Canadian Dollar, USD/CAD Talking Points:

- USD/CAD has posted its largest sell-off since 2020 as the pair has pushed below the psychologically important 1.4000 handle and back into the big picture range.

- It probably seemed unthinkable in early-February when the pair pushed a fresh 20-plus year high, but bulls continually failed at 1.4500 and that lasted long enough for sellers to take over, continuing the nine-year pattern of mean reversion in the pair.

- Markets remain volatile but if you’re reading this you probably already knew that. In this article I look at a couple of different ways of working with the current backdrop in the USD/CAD pair.

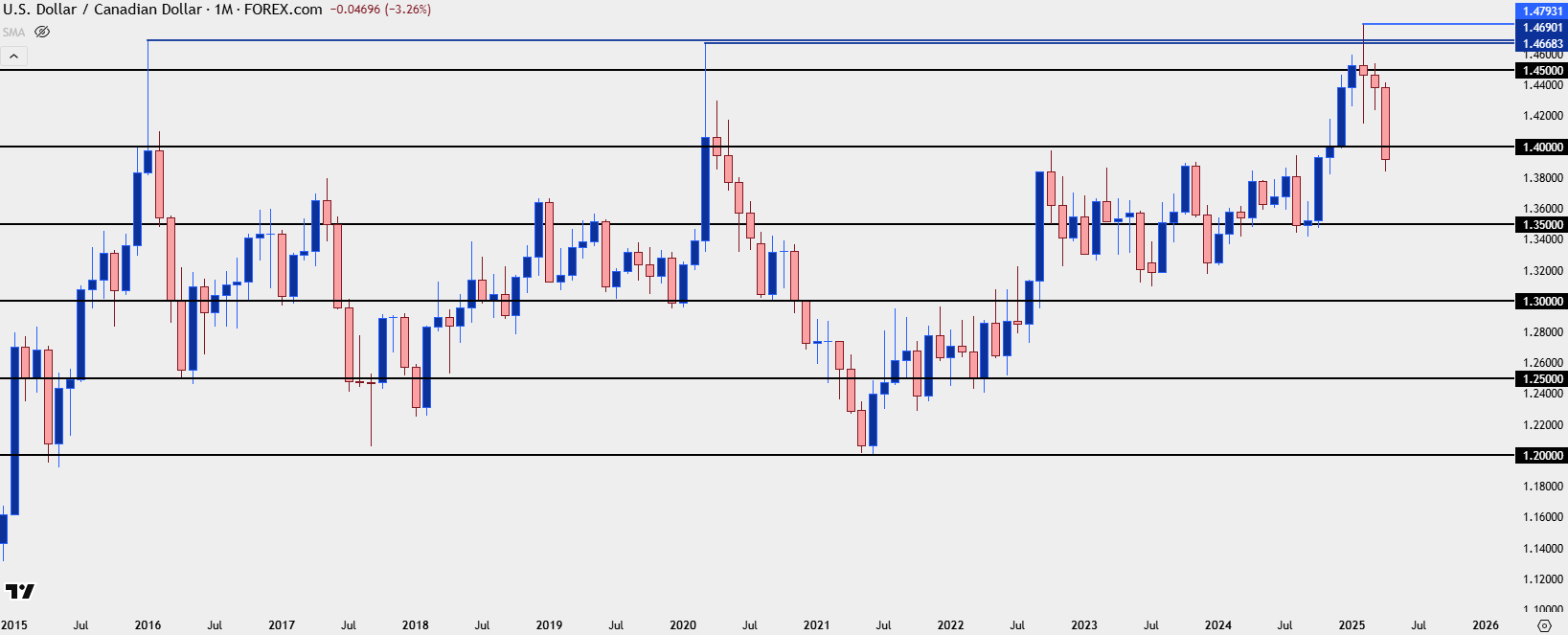

If tracking it from the monthly chart it looks somewhat clean, but on shorter-term basis the USD/CAD pair has been quite chaotic through the first three months and change of 2025 trade.

The pair started to trend higher last year as President-elect Trump began to talk up tariffs on Canada. It was messy but there was certainly intent there, and the initial breakout was somewhat tenuous. But as the verbiage persisted the 1.4000 level that bulls previously didn’t want to test started to show as support, and that led to a continued trend into the end of 2024 and the first month of 2025.

The 1.4500 level was first tested the day after Trump’s inauguration, but it couldn’t hold. Tariffs at that point were opaque as Trump had initially said that they’d be imposed on ‘day one’ of his presidency, but when it became clear that wasn’t the case the pair recoiled down to support. Trump then said February 1st and that’s where the tension seemed to climax. Feb 1st was a Saturday, and on that Sunday open confusion reigned supreme and USD/CAD broke out aggressively, although the move couldn’t hold. By early-Monday morning another delay was announced and the pair pulled back again. But March was still a go at that point and USD/CAD pushed up to 1.4500 early in the month, only for buyers to fail again.

Collectively, this produced a spinning top (or perhaps a long-legged doji, depending on how you qualify such formations) on the monthly chart. As I had opined after the March open this kept the door open for bigger-picture mean reversion, and then the rest of March showed a tepid move with 1.4500 remaining as resistance.

But so far this month sellers have taken over in a big way and USD/CAD has now pushed below the psychologically important 1.4000 level, indicating continuation of the longer-term range in the pair.

USD/CAD Monthly Price Chart

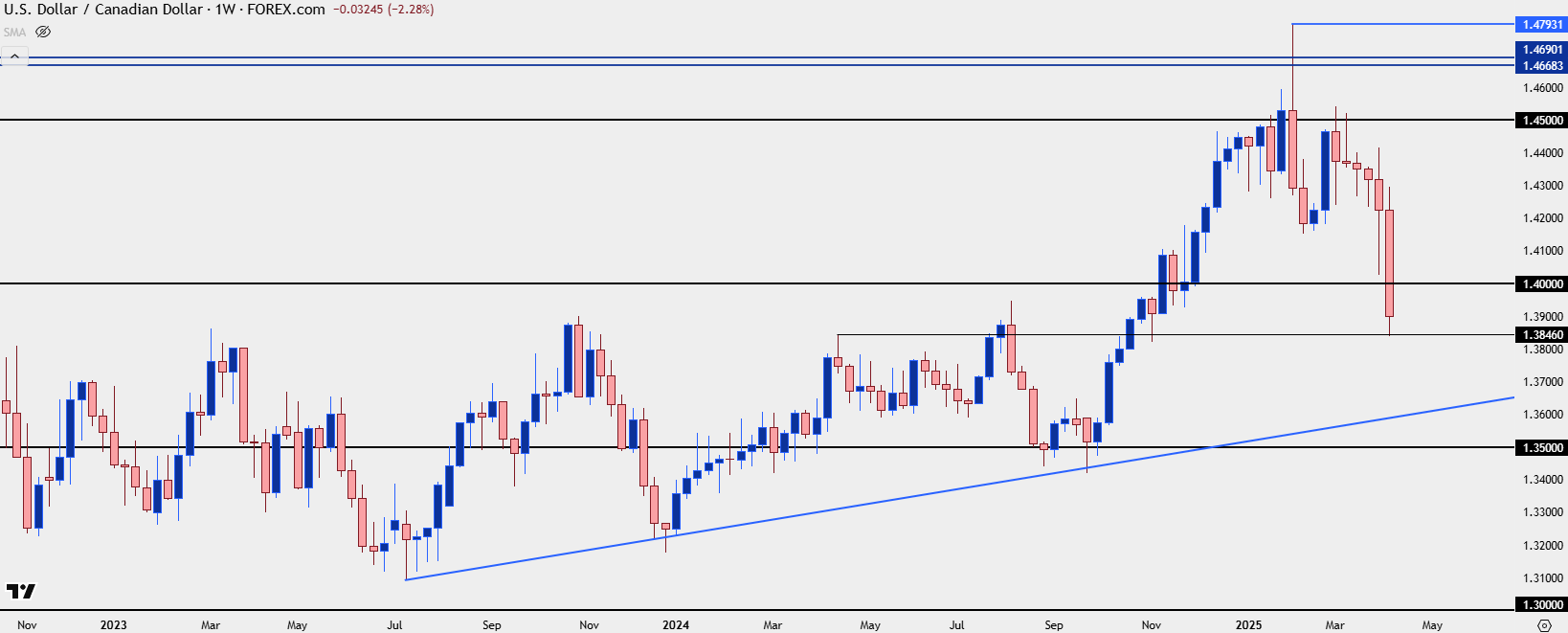

USD/CAD Weekly

The big item so far this week is that bears have taken an important step that they seemed unwilling to commit to even a week ago. While the lower-highs were fairly clear with respect of the 1.4500 handle, sellers weren’t able to hold on to lower-lows. There was a test last week, but a late-week bounce left an extended underside wick.

This week, however, that has not been a problem as broad-based USD-selling has taken over. Sellers have so far pushed a lower-low down to the 1.3846 swing. While RSI isn’t quite oversold on the daily chart as of this writing, it’s still a tough move to chase given how much distance has shown on the weekly bar, but it can highlight attractiveness behind a trend that could open the door for lower-high resistance in effort of tracking continuation.

USD/CAD Weekly Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

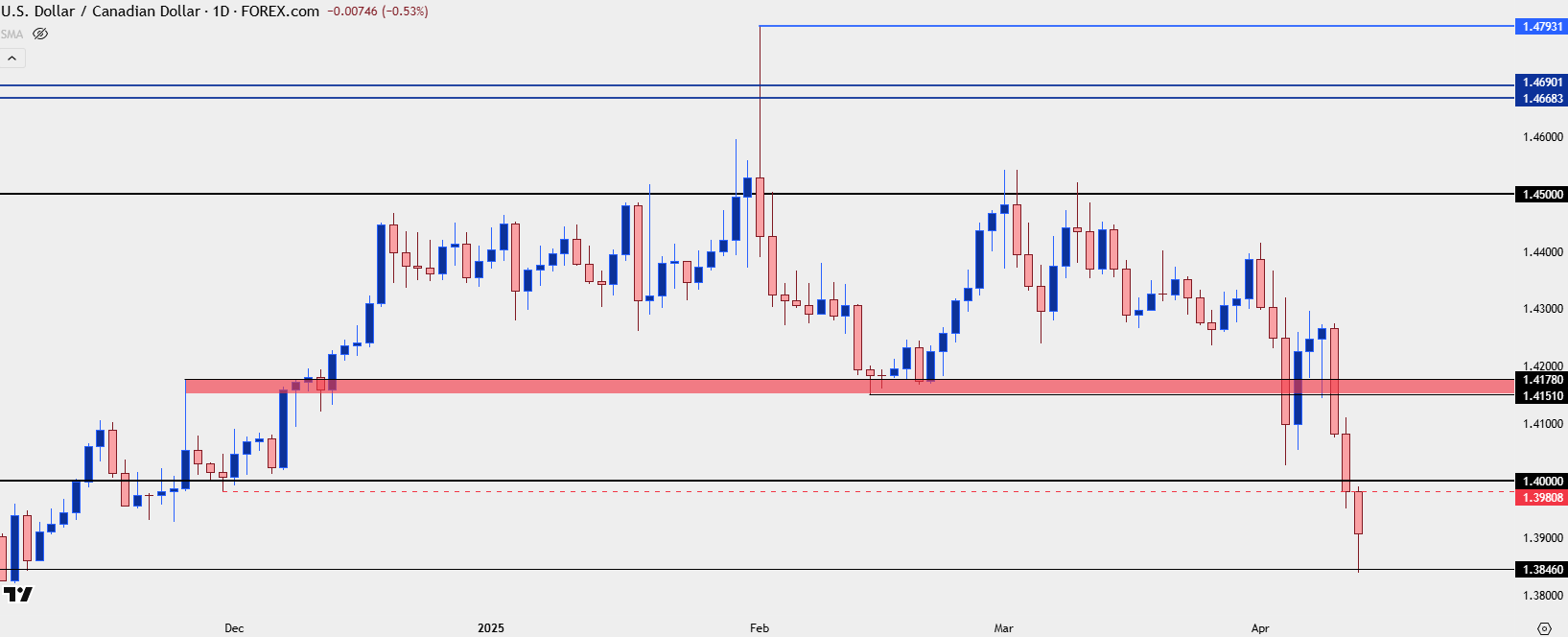

USD/CAD Daily

If that longer-term range is going to continue there could be considerable downside left to be seen. But it can also be difficult to set risk levels on a trade that’s already seen the market sell-off by more than 360 pips from the week’s high.

From the daily chart, we can get a couple of additional items that could assist with bearish approaches, key of which is the 1.4000 psychological level which I’ll touch on in a moment. Above that is a zone of resistance-turned-support around the 1.4151 level and that becomes a secondary area of resistance potential.

The complication with 1.4000 is just how obvious that is for a point of reference. If we employ a bit of game theory, we can imagine that sellers might already be anticipating that, to the point where they may come in early to defend the big figure. So, ideally, for bearish continuation approaches we would see some degree of anticipation from bears that would disallow a test through that 1.4000 handle. I’ve marked 1.3981 on the below chart as it was a nearby swing of reference that could suffice for such a purpose.

But, even if 1.4000 does trade, that doesn’t mean price has to go up to the 1.4150 zone, as you can see from the multiple instances of resistance at 1.4500 on the below daily chart in March, those wick reactions highlight intra-day reversals after failed tests of the big figure and something of that nature could certainly remain of interest in USD/CAD for next week.

USD/CAD Daily Price Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

--- written by James Stanley, Senior Strategist