the federal election on April 28 as the Bank of Canada (BoC) warns that ‘monetary policy cannot offset the impacts of a trade war.’

Canada Economic Calendar

It seems as though the BoC will retain the current policy at its next rate decision on April 16 as the ‘Governing Council will be carefully assessing the timing and strength of both the downward pressures on inflation from a weaker economy and the upward pressures on inflation from higher costs,’ and the update to Canada’s Employment report may encourage Governor Tiff Macklem and Co. to further combat inflation as the economy is anticipated to add 12.0K jobs in March.

Signs of a resilient labor market may keep USD/CAD under pressure as it instills an improved outlook for growth, but a weaker-than-expected employment report may drag on the Canadian Dollar as it fuels speculation for another BoC rate-cut.

With that said, lack of momentum to test the December low (1.3991) may keep the Relative Strength Index (RSI) above 30, but the selloff in USD/CAD may persist as it extends the series of lower highs and lows from earlier this week.

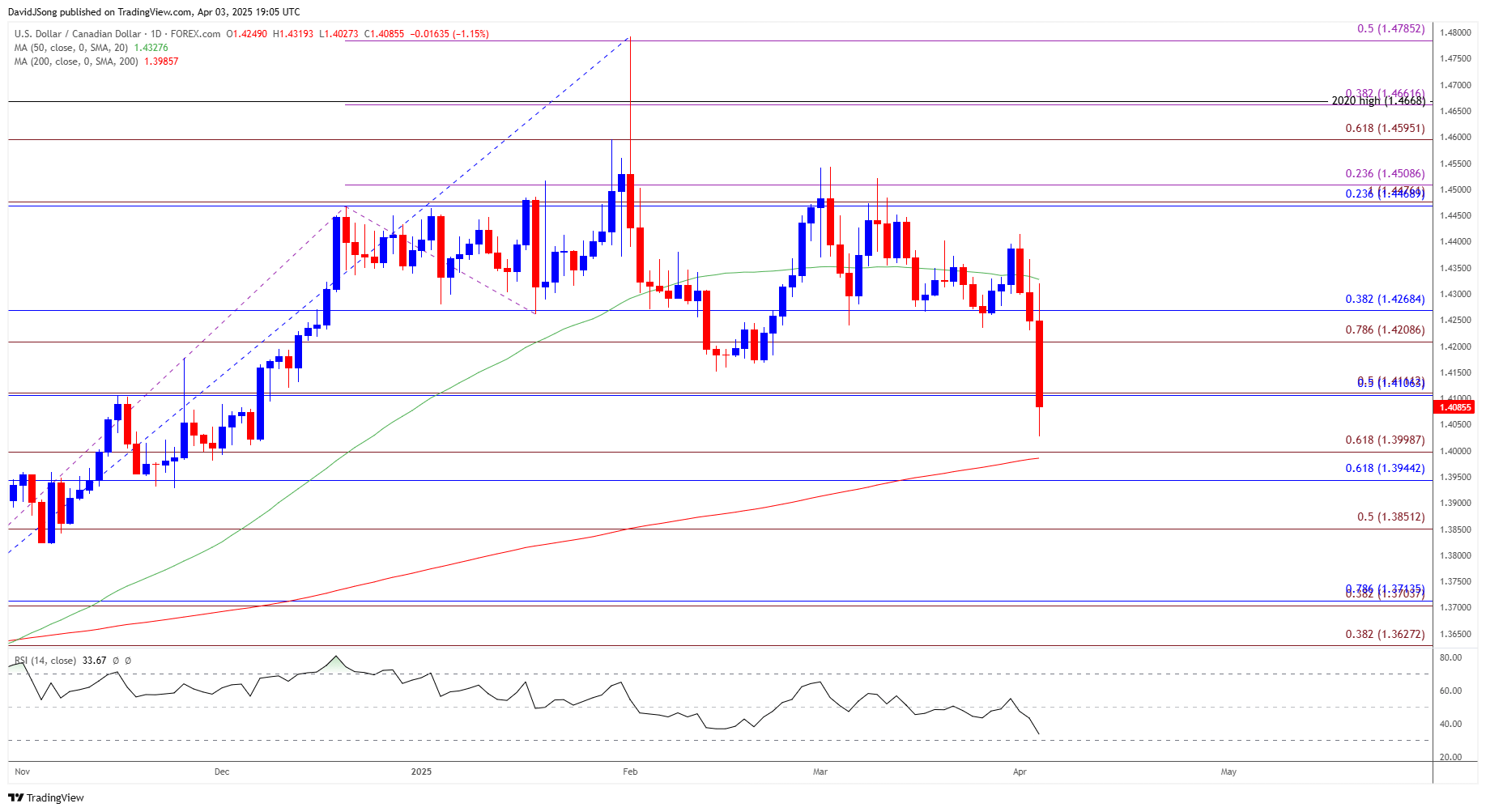

USD/CAD Price Chart – Daily

Chart Prepared by David Song, Senior Strategist; USD/CAD Price on TradingView

- USD/CAD snaps the February range to register a fresh yearly low (1.4027), with a break/close below the 1.3940 (61.8% Fibonacci retracement) to 1.4000 (61.8% Fibonacci extension) opening up 1.3850 (50% Fibonacci extension).

- Next area of interest comes in around the November low (1.3821), but USD/CAD may struggle to extend the bearish price a series should it defend the December low (1.3991).

- Need a move/close above 1.4110 (50% Fibonacci retracement) to bring the 1.4210 (78.6% Fibonacci extension) to 1.4270 (38.2% Fibonacci retracement) zone back on the radar, with the next area of interest coming in around the monthly high (1.4415).

Additional Market Outlooks

USD/JPY Selloff Pushes RSI Toward Oversold Territory

Euro Forecast: EUR/USD Cup-and-Handle Formation Takes Shape

Gold Price Halts Decline from Record High Ahead of Trump Tariffs

Australian Dollar Forecast: AUD/USD Coils Ahead of RBA Rate Decision

--- Written by David Song, Senior Strategist

Follow on Twitter at @DavidJSong