USD/CAD Summary

Softer U.S. inflation reads have reignited the case for the Federal Reserve to resume its easing cycle, working in tandem with strong demand for Treasuries to see yield spreads between the United States and Canada narrow sharply. For the first time in months, that’s been a powerful force behind recent U.S. dollar movements, contributing to USD/CAD breaking several key technical levels on Thursday.

U.S. Inflation Undershoots Surge

Federal Reserve officials may be reluctant to act upon it yet, but inflation data in the United States is now undershooting on the downside at rates not seen in over a decade—a period when central banks were purposely running loose monetary policy settings to help spur on price pressures.

Source: TradingView

Citi’s U.S. economic surprise index—which tracks how inflation readings print relative to forecasts—has fallen off a cliff in recent months, likely reflecting a combination of limited passthrough of import tariffs, along with signs of weakening price pressures in services which may reflect softer labour market conditions.

Market-based inflation expectations have shifted to reflect the weak inflationary pulse, with five and 10-year inflation swaps—tracking expectations for annual inflation rates over those periods—tumbling 50 and 25 basis points respectively from the highs seen in February. Even though they both remain above the Fed’s 2% inflation target, given the current trajectory, that may not remain the case for long. So far, there’s been scant evidence of recent U.S. tariff increases showing up in the data.

U.S. Yields Tumble, Bonds Bid

Short-end rates traders are becoming alert to the risk that inflation may not accelerate as many previously expected, with pricing for rate cuts from the Federal Reserve this year moving to over two full 25bp cuts, up 15bp this week alone following the release of soft CPI and PPI data for May.

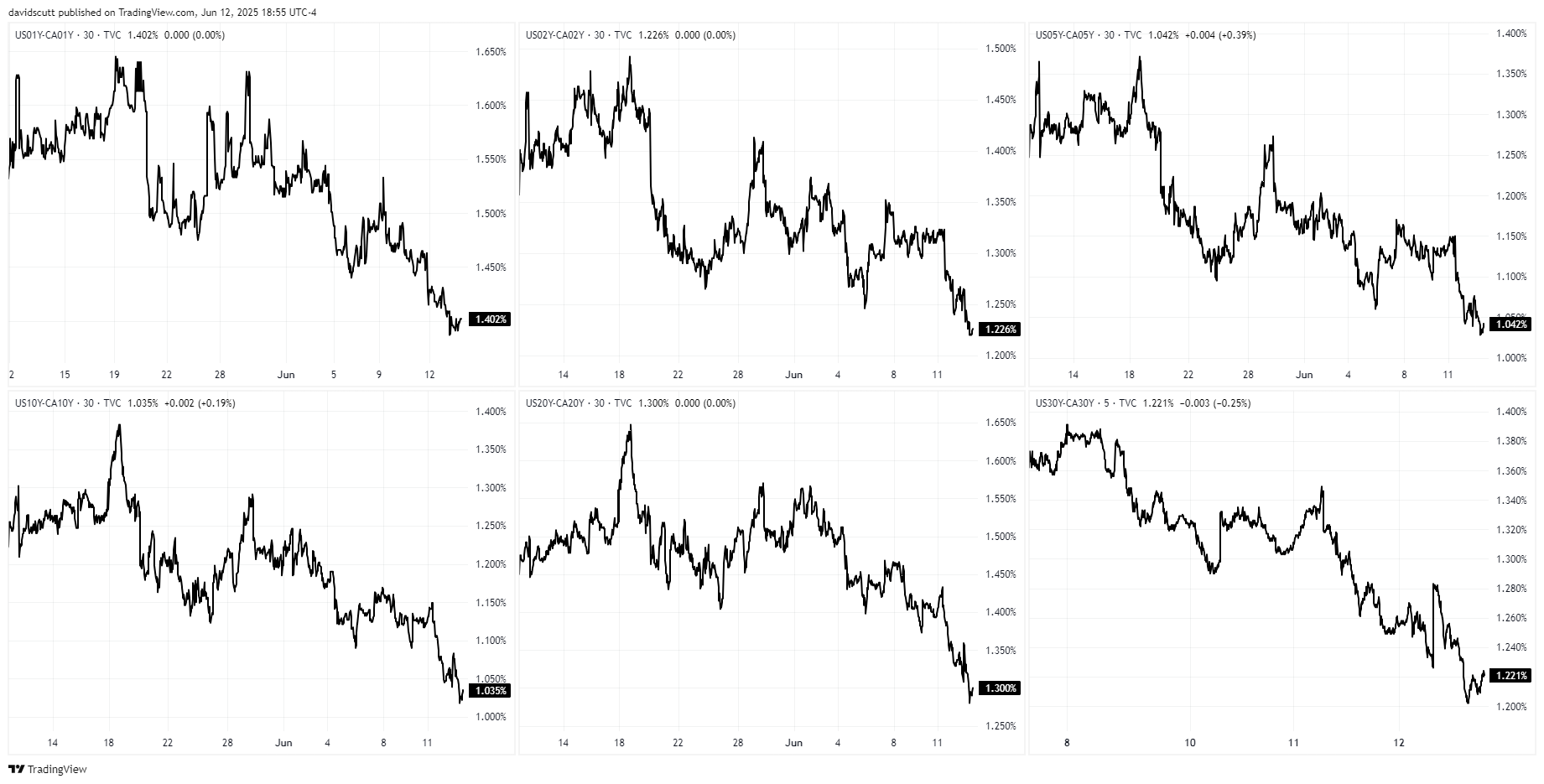

Source: TradingView

Combined with strong demand at recent U.S. Treasury auctions for 10 and 30-year debt, it’s resulted in significant declines in U.S. bond yields across the curve, seeing yield differentials with other major nations narrow sharply, including Canada. That can be seen above, with yield spreads between U.S. and Canadian bonds compressing significantly, in part because of reduced expectations for continued rate cuts from the Bank of Canada.

U.S.-Canada Yield Spreads Implode

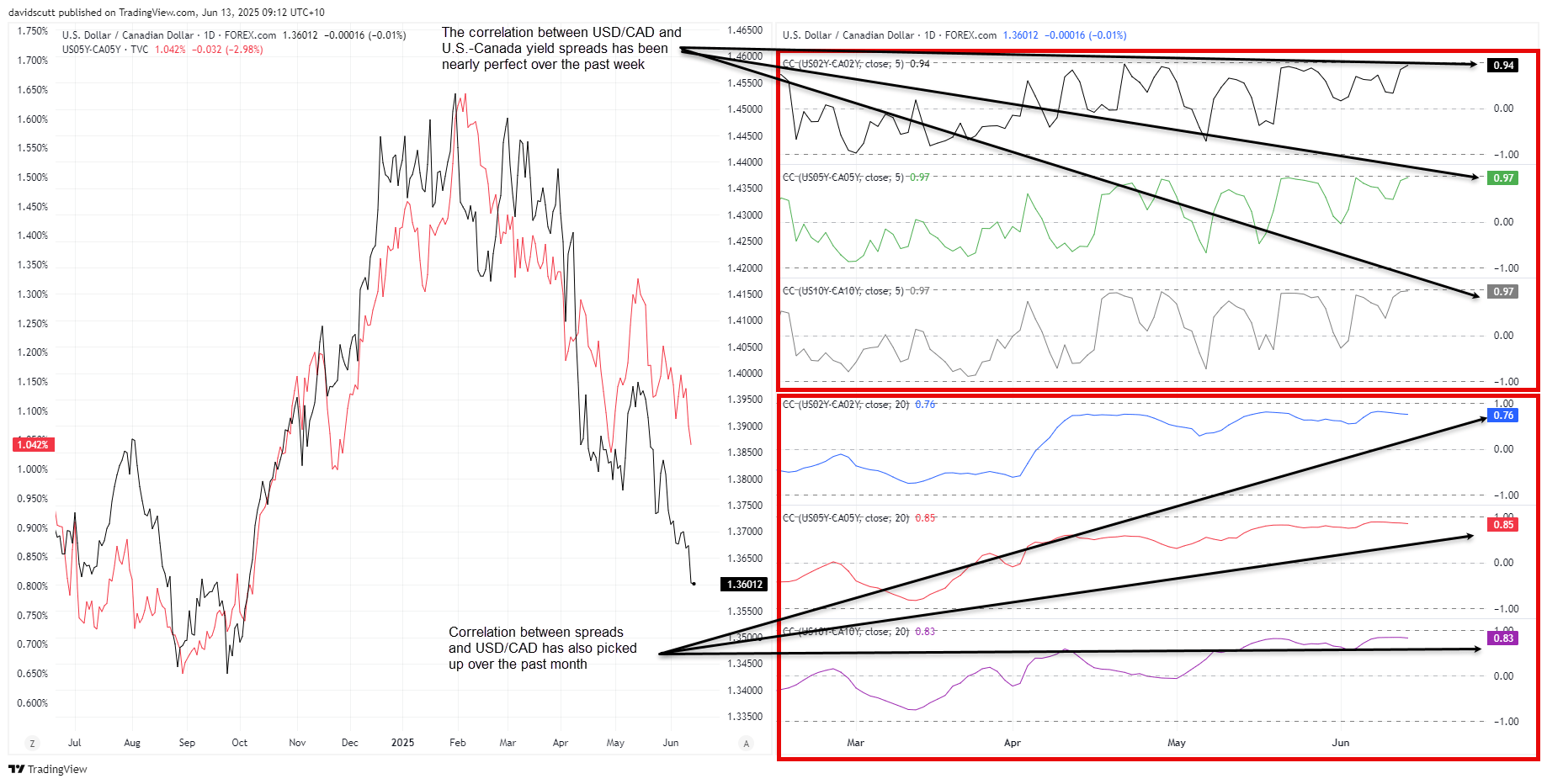

As seen below, that compression has been a major force behind recent weakness in USD/CAD, with its correlation with two, five and 10-year spreads strengthening noticeably over the past month, especially the past week where the relationship has been nearly perfect. For the first time in a while, rate differentials matter for the U.S. dollar.

Source: TradingView

USD/CAD Cracks Key Support Zone

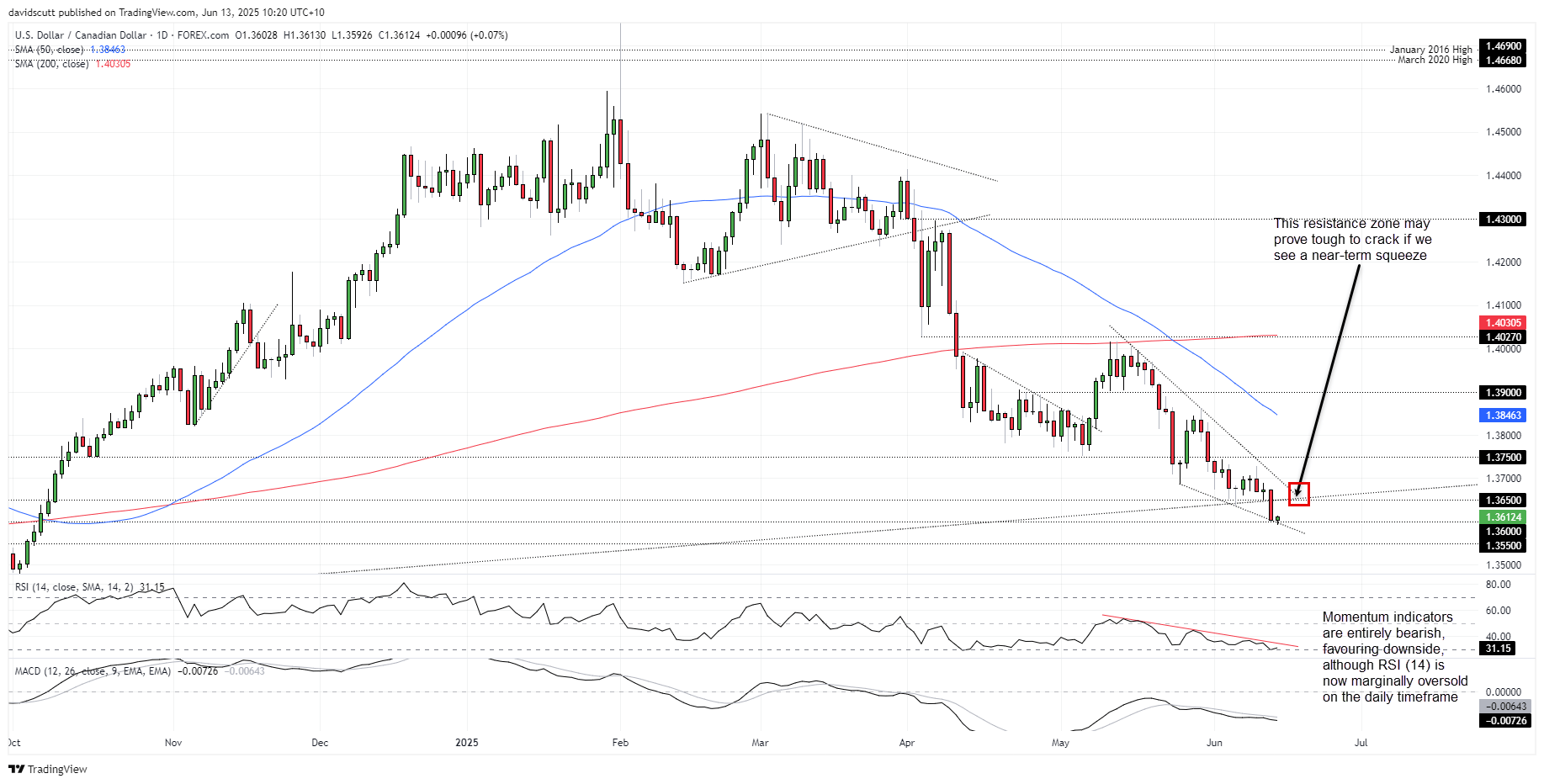

Considering the yield compression between the two nations’ debt, and its strong relationship with USD movements recently, it comes as no surprise that we’ve seen some serious technical damage done in USD/CAD this week.

Having prodded and probed the support zone on several occasions over the past week, USD/CAD bears finally found the courage to test the waters below 1.3650 on Thursday, an important development considering it also saw the price take out long-running uptrend support dating back to December 2023.

Source: TradingView

So far, the bearish move stalled at 1.3600—another level the price has done ample work either side of going back several years. It’s often been tested but rarely crossed, making what happens next potentially important following the uptrend break of Thursday.

If the move continues, 1.3550 is the next downside level to keep on the radar having provided support and resistance in September last year. Beyond, 1.3420 looms as a more substantial test for bears.

While the price remains in a solid downtrend from the highs set in May, you could make the argument that it now sits in a falling wedge pattern, hinting a countertrend move may arrive in the not-too-distant future. That’s relevant at a time when RSI (14) sits in oversold territory, another indicator that squeeze risk may be building. More broadly, the momentum picture remains entirely bearish at this stage, favouring selling rallies.

On the topside, the confluence of horizontal support at 1.3650, former uptrend support and downtrend resistance from the May highs would provide a significant test for bulls if and when it’s tested. If the price were able to break and close above that zone, it would invalidate the bearish bias, putting a potential retest of 1.3750 on the table.

Upcoming Event Risk

Looking ahead, next Wednesday’s U.S. FOMC interest rate decision will be a key event given the influence rate differentials have had on recent USD/CAD movements. With little risk ascribed to a change in the funds rate, it will likely come down to the Fed’s updated dot plot to drive market direction, remembering at the last meeting the median forecast looked for two rate cuts this year. Given recent data flow, arguably, the risk may be the median forecast shifts more dovish on this occasion. Jerome Powell’s post meeting presser will also be important for massaging market messaging.

On the data front, the key releases will be retail sales figures from both the United States and Canada.

-- Written by David Scutt

Follow David on Twitter @scutty